The Weekly - 23rd September 2025

SEP 23, 2025

5 Charts That Make You Go Hmm…

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management and DeFi ecosystem design. Learn more…

This Week at Re7:

Re7 Capital at TOKEN2049 Singapore

The Re7 team will attend TOKEN2049 in Singapore on October 1–2, 2025. Our leadership team is available for meetings on liquidity provisioning, DeFi yield, and institutional on-chain risk management.

Re7 is Hiring!

Re7 Capital is a London-based digital asset firm leveraging its deep crypto network and proprietary data infrastructure to drive portfolio decisions across multiple fund strategies.

We’re currently hiring across business development, capital formation, operations, and research roles. If you’re serious about DeFi and want to operate at the highest level, explore our open positions here:

Join Re7 Capital

We want to hear from you!

Summary

In this edition, we cover:

5 charts that make you go hmm…

Market update

5 Charts That Make You Go Hmm…

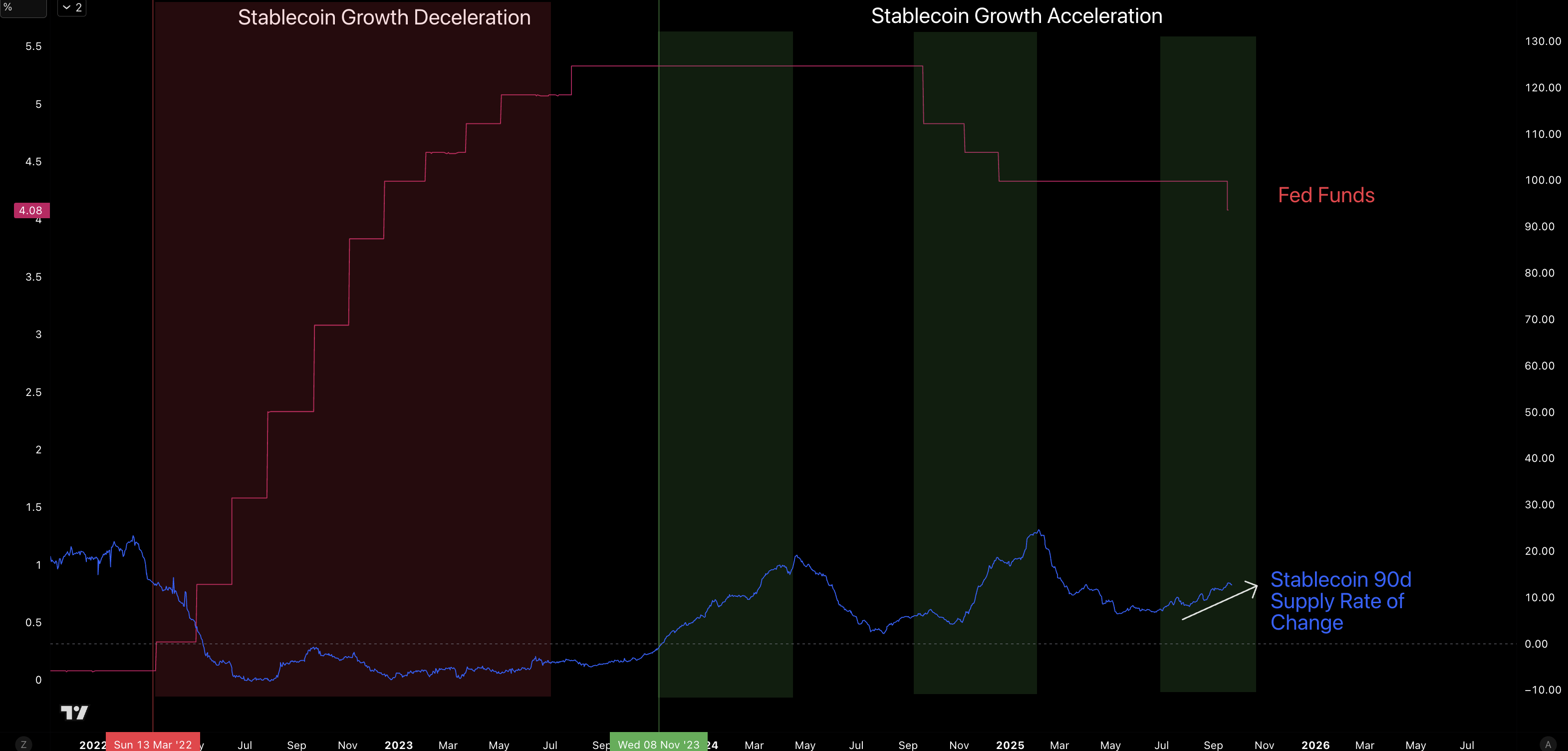

Stablecoin growth vs. Fed Funds

The Fed cutting 25bps at September’s FOMC confirmed the central bank’s intention to ease by favouring job market stability over inflation risks.

With a further two cuts expected in 2025 alone, the resumption of cuts is likely to drive a re-acceleration of stablecoin supply on-chain.

Why? As we’ve noted before, lower rates drive capital to seek higher-yield opportunities within DeFi as risk appetite rises. The net effect is higher borrow amounts and liquidity.

