The Weekly - 20th May 2025

MAY 20, 2025

What's moving markets

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital Website / Re7 Labs Website> Weekly Research / Real-time Insights> Re7 Capital Twitter / Re7 Labs Twitter

This week at Re7:

Re7 Capital Joins “Small Managers – BIG ALPHA” SeriesEvgeny Gokhberg, Managing Partner at Re7 Capital, will join Episode 17 of the Small Managers – BIG ALPHA webinar series on Tuesday, June 10th. The panel will spotlight high-performing, under-the-radar managers delivering differentiated alpha—an increasingly scarce resource amid capital crowding in legacy strategies. Register here to attend or receive the replay (for eligible investors only).

Re7 Capital at Consensus 2025 Re7 Capital attended Consensus 2025 in Toronto — CoinDesk’s flagship event bringing together global leaders across digital assets, DeFi, and institutional finance. Over three days, we engaged with allocators, founders, and ecosystem partners to discuss capital formation, on-chain strategies, and the evolving role of institutions in crypto.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

DeFi Associate

DeFi Program Manager

Operations Associate

We want to hear from you!

Summary

In this edition, we cover:

Gyrations in crypto markets at ATH levels

What’s driving volatility

Stablecoin ATH trends

What’s Moving Markets

Crypto markets continue to edge closer to ATHs ($3.2T global market capitalisation).

Resistance at ATHs

Meanwhile, BTC has closed its highest weekly candle on record at $106,451 as the orange coin sets the tone for the broader sentiment.

Investors have been continuing to digest ongoing economic headlines leading to price gyrations at these ATH levels.

Spikes

Trump tax bill advances to the US Congress which some analysts expect will increase the US debt by $3-$5T over the next decade. This is, no doubt, shifting attention and capital to scarcity as well as growth technologies and sectors.

