The Weekly - 28th October 2024

OCT 28, 2024

Rumble in the Jungle

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Re7 is Hiring!

DeFi Business Development

Re7 utilises our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of DeFi and alpha strategies.

We also work with leading projects and blockchains to design their DeFi ecosystem and provide on-chain risk curation and vault management services through Re7 Labs.

We are looking for a talented DeFi Business Development person to support the Re7 Group, scale its vaults, establish partnerships and source crypto clients who could benefit from Re7’s product suite.

Summary

In this edition, we cover:

The broad shift in investor positioning

Why investors are increasing allocating to higher yield opportunities

The crypto market inflection points

All-time-high fundamentals underpinning the growing market momentum

Rumble in the Jungle

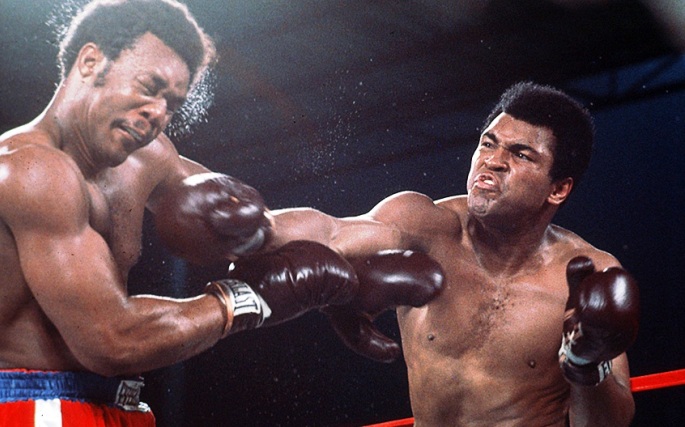

One of the most iconic examples of patience paying off in boxing is Muhammad Ali’s famous "Rope-a-Dope" strategy against George Foreman in their 1974 fight, "The Rumble in the Jungle."

In this match, Ali leaned against the ropes, letting Foreman tire himself out with powerful punches while he conserved his own energy.

Ali's patience and resilience paid off: in the eighth round, with Foreman exhausted, Ali took the opportunity to strike back, eventually knocking him out.

Ali vs. Foreman

This strategy showcased the power of patience and intelligence in boxing, proving that sometimes waiting for the right moment can be more effective than brute force.

On August 5th 2024, just 2 months ago, crypto markets sold off on fears of a looming US recession using backwards-looking data.

On this day, we wrote how ‘valuations were diverging from fundamentals, creating opportunities.’

Crypto was taking the countless George Foreman punches.

Since then, with no recession taking place and investors realising we are actually in a growth phase, crypto has since rebounded by over 35%.

The bellwether of the market, BTC, is now re-testing $70k, looking for the knockout punch.

With equities at all-time-highs, yields rising, and inflation hedges rallying, the market is signalling a broader re-positioning from investors.

The risk premium is increasing, and investors are allocating down the risk continuum to achieve higher yields in order to outpace inflation. After all, central banks need to refinance the $35T debt.

During this positioning shift, crypto has been providing better returns than equities.

Since the August lows in markets, crypto has outperformed the S&P by >18%.

Despite the run-up in markets, the path of least resistance from here also remains higher, than lower.