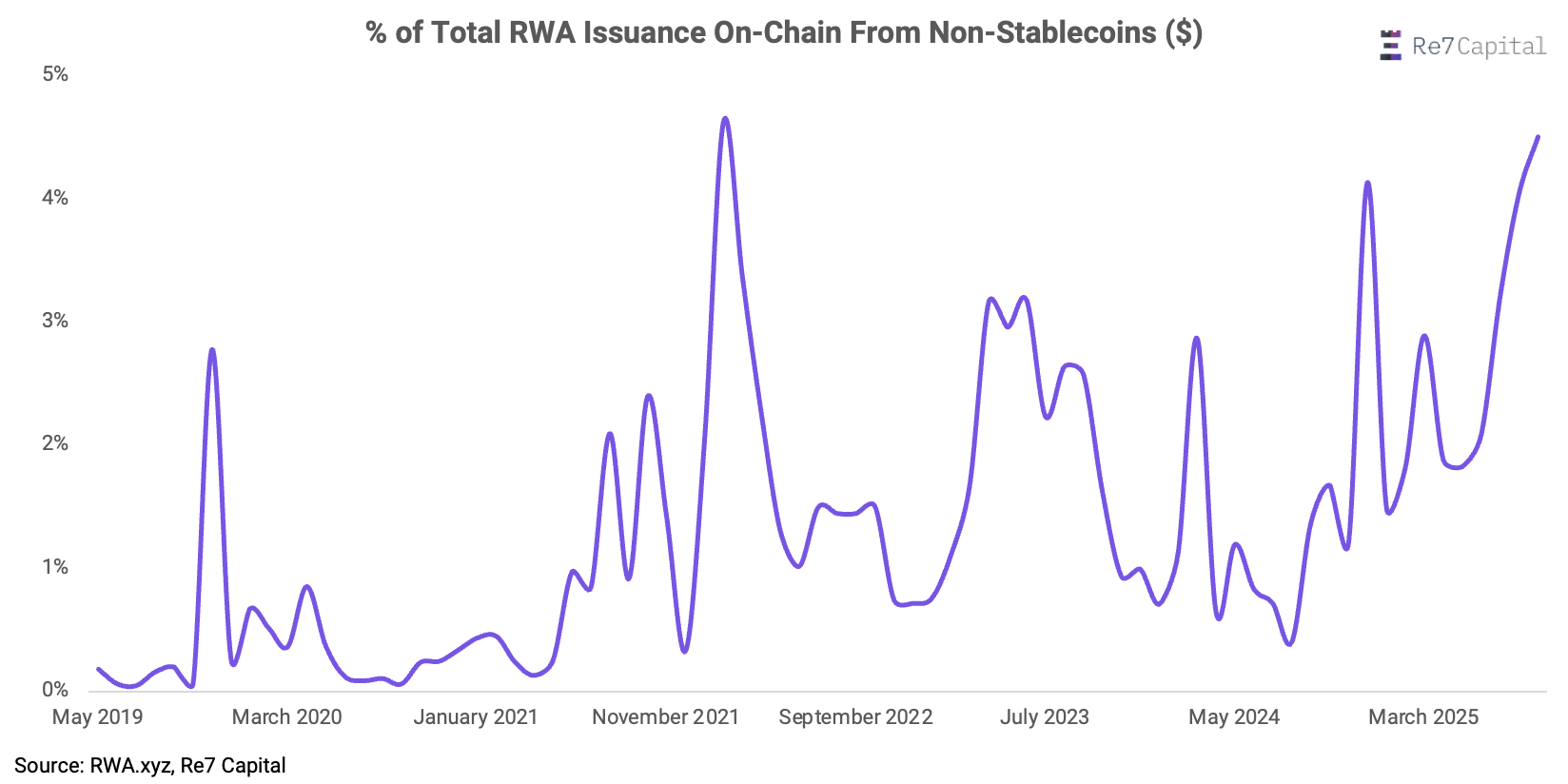

RWA On-Chain Issuance Outside Stablecoins

The percentage of RWA issuance in dollar terms from non-stablecoins is trending to new all-time highs of ~5%.

Verticals such as private credit, US Treasury debt, and commodities are being issued at an accelerated rate. Considering the re-acceleration of stablecoins over the last two years, this is impressive and likely marks a secular trend underway.

In the words of Larry Fink (CEO of BlackRock) in his most recent annual letter to investors:

“Every asset — can be tokenized.”

