The Weekly - 19th August 2025

AUG 19, 2025

Pause for thought

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design. Learn more…

Re7 is Hiring!

Re7 Capital is a London-based digital asset firm leveraging its deep crypto network and proprietary data infrastructure to drive investment decisions across multiple fund strategies.

We’re currently hiring across business development, capital formation, operations, and research roles. If you’re serious about DeFi and want to operate at the highest level, explore our open positions here:

Join Re7 Capital

We want to hear from you!

Summary

In this edition, we cover:

Market update

Coinbase premium

Altcoin market vs. BTC

Pause for Thought

Crypto markets cooled for this week’s open after printing new ATHs in global market capitalisation of $3.95T.

This, so far, appears to be a corrective phase within a broader upward channel.

ETH continues to lead the majors after breaking its 3-year resistance. It’s reasonable to expect ETH to re-test this line…

…similar to BTC retesting its breakout line at $112k in early August. BTC is cooling again back down to this neckline area after a contentious ATH battle between buyers and sellers.

Yet, we’re also seeing the ‘Coinbase premium’ for BTC at the highest levels since December last year.

This is strange as normally the premium coincides with stronger price action, driven by institutional demand and accumulation. This could reflect ongoing TWAP from DATs that represent a large portion of consistent spot buyers.

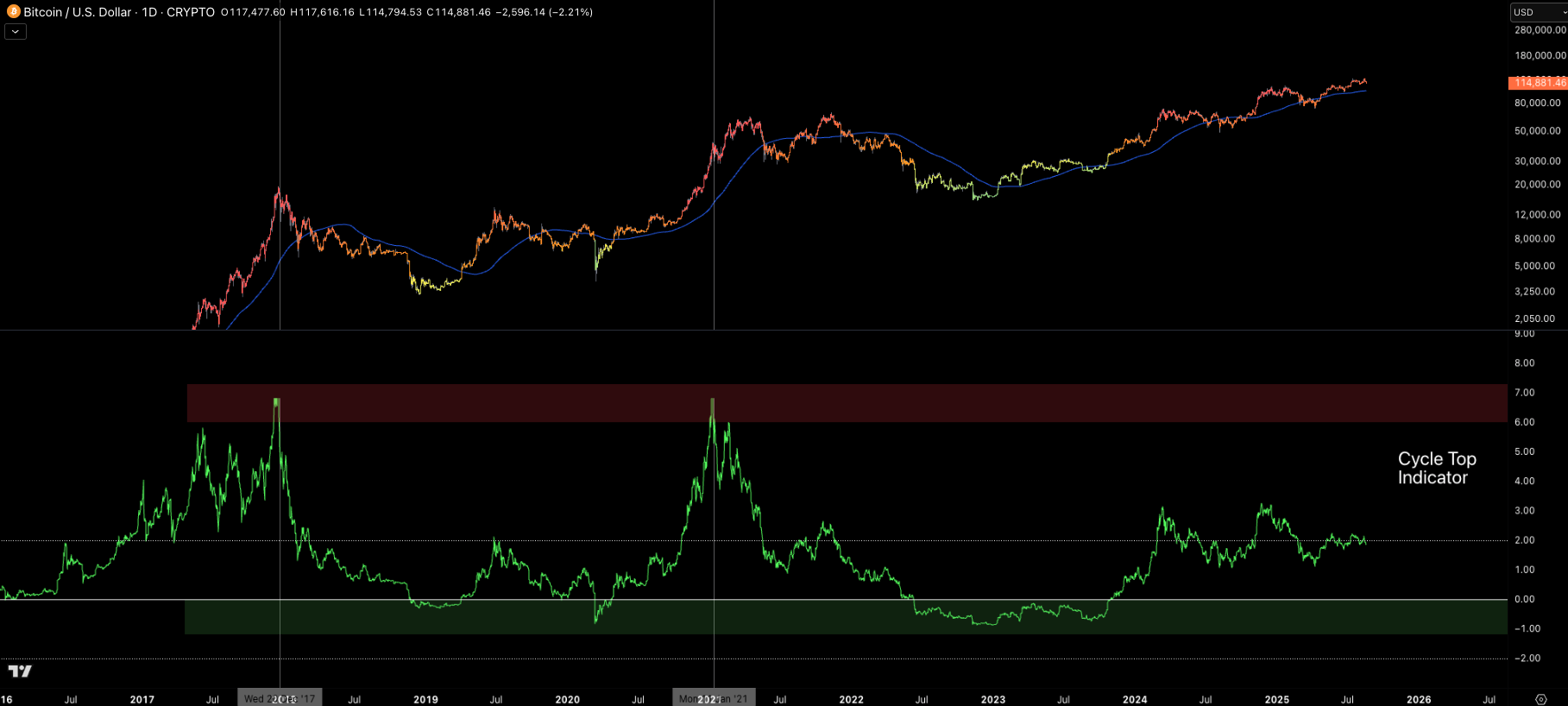

A number of our momentum indices point to current prices not being indicative of macro tops, which suggests potential room to run still over the coming months/quarters.