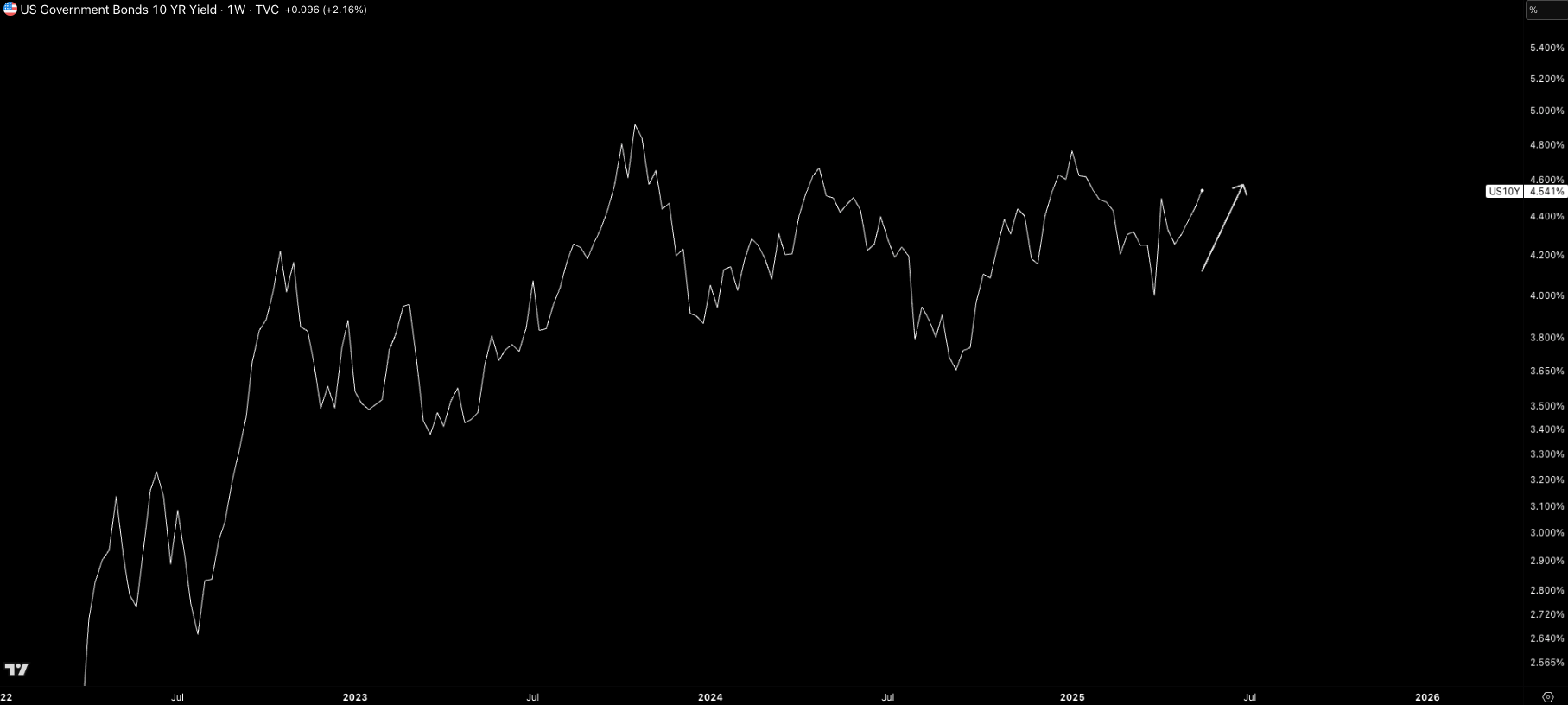

Countries like China and Japan are offloading US treasuries, coupled with a downgrade in US credit, is causing yields to spike.

Higher yields, more debt. Rising deficits. More monetary expansion.

