The Weekly - 9th September 2025

SEP 9, 2025

Market-Driven Evolution of Stablecoin Issuance

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management and DeFi ecosystem design. Learn more…

Re7 is Hiring!

Re7 Capital is a London-based digital asset firm leveraging its deep crypto network and proprietary data infrastructure to drive investment decisions across multiple fund strategies.

We’re currently hiring across business development, capital formation, operations, and research roles. If you’re serious about DeFi and want to operate at the highest level, explore our open positions here:

Join Re7 Capital

We want to hear from you!

Summary

In this edition, we cover:

Market rundown

The rate of stablecoin volume on-chain vs. other financial systems

Catalysts of further stablecoin adoption via Web2 integrations

Market-Driven Evolution of Stablecoin Issuance

Last week, we highlighted stablecoins showing strong, consistent PMF through a remittance lens. The majority of supply and volume over the past year is related to DeFi use cases.

This week, we show how stablecoins are becoming an increasingly integral part of specific DeFi apps like DEXs.

Stablecoins like USDC enable perpetual exchanges to be used as margin, liquidity provision, and fee tokens.

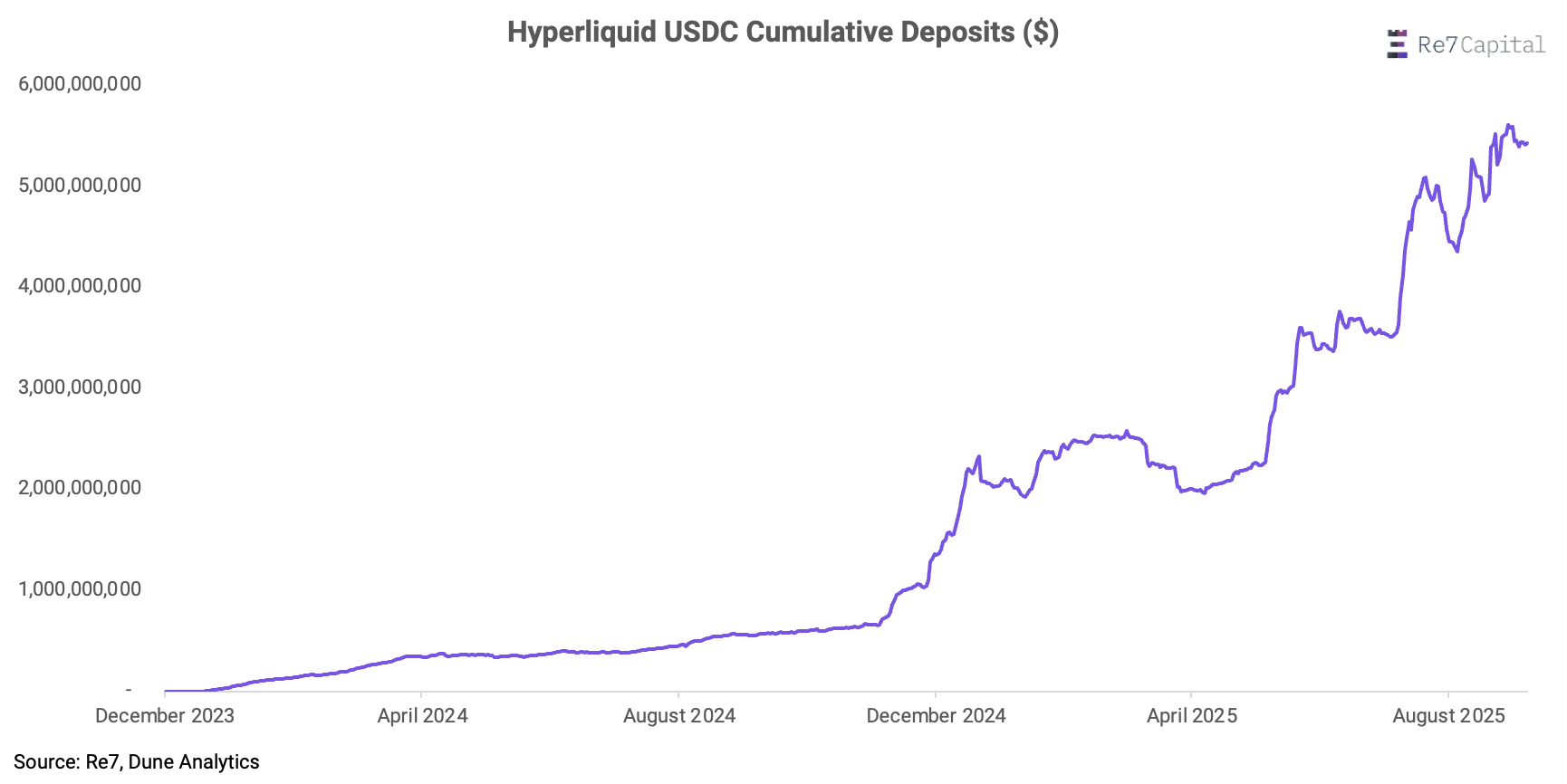

Hyperliquid, the largest on-chain perpetual exchange, has nearly 6B USDC on its platform as the DEX has seen growing interest and volume.

