The Weekly - 4th August 2025

AUG 4, 2025

Market rundown

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design. Learn more…

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

Senior Capital Formation

DeFi Business Development

Investor Relations Manager

Full Stack DeFi Web Developer

Recruitment Coordinator

Special Project Analyst

Fund Operations Manager

Head of Branding

Investment Analyst(Liquid Token)

DeFi Yield Analyst

We want to hear from you!

Summary

In this edition, we cover:

Seasonality

Key market drivers in the coming months

Relative strength market opportunities

Market Rundown

Crypto markets finished on a strong note for July, printing +14%.

Last week, we had a 6% pullback to the $3.7T level. This level is emerging as the December resistance-turned-support.

Global crypto market capitalisation (USD).

In prior post-halving years, Bitcoin has posted positive performance in July and August.

Can this time be different? Of course. A city experiencing rainfall for 10 consecutive weeks isn’t subject to a fixed daily probability that resets each morning. Instead, the pattern depends on complex atmospheric conditions.

In markets, prices are driven by a complex mix of factors — including liquidity, sentiment, and idiosyncratic catalysts.

Seasonality

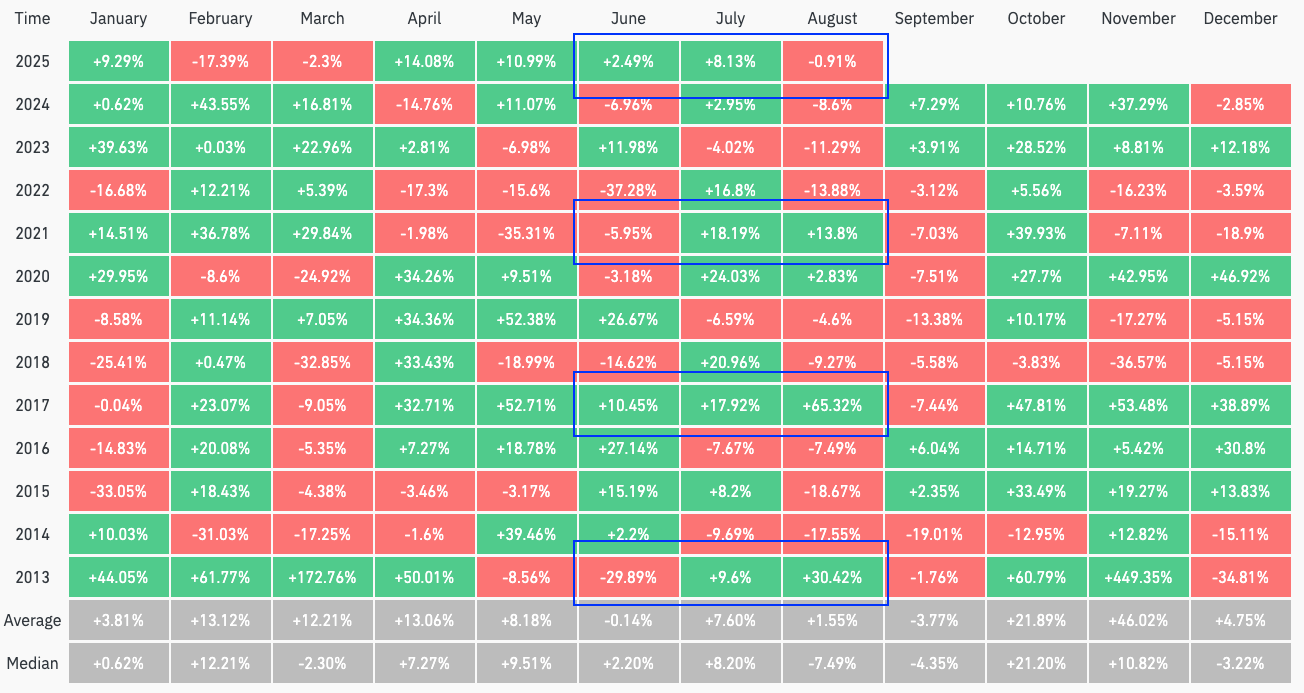

BTC monthly returns since inception.

However, there is an eery rhyme that has occurred every cycle.

