The Weekly - 5th August 2024

AUG 5, 2024

On markets creating opportunities

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

What’s going on in the market

How liquidity is already being injected into markets

How valuations are diverging from fundamentals, creating opportunities

Market Rundown

Like global markets, crypto is having a position clear-out.

In the last 24 hours, $1.06b liquidations have occurred for 274,729 traders.

More crypto was liquidated than on any single day in the past 3 years.

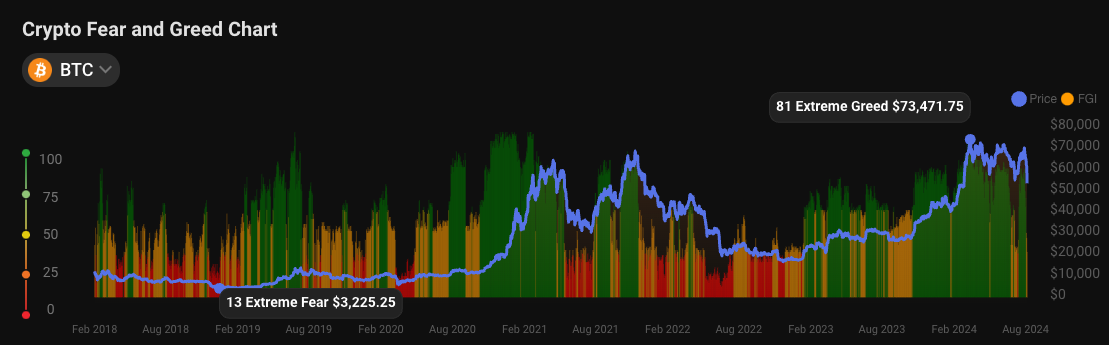

Fear is setting in once again during this flush-out. Markets have seen 6 ‘fear’ periods since the November 2022 bottom. Flush-outs are part of the game to realise the bull market outcome.

BTC is up +232% since November 2022.

Majors like BTC wicked back up to $52k - within the consolidation channel we’ve been trading in since March.

More Calls for Easing

Macroeconomic factors are tempering investor excitement about the Fed rate cuts.

Last week, Japan hiked for the second time since 2007 leading to higher Yen/Dollar. Investors have subsequently been selling assets (e.g. equities) to cover their Yen-denominated debt.

It’s becoming clear the main driver of volatility is not the US economy collapsing but a cascade of levered Japanese speculators.

The policy error is that the Fed didn’t cut as Japan raised their rates. And this rate differential can change on a dime.

Now we are getting predictions for more aggressive easing into year-end to re-balance the equation.

A Time for Divergences

During these times, the most interesting lens is to look for divergences.