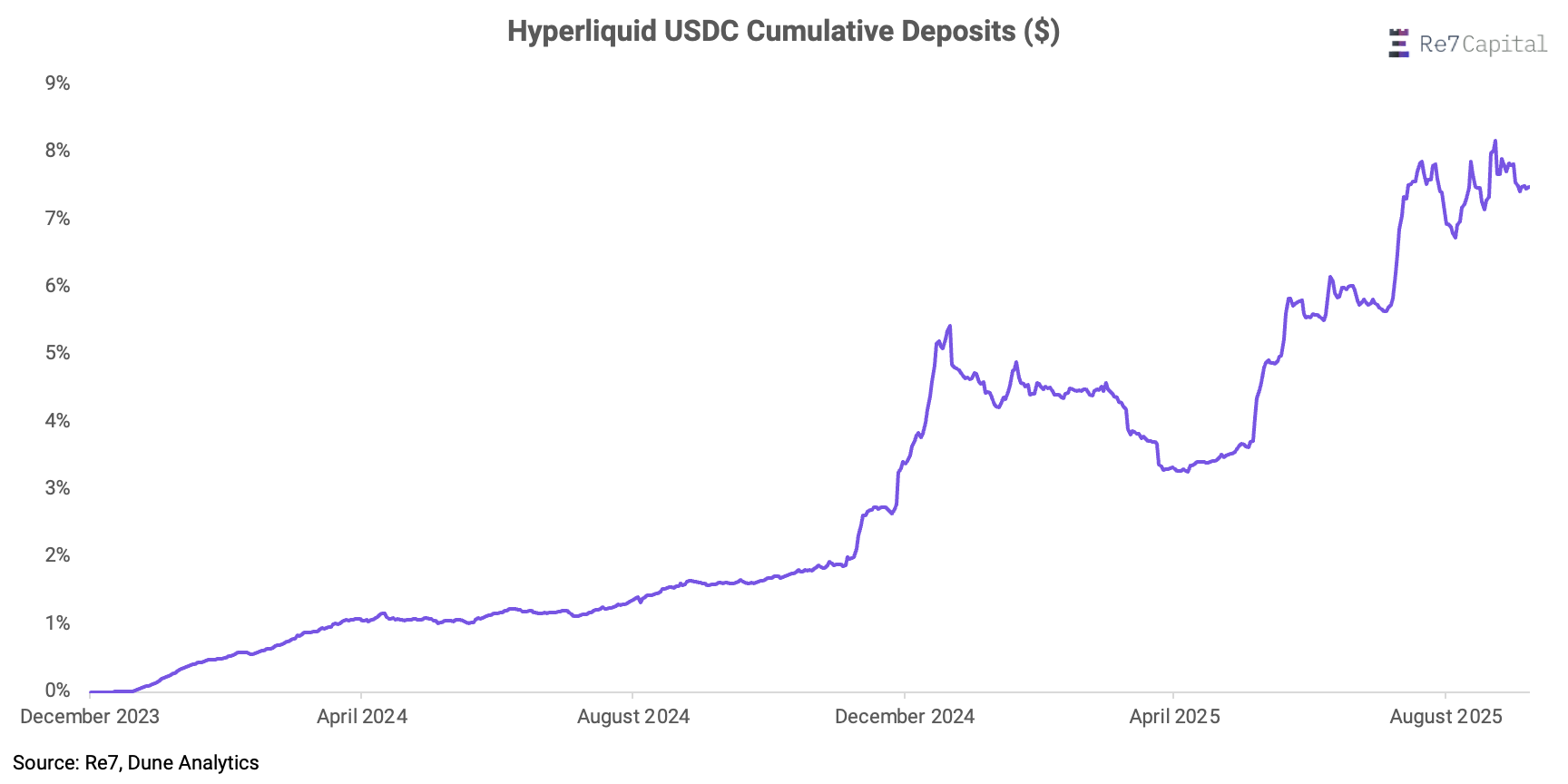

As a percentage of total supply, Hyperliquid alone houses ~8% and is effectively the largest holder of USDC.

One problem for Hyperliquid, though, is that its key margin asset is solely controlled by a 3rd party at the governance level. The other is that they are leaking value to Circle at the expense of their stakeholders (HYPE token holders).

This is because Circle does not distribute yield they receive from buying treasury yields from USD deposits backing USDC.

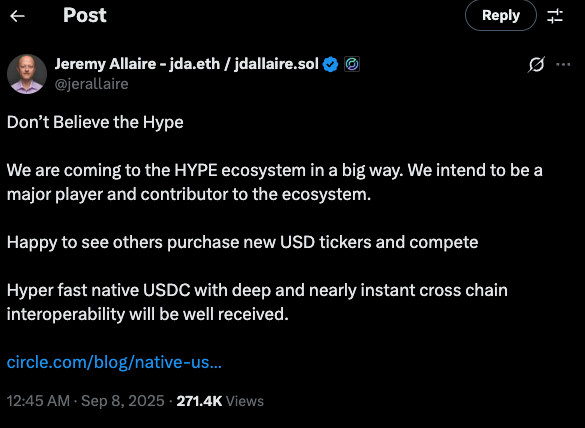

This has created a flurry of proposals from stablecoin issuers, including Paxos, Frax Finance, and Agora pitching to issue the new canonical stablecoin - USDH.

Every proposer has an incentive to tap into the growing Hyperliquid market by offering a competitive economics back to Hyperliquid stakeholders.

Meanwhile, Circle can’t afford to distribute out 95% of yield to Hyperliquid on nearly 10% of their supply.

At the same time, Circle can’t afford to lose out on the Hyperliquid opportunity given… its nearly 10% of their supply…(and largest USDC holder).

The trend emerging from all of this is market-leading DeFi apps have the leverage to command favourable economics because they own their distribution channels.

Decentralised markets eventually move towards becoming more efficient with value flows while avoiding partners that are maximally extractive.

Strategically, these platforms centre their token holders as key stakeholders, ensuring value accrues to those driving the ecosystem’s success, forging a more equitable and resilient financial future.

As Hyperliquid's developments unfold in the coming weeks, more teams will take notice, cementing this as a pivotal trend for the foreseeable future.