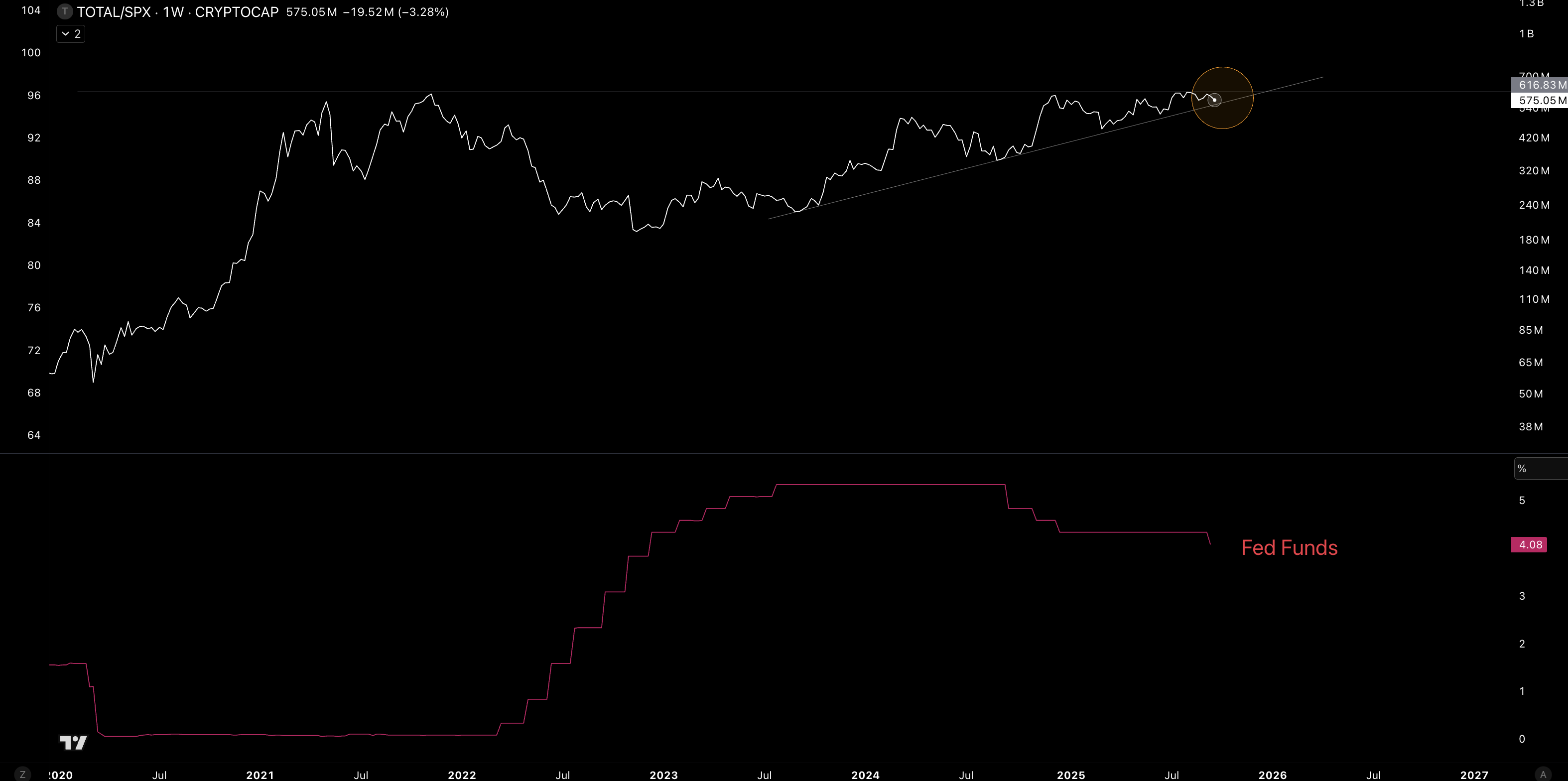

Crypto/SPX Ratio

And when it comes to other impacts of rate cuts on the crypto market, one is the performance of cryptoassets vs. US equities.

Global crypto market cap as a ratio of SPX is on the verge of a multi-year breakout.

Historically, we’ve seen crypto outperform US equities during rate-cut cycles, driven by lower risk premia and accelerated adoption of blockchain technology.

