Starknet BTCFi: Unlocking Bitcoin's DeFi Future

JAN 4, 2026

Starknet is a permissionless, general-purpose Layer-2 (L2) scaling solution launched by StarkWare in November 2021. Built from the ground up for Zero-Knowledge Proofs (ZKPs), Starknet diverges from traditional EVM-based L2s by introducing its own alternative virtual machine, the Cairo Virtual Machine (Cairo VM). This architecture marks Starknet as a leading force in the rise of altVMs, emphasizing performance, verifiability, and future-proof cryptographic security.

Key Insights

Starknet’s BTCFi marks another step toward making BTC an active participant in DeFi.

The BTCFi initiative, with preseeded capital from the $800M AUM Liquid Fund, Re7 Capital, support from bridges like LayerZero and Garden, and 100m STRK incentives from Starknet, brings regulated capital, compliance infrastructure, and offchain yield strategies to Starknet

In September, Starknet launched BTCFi, a coordinated initiative to transform BTC from a passive store of value into an active, yield-generating asset.

Starknet governance approved SNIP-31 in August, introducing a BTC staking mechanism and allocating 25% staking power to staked BTC.

Introduction

At the core of Starknet’s design is the ZK-rollup model, where transactions are executed offchain and aggregated into succinct proofs, specifically STARKs (Scalable Transparent Arguments of Knowledge). These validity proofs are then published to Ethereum, ensuring correctness and minimizing gas costs on the base layer. Starknet’s infrastructure includes sequencers that order transactions and provers that generate the STARK proofs required for L1 verification. STARK proofs are highly scalable and capable of compressing the computation of millions of transactions into succinct validity proofs that can be verified onchain.

Complementing this architecture is native account abstraction, a design choice that treats every user account as a smart contract by default. This enables advanced user flows, including passwordless authentication (e.g., email or biometric login), social recovery, multi-factor authentication, customizable transaction logic, and paymasters for gasless UX. Together, STARK proofs, Cairo VM, and account abstraction enable Starknet to operate as a secure, high-performance, multichain execution layer.

To further improve proving efficiency, StarkWare introduced S-TWO, a next-generation, open-source zero-knowledge prover optimized for performance, cost, and flexibility. S-TWO is an evolution of the Stone prover, designed to leverage the capabilities of the Circle-STARK protocol, which removes key constraints that limited the original STARK protocol. Circle-Stark is a new proving architecture that introduces circular composition, allowing proofs to verify other proofs recursively without requiring a trusted setup or sacrificing scalability. Its design is particularly suited to working efficiently with smaller fields. This breakthrough enables S-TWO to produce faster proofs with lower latency, making it particularly impactful for applications that require quick finality and a responsive user experience. It also improves scalability by reducing proof size and generation time, enhancing the throughput potential of the Starknet network.

As Starknet expands to support Bitcoin and embraces multichain settlement, S-TWO plays a foundational role in enabling efficient proof generation that is compatible with both Ethereum and Bitcoin-native verifiers. By bundling offchain transaction data into STARK proofs and submitting those to the Bitcoin mainnet for immutability, Starknet will be able to leverage Bitcoin for additional security without sacrificing scalability.

BTCFi

Ethereum has established itself as the backbone of DeFi, with ETH and Ethereum-based assets deeply integrated into lending, staking, and yield strategies across both its mainnet and L2s. In fact, Ethereum accounts for nearly 60% of all DeFi TVL. In contrast, BTC is the world’s largest cryptocurrency by market value, but remains an idle asset. Almost 6 million BTC have been dormant for over five years. While HODLers have benefited from extraordinary price appreciation, ~10 times from September 2020, $660 billion is absent from the DeFi economy. Beyond just dormancy, under 0.3% of BTC’s value is currently engaged in DeFi. There is a tremendous opportunity for Starknet to provide a home for that dormant value with its growing DeFi ecosystem. Wrapped BTC is already integrated into lending protocols on other networks, but the yield from Starknet’s new staking primitive, combined with lending and other liquidity provisioning, creates a comprehensive ecosystem for BTC to be put to work, and incentivizes holders to bridge to Starknet.

