The Weekly - 8th July 2025

JUL 8, 2025

Onboarding the next 100m users

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital Website / Re7 Labs website> Weekly Research / Real-time Insights> Re7 Capital Twitter / Re7 Labs Twitter

This Week at Re7:

Re7 Labs Vaults Surpassed $600M+ in Curated TVL

Top-performing strategies now live across Morpho, Euler, and Turtle with standout yields. Explore vaults purpose-built for institutional-grade, on-chain capital allocation.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

Full Stack DeFi Web Developer

Fund Operations Manager

Client Service Associate

Head of Branding

Investment Analyst(Liquid Token)

Senior Capital Formation

DeFi Associate

DeFi Account Manager

DeFi Business Development

We want to hear from you!

Summary

In this edition, we cover:

the emerging macro set up and trends

how fintech companies are looking on-chain as part of their next growth plan

Macro

Markets continue to edge higher. Global market capitalisation stands at $3.4T closing Q2 +24%.

BTC closed its highest weekly candle ever ($109,200). The orange coin has seemingly broken out of its consolidation range and putting in a post breakout retest.

This structurally rhymes with what we saw back in May earlier this year.

This comes as both SPX and NASDAQ put in new all-time-highs in a signal of strong investor sentiment.

Yet, investor positioning doesn’t appear to be overextended.

With tensions in the middle east easing and money managers selling out of the depths of the tariff-fueled market meltdown, there’s a set up for a revenge rally.

Now, the ‘Big, Beautiful Bill’ is signed into law we will also now see $3.3T in fiscal stimulus weakening the dollar further. Tarrif tensions become the red herring and backbone for the revenge rally.

