The Weekly - 30th September 2025

SEP 30, 2025

New frontiers of market speculation

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management, and DeFi ecosystem design. Learn more…

This Week at Re7:

Re7 BTC Yield Strategy Is Live

Re7 announced the launch of a market-neutral, BTC-denominated strategy on Starknet, designed to accumulate more units of BTC through options and curated DeFi yield. With ~2,000 BTC in soft commitments, access is available via an institutional format and a tokenized version offered by Midas RWA. Covered by The BlockRe7 Capital at TOKEN2049 Singapore

The Re7 team is heading to TOKEN2049 in Singapore on October 1–2, 2025. Our leadership team is available for meetings on liquidity provisioning, DeFi yield, and institutional on-chain risk management.

Re7 is Hiring!

Re7 Capital is a London-based digital asset firm leveraging its deep crypto network and proprietary data infrastructure to drive portfolio decisions across multiple fund strategies. If you’re serious about DeFi and want to operate at the highest level, explore our open positions here:

Join Re7 Capital

We want to hear from you!

Summary

In this edition, we cover:

How memetic speculation is losing steam on the surface

Emerging models of token issuance and trading

New Frontiers of Token Issuance and Speculation

The meme sector has certainly defined how market participants have speculated this cycle.

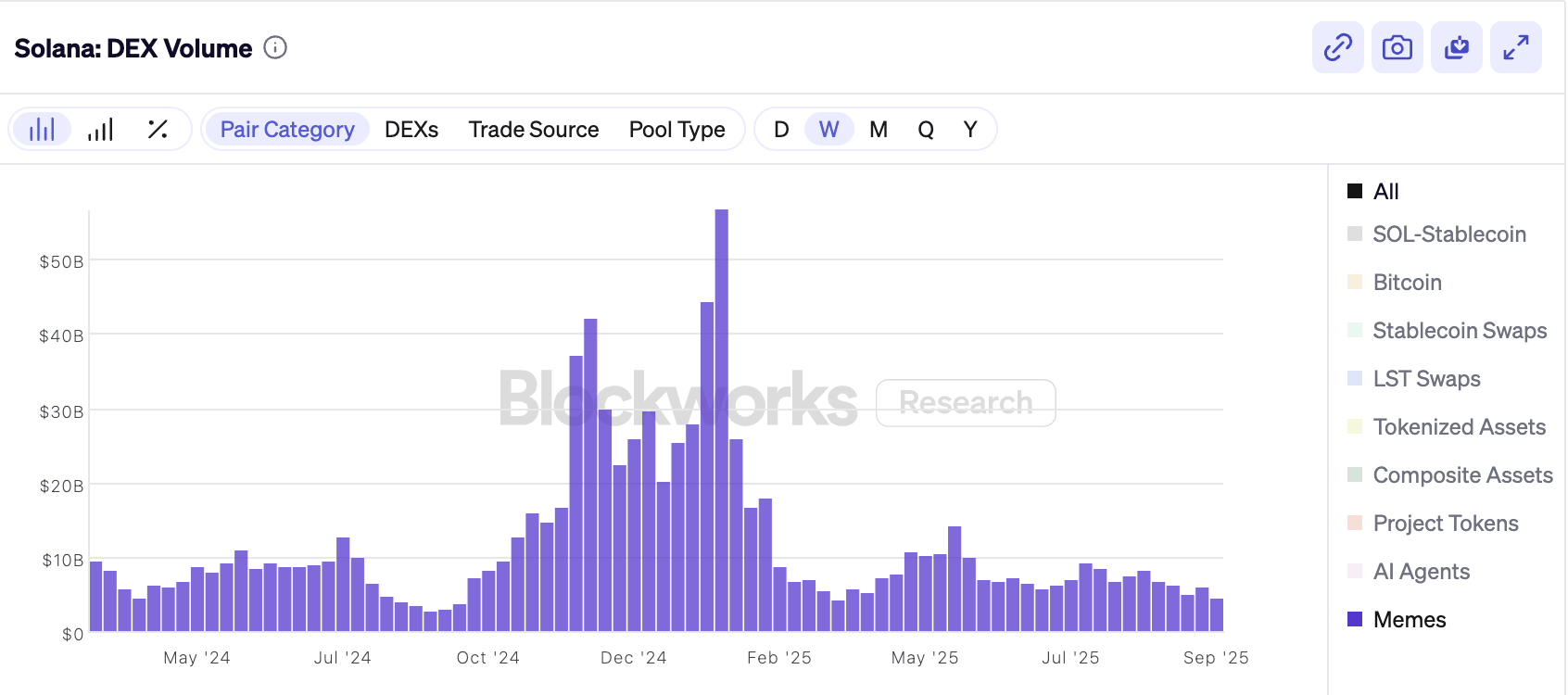

During Q4 2024–Q1 2025, weekly meme DEX volume on Solana consistently surpassed $20B.