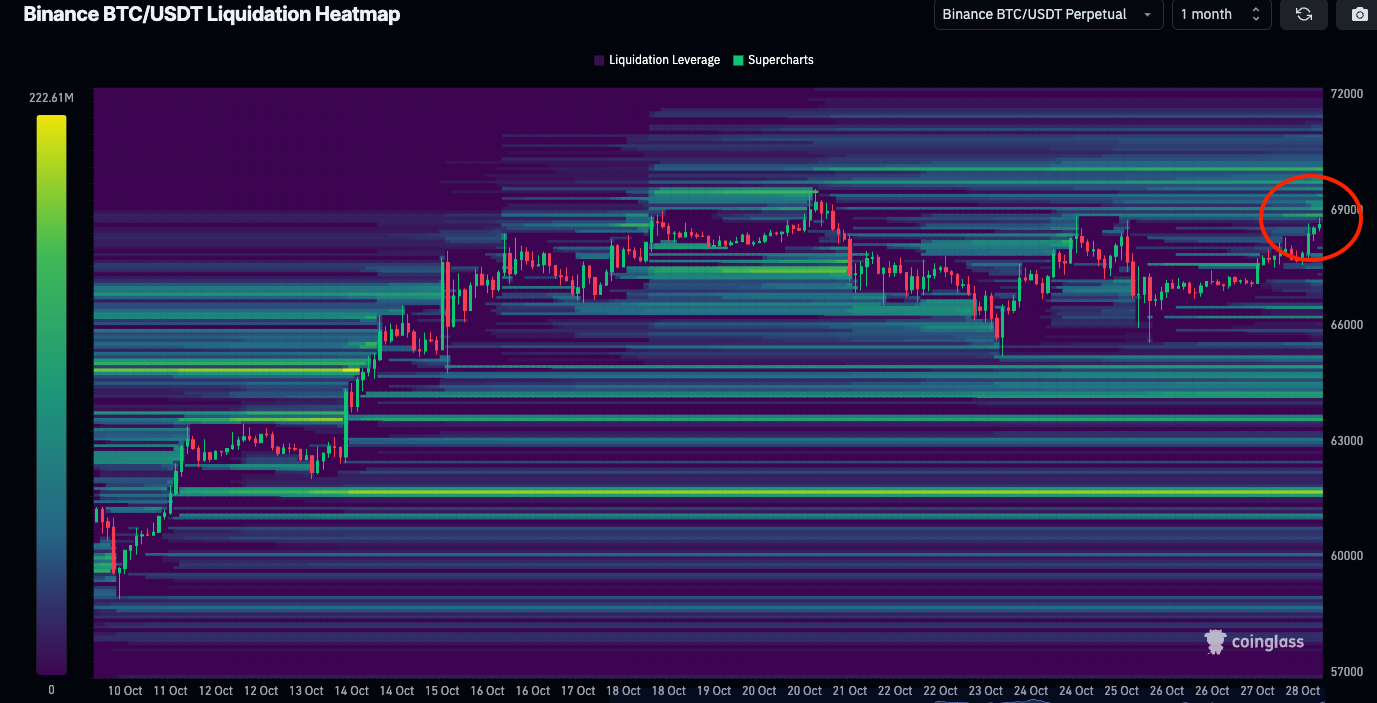

For BTC, the bellwether of the market, a higher amount of $ liquidations (lighter colours in the below image) occurs above BTC’s current spot price up to $72k - not below.

This momentum also comes as the underlying fundamentals of the market continue to grow.

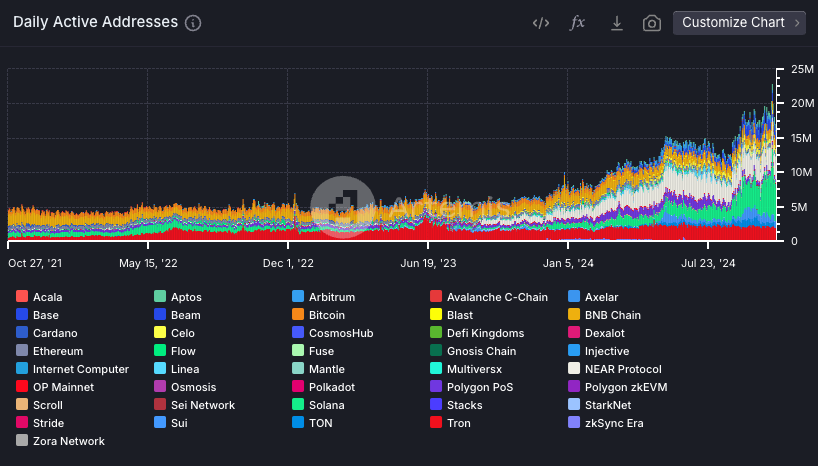

In fact, the growth has been so intense over the past year, that we are seeing new ATHs in a number of key heading metrics.

