The Weekly - 12nd August 2025

AUG 12, 2025

Higher

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design. Learn more…

This Week at Re7:

Re7 Capital featured in Bloomberg News

As the market rushes into crypto treasury plays, our founder Evgeny Gokhberg offers a more grounded perspective. Trading above NAV only makes sense when supported by a clearly defined, yield-generating strategy. Read the full article

Re7 Capital featured in Blockstories

Our portfolio manager Lewis Harland was featured in Blockstories’ coverage of Pendle’s launch of Boros. Interest rate swaps are a cornerstone of global finance, with over $200T in notional volume, and bringing them fully onchain could make this critical instrument more transparent, efficient and accessible. Read full article

Re7 Labs Vaults surpass $700M in curated TVL

Our risk-managed, protocol-aligned strategies have crossed a new milestone — $700M in total value locked. Explore top-performing vaults delivering scalable, sustainable yield across Morpho, Euler, Turtle, and more.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes its deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

Senior Capital Formation

DeFi Business Development

Investor Relations Manager

Full Stack DeFi Web Developer

Recruitment Coordinator

Special Project Analyst

Fund Operations Manager

Head of Branding

Investment Analyst(Liquid Token)

DeFi Yield Analyst

We want to hear from you!

Summary

In this edition, we cover:

market update

what phase we could be in within the cycle

performance leaders

Higher

Crypto markets continue to make new ATHs in what feels like a full risk-on environment. Global market capitalisation has reached $4T for the first time, printing +7.4% last week.

