The Weekly - 10th January 2025

JAN 10, 2025

Turning the page to 2025

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

The phases that shaped 2024

What worked in 2024 for investors (e.g. proactively positioning, active management)

The 2025 look ahead

2024 - A Year of Many Chapters

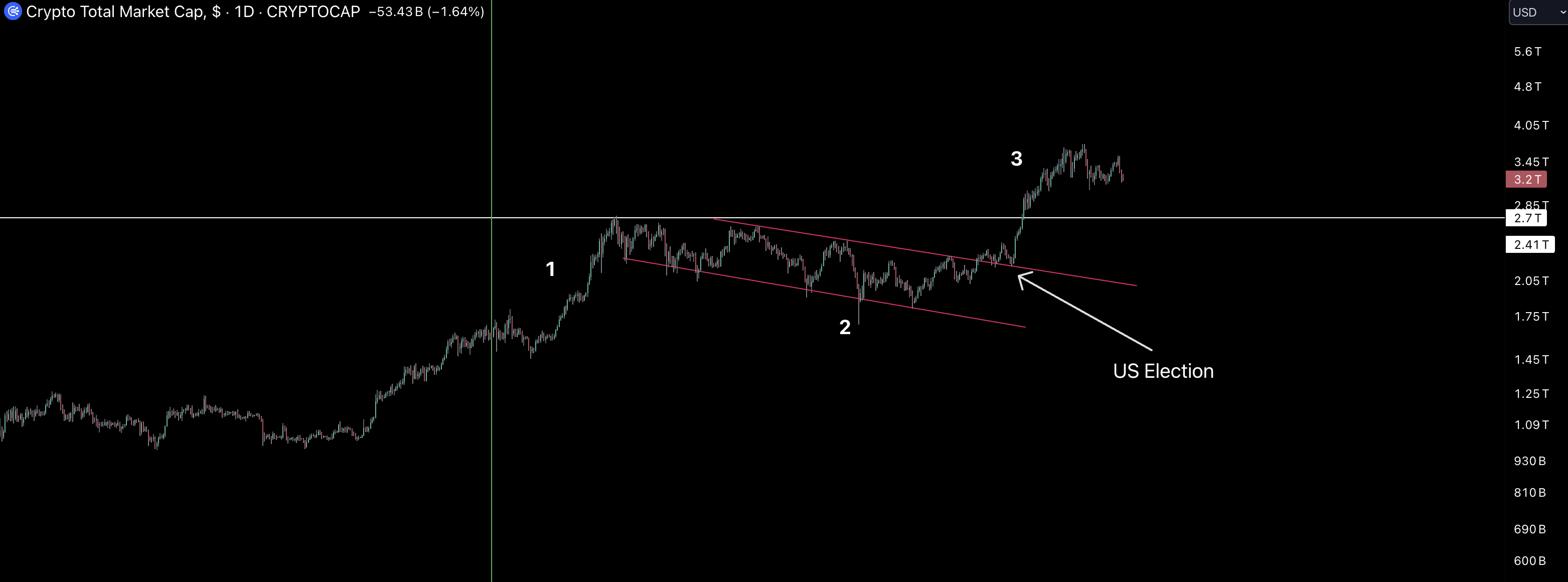

2024 started the year off the back of the 2023 rally with global market capitalisation at $1.62T. The year seemed to have 3 main subjective phases:

1st Phase: A Q1 rally bolstered by strong BTC ETF net inflows that kept BTC dominance between 47%-50%. By the end of Q1 24, US Bitcoin spot ETFs saw over $12B of cumulative net inflows, validating and further contributing to renewed interest in the market.

2nd Phase: Consolidation pattern ($1.7T-$2.6T) from mid-March until a break out in early October. As one of the more forward-looking markets, crypto sniffed out a regime change a month before it occurred (which marked the next phase below).

3rd Phase: A breakout to the upside (+70%) as Trump win the US election cementing renewed optimism around several facets including: 1) more favourable US regulatory environment, 2) pro-business stance, 3) deficit spending and debt expansion through low interest rate and stimulus promoting policies. BTC made new cycle highs.

Global market capitalisation. Green line marks start of 2024.