Markets

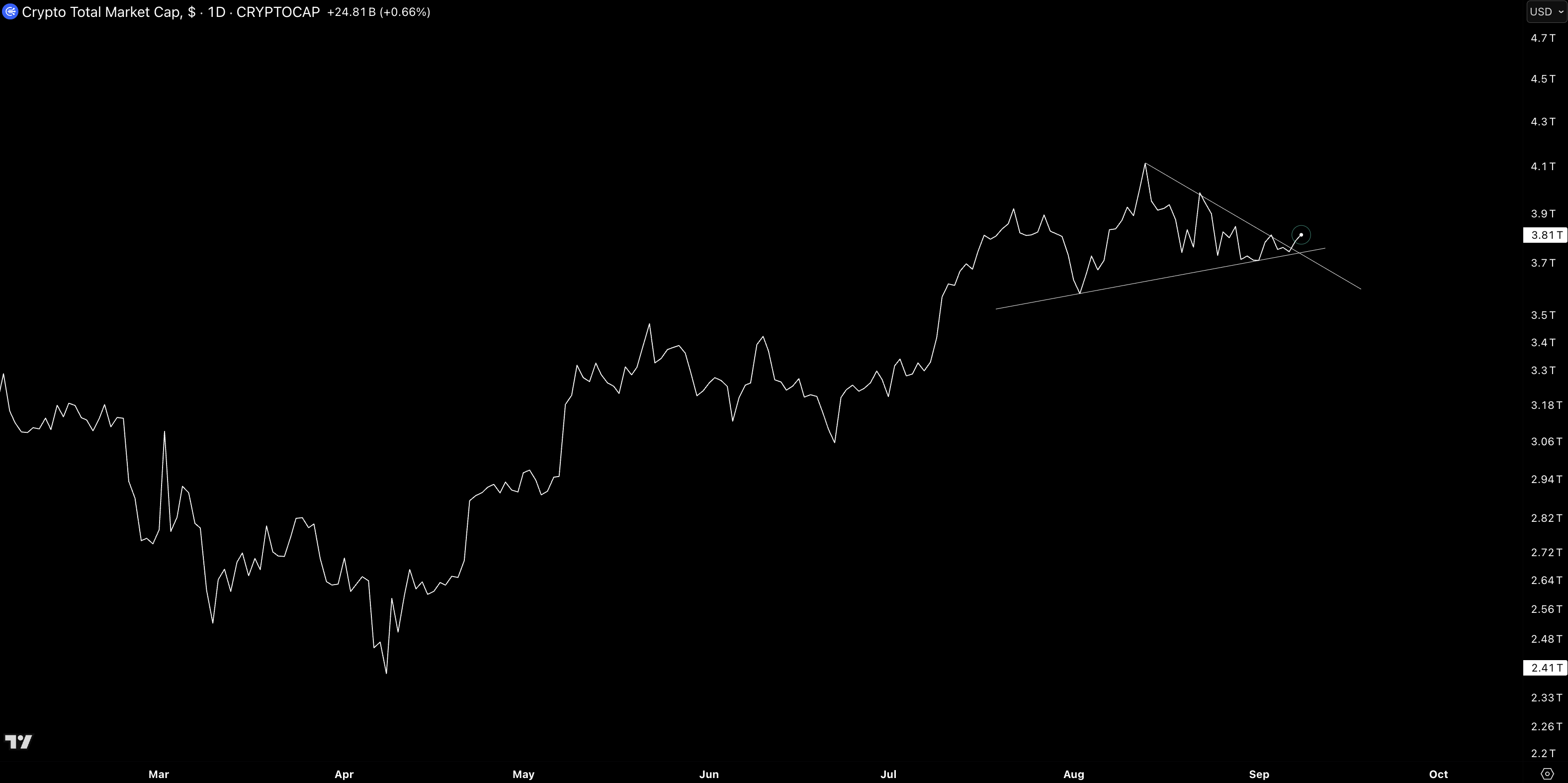

Crypto markets edged higher (+2%) last week. Valuations continued to consolidate has given more reason for investors to remain cautious overall.

Weaker-than-expected economic data gave the Fed even more reason to cut in September which structurally buoys risk assets longer-term.

Yet, we see potential breaks to the upside forming that could signal the next high-conviction direction investors have been looking for.