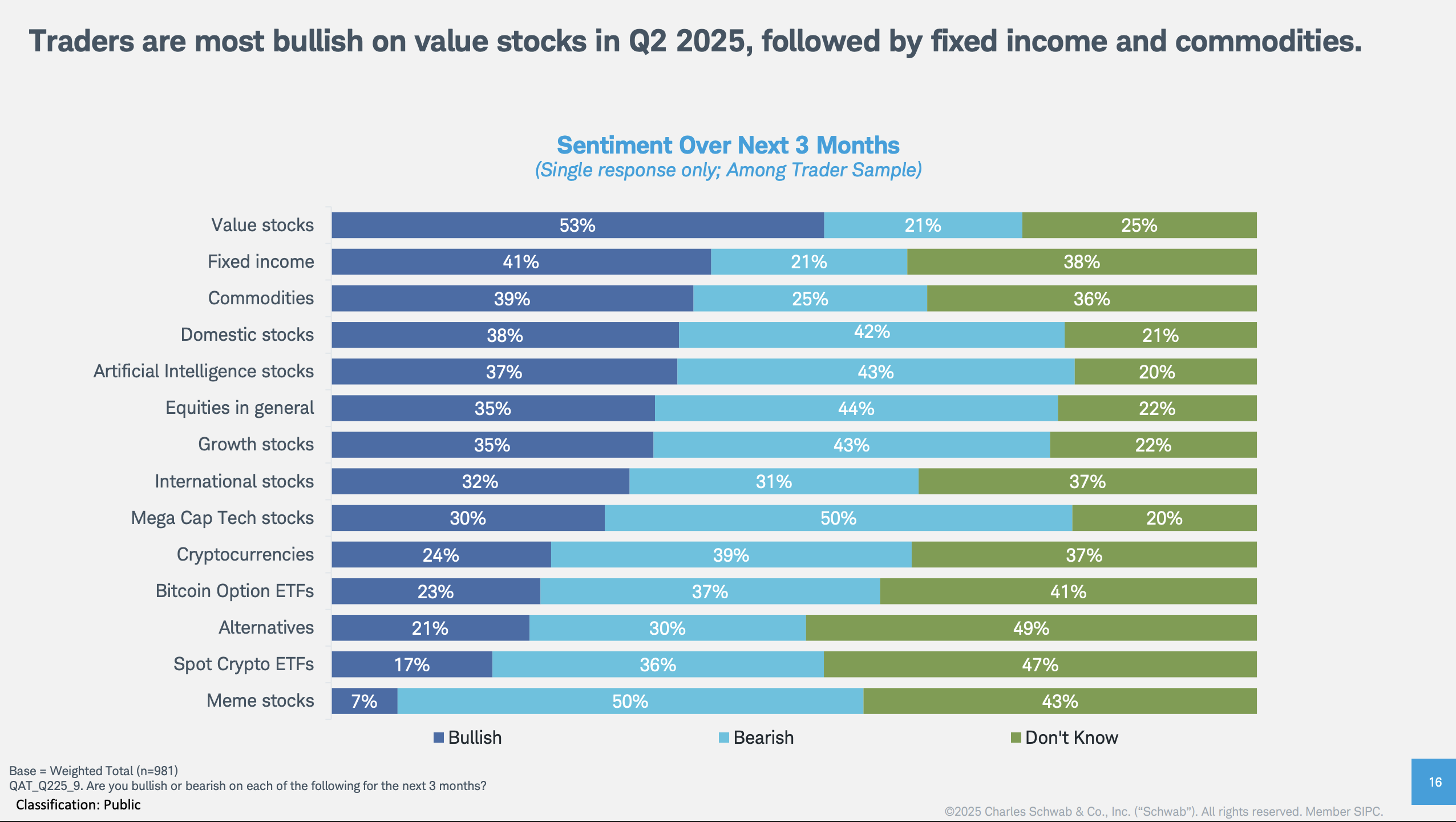

Heading into this year, most investors, when asked if they were bullish or bearish on select sectors for the next 3 months, were bearish on long tail assets and US equities.

This is despite there being an ongoing constructive backdrop of rising liquidity and the prospect of lower interest rates.

Markets were climbing the ‘wall of worry’.

Incremental new all-time-highs came as majors broke through significant resistance levels. ETH finally broke through its multi-year wedge formation and the key $4k level.

