Starknet: Borrowing, Staking, and Real-World Utility in BTCFi

JAN 4, 2026

Starknet’s DeFi TVL has grown 98.9% in the last six months, from $155 million to $310 million. This includes approximately $210 million in bridged BTC, $162 million in stablecoins, and $122 million in staked STRK, amongst others.

Key Insights

Starknet’s DeFi TVL has grown 98.9% in the last six months, from $155 million to $310 million. This includes approximately $210 million in bridged BTC, $162 million in stablecoins, and $122 million in staked STRK, amongst others.

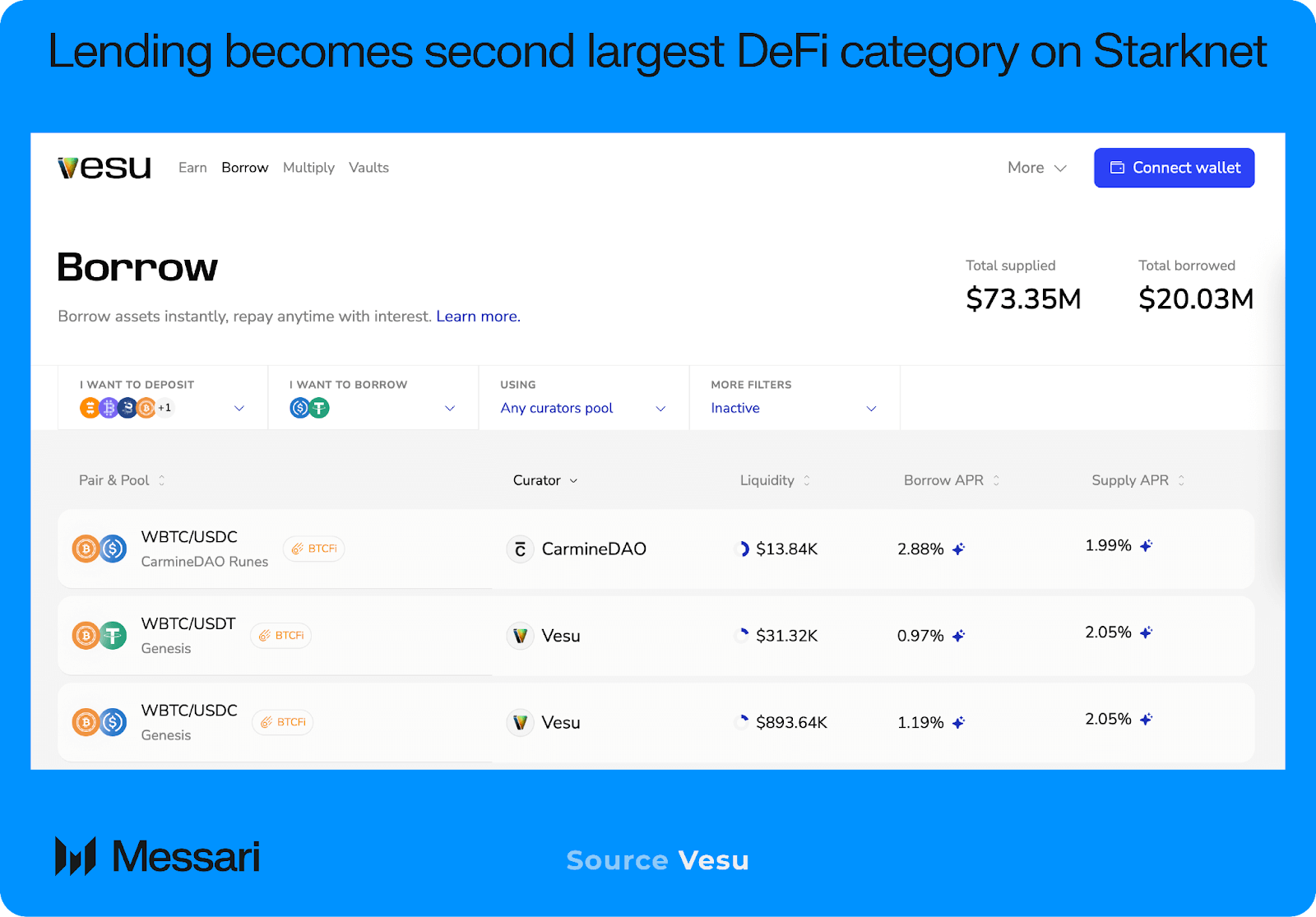

Lending protocols like Vesu are emerging as complementary destinations to staking platforms, offering BTC holders sustainable yields and low-cost stablecoin liquidity backed by 100 million STRK in incentives.