For example, active addresses are on track to 3x over 2024.

We are seeing this increased desire for risk manifest differently between ecosystems.

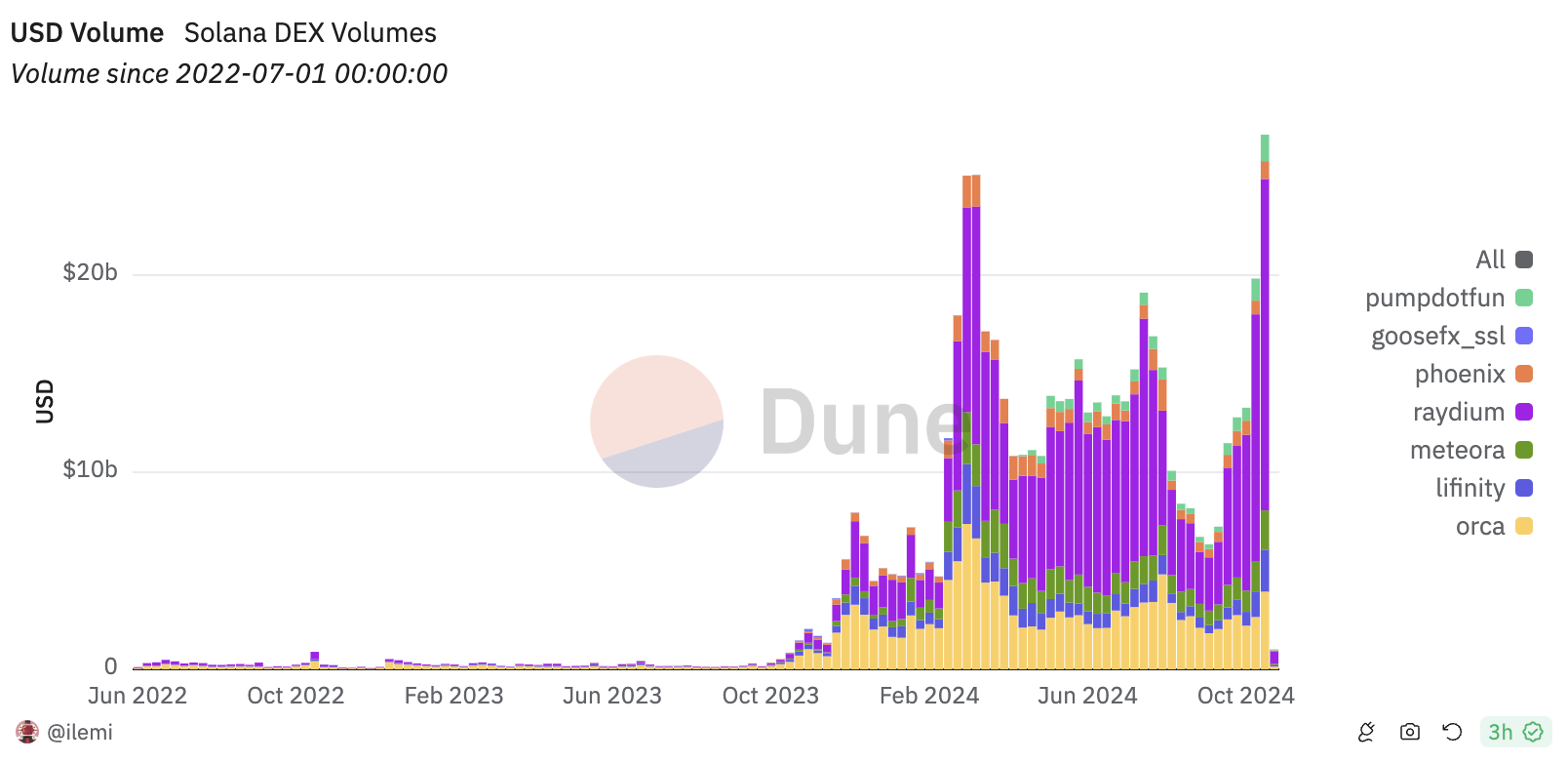