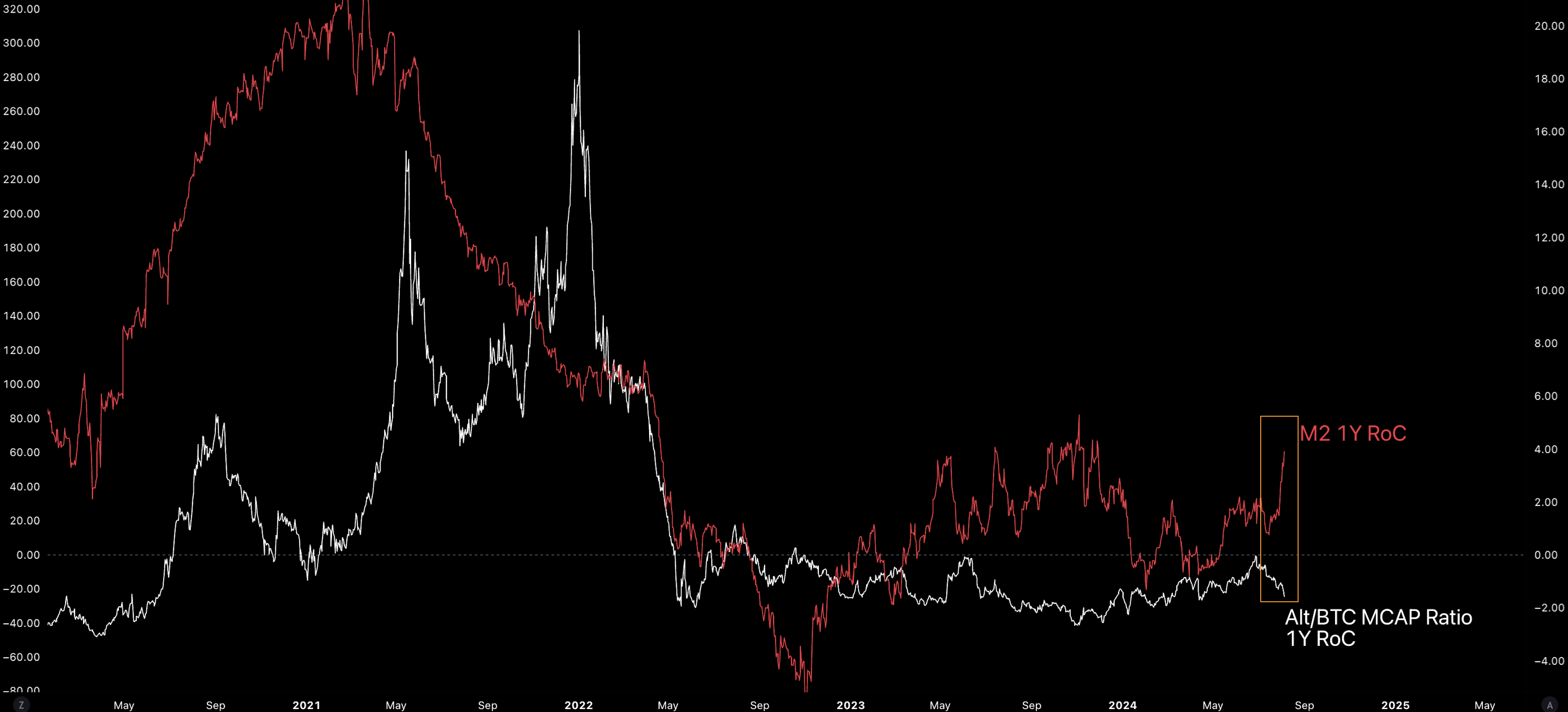

While everyone is focusing on rate hikes, we see global liquidity increase at the sharpest rate so far in 2024 while liquidations drag prices down short term.

Central banks are already at work supporting the system like clockwork. The easing is already in process.

M2 supply expansion is now diverging away from Alts/BTC.

The rate of changes between these two follow each other as liquidity expansion drives a more risk-on environment for investors that move down the risk continuum.

