The Weekly - 14th October 2025

OCT 14, 2025

The Largest Liquidation Event In Crypto

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

Summary

Last week saw the largest liquidation event in crypto history, with over $19B in leveraged positions wiped out as global markets reacted to President Trump’s surprise 100% tariff announcement on Chinese imports. BTC briefly dipped to $102K before rebounding sharply as sentiment stabilized and dialogue resumed. Despite the turmoil, DeFi systems performed flawlessly & protocols absorbed over $100M in liquidations with zero bad debt.

The Largest Liquidation Event In Crypto

It was the largest liquidation event in crypto. Over $19B in crypto bets were erased affecting approximately 1.6m traders.

These liquidations caused crypto prices to tumble across the board after severe new China tariffs were announced by Trump on Friday.

BTC wicked down to $102k while ETH fell $3,445. Altcoins were hit even harder, with many losing over 40% within minutes. Major names like XRP, SOL, ADA, and LINK slid 20–40%, while others such as HYPE (-54%), DOGE (-62%), and AVAX (-70%) saw the steepest drawdowns before partially recovering.

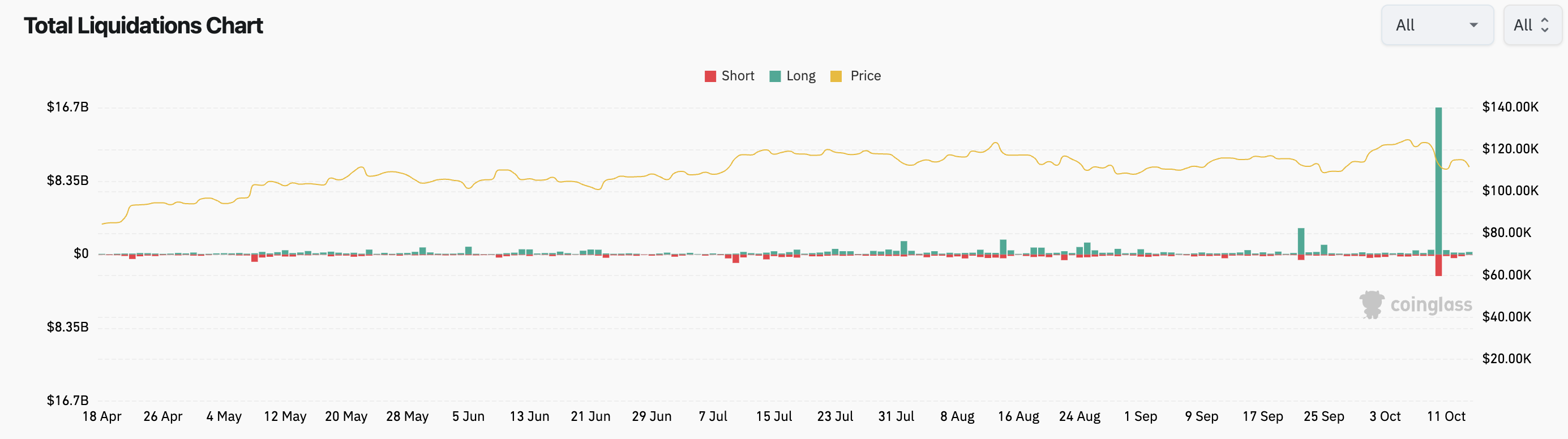

Total liquidation across all coins (USD).

In the weeks leading up to the selloff, equities had rallied over 8% since late July. When the tariff news broke, many investors used it as a reason to de-risk.

After all, tariff fear was also what drove markets to correct sharply back in April. Given the limited liquidity in the market and the auto-liquidation of collateral tied to cross-margined positions, alts were hit hard.

Now the market’s speculative excess has been completely reset.

