Starknet Is Building Bitcoin’s Economic Flywheel

JAN 4, 2026

The missing pieces are finally in place. For most of its life, Bitcoin was passive. An asset that crypto natives trusted but rarely used. It sat in cold storage, on exchanges, or in fragmented wrapped versions that saw little participation in the broader onchain economy. That gap was the opening for BTCFi.

Bitcoin can now play a more active role across crypto. Wrapped representations have become more secure and interoperable. Institutions are entering the market as compliance standards have improved. And the surrounding infrastructure has matured, allowing Bitcoin to secure networks, serve as pristine collateral, and generate real yield directly onchain.

At the same time, the market itself has evolved. Most altcoins remain below their prior cycle highs, while capital has rotated toward Bitcoin and a handful of protocols showing real usage and recurring revenue. Incentives still matter, but they must be paired with products that create lasting demand.

These shifts set the stage for Bitcoin’s transformation from a static store of value into productive capital across DeFi. It’s a shift Starknet has long anticipated, building zero-knowledge (ZK) technology that traces its origins back to scaling Bitcoin itself.

Their next chapter builds on that foundation. Starknet is moving beyond a high-performance Ethereum rollup to become its own self-sufficient network anchored to both Bitcoin and Ethereum. BTCFi marks the beginning of this new phase, bridging Bitcoin’s role as a digital reserve asset with Starknet’s programmable, composable ecosystem.

BTCFi: Starknet’s All-In on Bitcoin

The vision Starknet is executing today took root more than a decade ago. In 2013, long before Starknet existed, co-founder Eli Ben-Sasson was exploring how ZK proofs could improve on Bitcoin without introducing new trust assumptions. That research became the foundation of STARK cryptography, which now underpins Starknet, one of Ethereum’s most secure and technically advanced rollups.

Over the past year, the team has come full circle to that original idea with a broader focus. Not only scaling Bitcoin’s throughput, but also enabling it to serve as usable collateral. Each part of Starknet’s architecture, incentive design, and ecosystem strategy has been refined with this in mind.

Their efforts culminated in the formal launch of BTCFi, a coordinated initiative between StarkWare and the Starknet Foundation that introduced three core pillars:

Bitcoin staking on Starknet as part of a dual-token consensus model

A 100M STRK incentive program to bootstrap Bitcoin liquidity

Infrastructure collaborations with various institutions, bridges, custodians, and DeFi applications

How Starknet is Built for Bitcoin

To be truly aligned with Bitcoin, BTCFi needs a foundation that is transparent, verifiable, and secure in the long term (perhaps, more importantly now, quantum-resistant). Starknet is built on STARK proofs, a system originally developed to trustlessly scale Bitcoin that now gives the network a credible advantage as the go-to execution environment for BTC activity.

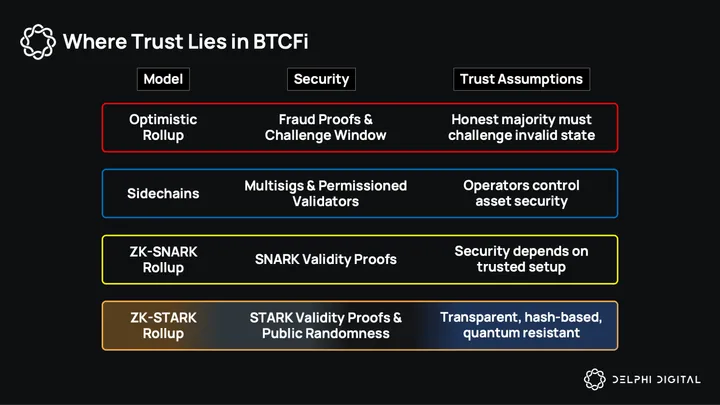

Across today’s BTCFi landscape, most chains introduce new trust requirements. Optimistic rollups assume that enough participants will monitor the network and challenge invalid transactions. Sidechains use multisigs to collectively control user assets. SNARK rollups rely on a trusted setup ceremony that must be kept secure. All of these require users to trust actors or processes beyond Bitcoin.

Starknet avoids these assumptions entirely by using transparent STARK proofs. Instead of relying on a trusted setup that comes with “toxic waste”, STARKs use publicly generated randomness to establish security. Anyone can check the proofs themselves, without hidden parameters or external actors.