Fundamental Data: Growth Remains The Story

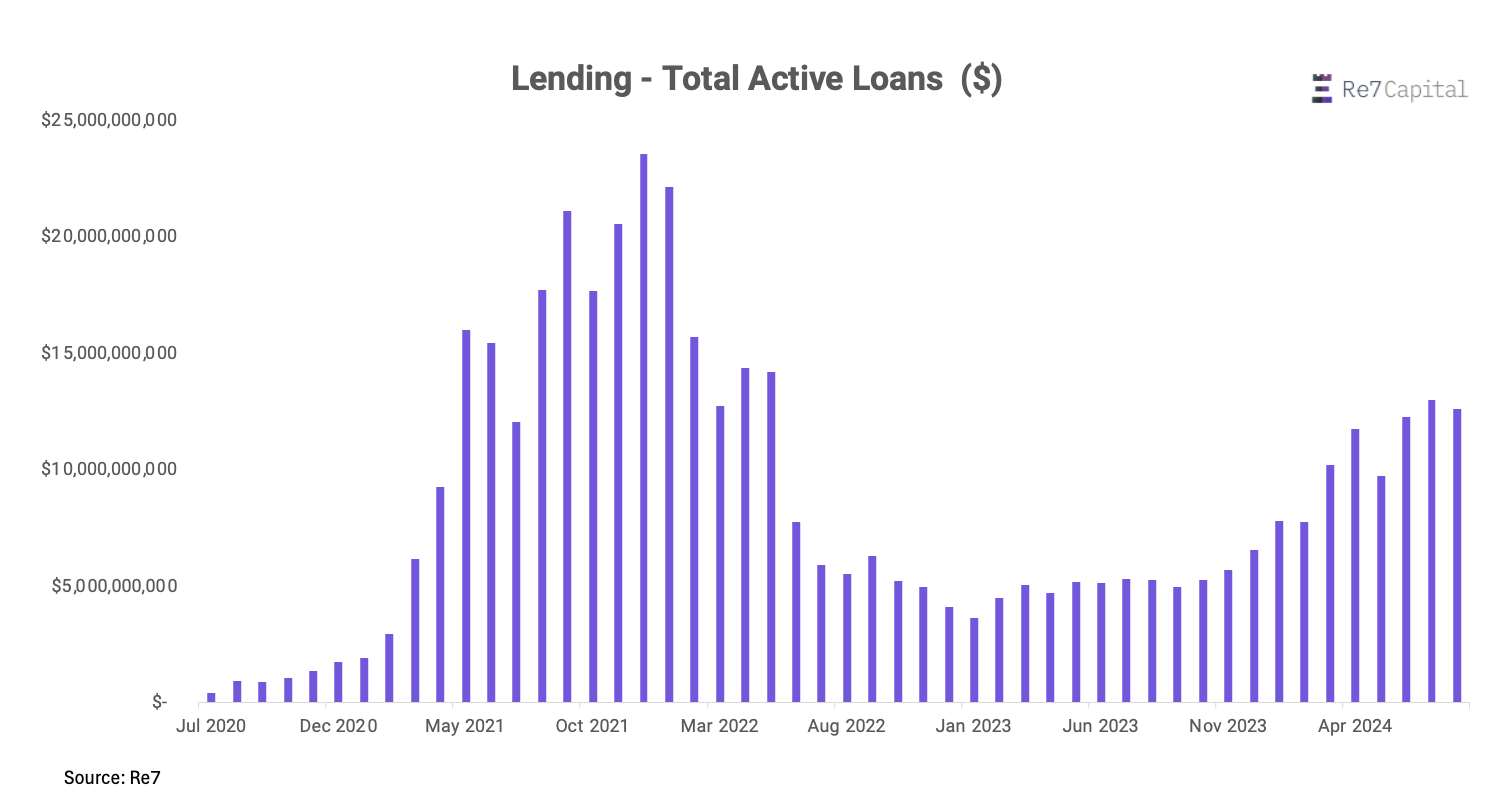

And when we look at what’s happening on-chain, the data suggests growth remains the story.

Active loans in DeFi are 2.5x YoY.