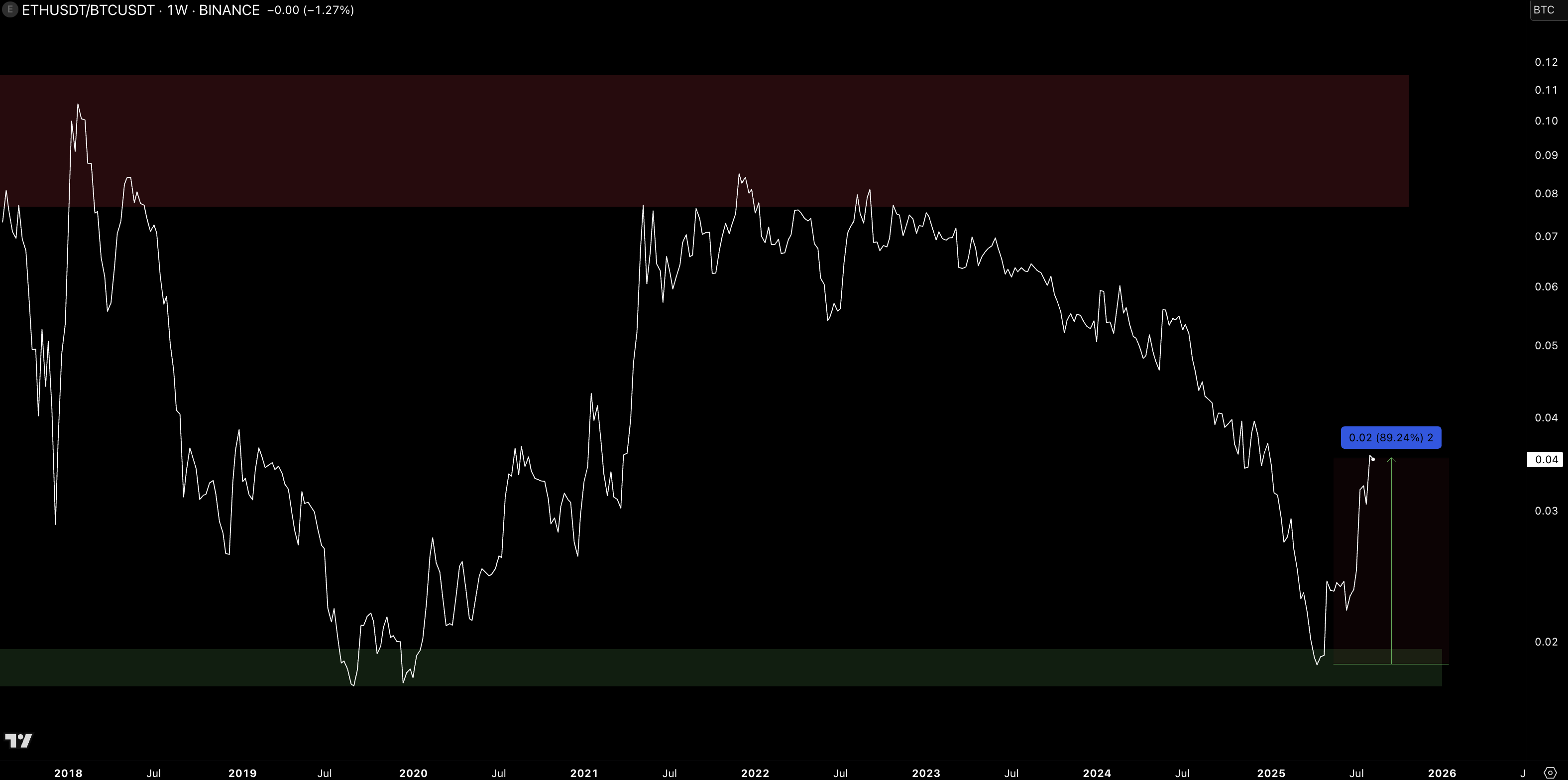

ETH’s significant breaks also translated into continuation of ETH/BTC upside, with the ratio now up ~90% from cycle lows.

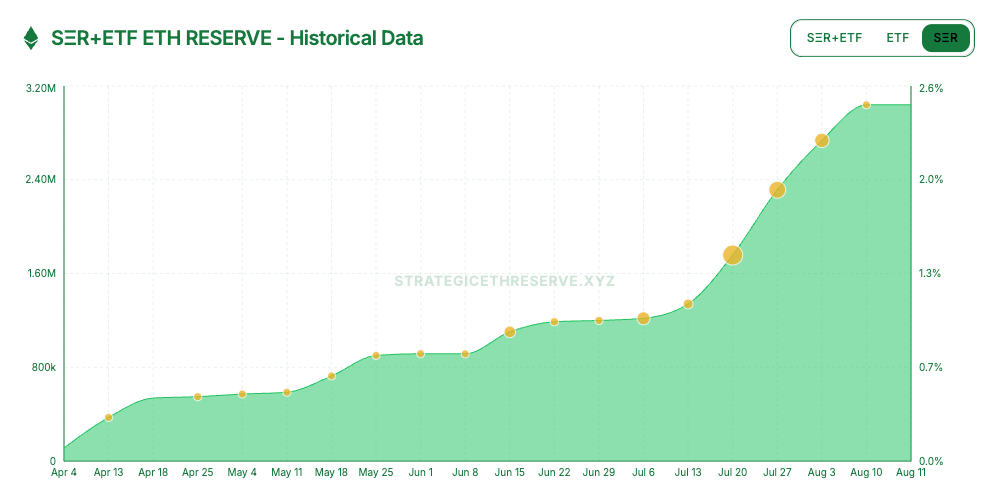

A key driver of ETH’s performance has been the accumulation by treasury companies which has gobbled up 2.5% of the total supply since April.

Total ETH notional bought by these companies has been $13B+.