The STARK proofs are then posted and verified on Ethereum. Meaning, Starknet inherits Ethereum’s security guarantees while preserving a proof system that remains fully transparent and independently verifiable.

Starknet and STARKs also differ in the security of their proof mechanisms. Most chains rely on elliptic curve cryptography for both transaction signatures and proofs. This model is efficient today but is vulnerable to future quantum computers, which can break elliptic curve assumptions.

STARKs instead rely on collision-resistant hash functions, like SHA-256. These hash functions are simpler, widely studied, and have no known efficient quantum attacks. This provides stronger assurances for assets intended to be held long term, such as Bitcoin.

Altogether, these attributes position Starknet on a meaningfully different security foundation than other networks integrating Bitcoin. Its guarantees are rooted in verifiable computation rather than external trust. For Bitcoin holders, one of crypto’s most risk-averse participants, the emphasis on independent verification and viability is a clear advantage.

If they are going to deploy their Bitcoin stack, the underlying system must minimize trust wherever possible. Starknet’s architecture meets that expectation, making it a natural fit for users who want yield while protecting the standards they value in Bitcoin.

The BTCFi Flywheel

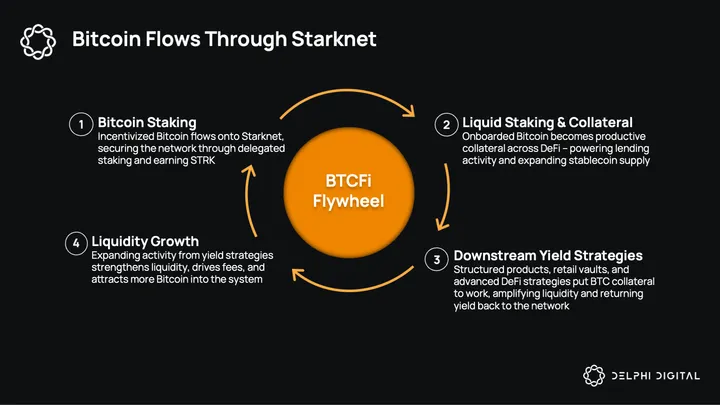

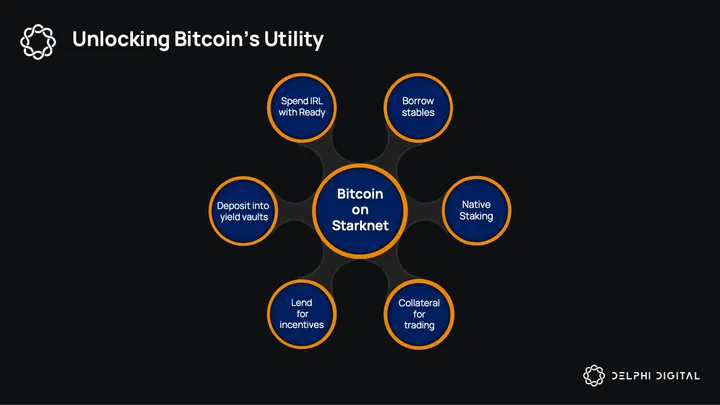

The BTCFi initiative reframes Starknet around a simple idea. Bitcoin is the reserve currency, and Starknet is the layer where that currency becomes productive.

Rather than a few isolated projects or integrations, the team has focused on establishing a circular system built around Bitcoin liquidity. Native Bitcoin staking, lending, borrowing, and trading all interact in a set of reinforcing flows that strengthen the flywheel over time.

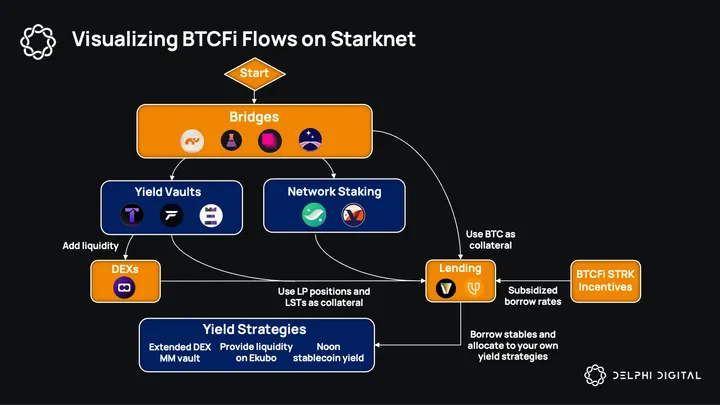

The first step in that system is staking. Users can delegate their Bitcoin to validators on Starknet, helping to secure the network while earning a yield paid in STRK. Capital that would otherwise sit idle is now an active part of Starknet’s security.