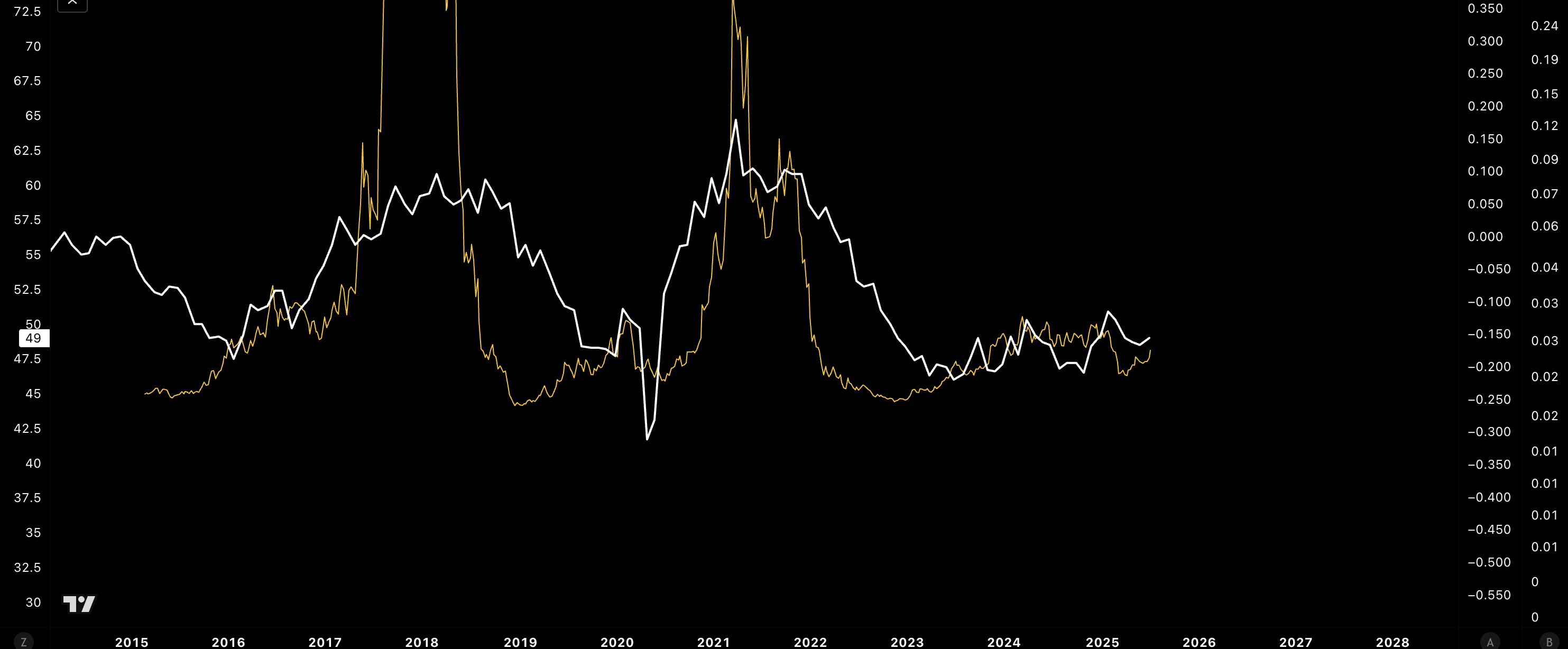

US economic production is set to increase as part of its cyclical pattern (white below) as financial conditions continue to ease at pace (red below).

Economic expansion drives higher asset prices.

Global crypto market cap trends (yellow below) in line with these economic growth measures such as the ISM.