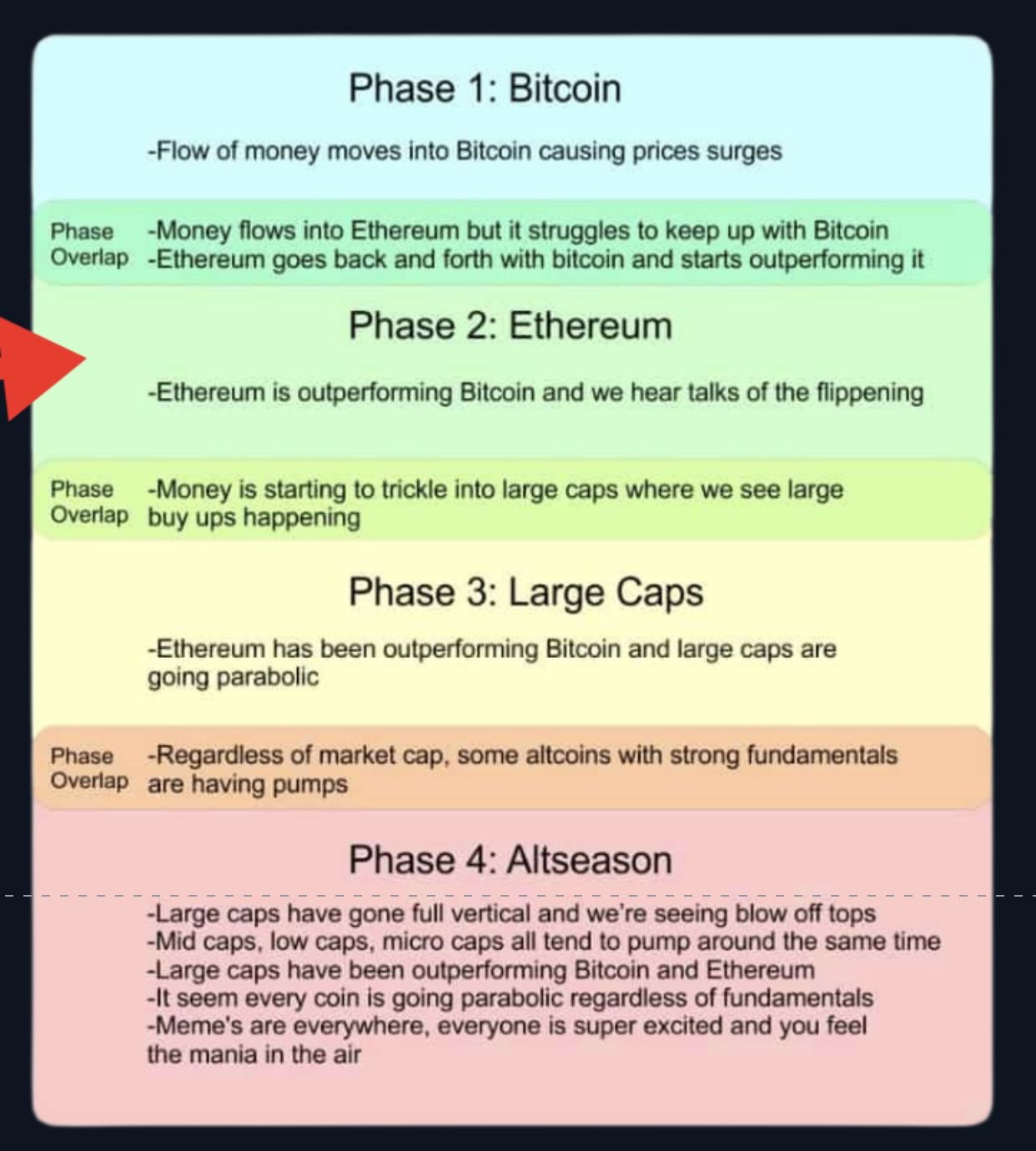

Just as we have seen in previous cycles, this market phase is defined as Ethereum outperforming BTC where this capital eventually ends up in large to smaller cap names.

And we’re already hearing of talks of ETH flippening BTC in market capitalisation.

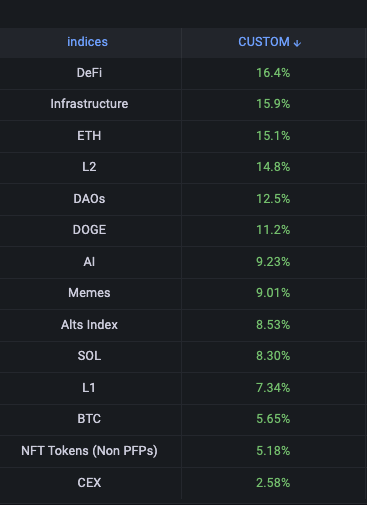

When it comes to relative performance over the past 7 days, the DeFi sector has led the charge showing marginal gains over ETH.