Yet, this appears to have cooled off, with volumes now dropping by 75% to $5B/week.

Meme markets continuously feed on exogenous capital flows and, without those flows in recent months, these markets have struggled to return back to ATH levels.

Solana DEX volumes driven by memes ($).

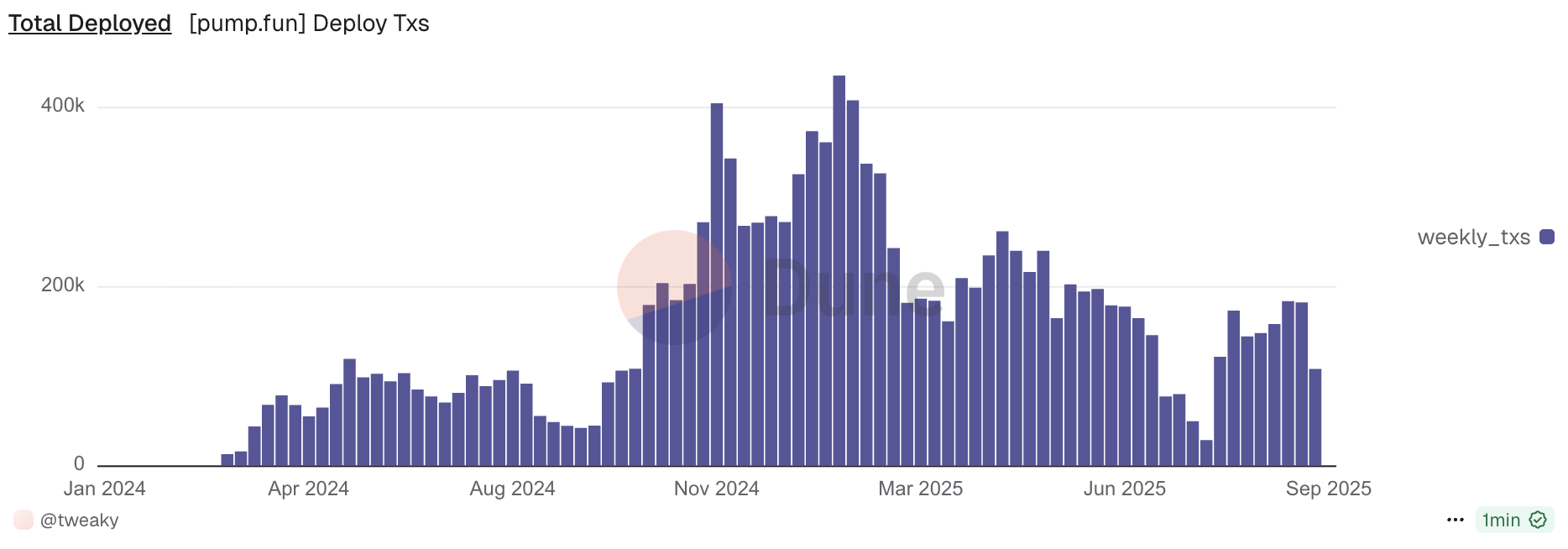

For market-leading meme launchpads, the retail game is still lucrative, generating >$700m in annualised revenue as a sector.

Total weekly # of Pump tokens launches.

While on the surface it may seem that memetic speculation is dying out, traders are just choosing new arenas to speculate in.

For example, we see other frontiers of asset issuance and speculation as part of a growing experimentation that we’ve been tracking within SocialFi.