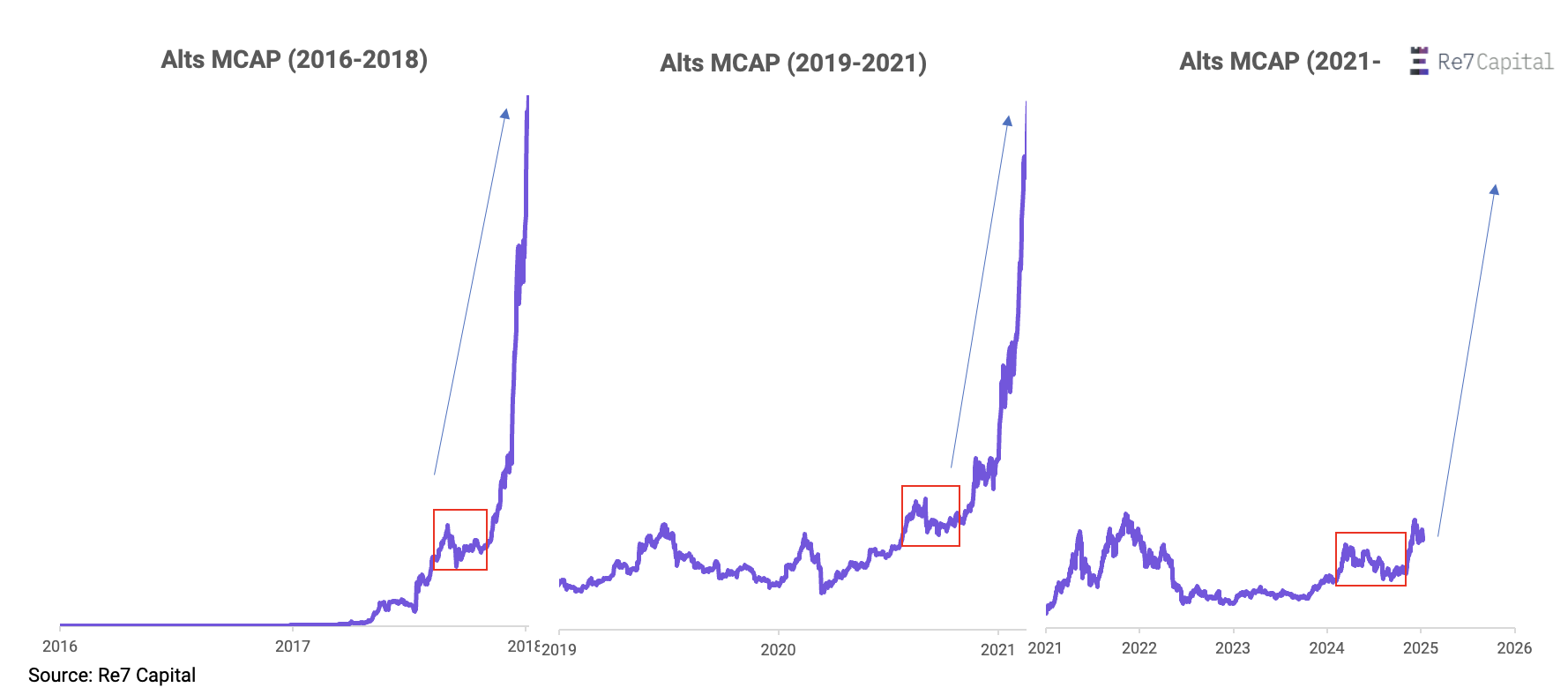

Across all of the phases though, altcoins had a challenging year.

Altcoin dominance stayed flat (+1% nominal) in 12 months. It wasn’t until BTC convincingly broke its previous cycle highs (~$73k) that altcoins got the green light to re-rate vs. beta.

This mirrors previous cycle dynamics where Altcoin market dominance increased +23% nominally to new highs.

Altcoin dominance this cycle has only done ~20% of the re-rate move so far vs. the last cycle.

That said, there were pockets of altcoin strength throughout the year for those looking to capitalise.