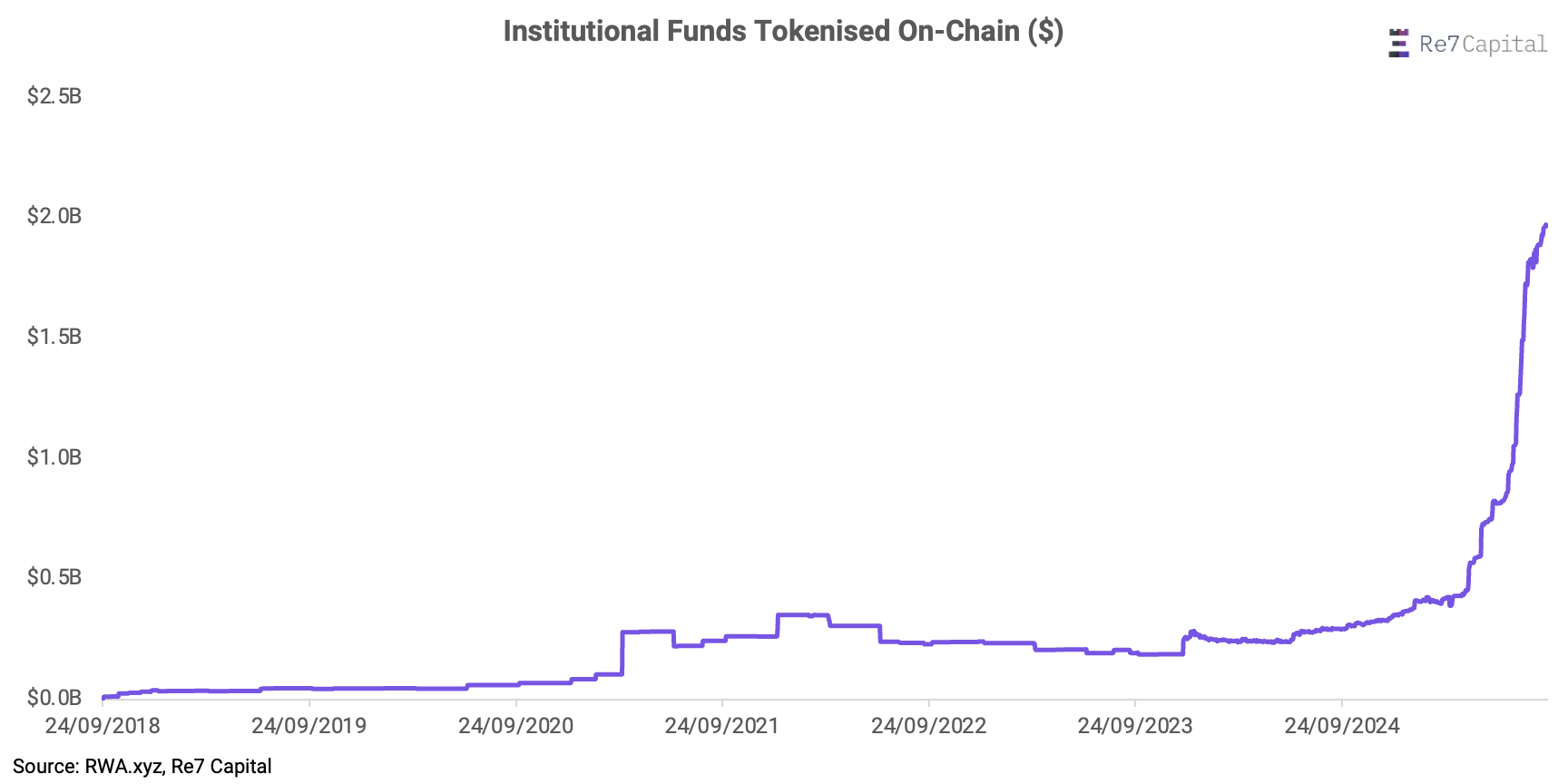

Tokenised Institutional Funds

The total value of tokenised Institutional Funds on-chain has surged 4x in 12 months.

Tokenised alternatives unlock operational and economic efficiency gains such as 24/7 trading, atomic settlement, and cost savings through reduced counterparty risk.

But it feels we’re just scratching the surface.

BCG projects that tokenised funds AUM could reach $600B by 2030 (implying ~300x growth in just four years).