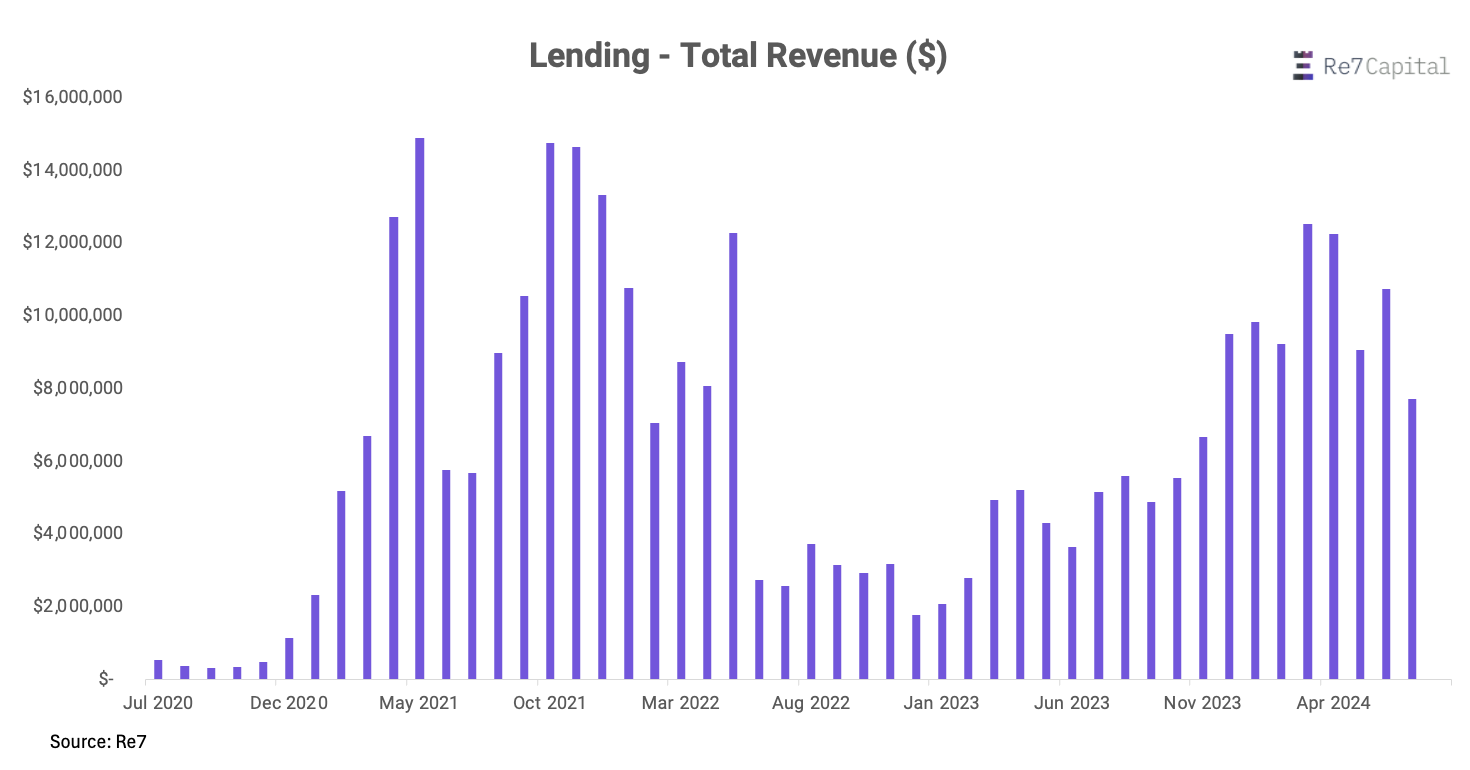

Strengthening fundamentals for protocols continues to translate into revenue.

Lending protocols have already generated 30% more revenue so far in 2024 than in the whole of 2023.

In some cases, liquidations are monetised and act as revenue drivers.

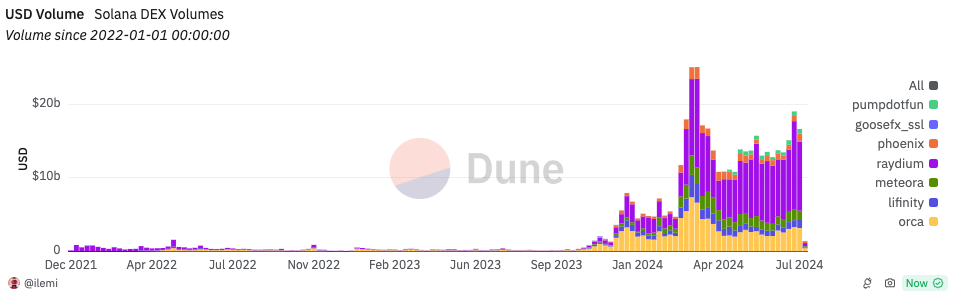

Meanwhile, on-chain trading volumes on Solana are 2.5x YTD.

