The Weekly - 26th August 2025

AUG 26, 2025

Jitters

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on in on-chain risk curation, vault management and DeFi ecosystem design. Learn more…

Re7 is Hiring!

Re7 Capital is a London-based digital asset firm leveraging its deep crypto network and proprietary data infrastructure to drive investment decisions across multiple fund strategies.

We’re currently hiring across business development, capital formation, operations, and research roles. If you’re serious about DeFi and want to operate at the highest level, explore our open positions here:

Join Re7 Capital

We want to hear from you!

Summary

In this edition, we cover:

Jackson Hole market reaction

Weekend volatility and drivers

Neutralisation of sentiment and altcoin strength

Markets

All eyes were on Fed Chair Jerome Powell on Friday, looking for signals of potential rate cuts.

Leading into the event, markets were pricing in hawkish commentary. What ensued was ultimately a dovish presentation.

Referencing changes in both labor market and unemployment dynamics, rate cuts seem inevitable at the September FOMC.

The S&P rallied +1.5% in a single day while crypto markets gained +6% - outperforming by +4.5%.

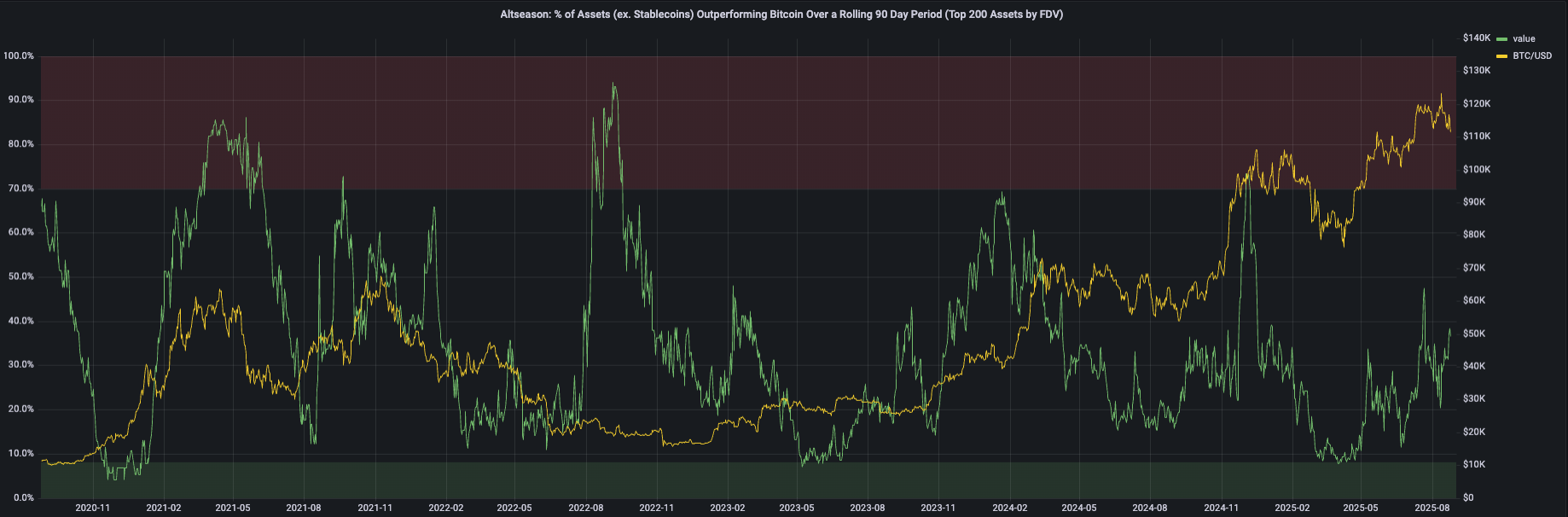

ETH once again led the move higher, gaining +14% with alts behind at 8%. This is in line with the capital rotation dynamics we have seen historically in previous cycles - where ETH leads the market for a period of time with select alts outperforming.