Advanced strategies, such as looping and carry trades, are gaining traction, enabling users to amplify BTC yield through leveraged cycles and rate arbitrage across Starknet protocols.

mRe7BTC, an exotic BTC wrapper by Re7 Capital, implements options-based strategies with an expected yield of ~20% APY.

“Ready” has emerged as Starknet’s first crypto-native neobank, enabling fiat onramps, a self-custodial debit card, and real-world spending directly from Starknet wallets.

Primer

Starknet (STRK) is a permissionless Layer-2 rollup developed by StarkWare and launched in November 2021. It uses STARK-based zero-knowledge proofs and the Cairo Virtual Machine (Cairo VM), which is designed for efficient proof generation rather than EVM compatibility. As a ZK-rollup, Starknet executes transactions offchain and batches them into STARK proofs that are verified on Ethereum. Sequencers handle transaction ordering, while provers generate the corresponding validity proofs. The network also supports native account abstraction, meaning every account is a smart contract with programmable verification logic, enabling features like social recovery and custom authentication.

StarkWare recently introduced S-TWO, an open-source prover built on the Circle-STARK protocol. S-TWO improves proof speed through recursive composition and optimizations for smaller fields, increasing throughput and reducing latency. As Starknet moves toward supporting settlement on both Ethereum and Bitcoin, S-TWO enables proof generation compatible with verifiers on either chain, allowing Starknet to post proofs to Ethereum today and potentially to Bitcoin in the future. By bundling offchain transaction data into STARK proofs and submitting those to the Bitcoin mainnet for immutability, Starknet will be able to leverage Bitcoin for additional security without sacrificing scalability.