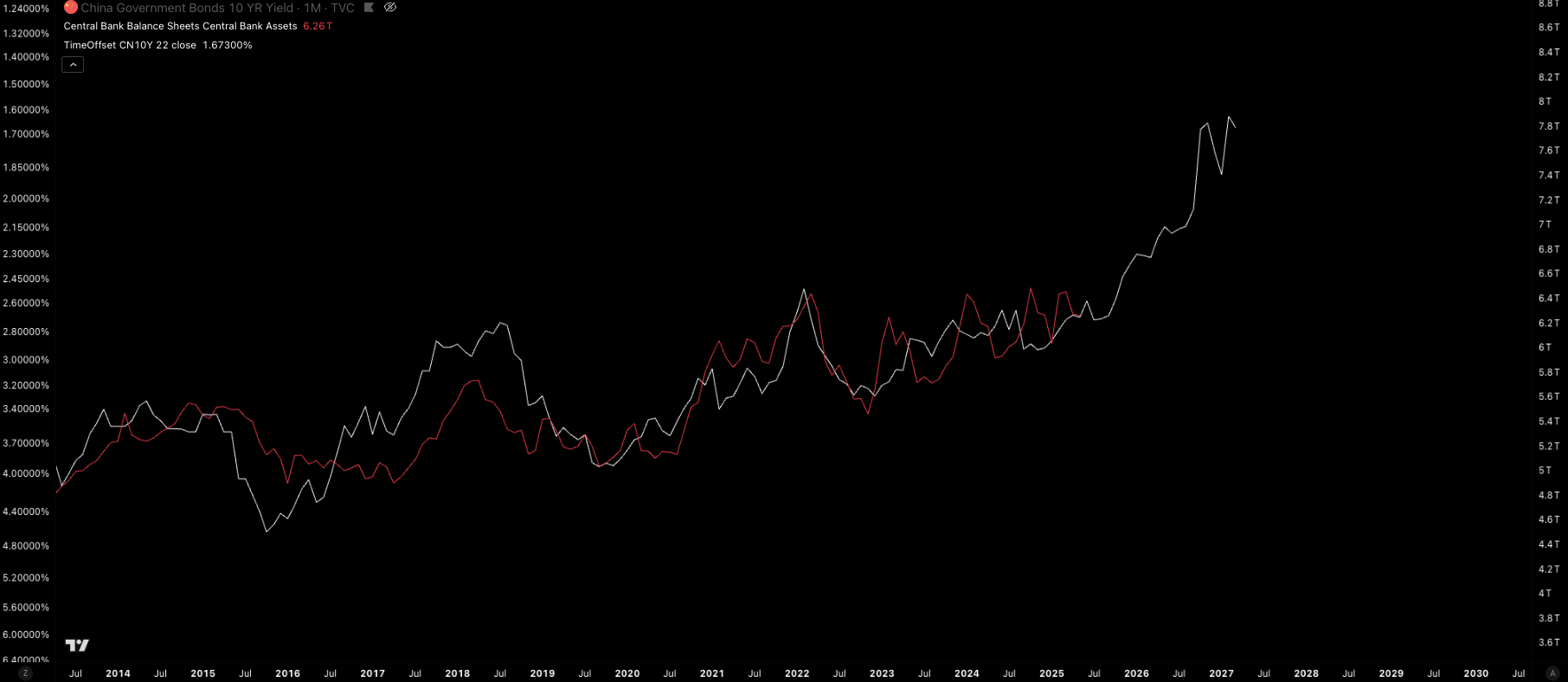

In China, yields are also dictating liquidity - albeit slightly differently.

Its 10Y trend is a forward looking insight into expansion of central bank balance sheets by 22 months. Rate cuts are needed to counteract slowdown by injecting liquidity. China has just increased its debt ceiling once again.

With this, the PBOC balance sheet is growing at an accelerated rate.