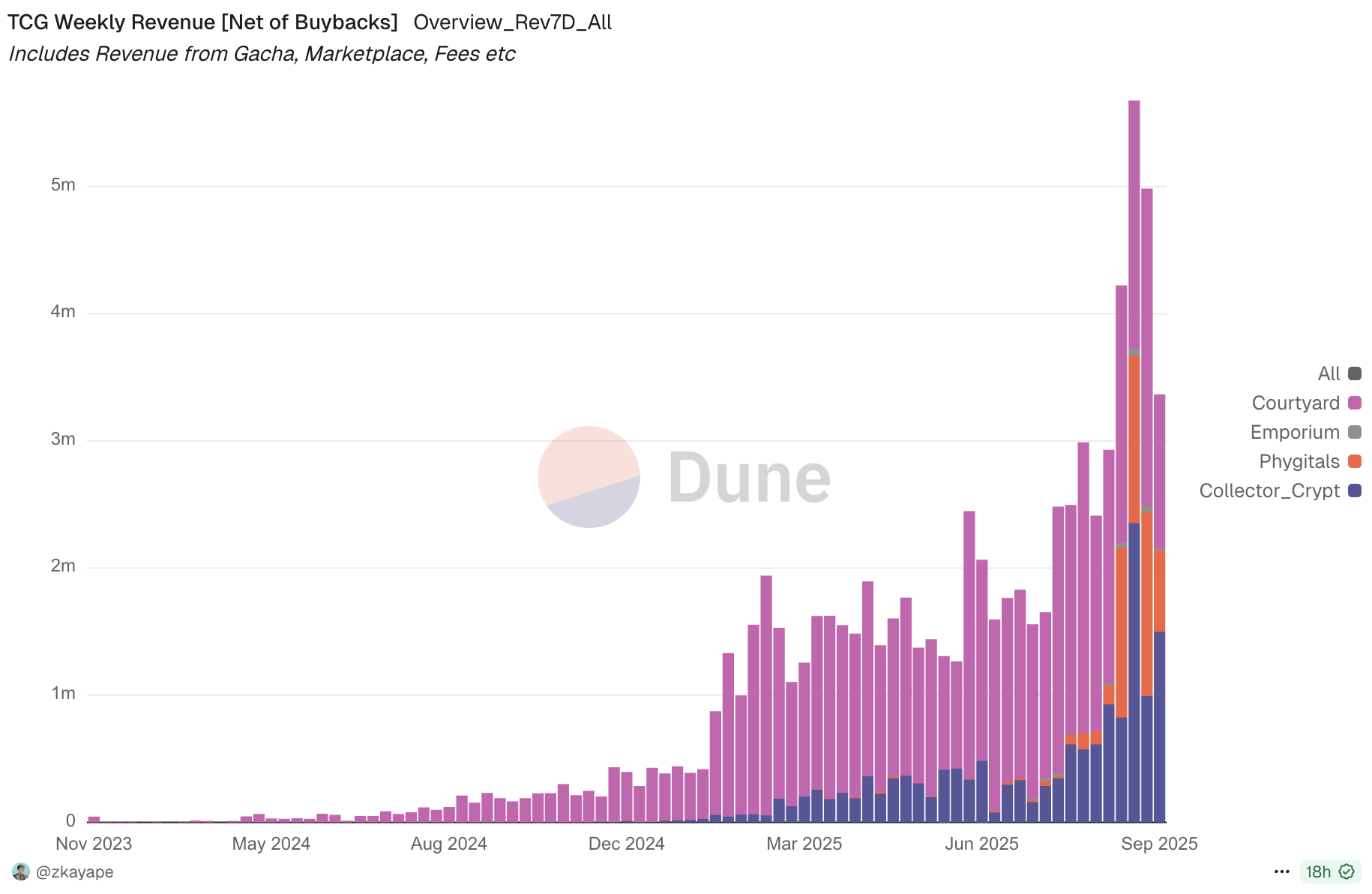

For example, trading card games issued on-chain as NFTs have surged in popularity where the sector is already a $200m+ market.

Total revenue from select token card game NFT platforms ($).

Card ‘packs’ (“Gacha”) have been a key driver of trader interest and stickiness. For example, traders can gamble on Pokemon cards using vending machine-style pack openings.