For users who want to remain flexible, they can swap into liquid staked representations instead of staking directly with a validator. These tokens preserve the underlying staking rewards while maintaining BTC’s usability. With liquid staked Bitcoin, users can supply it to vault curators for additional yield, provide liquidity on trading venues, or simply borrow USDC against it.

These staking and subsequent liquid staking flows form the base of BTCFi on Starknet. Inherent demand for borrowing against newly onboarded Bitcoin deepens stablecoin liquidity, while lending, liquidity provision, and trading continue to generate fees and activity across the network.

Starknet has done well supporting early market formation here with targeted STRK incentives that effectively subsidize Bitcoin borrowing and improve returns for lenders. This has bolstered the initial phase of deposit growth and stablecoin demand, which are necessary to activate the flywheel.

Downstream strategies continue to build on this. As Bitcoin activity expands across Starknet, it acts as new material for yield opportunities.

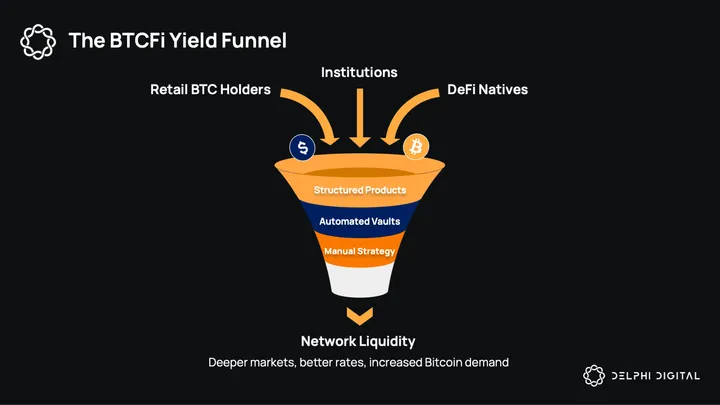

Institutions can allocate to structured products that earn returns from lending markets or option strategies. Retail holders can deposit into vaults that simplify mechanics, such as staking loops, into accessible yield products. And DeFi natives can connect across multiple Starknet protocols to build more advanced Bitcoin strategies that capture funding spreads or market-making incentives.

These activities sit downstream because they rely on each of the earlier steps in the system. Staking brings Bitcoin onto Starknet. Liquid staking makes it composable. Borrowing demand expands stablecoin supply. Onchain trading and lending generate volume and fees. The downstream layer converts these inputs into returns, pulling additional Bitcoin and USDC into the cycle.

Starknet’s Bitcoin Ecosystem

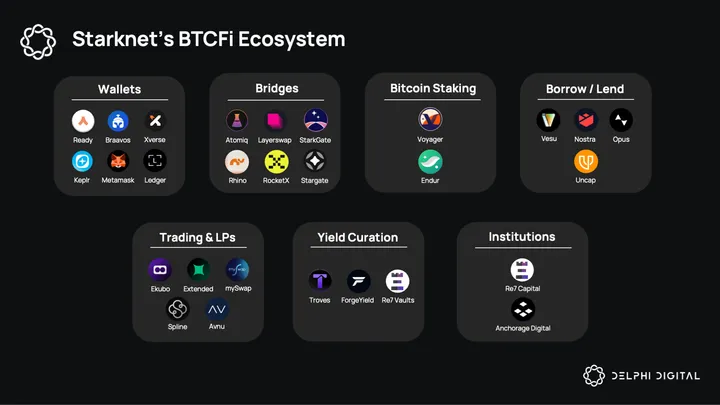

Starknet’s BTCFi ecosystem is supported by an increasingly comprehensive set of protocols, bridges, custodians, and trading venues. Instead of a scattered collection of apps, the network has developed a fully cohesive stack that lets users bring Bitcoin onto Starknet and truly use it. This infrastructure is what turns the conceptual flywheel into a real, operational system.

Bridging Over

The entry point to Starknet begins with wallets and bridges that simplify Bitcoin onboarding for both everyday users and institutions. Native Starknet wallets, such as Braavos and Ready, work best, but other popular wallets, such as Xverse, MetaMask, and Ledger, are also compatible with Starknet.