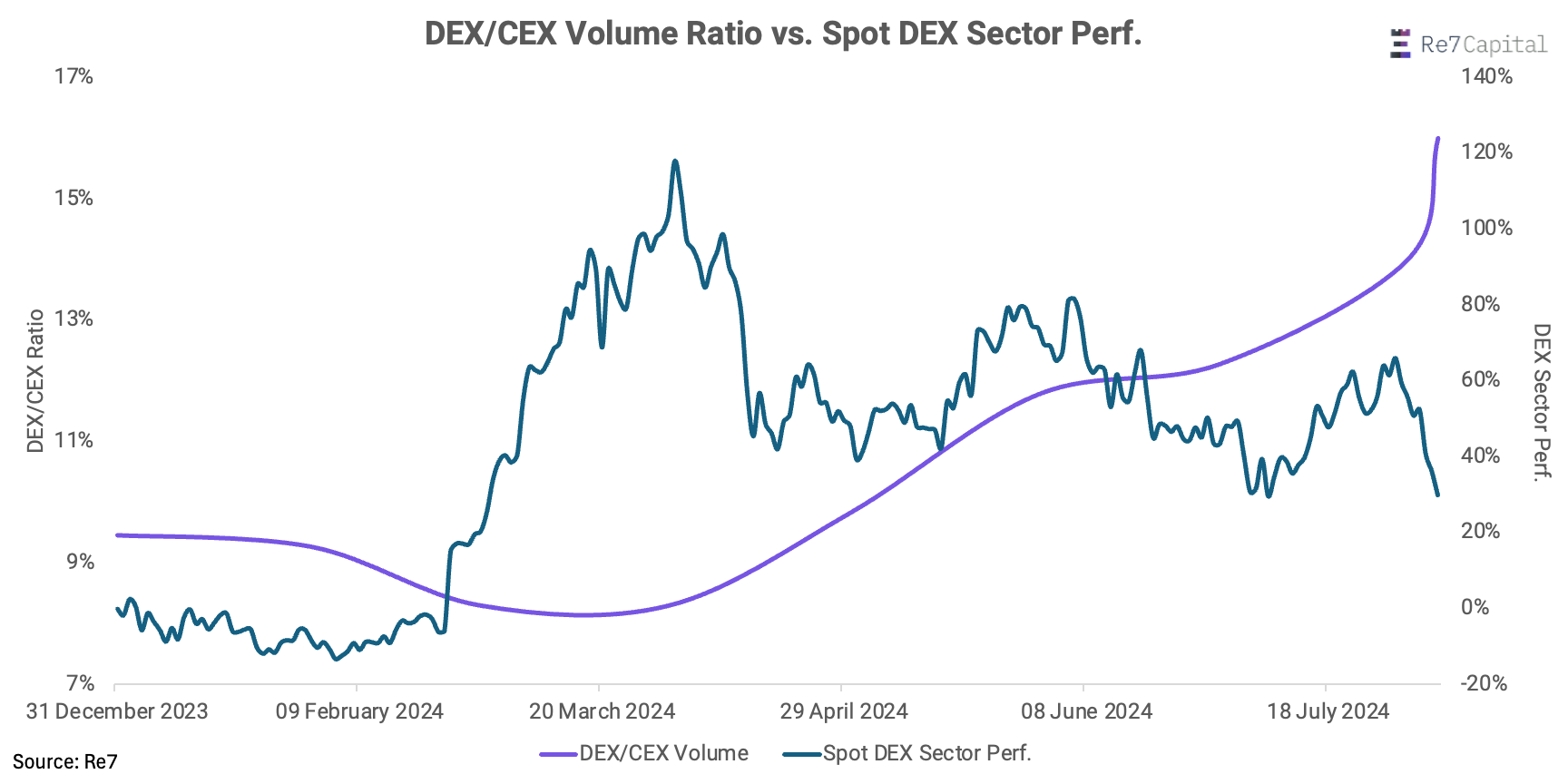

And this DEX growth in alternative ecosystems is outpacing CEX growth for volume.

DEX/CEX volume ratio prints new ATHs while the spot DEX sector corrects. The divergence is becoming more extreme.

This comes as we have:

ETH gas stabilising at ~20

+$300m stablecoin net inflows in the past 24hrs

Borrowing/lending leverage dropping, resetting leverage

No LST de-pegs

So while turbulence is to be expected in every bull market, our financial system of tomorrow is operating as designed. It’s business as usual.

Market drawdowns are creating fundamental divergences; they are creating more opportunities.

DeFi Runs Smoothly

DeFI continues to churn along as well as ever, permissionlessly processing billions of dollars of volume and activity:

Aave had it's most profitable day ever on the back of huge liquidation volume. Earning over $3.5m for the protocol without observed bad debt on over $300m of liquidations.

Morpho markets on our Re7WETH vault performed as expected, with some large positions liquidated and no bad debt observed.

Ethena processed $50m of redemptions without issue and still has full expected backing.

ETH unstaking queue times haven't elevated despite large amounts exiting the beacon chain, with an average wait of just over a day

Perp DEXs and AMMs saw record volumes for the year, with Curve daily volume at almost $2b.