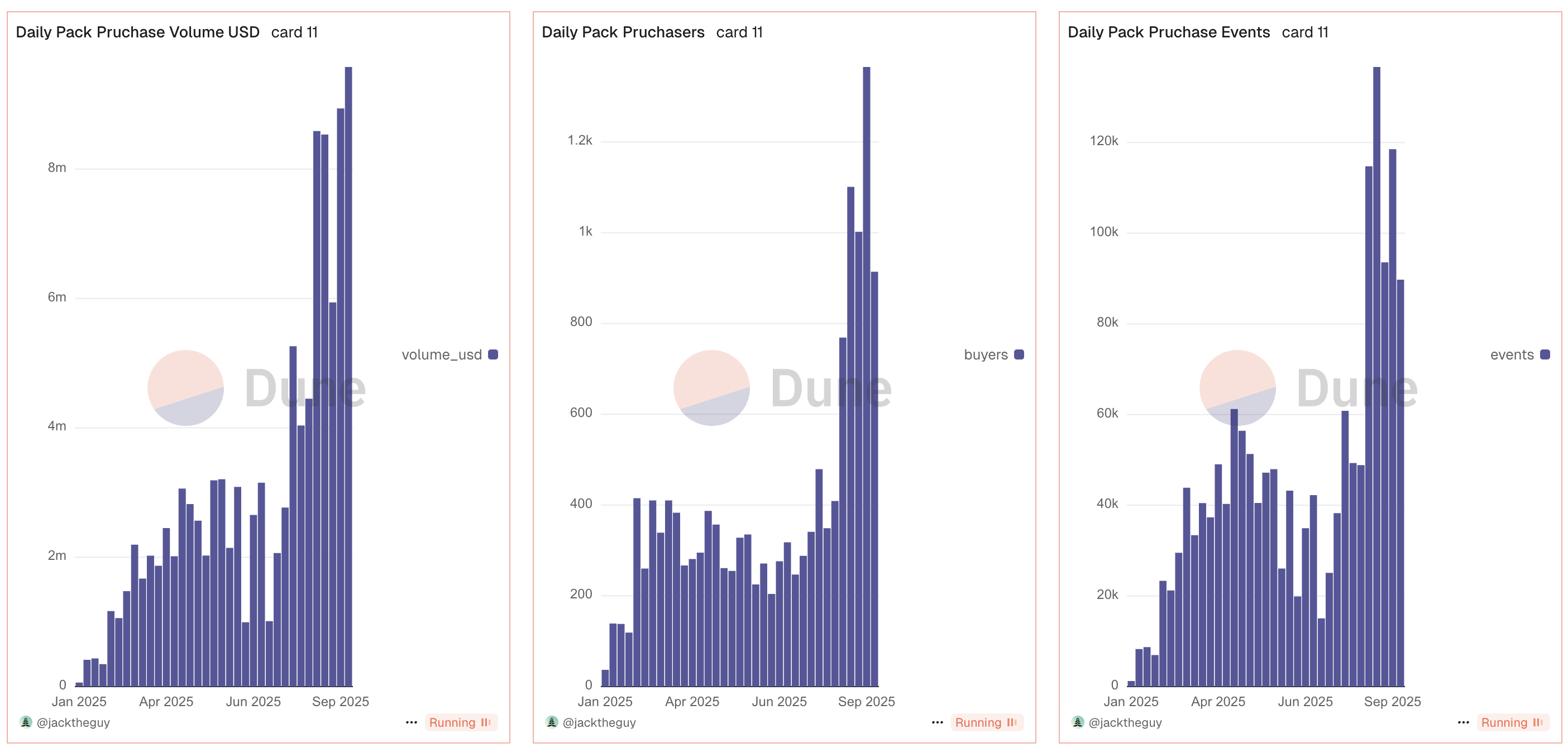

Some models like Collector Crypt allow traders to keep, swap out, and then trade instantly on-chain. Daily pack rolls and volumes have often sold out in hours.

Unlike typical memetic markets, traders here have the prospect of redeeming physical cards with real-world value.

Collector Crypt Gacha pack market KPIs.

We may see other forms of TCG emerging from other franchises within the gaming sector such as Might and Magic from large game studios like Ubisoft.

Other forms of markets have been heavily social-centric with creator coin models allowing users to speculate on and support creators in achieving virality.

The number of monthly Zora creator coins surged to 250k in August - a 3x increase month-over-month.

Zora creator coins launched (left) and trading volume (right).