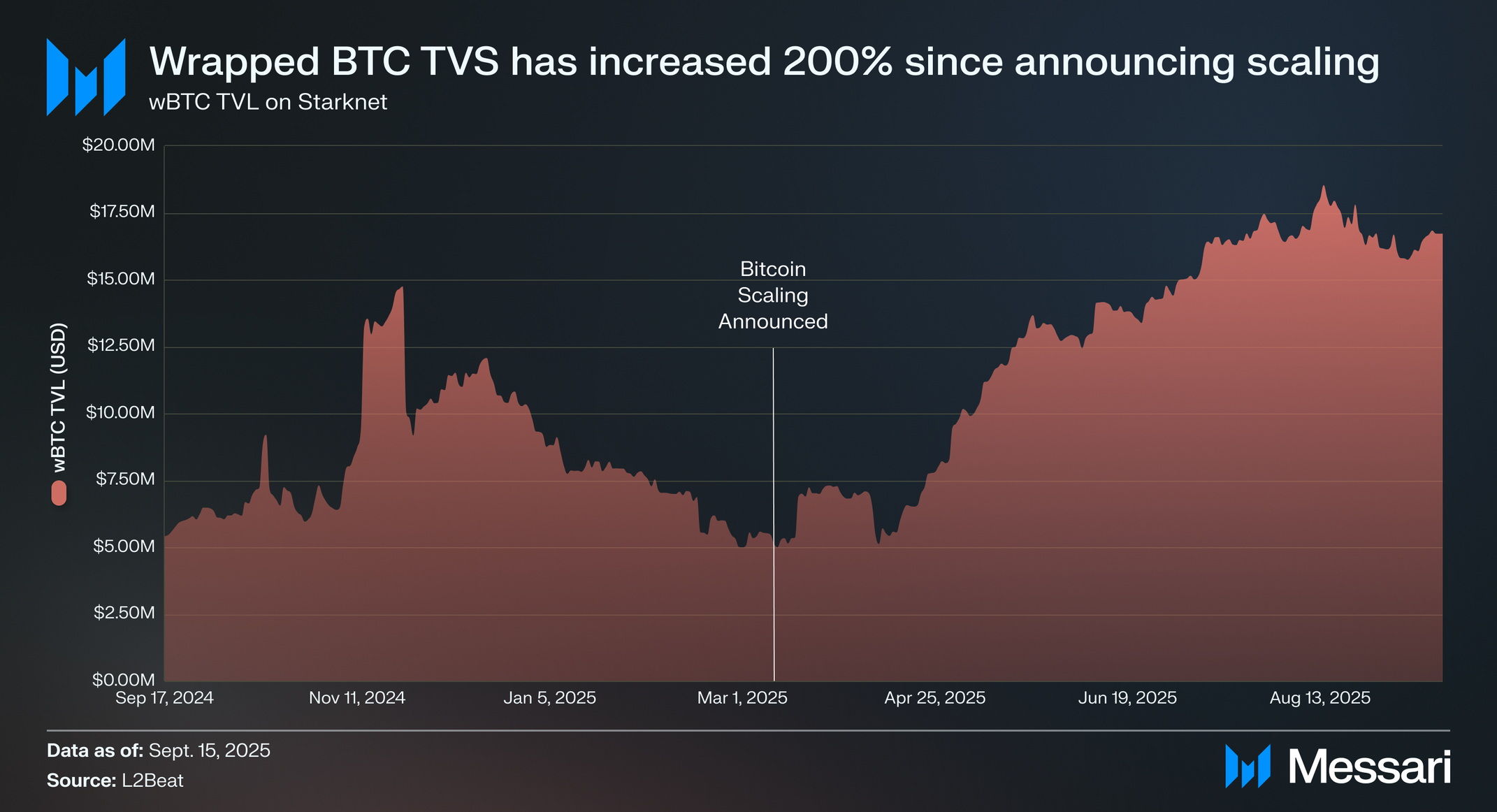

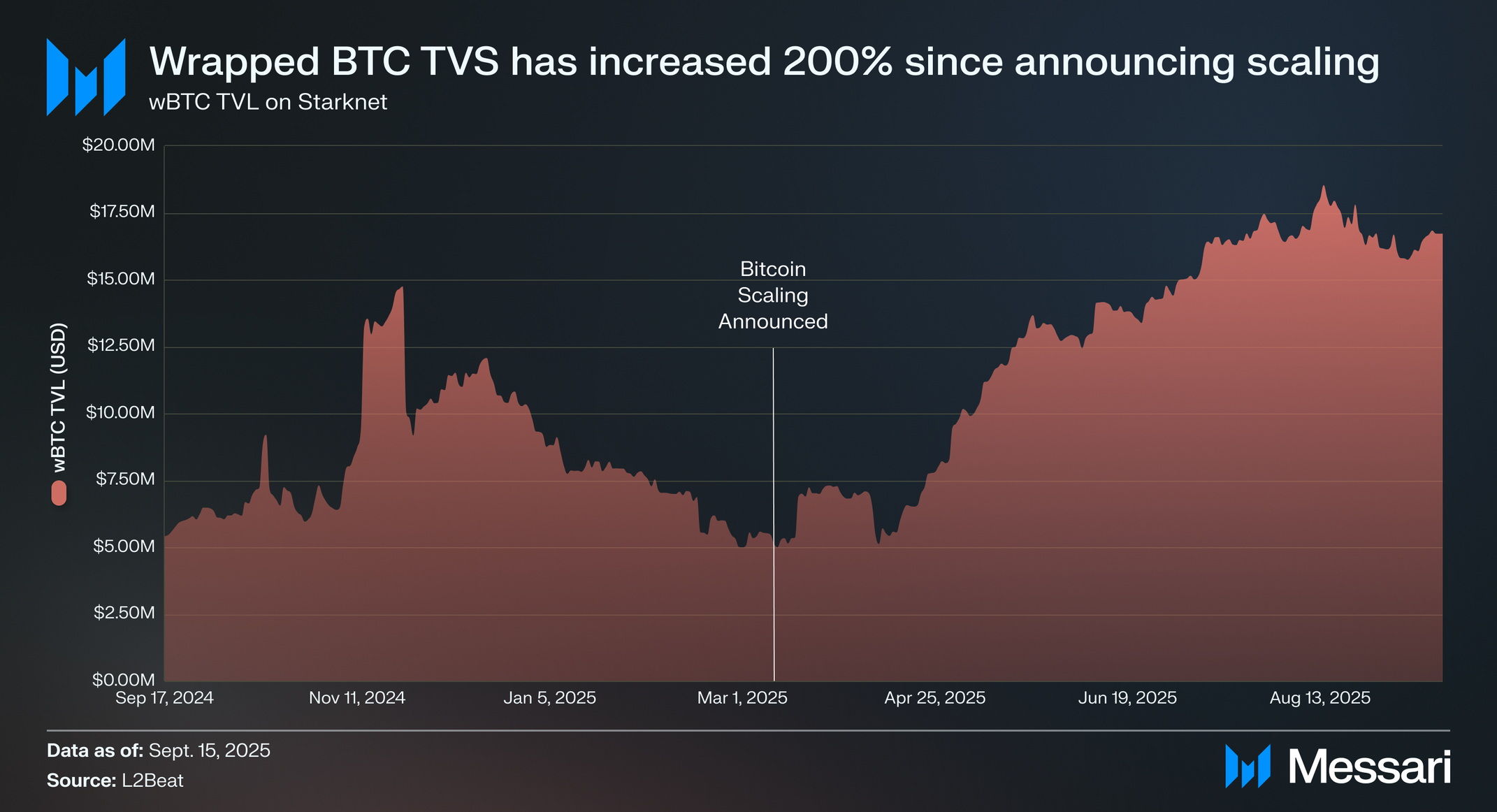

Starknet has been methodically building the infrastructure needed for meaningful Bitcoin utility, long before any formal proposal for Bitcoin staking. Their Bitcoin Scaling efforts signaled a deliberate roadmap: enhancing bridging security, enabling multisignature and lock-release mechanisms, and supporting trust-minimized BTC wrappers. These technical underpinnings created the prerequisites for integrating wrapped BTC into native Starknet systems. As Starknet continued to make strides towards this official integration, the BTC total value secured (TVS) has followed, rising from $5.0 million to $16.2 million, or ~62.5 BTC to ~138 BTC.

BTCFi is a coordinated initiative between StarkWare and the Starknet Foundation in their effort to serve “1 billion BTC users.” BTCFi aims to position Starknet as the infrastructure hub where BTC transforms into an economically active asset, further securing the Starknet network as it transitions into a Proof-of-Stake network.