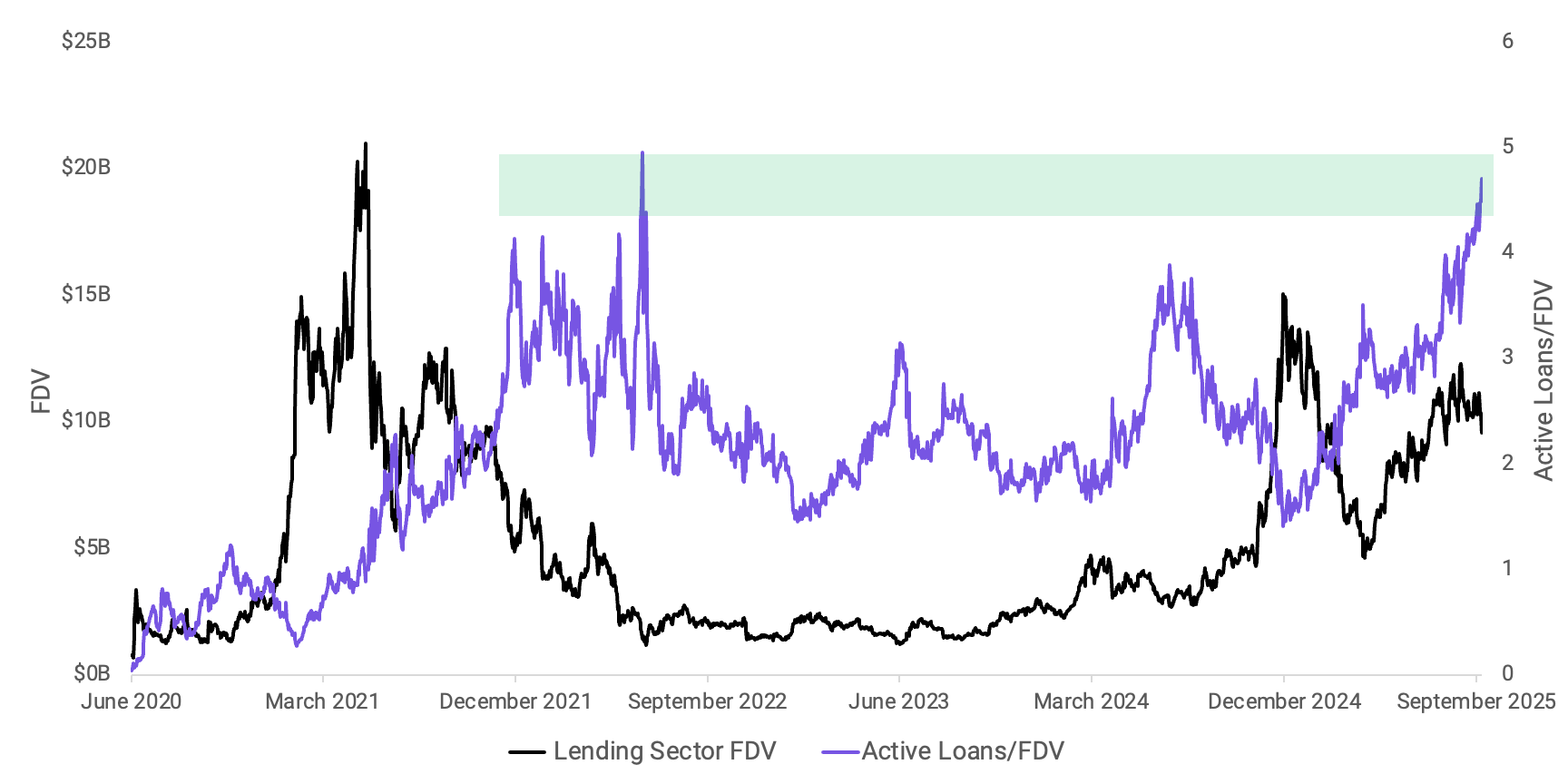

Global Lending Active Loans vs. Sector Valuations

Global active loans have surged to $50B for the first time ever. With borrow demand accelerating from broader macro dynamics, sector valuations have yet to catch up.

Active loans have now outpaced sector valuations to near ATHs reached in July 2022, a period when the sector put in its cycle bottom.

As borrow demand increases, lending protocols are able to generate higher revenue via several means: spreads, interest payments, and loan origination fees, which could then inform valuation re-rates.

Market Update

This week began negatively following the FOMC rate decision, but the overall impact has been muted so far.

Consensus on the post-FOMC direction was generally bearish and, with little price action following the event, investors got the signal to lever long but were quickly over their skis.

The market whipsawed traders in classic fashion, leading to the largest daily liquidation event since summer 2023 for ETH and SOL (and June for BTC).

That said, September is still on track to be an up month (+3.6%), so a positive monthly print would be a non-consensus outcome.

ETH has so far stayed above three-year resistance-turned-support and the $4K level.

Meanwhile, global market cap excluding BTC and ETH (i.e., an altcoin MCAP proxy) is getting closer to a wedge breakout, hitting resistance as the market consolidates near-term.

And the trend higher in altcoin market dominance remains intact after bouncing off cycle support in June 2025.

Re7 in Media:

Trump’s World Liberty joins forces with Re7 as featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, it was covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as its Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies., a move, that reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Re7 Capital featured in Bloomberg News

As the market rushes into crypto treasury plays, our founder Evgeny Gokhberg offers a more grounded perspective. Trading above NAV only makes sense when supported by a clearly defined, yield-generating strategy. Read the full article

Updates on Re7 Labs

Last week was another testament to our commitment to building a more robust and efficient DeFi ecosystem. We are thrilled to share some of the key milestones and developments from the Re7 Labs team.

mUSD is now live on EulerCurated by Re7, MetaMask’s mUSD is now live on Euler (Linea).As part of Linea Ignition, LPs can access mUSD pools with rewards powering Linea’s native yield.

Euler Earn Vaults LaunchedOur new Euler Earn vaults are live. The incentives will further reward depositors and boost vault adoption. The launch includes:USDC VaultaUSD Vault

Linea New Collaterals: yUSD, wsrUSDStay tuned for new collaterals being added to our Linea vaults.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.