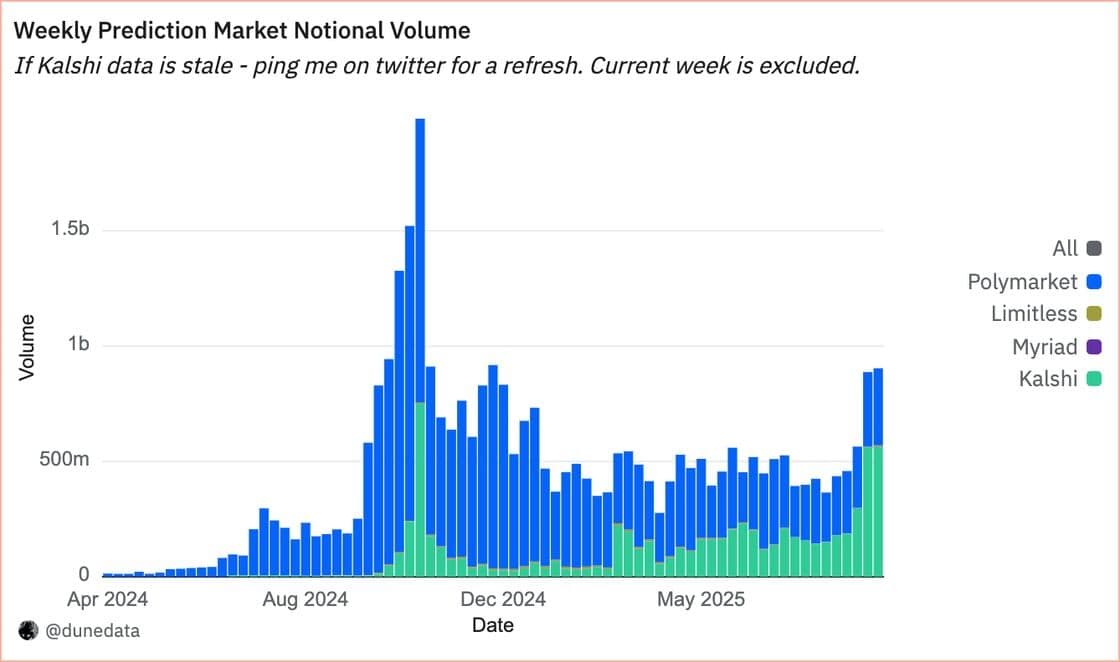

Prediction markets have also seen sustained interest as legacy memetic markets have waned. They survive because the extraction rate is typically small and global events (e.g. political, economic, etc) ensure a constant stream of extraneous capital comes in.

Kalshi, the leading on-chain prediction market, just saw weekly trading volume surge to $500m with $190m in OI.

Weekly prediction market trading volume ($).

A growing number of these platforms are now offering native on-chain deposits making it easier for users in crypto to participate directly.