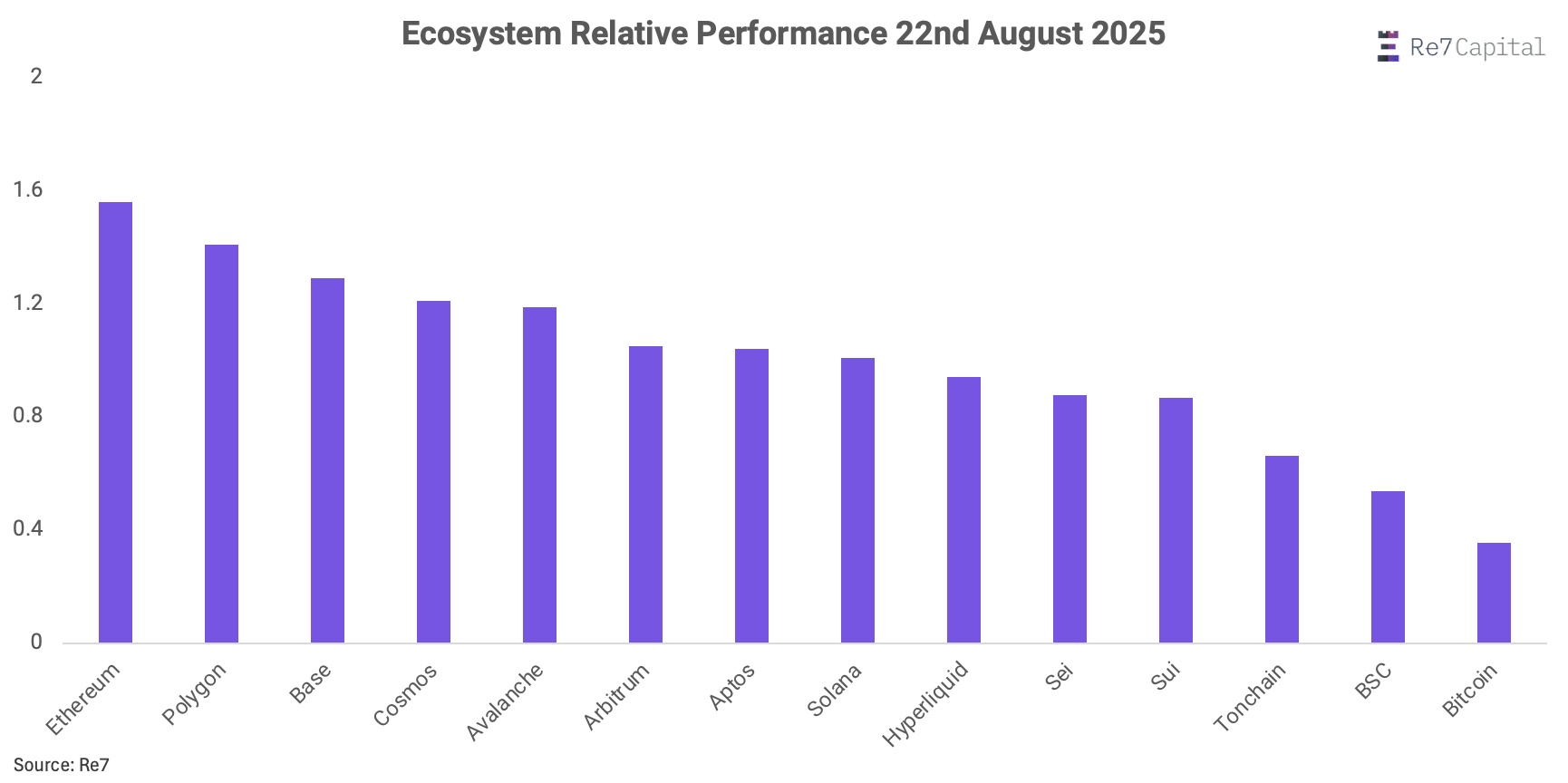

On Jackson Hole day, we see that the relative performance of alts was strongest within the EVM land.

However, momentum stalled into the weekend when a single BTC address sold 24k BTC during an illiquid session on Sunday.

It appears this BTC wallet then bought ETH with the proceeds.

This BTC sell market order then triggered long liquidation cascade totalling $800m. ~$400m (half) were related to BTC longs.