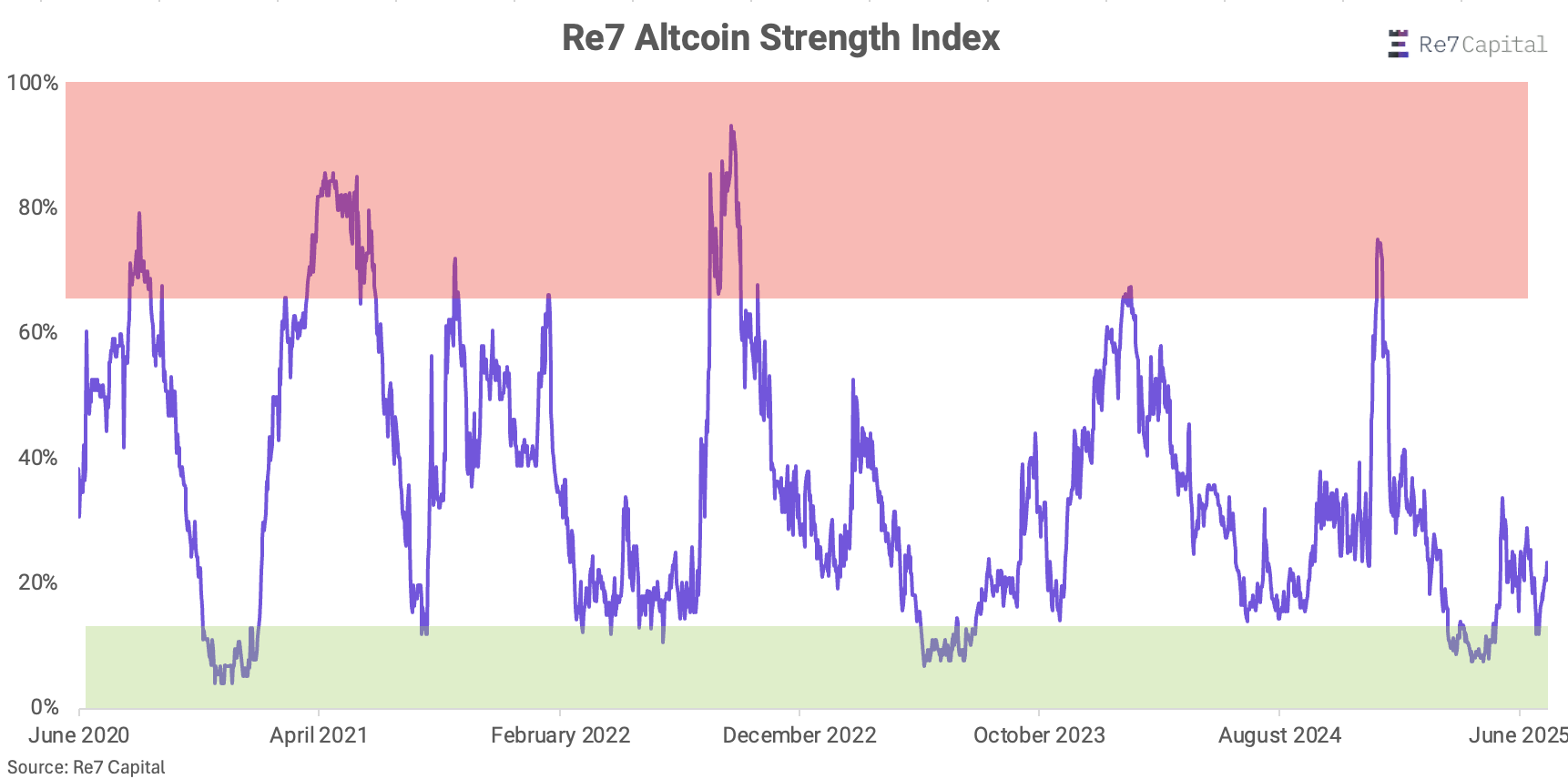

The growth story being shaped comes as alts are bouncing off from cyclical lows where sentiment is starting to recover in the sector.

It’s in this part of the cycle where alts have the ability to be the most reflexive opportunity in the market upswing. Historically, reflexivity starts from a phase of disillusionment as this is what leads to the re-pricing itself.

“When the time comes to buy, you won’t want to.” - Walter Deemer

Onboarding the Next 100m Users

Last week, we saw further adoption of companies developing their business strategy on-chain.

You don’t have to look far to see the opportunity.

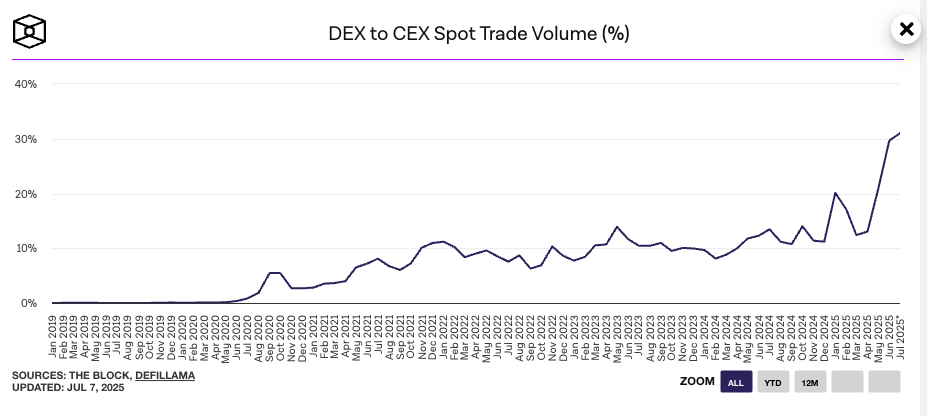

As we’ve highlighted before, DEX/CEX trade volume has been surging collectively from fast token listing, improved accessibility and efficiency, and pace of innovation.