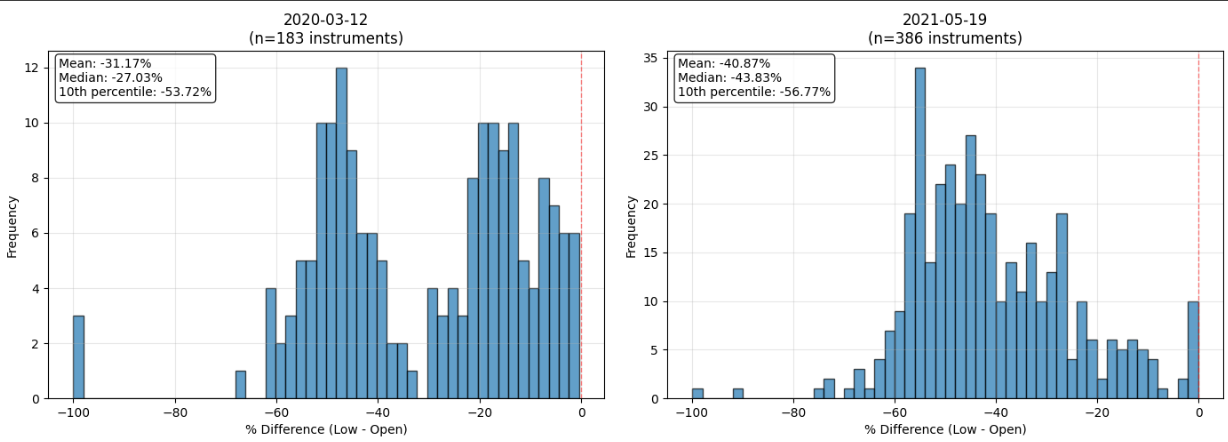

To illustrate, past liquidation events in the last cycle saw drawdowns of -30-40%.

Histogram of drawdowns in the 2020 and 2021 market liquidation events.

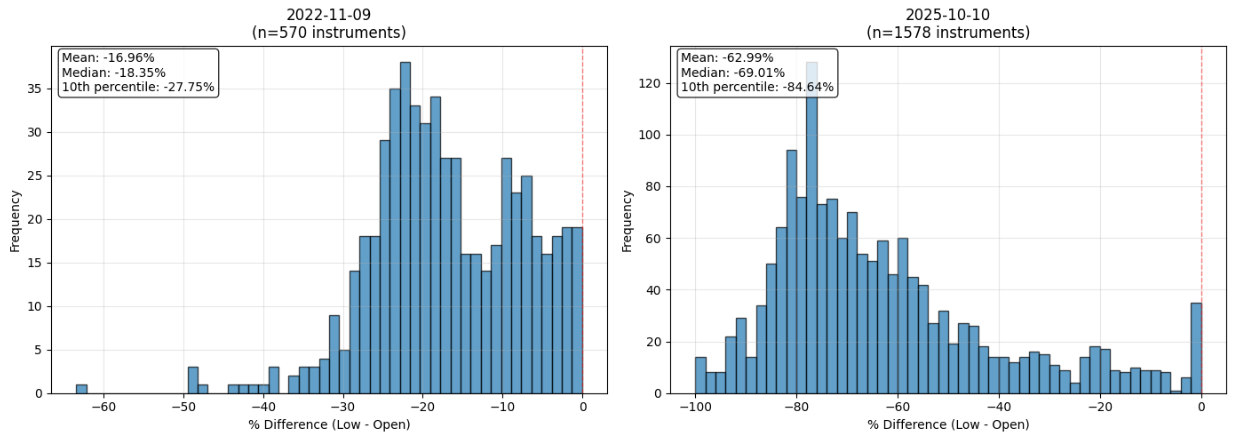

Last weekend, the mean average drawdown was ~60%, which is nearly twice that.

Histogram of drawdowns in the 2022 and 2025 (October) market liquidation events.

Now, Trump appears to be resuming positive dialogue, leading to a sharp rebound in markets from Sunday evening into Monday morning.

Just like in April, where investors quickly discounted tariff fears, markets have again shown a V-shaped recovery following the initial headlines.

DeFi Resilience and Market Structure

The first remarkable aspect of this significant event is that DeFi continued functioning exactly as designed.

Lending protocols incurred no bad debt while liquidating over $100M in notional value, while other perpetual markets recorded tens of millions in profit with full uptime.

The second remarkable aspect was how longer-term fractals were respected.

BTC wicked cleanly down to its 200-week moving average and long-term support line held since September 2024.

BTC/USD (daily) wicked down to its 1 year ascending trend line.