Depending on a user’s setup, there are several routes to bridge Bitcoin to Starknet. For native Bitcoin holders, Atomiq and Layerswap provide secure bridges that enable low-slippage swaps directly into WBTC on Starknet – one of the most direct paths for onboarding native Bitcoin.

For users already on Ethereum or Solana, StarkGate serves as Starknet’s official bridge, supporting transfers from a range of Bitcoin assets, including WBTC, SolvBTC, LBTC, and tBTC, as well as other popular tokens like ETH and USDC. Users from other chains, such as Arbitrum or Base, can bridge directly to Starknet through a few cross-chain bridges, including Rhino, Layerswap, and, soon, Stargate.

Bitcoin Staking on Starknet

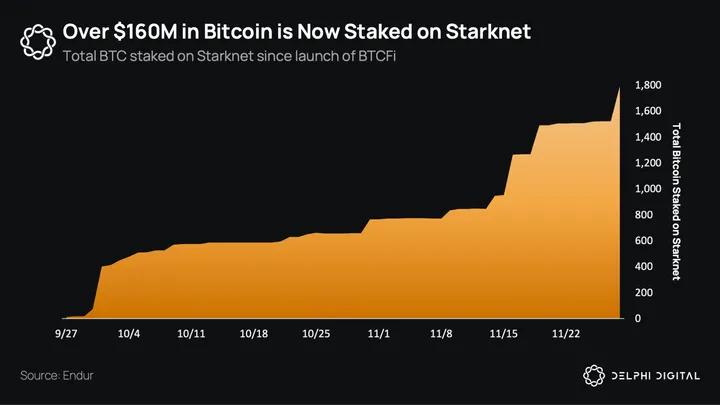

Once Bitcoin is on Starknet, most users start with staking. It anchors the BTCFi system and draws the first meaningful inflows of liquidity onto the network. Since its launch under two months ago, it has already attracted over $160 million in Bitcoin.

Users can stake their Bitcoin and delegate it to validators on platforms like Endur and Voyager, or stake it directly from wallets like Braavos. Once delegated, BTC increases the validator’s effective stake, which determines their weight in Starknet’s attestation process and the share of rewards they can earn.

The more stake a validator backs, the greater their share of rewards when they successfully fulfill attestation duties. In return, stakers earn STRK that scales with the validator’s reliability and uptime – current yields range from 4% to 6% APY. Bitcoin that previously sat unproductive now strengthens Starknet’s security and earns a predictable share of staking rewards.

For users who prefer to remain liquid, there is an alternative to locking their Bitcoin in direct native staking. Through Endur, they can swap into liquid staked Bitcoin (xWBTC, xsBTC, xtBTC, etc.) that preserves the underlying staking yield while remaining usable across Starknet. These can be used immediately for actions like borrowing USDC or accessing yield markets. Each LST is tied to a different form of wrapped Bitcoin, allowing users to select the version that best suits their custody preference while still accessing the same utility.

It’s important to note that these LSTs accrue staking rewards in BTC rather than STRK through native staking, which matters for users deciding whether to maximize their STRK exposure or simply earn BTC yield.

Bitcoin Becomes Composable Collateral

Once Bitcoin is onboarded to Starknet, it moves from being digital gold to a more useful crypto asset. This phase is all about optionality rather than strategy, the middle layer where Bitcoin is free to move between protocols.

A key enabler of this optionality is that bridged Bitcoin follows a common standard across the network. Whether it’s SolvBTC or LBTC, each representation plugs into the same lending markets, money markets, and staking apps.

Users looking to get the most out of their capital can then tap Starknet’s BTCFi stack to:

Borrow stablecoins against Bitcoin on platforms like Vesu at the lowest rates across all of crypto, often just 0.1% – 1% APR

Lend Bitcoin on Vesu’s permissionless pools to earn yield and incentives on idle capital

Spend in person while earning cashback with Ready wallet’s crypto debit card and full Starknet BTCFi integration

This composability is the connective tissue between staking and yield. It ensures Bitcoin can circulate through the network and slot into whichever role a user needs at any moment. Once Bitcoin achieves this level of functional mobility, the more advanced strategies in the next section will have something to build on.