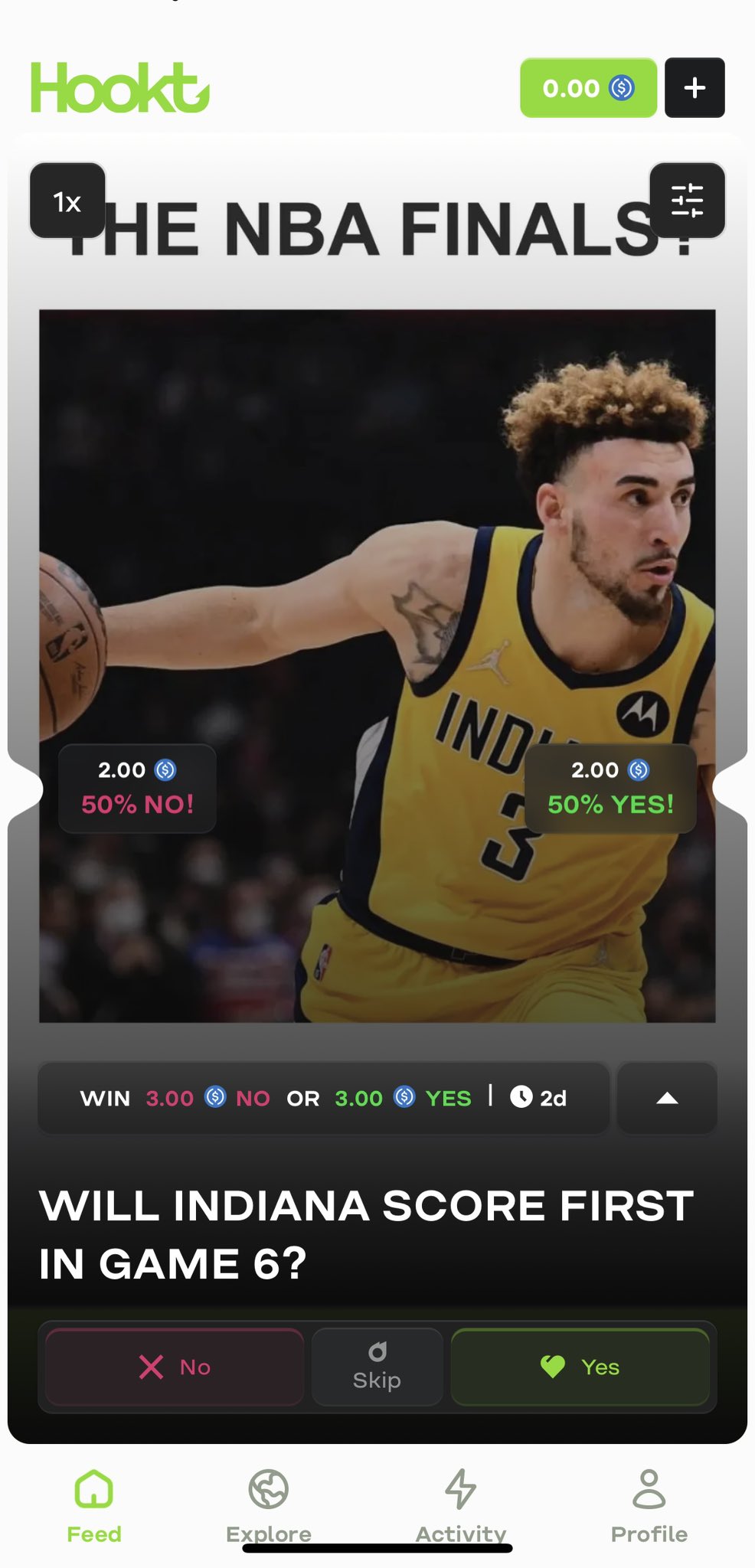

Short-horizon prediction markets will also likely take the form of swipe-style functionality. Platforms like Hookt and Memelut allow you to speculate on real-time events as they unfold.

An example Hookt market.

Growing prominence of prediction markets will inevitably lead to a growing prominence of prediction market tooling.

For example, AI companions like Bracky or Pricediction are evolving into hybrid intelligence systems, blending crowd wisdom with on-chain data for superior predictions for retail users.

Unlike fleeting legacy memetic markets, on-chain prediction markets with AI companions naturally catalyse extraneous capital flows due to incentive structures.

Their stickiness stems from economic incentives: agents and creators earn fees for high-accuracy models, fuelling a self-reinforcing cycle of innovation and engagement for both traders and developers.

We are excited to see what other experiments emerge at the forefront of SocialFi that push the boundaries of legacy memetic speculative markets.

Updates on Re7 Labs

Last week was another testament to our commitment to building a more robust and efficient DeFi ecosystem. We are thrilled to share some of the key milestones and developments from the Re7 Labs team.

mRe7YIELD Continues to Outperformwith 20%+ APYOur premier yield-generating product, the mRe7YIELD Liquid Yield Token, is demonstrating exceptional performance with a current APY exceeding 20%.

Re7 USDT0 Plasma VaultReaches$100M TVLJust 4 days after being launched, the Re7 USDT0 Plasma Vault has crossed $100 million in Total Value Locked (TVL).

Upcoming Addition: wsrUSD to Euler Cluster on LineaExpanding our utility and offerings on the Linea network, Re7 Labs is preparing to add wsrUSD to our dedicated Euler cluster.

mWildUSD

Re7 Labs Launches Re7 ALMM for Ekubo on StarknetThe Re7 ALMM (Automated Liquidity Market Maker) automates LP strategies with continuous monitoring, rebalancing, and a simple deposit flow. It runs on Trove’s audited infrastructure with Re7 Labs’ proprietary rebalancing to keep capital actively deployed.

In collaboration with Re7, Midas introduces mRe7BTC Introducing mRe7BTC, a tokenised BTC yield certificate issued in collaboration with Midas and Starknet. mRe7BTC provides digital exposure to BTC-linked yield strategies.

Introducing mWildUSD Re7 Labs, Plasma, WildcatFi and Ethena launched a USD-denominated pre-deposit vault on Midas targeting ~20% APY. APY is variable and not guaranteed. Built for scale with clear parameters from day one.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week.

Re7 in Media:

Re7 BTC Yield Strategy Is Live, covered by The Block

Trump’s World Liberty joins forces with Re7 as featured by Bloomberg.

Bloomberg: VMS Group Enters Crypto, choosing Re7 Capital as its Partner

Re7 Capital featured in Bloomberg News

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.