Website / X (Twitter) / Discord

TVL Expansion on Starknet

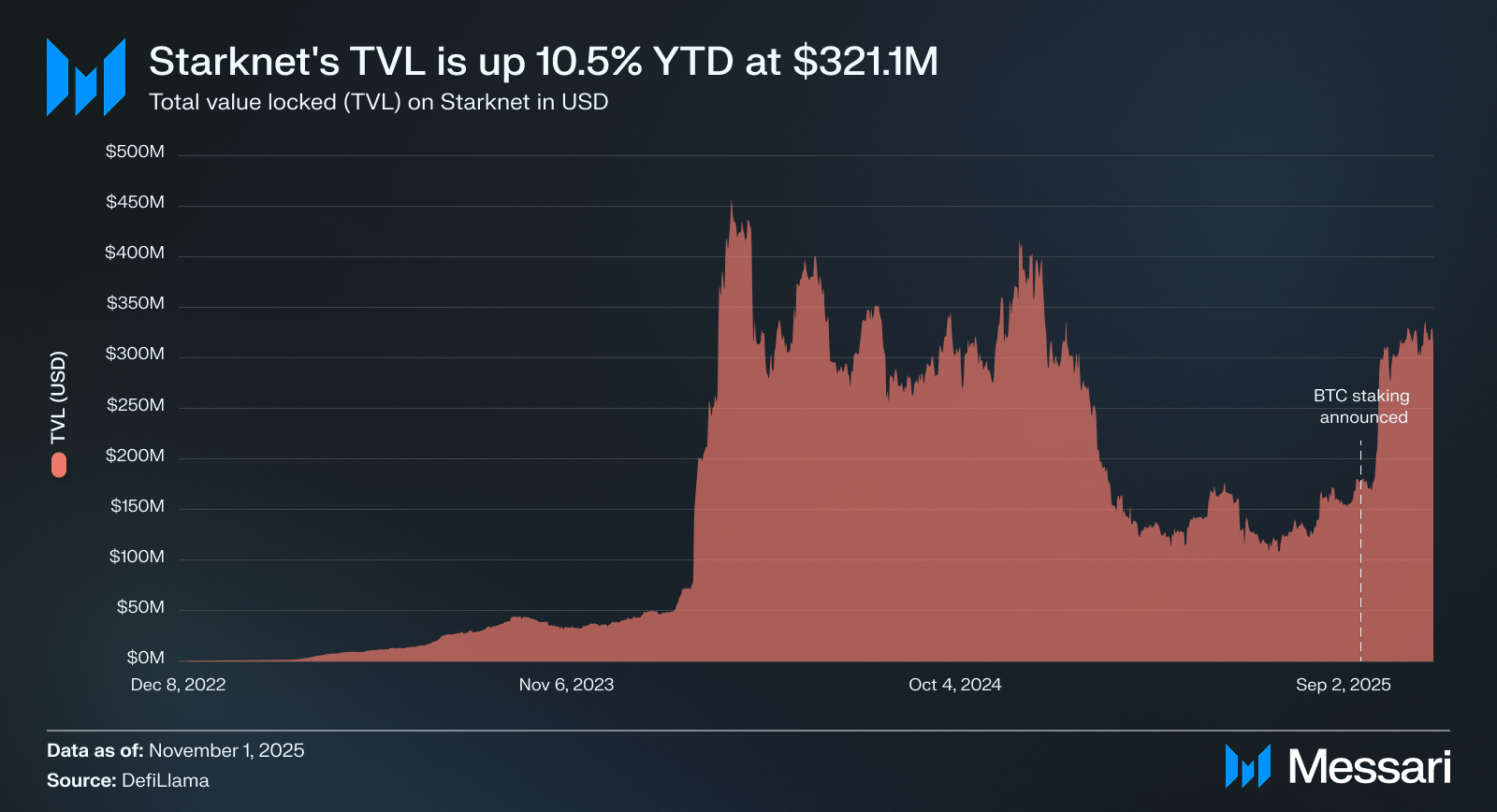

Starknet’s total value locked (TVL) has increased significantly since late 2022, driven by the introduction of staking programs and the influx of Bitcoin liquidity. As of early November 2025, TVL stands at $321.2 million, marking a 10.5% year-to-date increase and a strong rebound from its August 2025 lows, just ahead of the network’s major “BTCFi” initiative.

This growth has been driven primarily by wrapped Bitcoin and DeFi protocols. As of November 2025, bridged BTC assets total nearly $130 million, including SolvBTC ($122.4 million), WBTC ($43.3 million), LBTC ($22.4 million), and tBTC ($12.0 million). Stablecoin TVL has also reached all-time highs, with $147 million in TVL as users bridge assets to trade and borrow against their BTC.

On the DeFi side, the network’s TVL is heavily concentrated across a few dominant sectors: derivatives, lending, and staking-adjacent strategies. Extended (derivatives) and Vesu (lending) collectively account for over $160 million. Other notable contributors include Endur ($39.2 million), which offers liquid staking vaults, and Starknet’s native STRK staking contract, the largest pool of locked value ($120 million).

Capital on Starknet is clearly increasing, with a growing flow into lending, following an initial wave of activity driven by high STRK staking incentives. Like past BTCFi cycles on other chains, early growth was fueled by staking-based TVL accumulation, which had limited utility. However, as yields on STRK and wrapped BTC compress, users are rotating into protocols like Vesu that offer real yield through borrow interest and structured strategies, such as carry trades. This trend reflects Starknet’s broader objective: turning parked assets into economically useful ones. The next section examines how lending and borrowing mechanisms on Starknet facilitate this goal.

The Opportunity: Lending and Borrowing

In DeFi, lending protocols are smart contracts that enable users to supply assets (earning interest) and others to borrow those assets (paying interest). Commonly, loans are overcollateralized, meaning a borrower must deposit collateral worth more than the loan to secure it. Lenders earn a yield from borrower interest and often from token incentives, while borrowers gain liquidity without having to sell their crypto. On Starknet, lending/borrowing allows BTC holders to unlock value without relinquishing their Bitcoin. For example, a user can deposit WBTC on Starknet and borrow USDC stablecoins, effectively using BTC as collateral to get dollars for trading or spending. Beyond simple borrowing, many users employ more advanced strategies to amplify yield; one of the most common is “looping.”