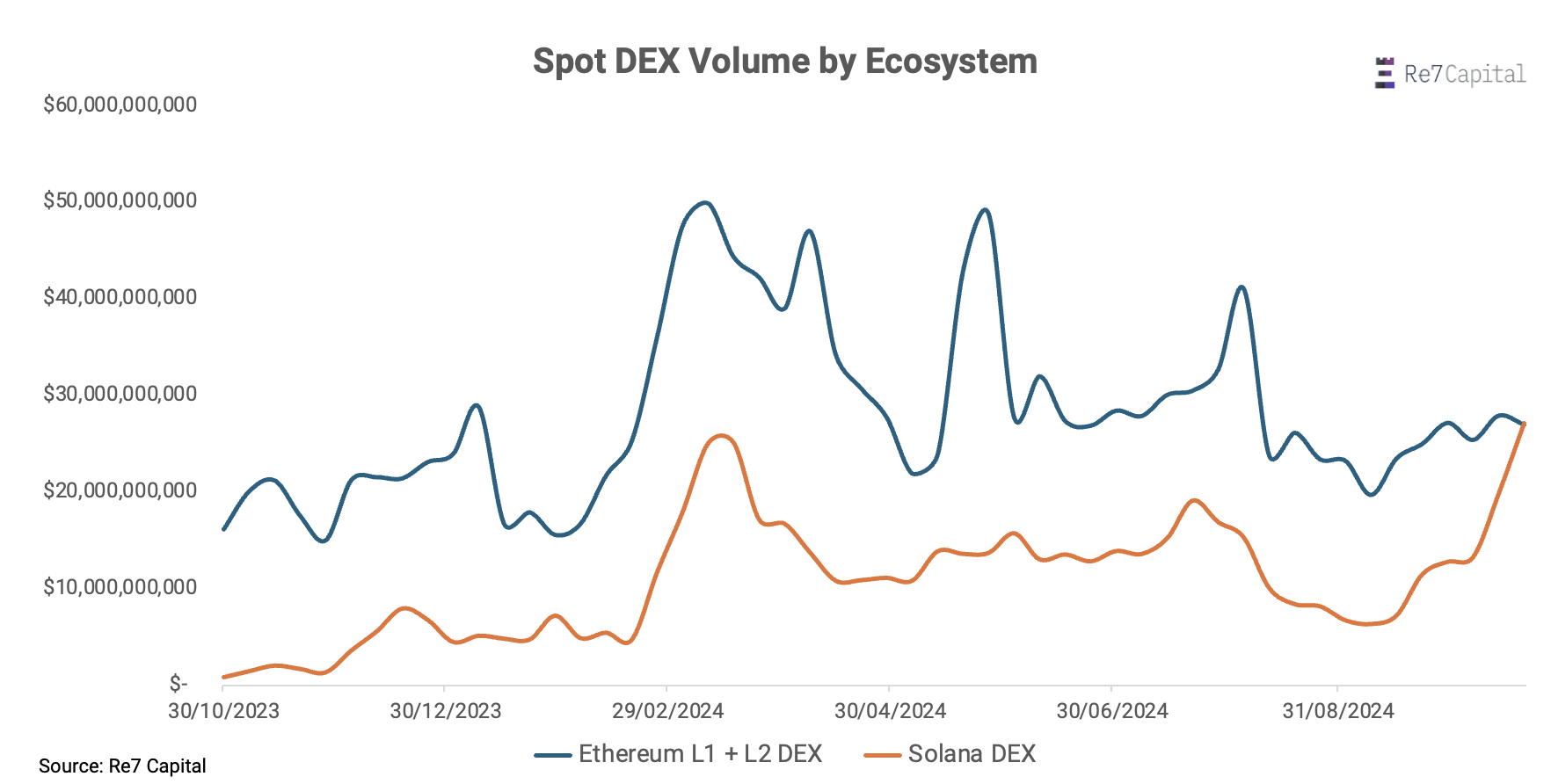

For example, Solana DEX volumes last week reached $27B - driven by increased interest to long tail exposure by investors.