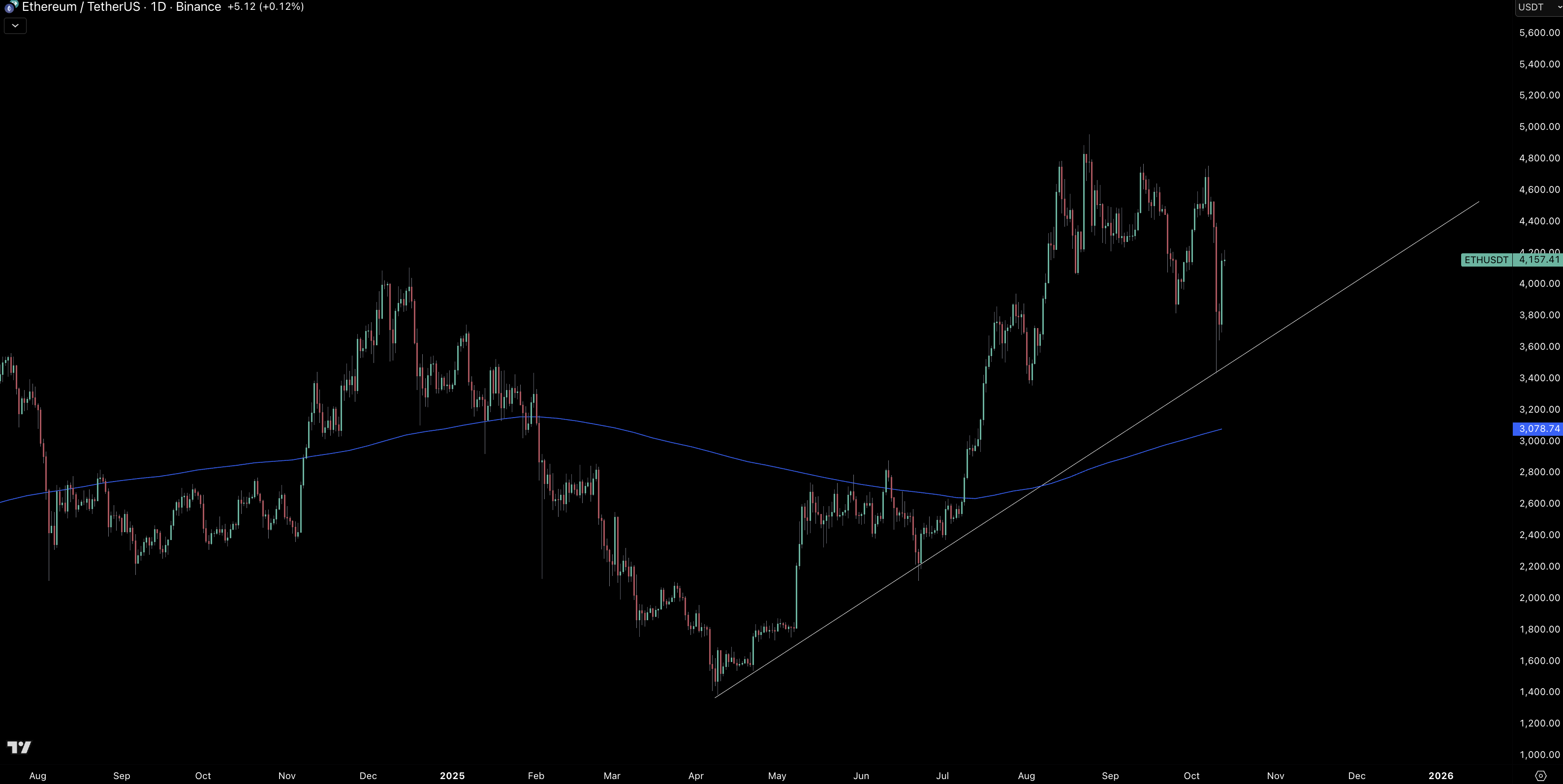

Meanwhile, ETH also wicked to its April 2025 support, remaining above August’s low of $3,358.

ETH/USD (daily) wicked down to its 2025 ascending trend line.

The SOL/ETH cross has been unable to break below its 2021 monthly highs so far.

SOL/ETH ratio (monthly) finding initial support above the 2021 highs.