Compared to previous cycles, rising tides in the alt sector didn’t lift all boats. Dispersion between macro and micro sectors was prevalent, favouring active managers who could proactively position effectively.

There were clear outperformers of select themes that were profitable for investors, diverging away from a long tail of underperformers into YE: memes, AI, and RWAs.

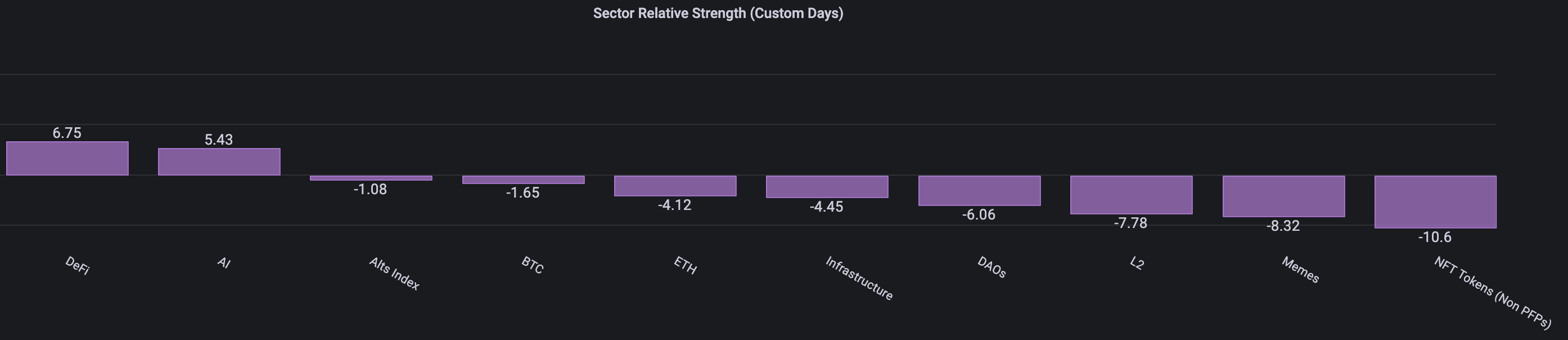

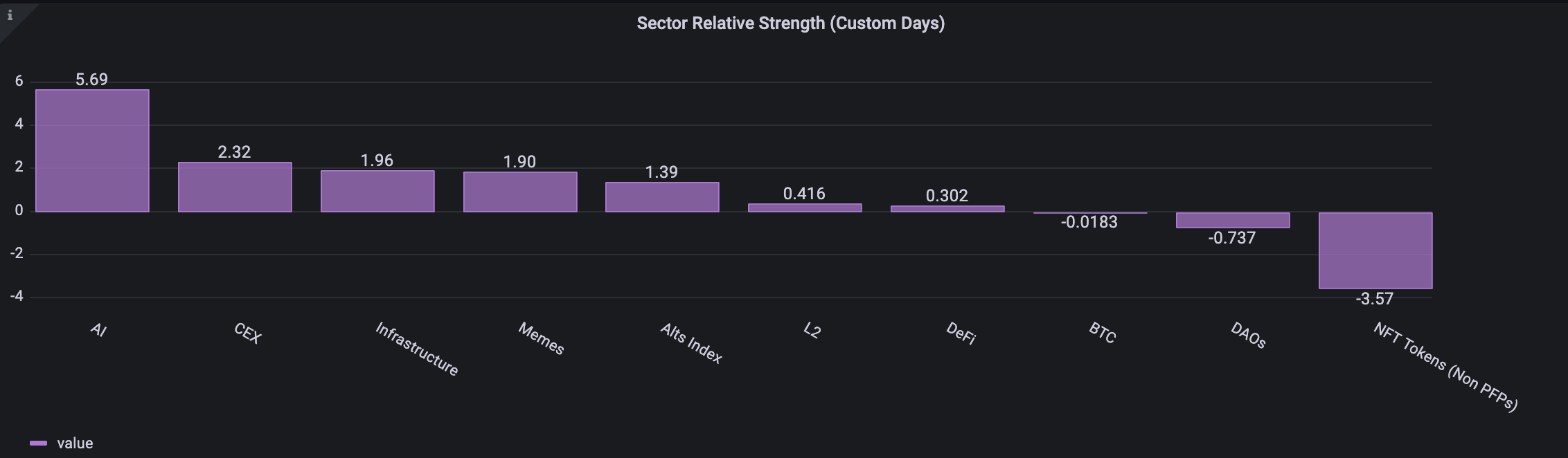

Looking at sectors as a whole (i.e. not just top 10), most sectors (outside of DeFi and AI) underperformed BTC and ETH in 2024 on a relative strength basis.