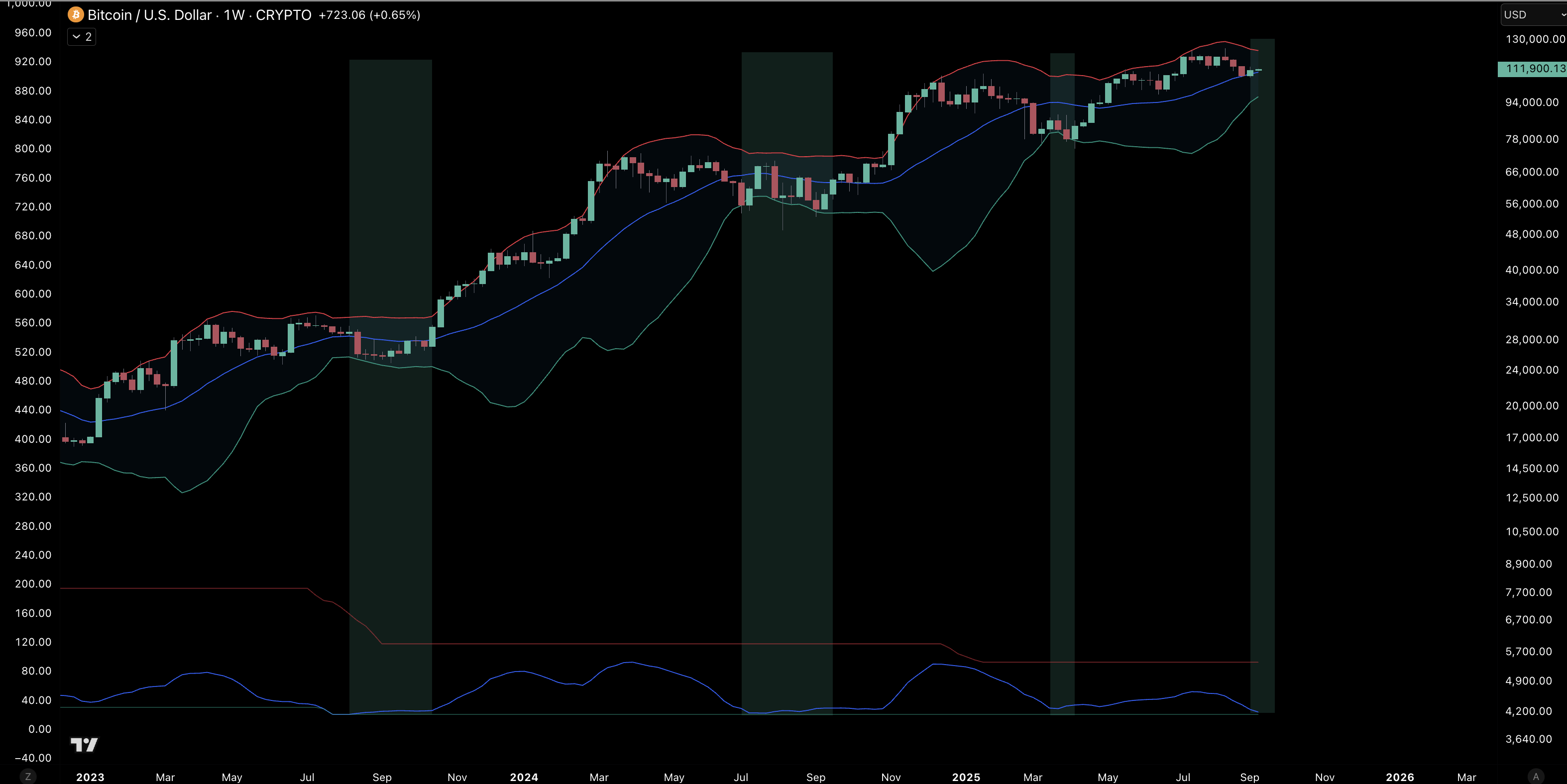

For BTC, volatility has been compressed for such a time that volatility metrics like Bollinger Bands are at weekly lows.