BTCFi is a three-pillar framework designed to unlock BTC’s full economic potential via Bitcoin Staking, institutional opportunities with offerings like Re7’s institutional yield fund, and STRK incentives. With these offerings, Starknet’s BTCFi provides opportunities for three main target markets: Institutions, DeFi power users, and onchain retail.

STRK Staking

Starknet’s security currently anchors to Ethereum’s consensus, but the foundation laid out a comprehensive roadmap towards decentralization in 2022. In November 2024, Starknet launched its STRK staking protocol, marking a significant step towards making Starknet its own trust-minimized, Proof-of-Stake network. 20k STRK is the minimum requirement to become a full-node validator, and any user can delegate STRK to existing validators for a share of STRK rewards. Staking rewards are proportionately distributed to validators and delegators based on contributions, with a minting curve agreed upon by the community.

Although block production isn’t live yet, STRK issuance incentivises governance participation and helps build the foundations for a decentralized validator set once block production responsibilities go live.

Bitcoin Staking - SNIP-31

To align the creation of a decentralized validator set with the goal of becoming a hub for BTC DeFi, StarkWare project manager Natan Granit proposed SNIP-31 on June 25, 2025. The proposal was ratified on August 21, 2025, with 93.64% in favor. SNIP-31 details the concept of BTC staking and how BTC stakers would benefit from a novel yield mechanic, while Starknet’s network would benefit from additional security once Starknet begins submitting proofs to Bitcoin.

Natan goes on to address how to best incentivize BTC holders to bridge and participate, either by increasing the STRK issuance rate to accommodate the new BTC stake or by splitting the existing issuance to include BTC stakers, thus reducing the rewards to STRK stakers. Ultimately, the first option was chosen. BTC stakers will earn yield via additional STRK issuance, and BTC is granted 25% of staking power. This issuance will not impact STRK stakers and their current 7% APR, but will immediately increase annual inflation from 1.6% to 2.1%. This increase still resides below the agreed-upon max annual inflation rate of 4%. The table below shows extrapolated yield rates for BTC and STRK stakers.

The proposal’s design creates strong incentives for BTC stakers to stake earned STRK. The issuance rate of newly minted STRK is determined by the amount of STRK staked on the network, illustrated in the table below. This minting curve is exclusively a function of staked STRK, not staked BTC. As additional BTC is staked, the APR for Bitcoin stakers declines, balancing incentives. The dynamic favors early BTC stakers and encourages them to compound their rewards by staking earned STRK, thereby increasing minted STRK and their share of emissions. This structure reinforces STRK’s role as Starknet’s primary asset while still creating meaningful opportunities for BTC participation. With BTC staking now live, stakers can expect between 1% and 3% yield in STRK rewards.

Since there is currently no BitVM bridge on Starknet, the staking apparatus will initially facilitate wrapped BTC, including WBTC, LBTC, solvBTC, and tBTC, with plans to expand to other wrappers in the future. Users can bridge their wrapped BTC to Starknet via StarkGate, LayerZero, Garden, Atomiq, RhinoFi, and others. Delegation pools will remain wrapper-specific to ensure risks from a single wrapper failing are contained, and a governance vote may officially delist a wrapper in the case of an emergency.

Endur

In addition to native staking, users can liquid-stake their BTC thanks to Endur. Endur is a liquid staking protocol on Starknet developed by Karnot and Troves, aiming to address the opportunity cost of staking and promote capital efficiency within the ecosystem. The protocol holds 44.5m STRK ($5.75m), and earns users 8% yield on their liquid-staked STRK.

Endur supports WBTC, tBTC, LBTC, and solvBTC for liquid staking and automatically converts STRK rewards from BTC staking into the underlying BTC for users. Users can lend or borrow against their liquid-staked tokens (LSTs) within Starknet’s BTCFi, utilizing lending protocols like Vesu, or immediately swap out their LSTs with Ekubo.