Macro sector relative strength in 2024 (Re7 Market Intelligence).

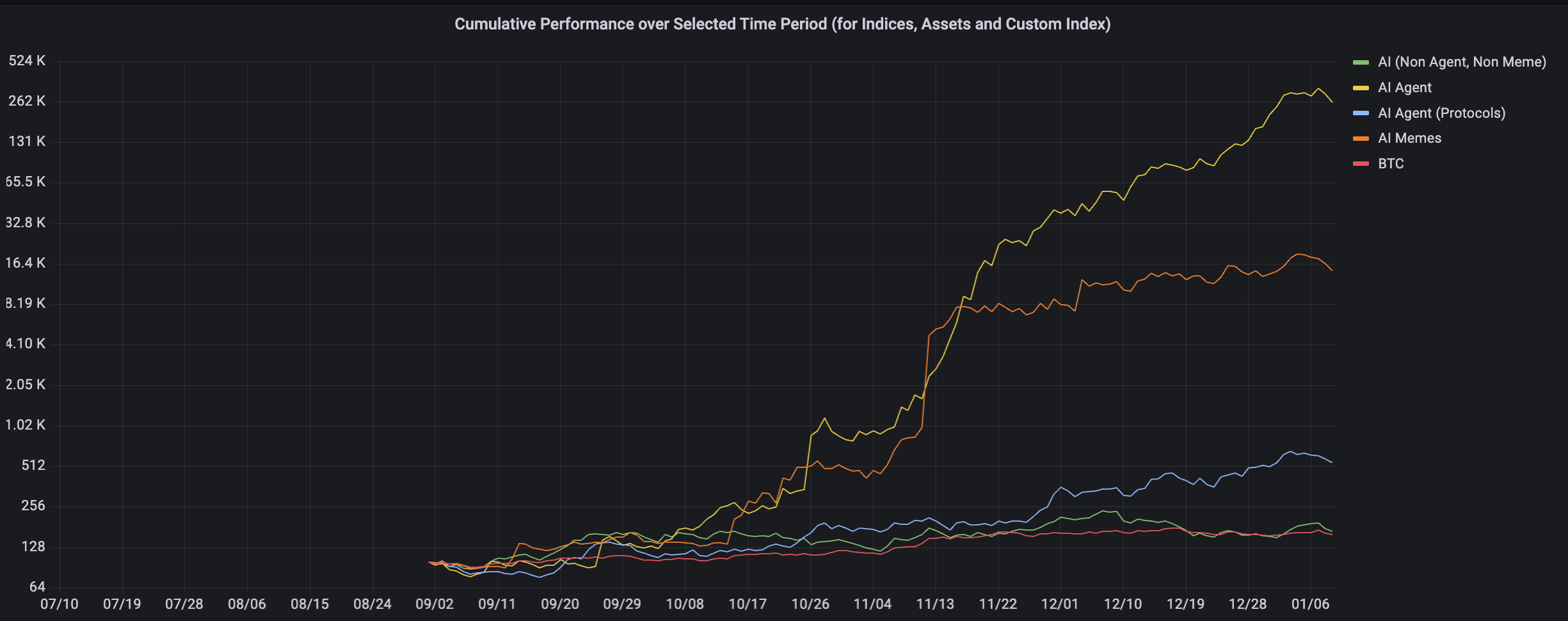

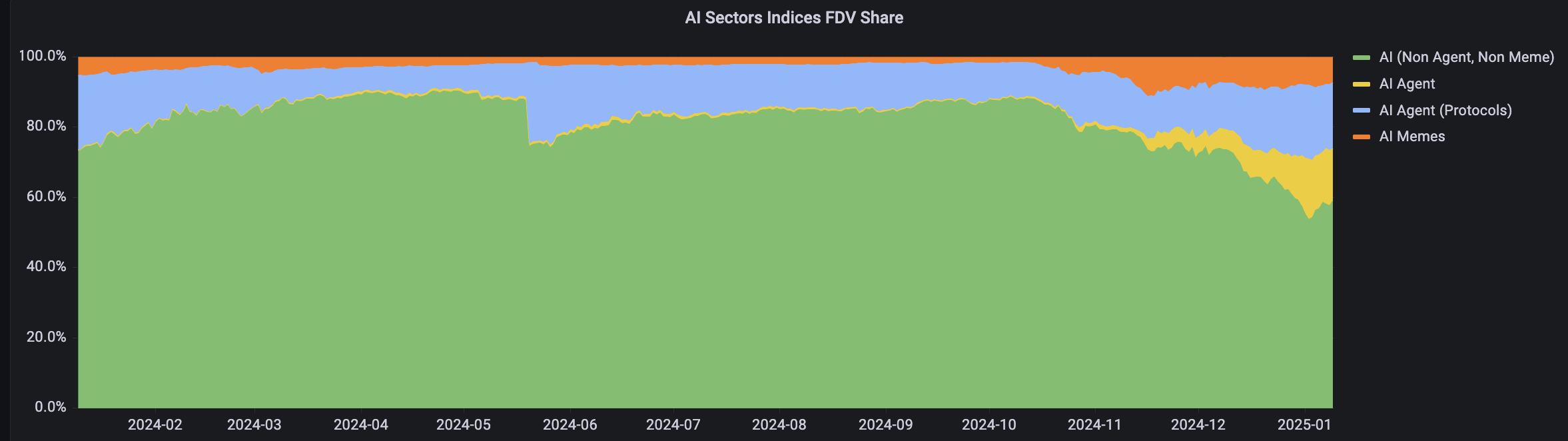

Identifying the emergence of micro themes within a macro theme equally matters. Take AI, where the sector had a notable lift in the last 2 months of the year.

Allocating into a broad AI bucket and negating the sub theme flux would have been sub optimal positoning.

Cumulative performance of AI sub sectors from Sep-YE (Re7 Market Intelligence).

AI sub sector Indices (Re7 Market Intelligence).

Taking these together, the signal is that being in the right theme, over the right time is crucial to outperforming beta.

And leveraging market intelligence tooling to identify these inflection points and regime changes has become a differentiator for investors.

The Look Ahead

So what’s the thread to tie all these things together for 2025? Altcoin dominance breakout to the upside may continue to make new cycle highs.

Yet dispersion will remain a theme for this cycle. We’re even already seeing a glimpse of initial dispersion in the first 2 weeks of this year so far…

Macro sector relative strength YTD (Re7 Market Intelligence).

We’re incredibly excited for the road ahead and the opportunities that will arise in the market.