These have historically preceded to high volatility upside moves throughout the current bull cycle.

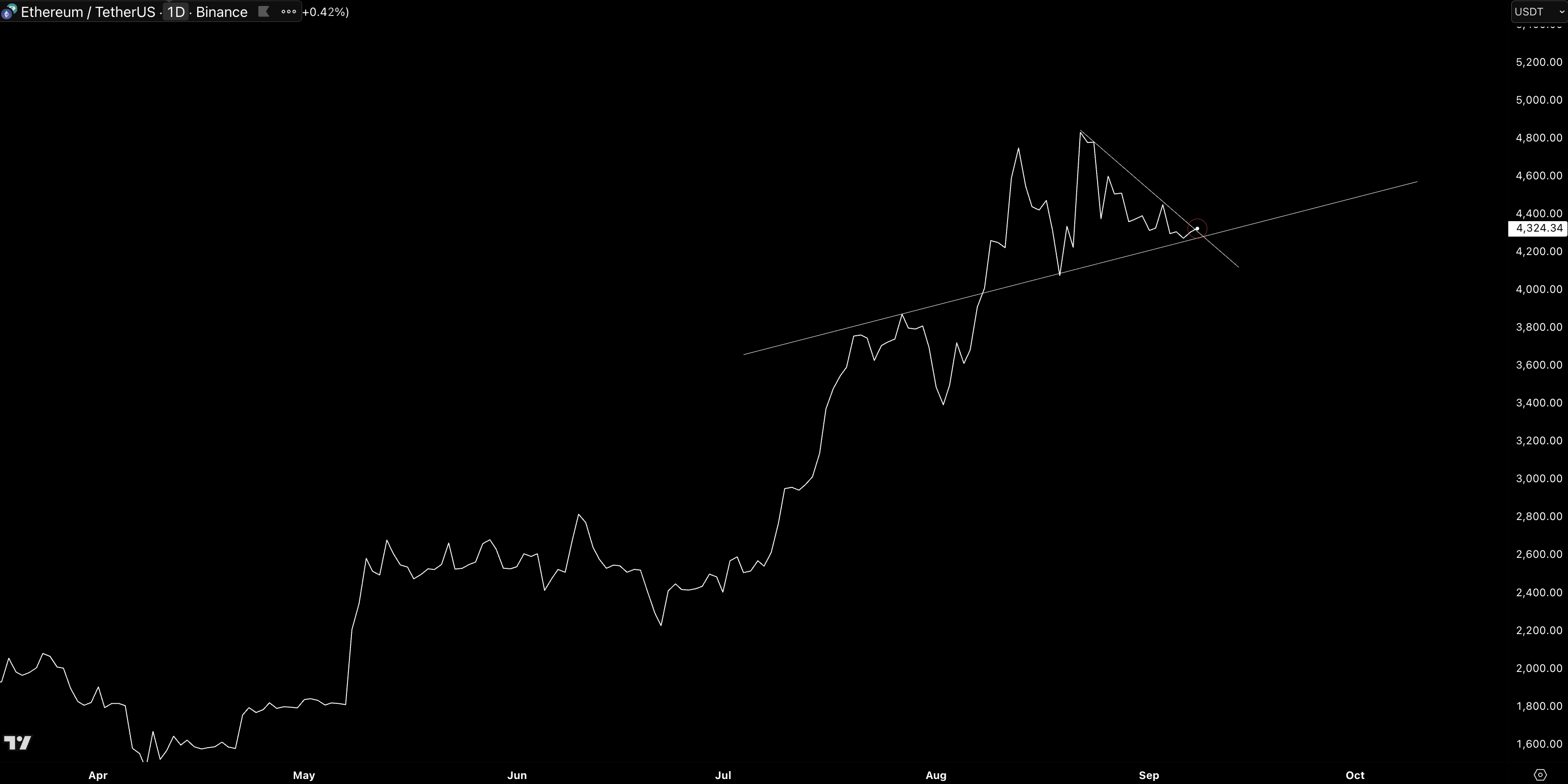

ETH is also on the brink of a wedge pattern break…

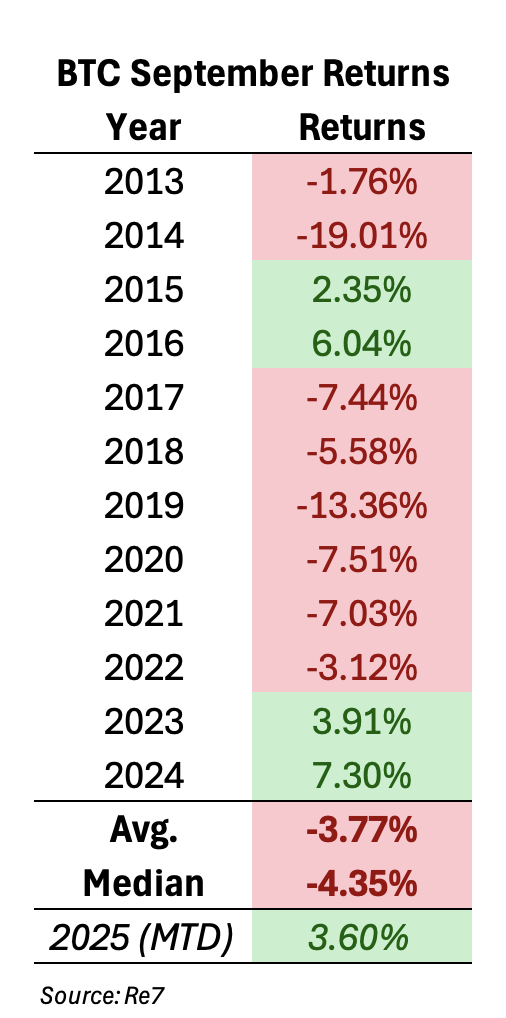

That said, September seasonality signals challenges may lie ahead for risk assets. One thing to bear in mind is the two years prior where the Fed remained on hold and ‘cut’ in September (1998, 2024) were both positive months for risk assets.

This would mark a contrarian call and crypto markets are aligning so far, with BTC up 3.6% month-to-date (MTD).

Re7 in Media:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as its Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Re7 Capital featured in Bloomberg News

As the market rushes into crypto treasury plays, our founder Evgeny Gokhberg offers a more grounded perspective. Trading above NAV only makes sense when supported by a clearly defined, yield-generating strategy. Read the full article

Updates on Re7 Labs | Expanding on Avalanche

Last week was another testament to our commitment to building a more robust and efficient DeFi ecosystem. We are thrilled to share some of the key milestones and developments from the Re7 Labs team.