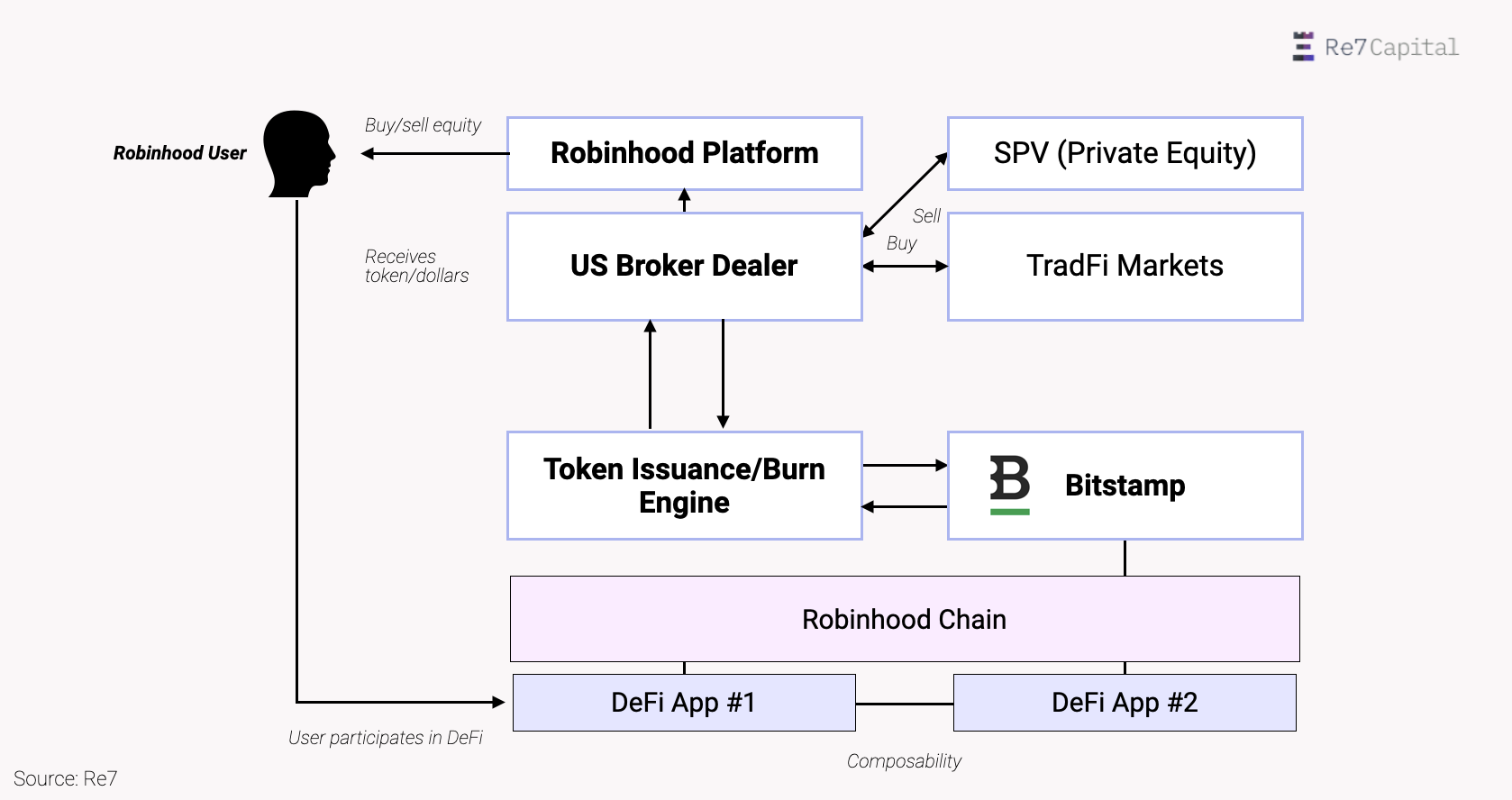

Robinhood will be launching an Arbitrum chain where EU users can trade 200+ US stocks and ETF tokens.

Just recently, Coinbase announced direct integrations with DEXs to enable on-chain access to a growing pie of on-chain liquidity.

By integrating centralized exchanges (CEXs), decentralized exchanges (DEXs), and wallets, they oversee every point of user engagement, from the initial order request to its final execution.

Over time, these companies will likely lean into enabling more permissionless markets while still owning more of the tech stack (e.g. migrating from Arbitrum to their own Robinhood Chain).

Illustrative schematic of how Robinhood facilitates tokenised equity services.