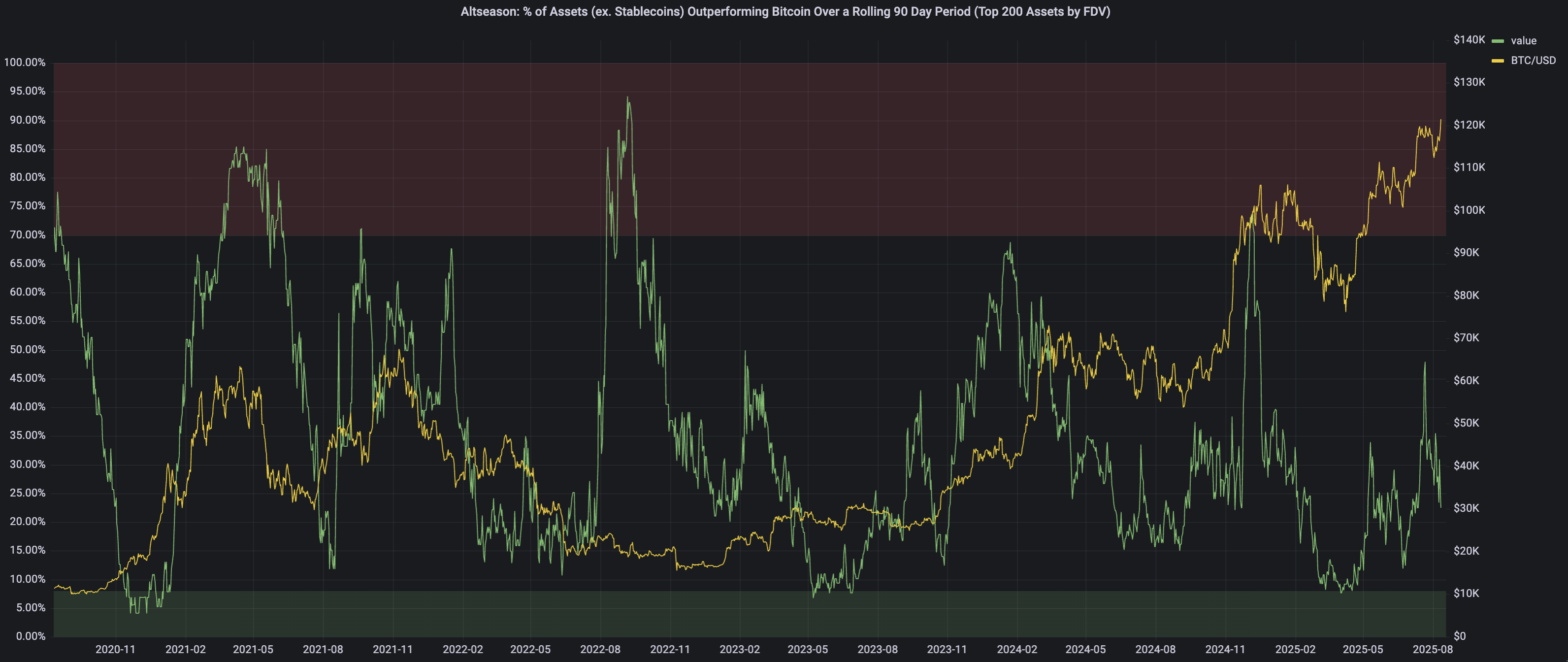

Because we have yet to see the huge capital flow into alts, the altcoin strength index is still in neutral territory and not yet at levels typically seen during market tops.

This signals that alts have much more potential room to perform vs. beta despite the market making new ATHs.

So overall, market momentum is strengthening but, so far, indicators don’t suggest peak euphoria has set in just yet.

Re7 in Media:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as its Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Updates on Re7 Lab Vaults

We are excited to announce that our Soneium Morpho Vaults are live in the Morpho Lite AppSupply WETH, ASTR, USDC and more!Keep an eye out for additional incentives to all of our our Soneium Vaults

We are excited to announce that our Gearbox Re7 USDC pool on Etherlink is LiveSupply USDC or use mBASIS and mTBILL as collateral.Additional incentives should be arriving soon.

Keep an eye out for our HyperEVM Morpho Vaults, this should be live very soon with an official announcement.

We are excited to share on AVAX the USDC Re7 Labs Cluster on Euler is earning up to 12% APY.Supplying USDC earns the base lending APY plus additional WAVAX rewards.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.