~$300m of these liquidations occurred within 10 minutes. It was the 6th largest long liquidation amount in the last year, showing the intensity of the move.

These liquidation events often act as flush out events for prices to stabilise.

Overall, the structure of the current uptrend in risk assets remains intact. Take the S&P..

It feels the pullback is idiosyncratic to crypto with the market needing to clear short-term momentum before initiating any leg higher.

A breakdown below Jackson Hole levels across the board would signal a stronger pullback may be underway.

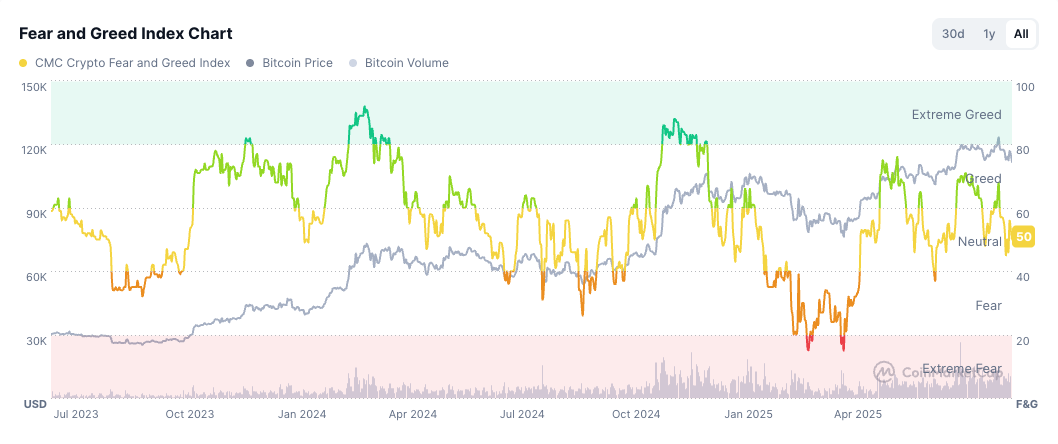

The Fear & Greed index has been neutralised from moderate greed level earlier this month.

This aligns with altcoin strength which still remains in neutral territory and not yet at levels typically seen during macro market tops historically.

Re7 in Media:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as its Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Re7 Capital featured in Bloomberg News

As the market rushes into crypto treasury plays, our founder Evgeny Gokhberg offers a more grounded perspective. Trading above NAV only makes sense when supported by a clearly defined, yield-generating strategy. Read the full article

Updates on Re7 Labs: A Week of Strategic Integrations and New Milestones

Last week was another testament to our commitment to building a more robust and efficient DeFi ecosystem. We are thrilled to share some of the key milestones and developments from the Re7 Labs team.

Enhancing Our Avalanche Cluster with Upshift's ProductsWe're excited to announce a new strategic integration that further diversifies and strengthens our USDC cluster on the Avalanche network. We have successfully added Upshift's innovative products, upAUSD and upAVAX, to our curated strategy.

Expanding to New Chains with a Gold-Backed AssetIn a major step forward, we are expanding our DeFi footprint to new, innovative ecosystems. The Re7 Labs team has successfully integrated XAUt (Tether Gold) as collateral into our upcoming USDC vaults on both Worldchain and HyperEVM.

Empowering the Ecosystem with Morpho BlueprintAs a key partner of the Morpho community, we were excited to announce the launch a Morpho Blueprint, an open-source frontend developed in collaboration with Paperclip Labs. This grant-funded project provides a customizable, easy-to-deploy framework for curators and builders to create their own user interfaces for Morpho. We believe this will be a powerful tool for accelerating the expansion of Morpho across new blockchain ecosystems. A beta frontend is already live, supporting over $120M in Re7 Labs vaults

Re7 Labs Launches Linea Vaults on Euler — $44M+ Already DepositedRe7 Labs has curated a new suite of Linea vaults on Euler, offering risk-managed access to USDC, USDT, WETH, WBTC, and leading ETH LSTs. With over $44M already deposited, these vaults bring institutional-grade yield opportunities to one of the fastest-growing ecosystems.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.