Onchain Yield Strategies

At this stage, Bitcoin stops just supporting the system and starts amplifying it. Once circulating across Starknet, deposits power lending markets, liquidity pools, and institutional products. This gives rise to three layers of strategies, each suited to different users but all reinforcing the same economic flywheel.

Institutions take the most structured route for instance. Re7, a $1 billion asset manager, that packages staking, lending, and derivatives strategies into products designed to generate BTC-denominated returns.

Their flagship strategy pairs offchain systematic options trading with onchain yield opportunities like liquidity provision on Ekubo and native Bitcoin staking on Starknet. The strategy is offered as an institutional vehicle for professional allocators, but features a tokenized version, mRe7BTC, that extends the same vehicle to onchain users.

Anchorage Digital has also recently expanded its multi-billion-dollar custodial platform to support Bitcoin staking on Starknet, enabling institutional clients to earn staking rewards (in STRK) through regulated custody while securing the network.

These products give investors an entry point that feels familiar, with consistent cash flows built from real activity rather than speculation. As firms package these strategies into vehicles with standard reporting, compliance frameworks, and transparent performance data, it becomes much easier for more allocators to participate.

Early demand has reflected this. Ahead of the official launch of their Starknet BTCFi yield fund at the end of September, Re7 had already secured commitments close to 2,000 BTC from a select group of allocators.

Retail users can access similar mechanics through simplified products. Platforms like Vesu, Troves, ForgeYields, and Re7’s portal offer Bitcoin vaults that automate their own strategy end-to-end. 0D Finance is also preparing to launch automated vaults, while Starkware provides an official Earn Portal, currently in beta, that aggregates these various yield opportunities in one place.

Critically, these vaults abstract complexity in the background, allowing users to access the same institutional strategies with less burden. Users can make a one-time deposit and earn yield without managing margin ratios, staking loops, or position upkeep.

Re7’s presence is most notable here. Beyond its institutional offerings, the team operates a set of retail-friendly vaults centered around Ekubo liquidity opportunities. These vaults deploy user deposits into curated pools, earn trading fees, auto-claim and swap rewards, and rebalance positions as needed. Everything is executed onchain and remains non-custodial, giving everyday users access to transparent, active strategies without the need for good faith.

Lastly, DeFi power users can take a different path and compose their own strategies across Starknet’s protocol stack. They can deploy their Bitcoin on Vesu or Uncap, borrow USDC, and run funding-rate, basis, or other perp strategies on exchanges like Extended or Paradex.

Extended in particular has grown into one of Starknet’s flagship venues. With over $100 million in TVL and daily volumes now clearing $500 million, the exchange leverages Starknet’s throughput and fast settlement for tight execution and deep liquidity on BTC perp strategies.

Others may provide concentrated liquidity on Ekubo, the most efficient onchain AMM, to capture trading fees in markets that are becoming increasingly active as inflows scale.

These manual strategies draw on the same building blocks as the institutional or retail products, but provide full control over leverage, collateral, and position structure. They come with another added advantage as well – no management or performance fees, so 100% of returns remain with the user.

Across all of these layers, this pursuit of yield ultimately feeds back into Starknet. Each deposit, borrow, and trade deepens liquidity, draws more Bitcoin into the system, and compounds network activity.

Why BTCFi Matters

Bitcoin accounts for roughly 60% of all crypto asset value, close to $2 trillion, yet less than 2% of that is used throughout DeFi. Most Bitcoins today sit idle on CEXs, hot wallets, or in cold storage. Activity is primarily limited to simple transfers. BTCFi on Starknet seeks to change this by giving Bitcoin a productive role without altering its trust assumptions.

Unlocking Bitcoin’s idle balances matters for more than just yield, too. As shown earlier, more Bitcoin onboarded, utilized, and circulated on Starknet directly strengthens the network’s economy. Liquidity deepens, stablecoin supply grows, and trading venues become more efficient. The end result is a system in which Bitcoin demand becomes a direct input into Starknet’s own network effects.

A functional Bitcoin economy also significantly broadens Starknet’s reach. Traditional Bitcoin holders behave differently from DeFi natives. They are more risk-sensitive, maintain longer time horizons, and represent one of the largest pools of idle capital in the entire crypto ecosystem. Providing an environment where their holdings can safely earn yield and serve as collateral brings an entirely new demographic onchain. Starknet and STARK proofs give them a trust model that aligns with their needs.