Re7 Institutional Fund

Re7 Capital is a UK-regulated crypto asset manager with over $800M AUM that has pre-seeded Starknet’s BTCFi with institutional liquidity to promote institutional activity at launch. In the past few years, Re7 was recognized for its performance with the Best DeFi Yield Award at The Digital Banker’s 2024 Digital Asset Awards and the Annual Excellence and Sustained Excellence Awards in the Liquid Ventures Fund of the Year category at Hedgeweek’s 2025 Global Digital Assets Awards. With their Bitcoin Yield Fund, Re7 bootstrapped the BTCFi initiative for institutions from Day 1. Re7 provides allocators with the proper compliance, reporting, and transparency standards required to participate in BTCFi.

The fund launched the Re7 BTC Yield Strategy, a market-neutral BTC strategy that aims to generate yield, regardless of market direction. Re7’s strategy will harvest volatility premiums on derivatives markets, as well as deploy BTC into DeFi through liquidity provisioning and BTC staking. The BTC Yield Strategy is also available to retail participants through a partnership with Midas, a $1.1B TVL DeFi platform specializing in Real-World Assets, which tokenizes the yield fund via mRe7. Users can then recursively loop their mRe7 to extend their capital efficiency.

BTCFi Season

The Starknet Foundation has allocated 100 million STRK to incentivize liquidity to bridge to the network, as well as engage with various native Starknet protocols, such as Ekubo and Vesu. STRK incentives will last for at least six months and are designed to make Starknet the most cost-effective platform for deploying BTC into DeFi. Rewards are focused on promoting that vision by incentivizing liquidity on DEXs, liquidity in lending markets, and rebates for those borrowing against BTC. Starknet created a sustainable DeFi flywheel with BTCFi to develop an economy that organically generates yield, beyond just BTCFi Season.

Users can borrow stables against their BTC using Vesu's money market to deploy into various yield opportunities, which generate yield through liquidity provisioning or basis trading. In collaboration with BTCFi Season, Vesu offers a 40% rebate in the form of STRK when borrowing stables against BTC.