Exponential Growth

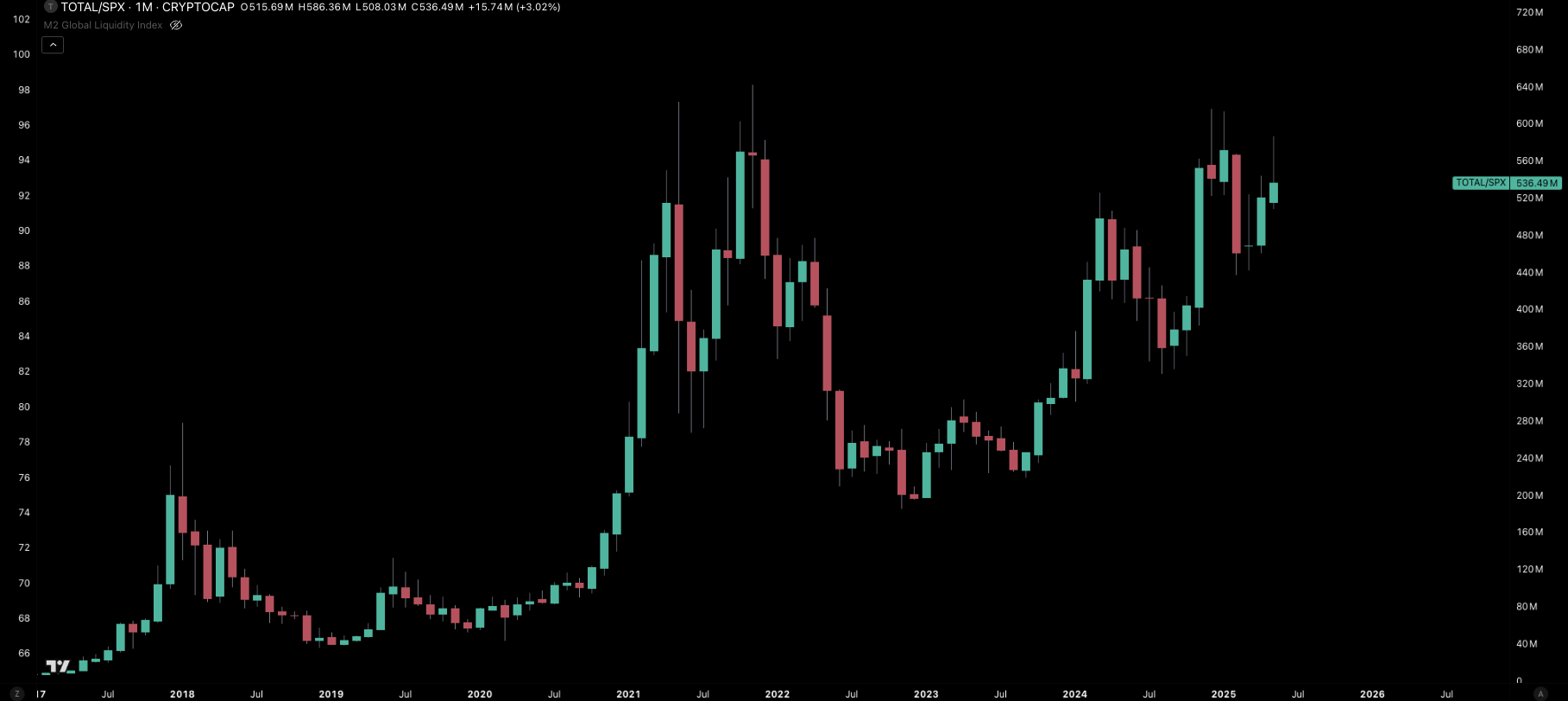

Meanwhile, this is occurring at the same time of a broader structural shift in capital allocation. Investors are increasingly exploring technology with current exponential rate of adoption.

It’s not just BTC but rather crypto more broadly.

For example, we see a clear structural upwards skew trend in Crypto/SPX.

That said, reaching new highs comes with initial resistance given the significance of the levels. Over $600m in liquidations occurred late Sunday with >$400m being longs adding to the price gyrations.

BTC dominance is approaching top end of its range at 63%.

This also comes at a time when the alts/BTC dominance ratio is at its inception to date support, suggesting a potential bottoming this month of global alt dominance vs. BTC dominance.

Stablecoins

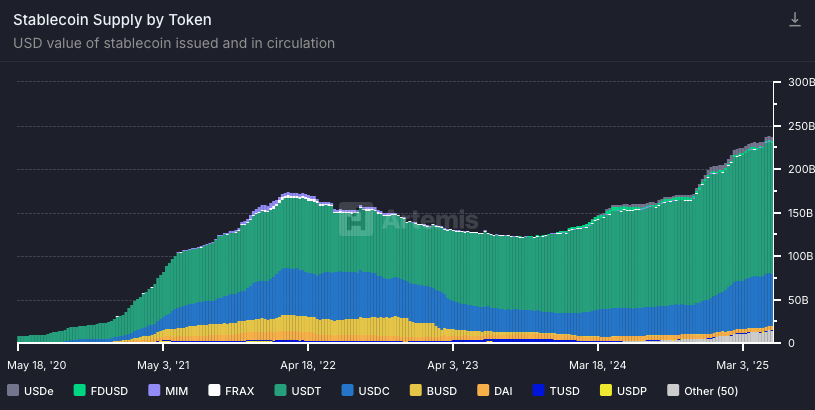

Stablecoins, which can proxy measure the total flows into the crypto market, continue to show growth.

Stablecoin supply is at ATHs $240B.