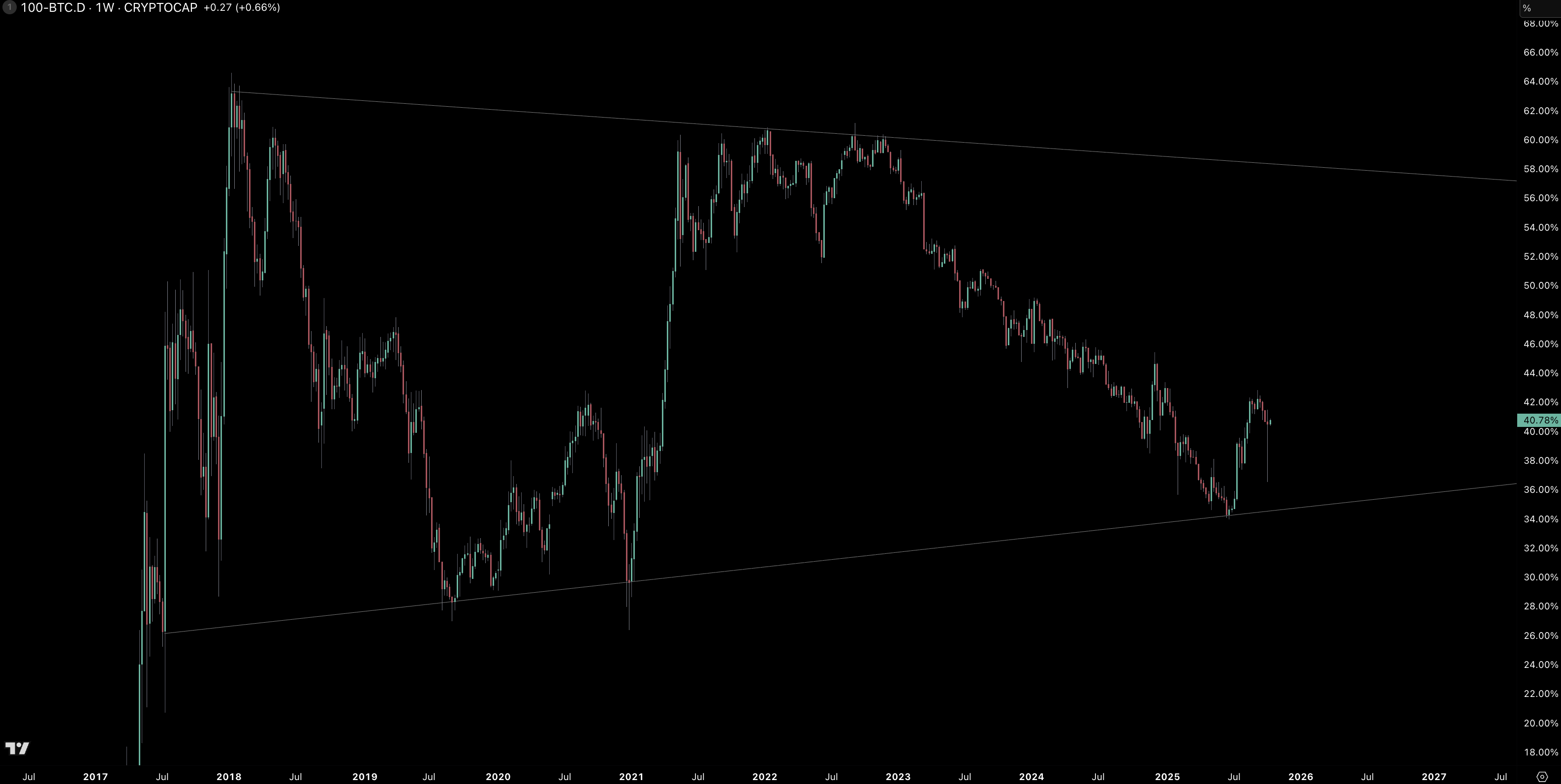

For alts dominance, there is no structural break of the broader 5 year pattern.

Altcoin market cap dominance (%).

Dominance outside of the top 10 has rebounded strongly from 5 year lows…

Global market cap of names outside of the top 10 (by market cap).

The market cap index excluding BTC, ETH, and stablecoins shows how little impact the week’s volatility had on the broader cycle structure.

While markets will take some time to process and recalibrate, the backdrop of falling rates, rising liquidity, and steady economic growth suggests it’s business as usual overall.

Market cap of all names excluding BTC, ETH, and stablecoins.

Meanwhile, US equity futures are rebounding within the current uptrend channel, signalling strong repositioning around Trump’s revised comments.

VIX, which measures the expected volatility of the S&P usually spikes at the lows, which we saw on Monday 13th October.

S&P 500 (daily) vs. VIX (below). VIX spikes coincide with increase downside protection by investors marking bottoms

Setting aside the weekend volatility, the market continues pushing toward record highs. Stablecoin supply has surpassed $300B for the first time in history, while prediction markets are seeing record participation. Kalshi’s active markets surged to ~75K/day after announcing its Series D at a $5B valuation.

Re7 Performance: Navigating Market Stress

Re7 portfolios remained resilient through one of the sharpest risk-off moves this year. Our real-time risk framework helped protect capital and identify selective opportunities. The Market Neutral Strategy benefited from being DeFi-focused and was able to capitalise on market dislocations. The BTC Yield Strategy entered the correction cautiously positioned and the crash ended up being a non-event. This has yet again underscored Re7’s focus on risk management and consistent performance.

Updates on Re7 Labs

Re7 Labs vault performance during the market crashMarkets have just faced a major stress test, and Re7 Labs vaults performed exactly as designed. Result: virtually zero bad debt across our $1B+ curated vaults. Even amid record volatility, no emergency measures were required.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week.

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management, and DeFi ecosystem design. Learn more…

We’re Hiring. We’ve just opened two new roles: Operations Portfolio Risk Manager and Vault Strategist, with more positions available across teams. If you’re excited by institutional DeFi and want to help shape its future, explore our open roles.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.