upAVAX Integrated on EulerWe’ve integrated upAVAX, the liquid staking token from Upshift, into our wAVAX cluster on Euler on Avalanche. This unlocks enhanced capital efficiency and deeper borrowing/lending opportunities for users.

Euler Earn Vaults LaunchedOur new Euler Earn vaults are live. The launch includes:USDC VaultaUSD VaultUpcoming incentives will further reward depositors and boost vault adoption. Stay tuned for the campaign launch.

New Collateral: PT-USDe-25SEP2025We’ve added PT-USDe-25SEP2025, a cross-chain Pendle asset, to our USDC cluster on Euler. This continues our strategy of onboarding quality assets that enable more advanced yield strategies.

DeFi Ecosystem SnapshotTVL hits $127B YTD, fuelled by institutional appetite for stablecoins and RWA tokenisation.Security reminders:Nemo Protocol (Sui): Exploited for $2.4MBunni: Hit by a rounding error exploit ($8.4M loss)These events reinforce the importance of rigorous audits and proactive risk management practices..🔓 Major Token Unlocks (Sept Highlights)SUI: $153MENA: $108MAPT: $50MARB: $48MSTRK: $16.8MThe landscape continues to evolve rapidly. We’re committed to building resilient, yield-driven infrastructure for the future of decentralised finance.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.