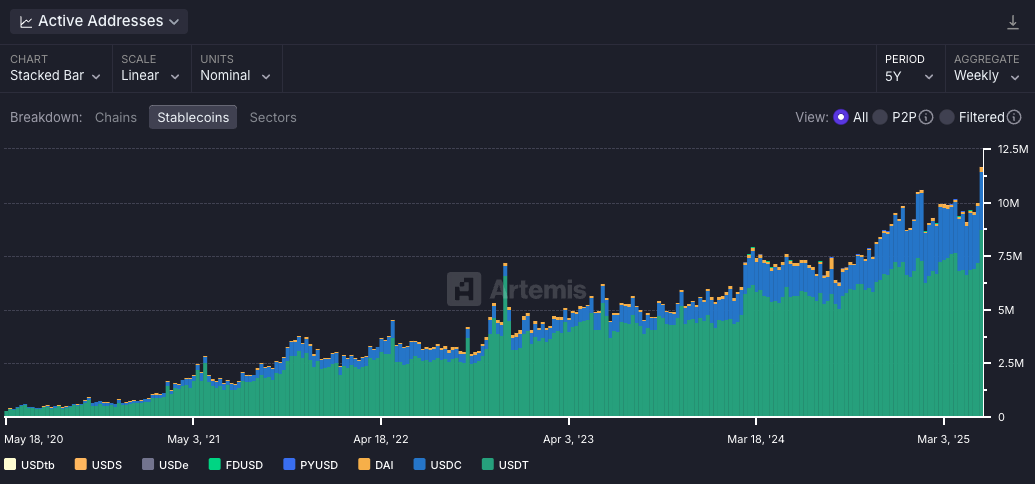

We’re also seeing new ATHs in active addresses interacting with stablecoins (11.7m), representing a 11% increase WoW - driven mainly from Tether (USDT).

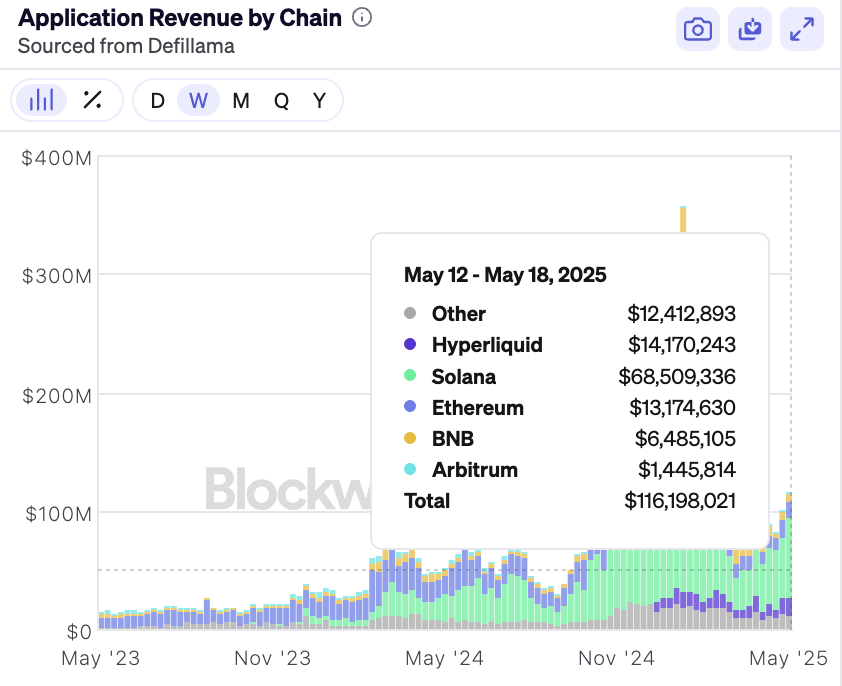

Zooming in further, we see new local highs for weekly on-chain revenue by applications for Solana ($68m).

Solana continues to dominate the market commanding over 58% market share of global on-chain app revenue.

Updates on Re7 Lab Vaults

BlackRock’s tokenized U.S. Treasury fund, sBUIDL, is now integrated into Euler on Avalanche, curated by Re7 Labs!BlackRock-backed sBUIDL’s first ever direct DeFi integration is now live on Euler on Avalanche, curated by Re7 Labs. sBUIDL is a 1:1 redeemable token backed by BlackRock’s BUIDL, which holds U.S. Treasuries and repos. It can now be used as collateral in the Re7 Cluster to borrow USDC, AUSD, USDT and deUSD while earning $AVAX rewards. The Re7 Euler Avalanche Cluster now has $214m TVL since launching a few weeks ago.Re7 Silo vaults got a major boost last week with 1M $SILO incentives. Same risk-managed strategies — now with even more rewards on top.Curated by Re7 Labs, uSOL3x and uSUI3x are now live on Base, offering capital-efficient leveraged exposure to SOL and SUI. Minting is open, but capacity is limited.Explore all our vaults and make sure to join the Re7 Labs Alpha TG for all the insights.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.