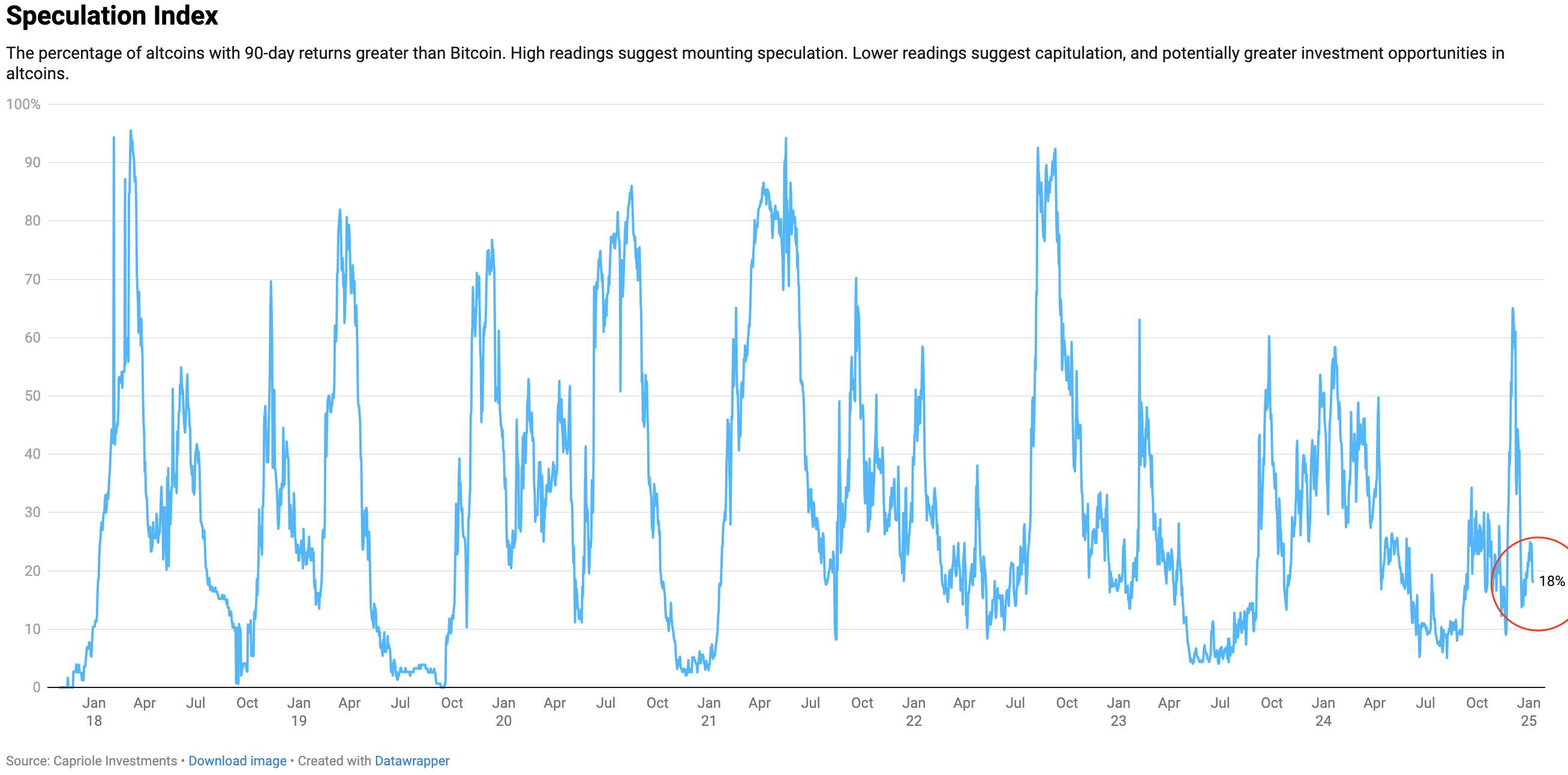

We even start the year with altcoin relative strength at marginally above current cycle lows despite the sector dominance breakout. The opportunities are already there for the taking.

A very happy new year from the Re7 team!

Onwards to 2025.

New vaults go live on Euler and Starknet

Stablecoin yields on fire despite market downturn:sUSDe on Euler is best place for liquid yield on top of sUSDe. Supply yields have been as high as 40% recently pushing total yield above 50%. This is before the 5x boost in points from holding sUSDe in the Stablecoin Maxi Euler vaultmBasis looping has increased caps coming soon that will allow looping mBASIS vs USDC on Base.ETH yields aren't shabby either:Re7WETH on Morpho has consistently had some of the highest ETH yield on mainnet. Total supply is currently at ATH (19.3k WETH / $64.2m). Addition of beraSTONE will keep the yield high.beraSTONE holders can also borrow ETH now, enabled by the recent RE7WETH vault cap addition. Cap increasings are ongoing to meet the high demand so get in while you can.New vaults and partnerships:Our recently launched vaults on Vesu (Starknet) have seen significant inflows directed towards STRK LST looping (xSTRK and sSTRK). We’ve continuously hit debt caps with increases coming soon.We also deployed a USDC vault on Term Finance (WETH vault coming soon) with weekly auctions for fixed-term lending against collateral assets such as wstETH, USD0++ or PT-sUSDe.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.