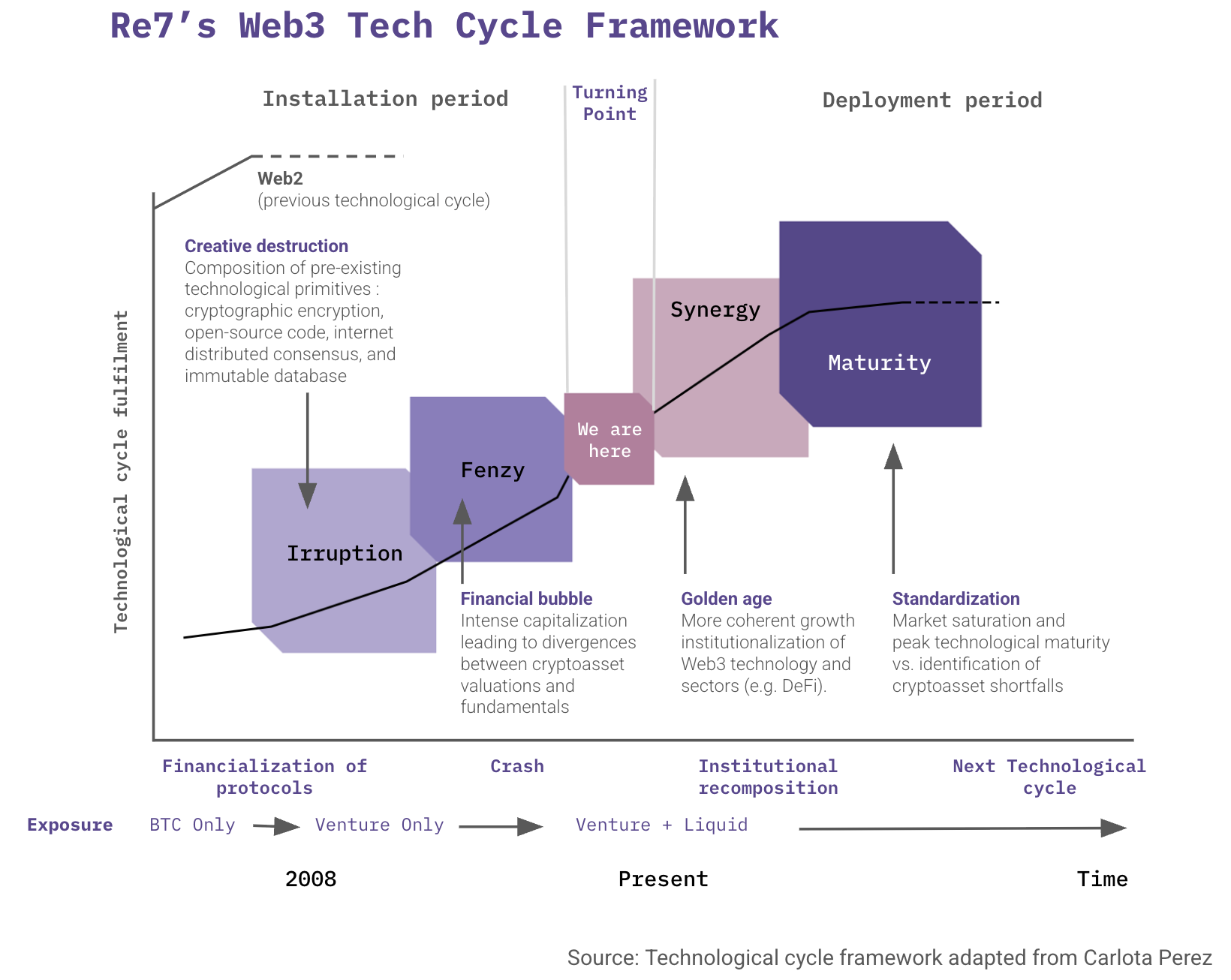

They are evolving into ‘super apps’, positioning themselves as key players driving the 'golden age' of Web3 adoption and growth by owning distribution.

All while abstracting away the ‘blockchain’ elements.

Updates on Re7 Lab Vaults

We are excited to announce that USD1 on Binance Smart chain has been added to the Re7 Labs Cluster on Euler with up to 14% APR in rEUL incentives.

We also launched other opportunities on Binance Smart Chain with the inclusion of USDX and sUSDX to the Re7 Labs cluster.

We are excited to share new additions to Euler on Avax: UTY and yUTY have been added to the Re7 Labs cluster.

We are excited to introduce a new BTC Yield Strategy on Gearbox Protocol. Borrow tBTC against BTC-native collateral and earn additional incentives until July 25th.

Keep an eye out for our Re7 Morpho vaults on Katana, these should be live very soon with an official announcement.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.