Digital asset treasury vehicles (DATs) like Strategy are seeing their mNAV compression continue. It is possible Strategy is lowering its share premium to NAV by ATM issuances to raise money (i.e. by selling more shares).

DATs may look to arbitrage any future discount of share price to NAV by selling the underlying to buy back equity which adds volatility in a downside scenario. For the larger DATs, mNAVs are still some way above par before this becomes a risk.

Despite the correction leading into this week, the altcoin market in dollar terms (global market cap excluding BTC market cap) is potentially eyeing its own wedge breakout.

The more interesting lens is charting the altcoin market cap as a ratio to BTC which has broken out of its 3-year downward trend.

This comes after reaching its wick support since inception.

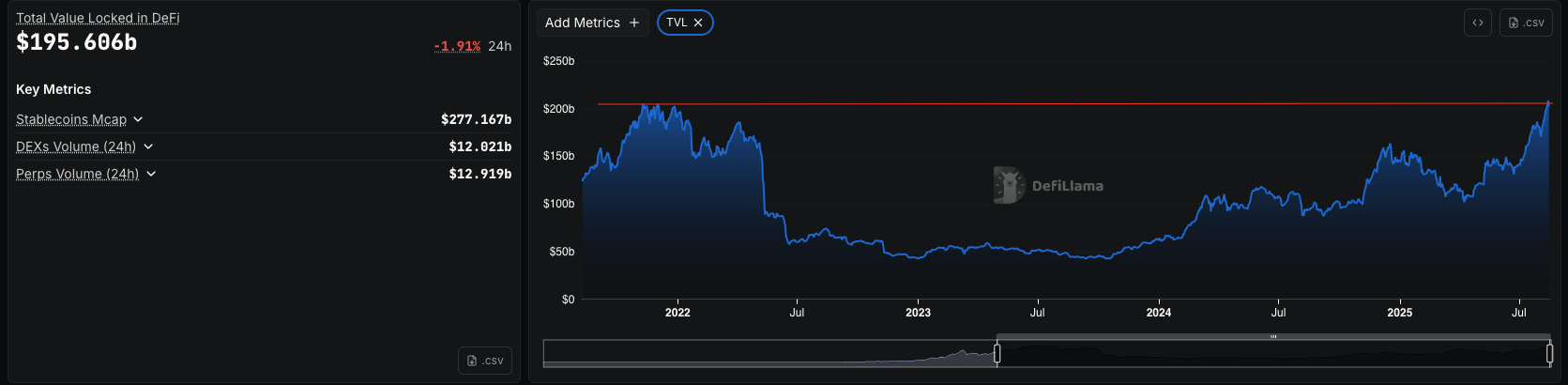

Meanwhile, the total value in DeFi has broken new ATHs of $200b, surpassing levels last seen in late 2022.

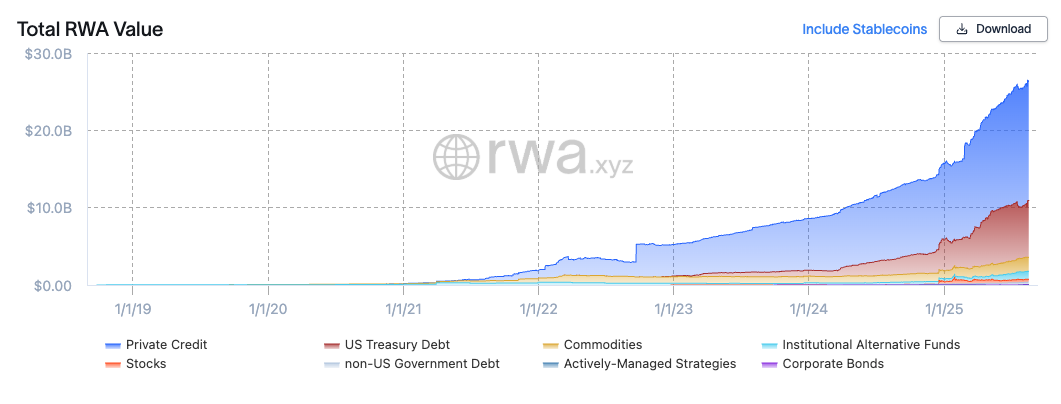

A major driver of growth in DeFi TVL has been the exponential growth of real-world-assets being represented on-chain ($26B) - a secular trend not seen at scale compared to the last cycle.

Re7 in Media:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as its Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Re7 Capital featured in Bloomberg News

As the market rushes into crypto treasury plays, our founder Evgeny Gokhberg offers a more grounded perspective. Trading above NAV only makes sense when supported by a clearly defined, yield-generating strategy. Read the full article

Updates on Re7 Lab Vaults

We are excited to announce that our HyperEVM Morpho Vaults are live on HyperbeatSupply USDT0 and wHYPE in MorphoBeat and earn additional rewards!

We are excited to share that the Re7 uSOL vault on Katana has incredible yield opportunitiesUsers can earn up to 30% APY by depositing uSOL into this vault

Keep an eye out for new additions to our Euler USDC cluster on AVAXUpshift's products upAUSD and upAVAX will be added as collateral!

Keep an eye out for our Euler Vaults on Linea, which should be live very soon with an official announcement.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.