Looping

Looping refers to the practice of borrowing and redepositing repeatedly to leverage an initial deposit. For example, suppose a user has one BTC on Starknet. They deposit it into a lending protocol (earning interest + potentially additional rewards), then borrow 50% of its value in a stablecoin (USDC). With that USDC, they buy more BTC (or a BTC derivative) and deposit it again as collateral. Now they have 1.5 BTC worth of collateral. Each loop increases its BTC collateral and, hence, its yield (since it earns on a larger deposit), minus the interest on the borrowed USDC. This is analogous to taking a home equity loan to buy a second property.

On Starknet, protocols like Vesu (via its Multiply feature) and Troves.fi offer one-click looping vaults for BTC staking, automating this strategy. Looping boosts APY but carries risk (i.e., if BTC price drops, positions can be liquidated).

Carry Trades

Another popular strategy on Starknet is the carry trade, which builds on borrowing but focuses on profiting from interest rate differentials between assets. A carry trade in crypto involves borrowing one asset at a low rate to invest in another that yields a higher rate, thereby pocketing the spread (i.e., the “carry”).

For example, a simple carry trade example could involve borrowing a stablecoin (e.g., USDC) at an APR of 2–3%, and lending it out at an APR of 8–10%. The difference is the profit. With Bitcoin, BTC holders borrow stablecoins at low interest (since stable borrow demand is incentivized, rates are kept low) and then use those stablecoins to buy yield-bearing BTC or participate in yield farming elsewhere.

On Starknet, BTC holders can borrow stables at low rates due to (i) STRK incentives, which offset interest costs, but also (ii) structurally low utilization rates that keep borrowing rates below what would be expected in a more mature market. At times, users have borrowed USDC against BTC at close to 0% effective interest, then deployed it into stablecoin farms, earning ~5–10%. These positive carry opportunities, driven by both subsidies and early-stage market dynamics, have attracted sophisticated DeFi participants.