Institutions now overwhelmingly prefer holding Bitcoin in size over other crypto assets. That preference is reshaping market structure as allocators look for regulated ways to deploy BTC into yield strategies. For them, the opportunity to deploy Bitcoin in regulated custody and participate in secure, onchain yield strategies is a meaningful shift.

It brings a segment of capital that has historically sat outside of onchain markets directly into the BTCFi flywheel on Starknet. As more institutions allocate to these strategies, the liquidity base for BTCFi thickens, enabling a larger set of products to develop on top of it.

Bitcoin’s growing footprint on Starknet means STRK should begin to reflect its role as Bitcoin’s DeFi layer. The more Bitcoin supply locked on Starknet, the more Starknet’s value becomes anchored to it. This is why BTCFi matters at a strategic level, and it gives STRK plenty of room to reprice alongside a Bitcoin-dominated market.

Positioning Starknet as Bitcoin’s Execution Layer

BTCFi expands what Bitcoin can do, but its impact depends on whether the network beneath it can support its full lifecycle.

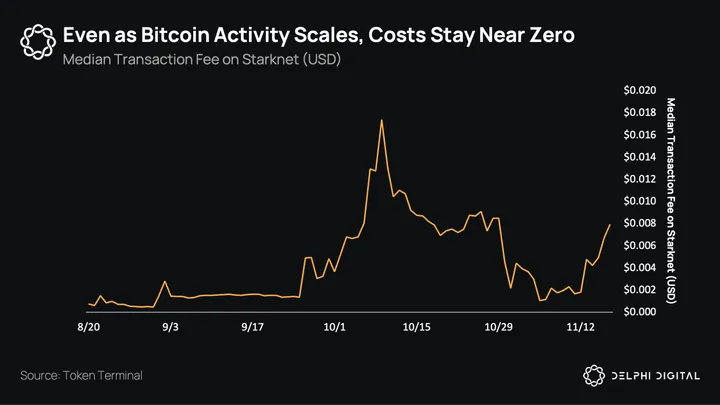

Starknet is built for that role. Low execution costs, high throughput, STARK validity proofs, quantum-resistant security, native Bitcoin staking, and a growing application stack allow Bitcoin to move, earn, borrow, and settle in one place.

This positions Starknet to serve as the most trust-minimized route between Bitcoin and Ethereum. A chain that enables Bitcoin to have utility and settle at low costs with top security becomes the natural entry point for the reserve asset in DeFi.

Over time, this role compounds. Once liquidity anchors itself in staking, lending, AMMs, and structured vaults, the path of least resistance for new inflows begins to favor Starknet by default.

Starknet’s approach is also perfectly timed. Rollup infrastructure has matured to the point where staking, borrowing, and liquidity rotations can be executed for under a cent – something that was impossible even two years ago. Combined with maturing bridges, stablecoin supply growth, and major leaps in tech like S-Two and parallel execution, the ecosystem has the technical foundation to support a full Bitcoin economy.

But the defining feature is Bitcoin staking. Starknet is the first Ethereum L2 to integrate Bitcoin directly into its consensus model and distribute rewards to Bitcoin stakers. This transforms Bitcoin from an external asset into a core component of the network’s security. And Bitcoin staking is supported by Starknet’s proof system, avoiding reliance on external actors.

By aligning the network with Bitcoin inflows, Starknet creates the first structural incentive for Bitcoin liquidity to flow onto Starknet rather than remain siloed away. It gives Bitcoin holders an onchain destination that is both economically rewarding and aligned with the trust assumptions they already operate under.

This alignment becomes more important when viewed against the broader landscape. Every major ecosystem, Ethereum L2s, alternative L1s, and Bitcoin sidechains, is vying to attract the same pool of Bitcoin liquidity. But most approaches treat Bitcoin as a foreign asset rather than a native one. Without deep integration or security at the network layer, these environments struggle to retain deposits once incentives taper off.

Starknet creates a network where Bitcoin activity can compound rather than reset each time capital moves between protocols. The components that matter, security, liquidity, low-cost execution, and institutional participation, are all moving in the right direction, and they reinforce one another in a way that few ecosystems can match.

Over time, the networks that succeed will be the ones that offer Bitcoin a place where it can be both protected and put to work. Starknet is one of the first ecosystems to take that challenge seriously, and the design choices being made today reflect a long-term effort to build the DeFi base layer that Bitcoin has historically lacked.