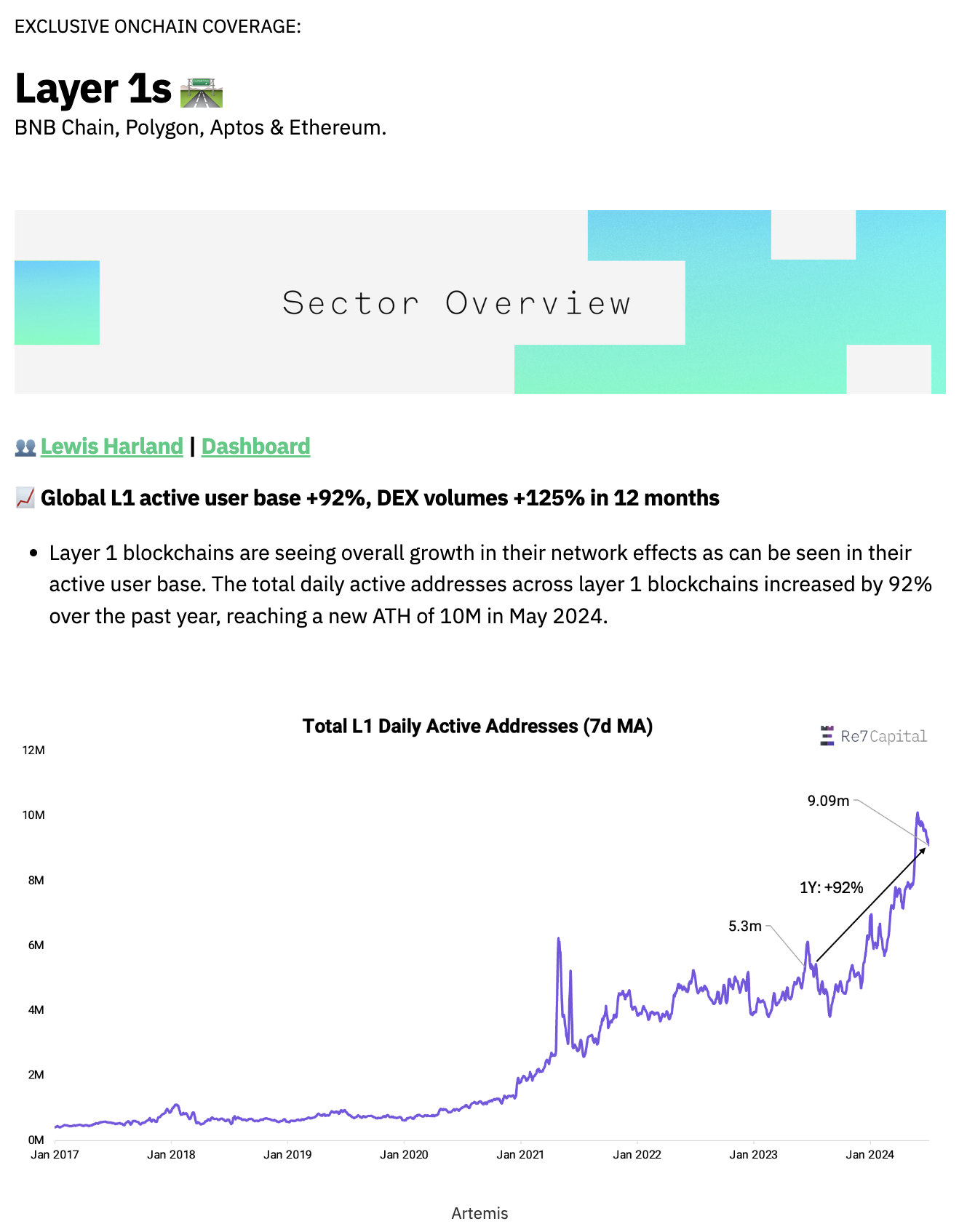

ICYMI - Re7 x OurNetwork (L1s)

OurNetwork teamed up with Re7 for the Layer 1 blockchain edition of the newsletter, providing the overall sector highlights.

OurNetwork Layer 1s

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.