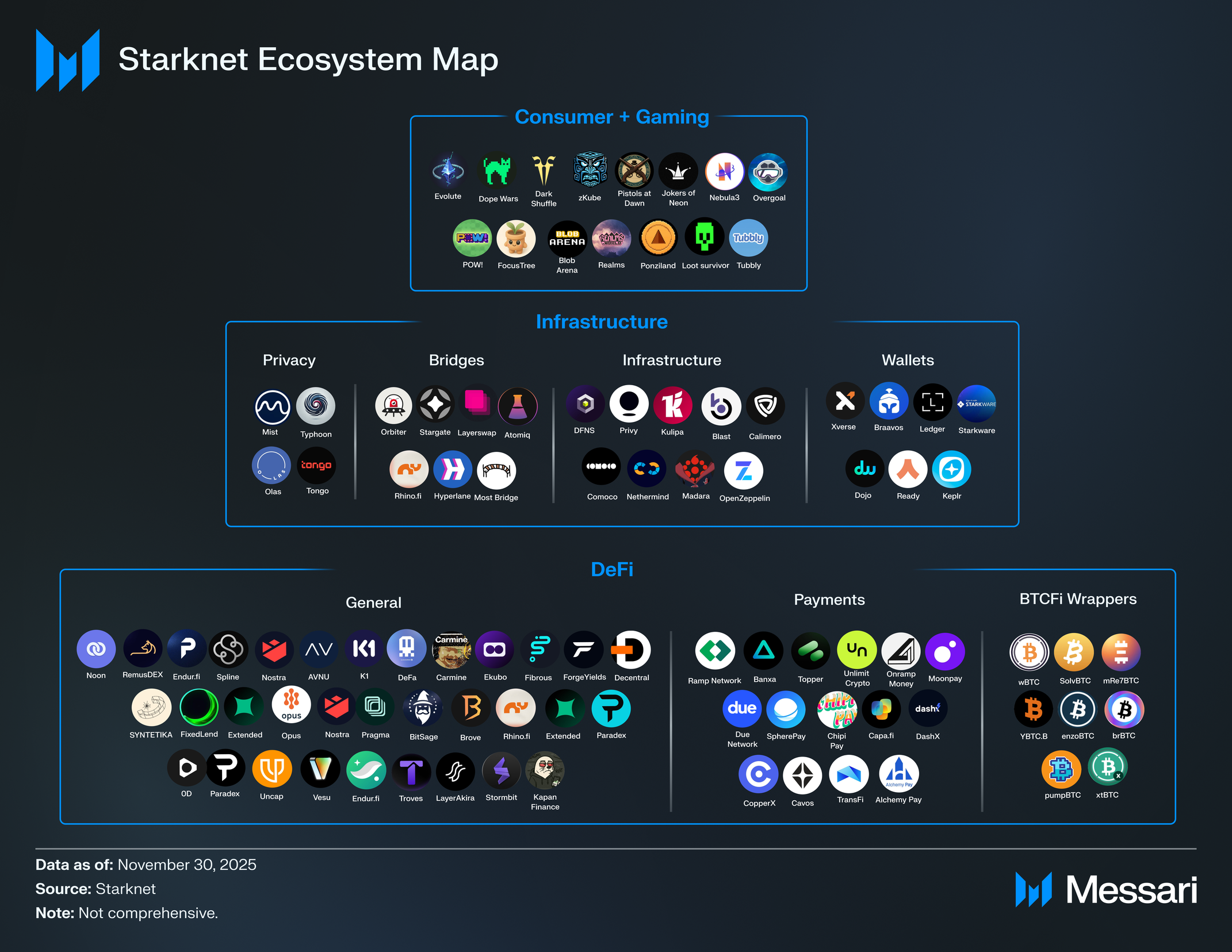

The Ecosystem

Starknet’s ecosystem now boasts a range of DeFi protocols and infrastructure tailored to the opportunities mentioned above. Below are a few such protocols:

Extended: A decentralized perpetual futures exchange on Starknet that offers low-slippage, capital-efficient trading of crypto assets with leverage.

Ekubo: An AMM built by a former Uniswap engineer, which combines concentrated liquidity with modular smart contract architecture.

Vesu: A permissionless lending protocol where anyone can create markets for assets. Its V2 launched in 2025, optimized for BTCFi. Suppliers of WBTC on Vesu earn a base interest rate (2-3% APY) plus STRK incentives from the BTCFi program. Notably, borrowing USDC against BTC was effectively 0–1% after rewards in October/November 2025.

Uncap Finance: A specialized, Liquity v2-style borrowing protocol focused on minting a BTC-collateralized stablecoin. Uncap introduced USDU, a stablecoin soft-pegged to USD and fully backed by BTC deposits. As a CDP model, lenders are unable to earn yield (since it’s minting a stablecoin), but USDU holders can often earn yield by providing the stablecoin as liquidity.

Opus: A cross-margin lending platform designed for advanced users, allowing them to borrow against a diversified portfolio of assets using dynamic risk parameters. It functions like a prime brokerage, supporting flexible collateralization with APYs ranging from 2% to 7% across various markets.

Re7 Yield Aggregator: An institutionally-focused yield aggregator whose BTC Yield Fund (mRe7BTC) deploys capital across multiple chains, including Starknet, to generate returns through advanced strategies. By taking on more complex market risk and employing active management, Re7 has consistently delivered higher yields than passive BTC lending. As of October 2025, mRe7BTC was advertising ~20% APR.

Noon: A yield-bearing stablecoin protocol that introduced sUSN on Starknet. Users can deposit BTC or USDC into vaults that mint sUSN, and then loop sUSN several times to enhance returns.

AVNU and LayerAkira: AVNU is a Starknet-based DEX aggregator focused on delivering best execution across liquidity sources. LayerAkira complements this with high-performance architecture for efficient spot trading.

Ready, Braavos, and Xverse: Wallets that offer built-in Earn products, enabling users to access BTCFi strategies directly within their interface.

Starknet Earn: A simple, curated front-end that aggregates BTCFi strategies in one place, making it easy for users to find, compare, and deploy capital into yield-generating products.

