The Weekly - 8th October 2025

OCT 8, 2025

Records

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

Summary

This week, Re7’s BTC Yield Strategy went live on Starknet, marking a milestone in bringing institutional-grade Bitcoin strategies fully on-chain. The launch coincided with Re7 Capital’s shortlisting for the HFM European Performance Awards 2025, recognizing disciplined performance and institutional execution in DeFi-native strategies. Meanwhile, tokenized equities and crypto ETFs both reached new all-time highs, propelling the broader crypto market to a record $4.24T. With altcoin dominance stabilizing and momentum indicators resetting, risk appetite across the sector continues to build.

Re7 BTC Yield Strategy Is Live

As Bitcoin’s role in DeFi expands, Re7 launched its BTC Yield Strategy on Starknet, a market-neutral approach designed to grow BTC holdings through options and on-chain yield. Featured in The Block, the launch underscores how institutional-grade execution is reaching Bitcoin itself.

Continuing the conversation, Harry Grant joined Cointelegraph’s Clear Crypto Podcast to discuss how BTC is evolving from static storage to a productive, yield-bearing asset through trustless strategies like Re7’s. The same week, Re7 Capital was shortlisted for the HFM European Performance Awards 2025, recognizing disciplined performance and institutional-grade execution across its DeFi-native strategies.