The performance of Solana’s underlying architecture is enabling a higher rate of speculative on-chain actions per unit of time.

So much so, that Solana spot DEX volumes overtook the combined spot DEX volume of Ethereum L1 plus all of its layer 2 derivative ecosystems.

Closing Thoughts

So all in all, we have a confluence of inflection points across the board - from the macro to the micro.

Resilient fundamentals are also supporting the market momentum. And with the former printing ATHs, it’s the market that is poised to play ‘catch up’.

So as we head into the last 2 months of the year, all eyes are on what happens next.

The main event is about to start and everyone wants a ring side seat.

BTC yield continues to climb with demand from new BTC restaking protocols

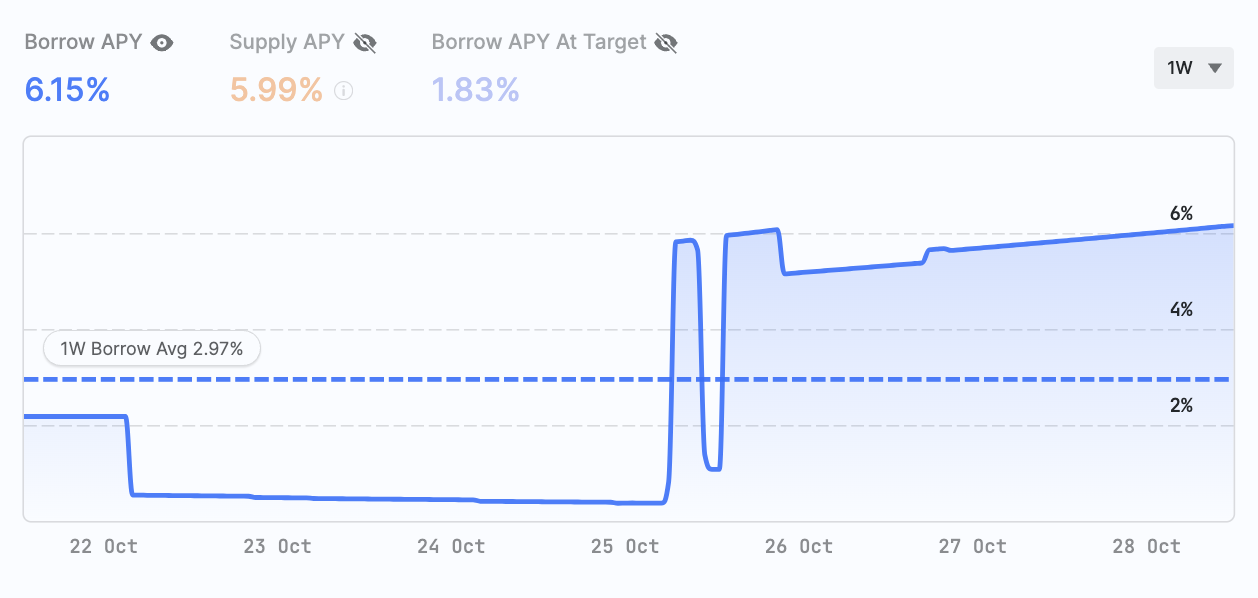

Re7 cbBTC vault on Morpho is currently getting over 5% yield with high demand from LBTC borrowers.

Expect new BTC restaking assets to get additions to the vault including pumpBTC, which will keep borrow demand and yields high for depositors.

With the Symbiotic mainnet launch expected later this quarter, deposits in the Re7 restaking vaults on Mellow continue to earn points for both Symbiotic and Mellow.

With caps filled on Babylon, the main restaking protocol for BTC, we expect the demand for BTC restaking to continue as even incremental flows from crypto’s largest asset represent potentially billions of liquidity that can get allocated to these protocols.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.