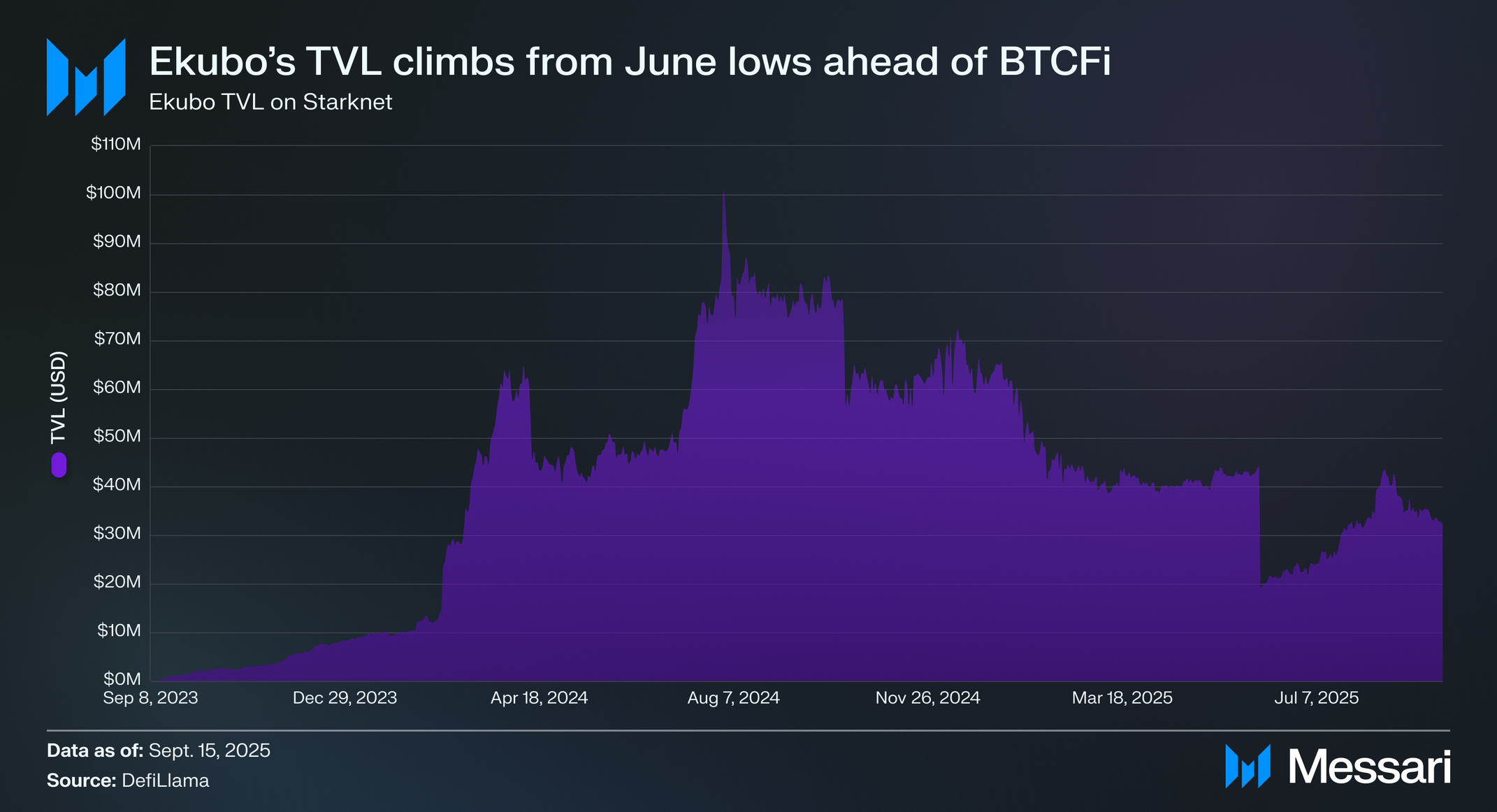

Ekubo

Ekubo is an AMM DEX built on Starknet’s Cairo, with a $17M TVL. Ekubo delivers best-in-class capital efficiency for swaps and liquidity providers thanks to the resolution of their liquidity pools, with ticks at 1/100th of a basis point. This resolution allows liquidity providers to avoid unnecessary impermanent loss, thus promoting depth in liquidity pools on Starknet. Averaging $7 million in daily trading volume over the past year, Ekubo is the leading DEX on the Starknet network. In collaboration with Spline, Ekubo ensures proper liquidity is available for swapping between BTC wrappers with minimal slippage. Additionally, Ekubo offers the Ecosystem Liquidity Pool (ELP), which earns revenue from trading fees from spot Ekubo pools and liquidations from Extended perpetual futures, a perpetual DEX on Starknet with a $54.26 million TVL.

Vesu

Vesu is a lending protocol with $45M TVL on Starknet that allows users to lend and borrow assets. Lenders can choose to supply to isolated liquidity pools to optimize their yield, with the ability to programmatically adjust their pools to maximize capital efficiency. Vesu’s offerings are accessible via Starknet native wallets as well as their own application.

Vesu’s TVL has grown 350% since reaching its $10M TVL milestone in September 2024, establishing itself as the premier lending protocol on Starknet. Users can lend various assets, ranging from stablecoins, ETH, wrapped BTC, Runes, and native Starknet tokens to earn yield or borrow against them. In addition to optimizing liquidity on Starknet, Vesu also supports the Starknet ecosystem by sponsoring Starknet Hackathons.

Users can borrow stables against their BTC using Vesu's money market to deploy into various yield opportunities, which generate yield through liquidity provisioning or basis trading. In collaboration with BTCFi Season, Vesu offers a 40% rebate in the form of STRK when borrowing stables against BTC.

Vesu and 0D Capital, the digital asset investment arm of Pragma Oracle, have partnered to provide users easy access to delta-neutral BTC vaults. 0D Capital is a professional trading desk that operates delta-neutral, BTC, and liquidity-providing vaults, providing DeFi users with access to institutional yield opportunities. With Vesu, they are bringing more opportunities to Starknet.

Closing Summary

BTCFi marks a strategic inflection point for Starknet, not just as a scaling solution, but in creating a comprehensive DeFi suite for BTC. By introducing BTC staking via SNIP-31, integrating institutional capital through Re7, and building yield-onboarding rails, Starknet is turning idle BTC into a productive asset class. The initiative strengthens Starknet’s future validator economy, deepens DeFi liquidity, and creates tangible incentives for both retail and institutional users to engage. With its custom-built architecture, STRK-based security, and native support for multichain assets, Starknet isn’t just giving Bitcoin a place in DeFi; it’s building the infrastructure for Bitcoin to matter in it.