Tokenised Equity Surging

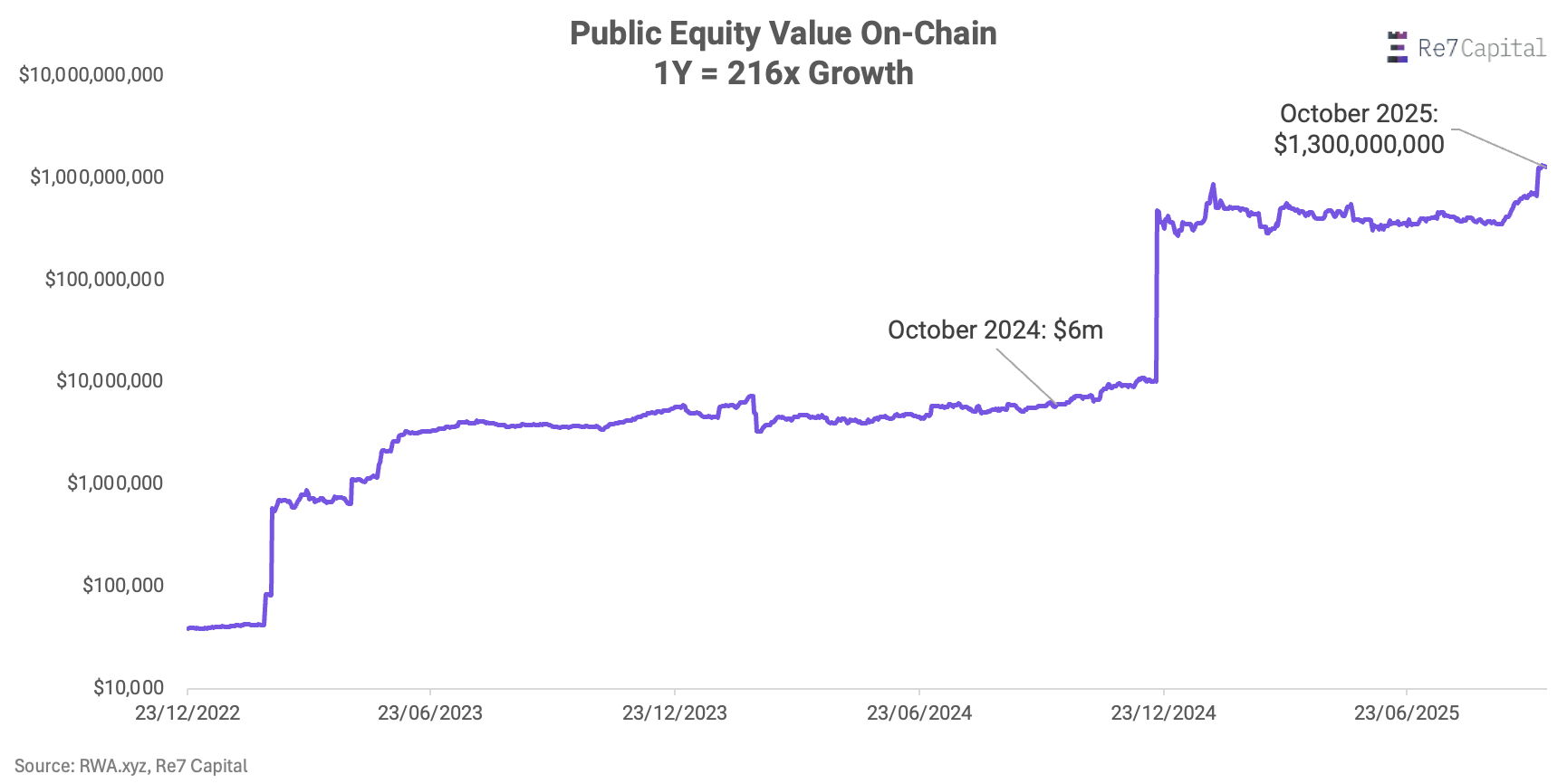

Tokenised stocks on-chain have grown 216x in just 1 year to $1.3B.

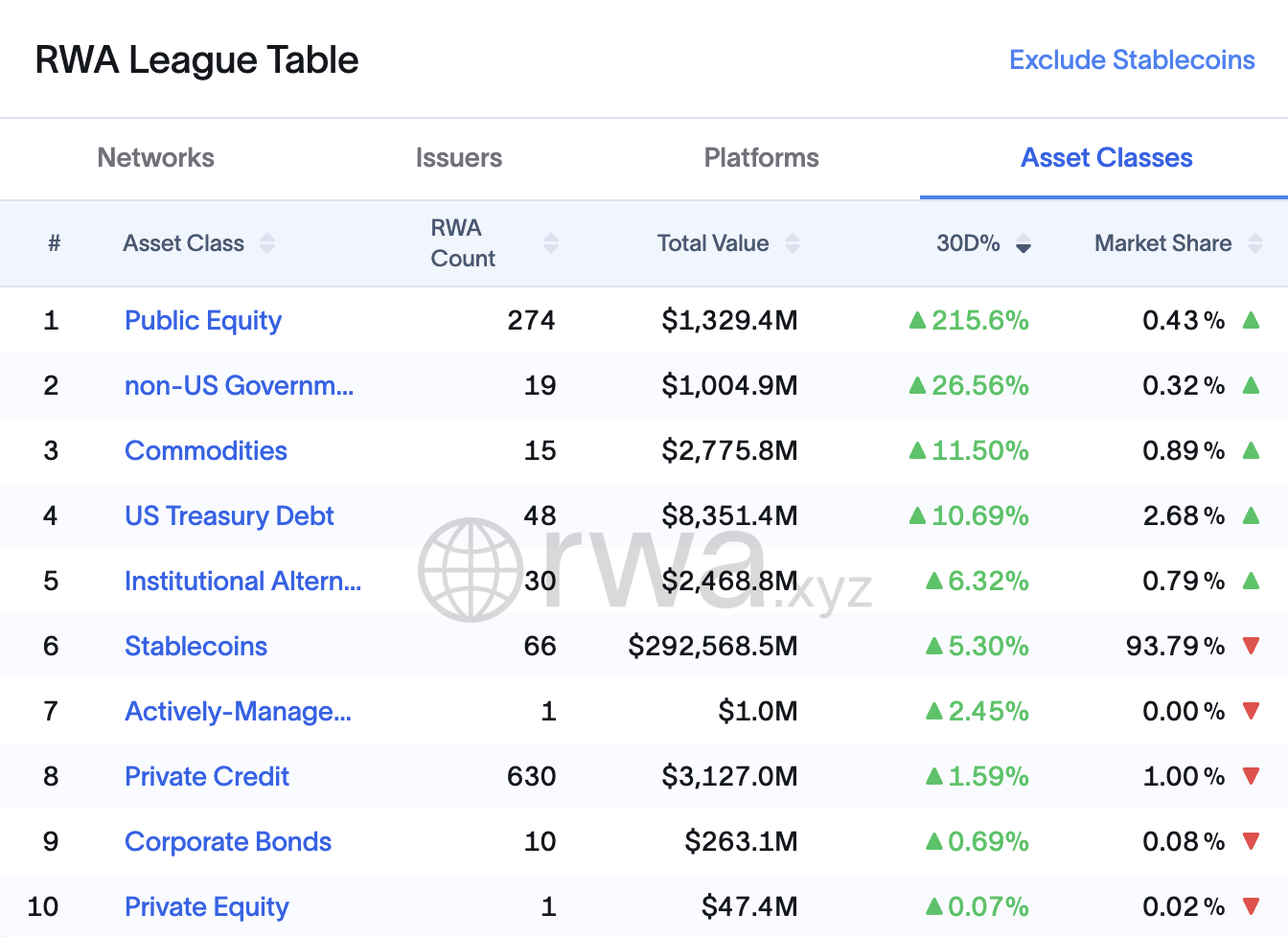

Growth in this asset class has been so strong that it ranks #1 for 30D growth vs. all other asset classes, including stablecoins.