Focus Tree: A product studio building consumer apps on Starknet that abstract away blockchain, having onboarded at least 1 million users to the network through its applications.

Overall, Starknet’s lending landscape is in a phase of growth. The 100 million STRK incentive program (running September 2025 – March 2026) subsidizes various DeFi activities, and according to the team, the goal is to make Starknet “the most affordable place to borrow stables against BTC.” Starknet’s bet is that by the time incentives wane, a critical mass of users will have gotten comfortable using these BTCFi protocols such that activity continues organically. For users, lending protocols transform Bitcoin from a passive asset into an active one: enabling yield generation, access to liquidity, and capital-efficient rotation strategies, all without relinquishing custody. These platforms replicate essential banking functions onchain, forming the backbone of Starknet’s self-custodied financial system. Now, that foundation is extending into more user-facing services, most notably the emergence of a crypto-native neobank experience.

A Neobank Vision

A neobank is a digital bank that typically offers high-yield accounts and low-fee spending through modern mobile apps. Starknet is enabling a crypto-native version where users can hold and earn on crypto assets (e.g., BTC and STRK) and spend their value seamlessly in everyday life, all while retaining self-custody. This effectively bridges the gap between DeFi and traditional finance rails, unlocking real-world utility for BTCFi participants.

Ready

The clearest example is Ready (formerly Argent), a leading Starknet wallet that rebranded in 2025 as a “crypto neobank.” Ready supports direct fiat bank transfers from over 150 countries, allowing users to convert fiat to stablecoins or STRK without using a centralized exchange. In late 2025, Ready integrated with Due, a service that issues virtual IBANs (vIBANs) linked to users’ wallets. This feature allows users in supported regions to send a bank transfer to their personal vIBAN and receive stablecoins directly into their Starknet wallet, all without any visible changes. This seamless, self-custodial fiat-to-crypto flow marks a major onboarding breakthrough for global users. Additionally, Ready has recently launched a self-custodial debit card linked to Visa/Mastercard. Purchases are settled by swapping crypto (e.g., USDC or STRK) from the user’s Starknet wallet to fiat at the point of sale. Its Google Pay integration went live in October 2025, with Apple Pay expected to follow in January 2026. This closes a long-missing loop in DeFi: BTCFi participants can now not only earn, but also spend. For example, a user can:

Deposit BTC on Starknet via integrated onramps, cross-chain bridges like StarkGate bridge, or a wrapper like tBTC.

Earn yield on BTC: Stake BTC to earn STRK, or lend it on Vesu to earn interest + STRK incentives, or invest in a product like mRe7BTC. Over time, that BTC position generates rewards, primarily in STRK (since staking pays in STRK), but sometimes in stablecoins.

Use rewards for expenses: The STRK accruing in the wallet can be directly spent via the Ready card. If the user earned 0.5 STRK per day in rewards, that could be used to buy a coffee by tapping the Ready card. The card transaction will convert the required STRK to fiat on the fly.

Importantly, at no point does the user have to withdraw to a bank or trust a custodian. Their BTC stays in their Starknet wallet, their STRK stays until spent, and conversions happen through smart contracts. Because Starknet offers fast, sub-cent transactions and account abstraction features like gasless transactions and programmable spending, it's uniquely suited for day-to-day use.

It’s a significant upgrade to how crypto can be utilized in everyday life. In effect, Starknet is laying the groundwork for a fully onchain, user-owned financial system that combines yield, liquidity, and payments without centralized intermediaries.

Closing Summary

Starknet’s BTCFi growth shows that users are starting to find real ways to use their Bitcoin beyond just holding it. Rather than simply attracting passive capital, Starknet’s ecosystem is designed to incentivize real usage, borrowing, spending, and structured yield strategies. Protocols like Vesu, Uncap, and reflect a growing suite of tools that enable sustainable yield, not yield for yield’s sake. With wallets like Ready and platforms like Starknet Earn simplifying access for everyday users, Starknet is not just attracting BTC liquidity, it’s turning Bitcoin into a productive, usable asset within a self-custodial DeFi stack.