We’ve seen companies like Robinhood, Galaxy, Kraken, Ondo Finance focus on private assets that allow near-instant settlement, lower operational costs, expand investor bases beyond select jurisdictions, and enable 24/7 trading.

While this growth is impressive, we’re only scratching the surface of the $100T global equity market.

Strong Market Inflows

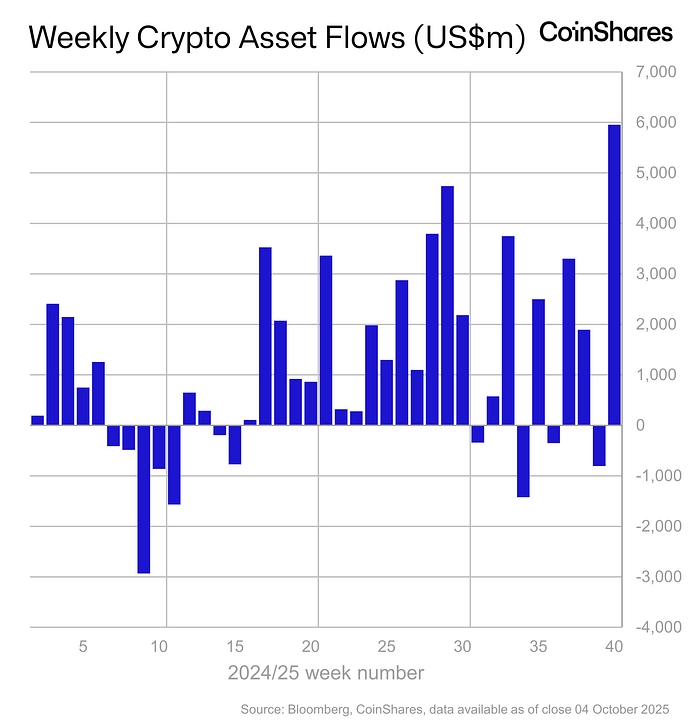

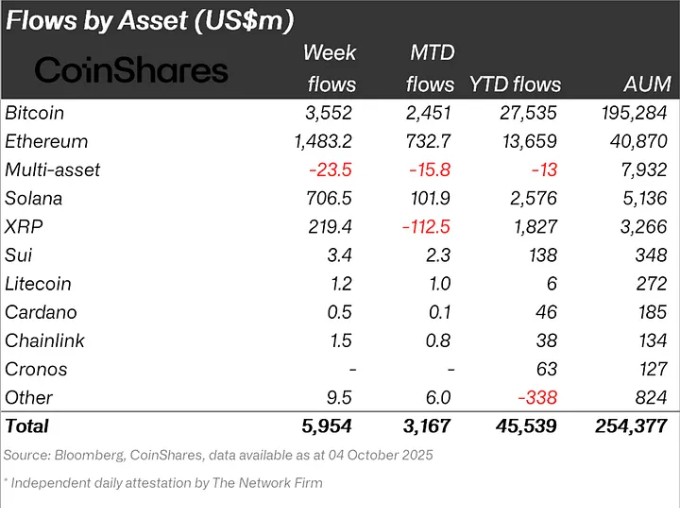

We saw the largest weekly inflow into digital asset products on record ($6B), of which 86% were US-led.

These strong inflows may be a response to Fed rate cuts, weaker employment and economic data, and political instability over a prolonged shutdown.

Every week, $15B in GDP is lost as unemployment rises.

Comments from Trump and the newly elected prime minister on pro-stimulus measures also helped buoy sentiment.

This comes as crypto markets gained +9% last week, reaching new all-time highs of $4.24T.

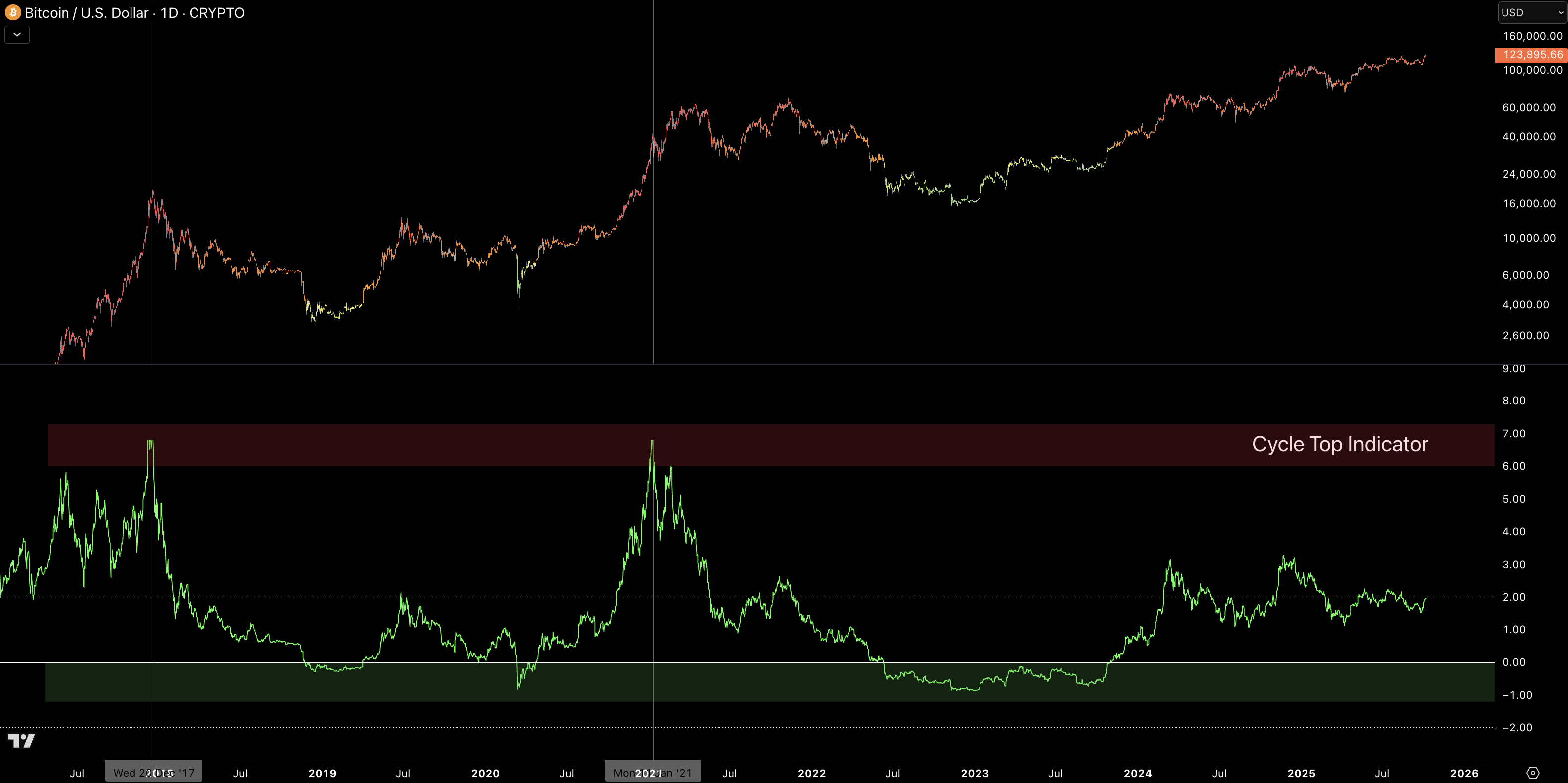

Yet, our cycle-top models don’t currently signal valuations are overextended into cautious levels.

What’s more interesting is that treasury companies, such as Strategy, claim to have not bought any BTC and with limited short liquidations over the past week means Bitcoin’s move higher is likely driven predominantly by spot demand.

It could therefore be that funds and macro PMs are rotating into crypto from other assets, reflecting increased investor appetite into crypto.

It’s not just BTC receiving attention. We’re seeing strong allocations to other large-cap names this week too..

Alts

For the alt sector, its market dominance fell by 2% (nominal) from its local peak as large cap names have received the initial inflows.

However, we see the path of least resistance upward, with increasing risk appetite as this largely remains a “hated rally” among investors.

Altcoin market dominance index.

Altcoin market momentum has corrected back to neutral levels after briefly overextending into overbought territory last month which has provided a reset in this sector.

Altcoin market momentum index.

Updates on Re7 Labs

$30M+ In New Re7 Labs Pools on VesuUSDC, tBTC, SolvBTC, LBTC, and WBTC are now live with accelerating inflows, enabling users to earn on BTC assets & unlock USDC liquidity, and scale on-chain strategies with Re7 Labs.

mRe7YIELD Upgraded To Instant MintMint and deploy in a click, enabling cleaner routing and deeper composability across DeFi. Current APR stands at 21% (as of Oct 6, 2025), with new integrations on the way.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week.

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management, and DeFi ecosystem design. Learn more…

We’re Hiring. We’ve just opened two new roles: Operations Portfolio Risk Manager and Vault Strategist, with more positions available across teams. If you’re excited by institutional DeFi and want to help shape its future, explore our open roles.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.