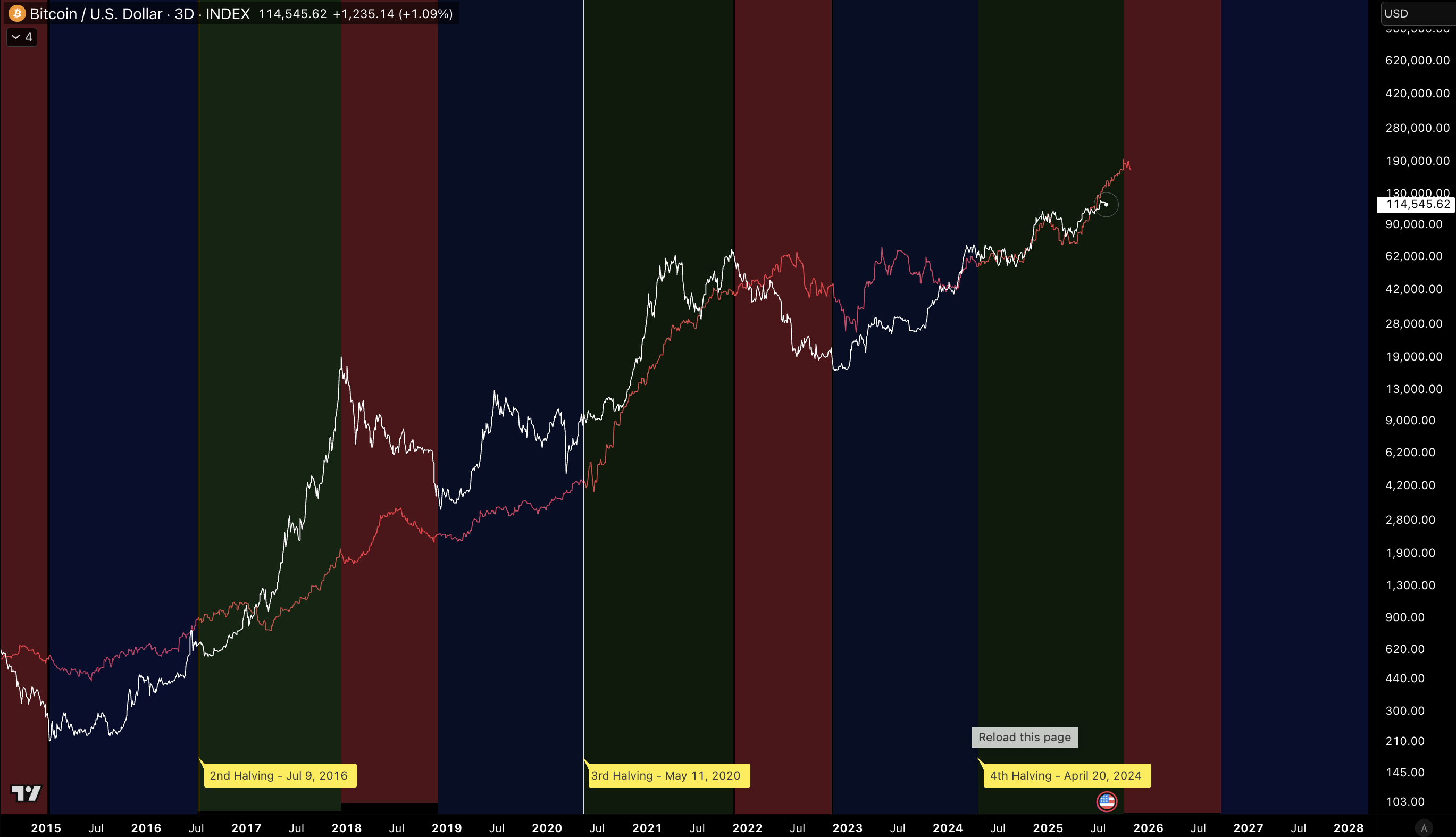

Post halvening, BTC enters a ~180 day bull phase to its cycle peak. This also coincides with an air pocket in liquidity.

BTC vs. global net liquidity index (80 day lead). Green = halvening to cycle peak, red = market peak to trough, blue = trough to halvening.

That said, calling the market top in September feels premature contrary to most calls at the moment for a number of reasons.

Economic Growth

Forward-looking financial conditions are easing which eventually gets reflected in business cycle metrics like US ISM.

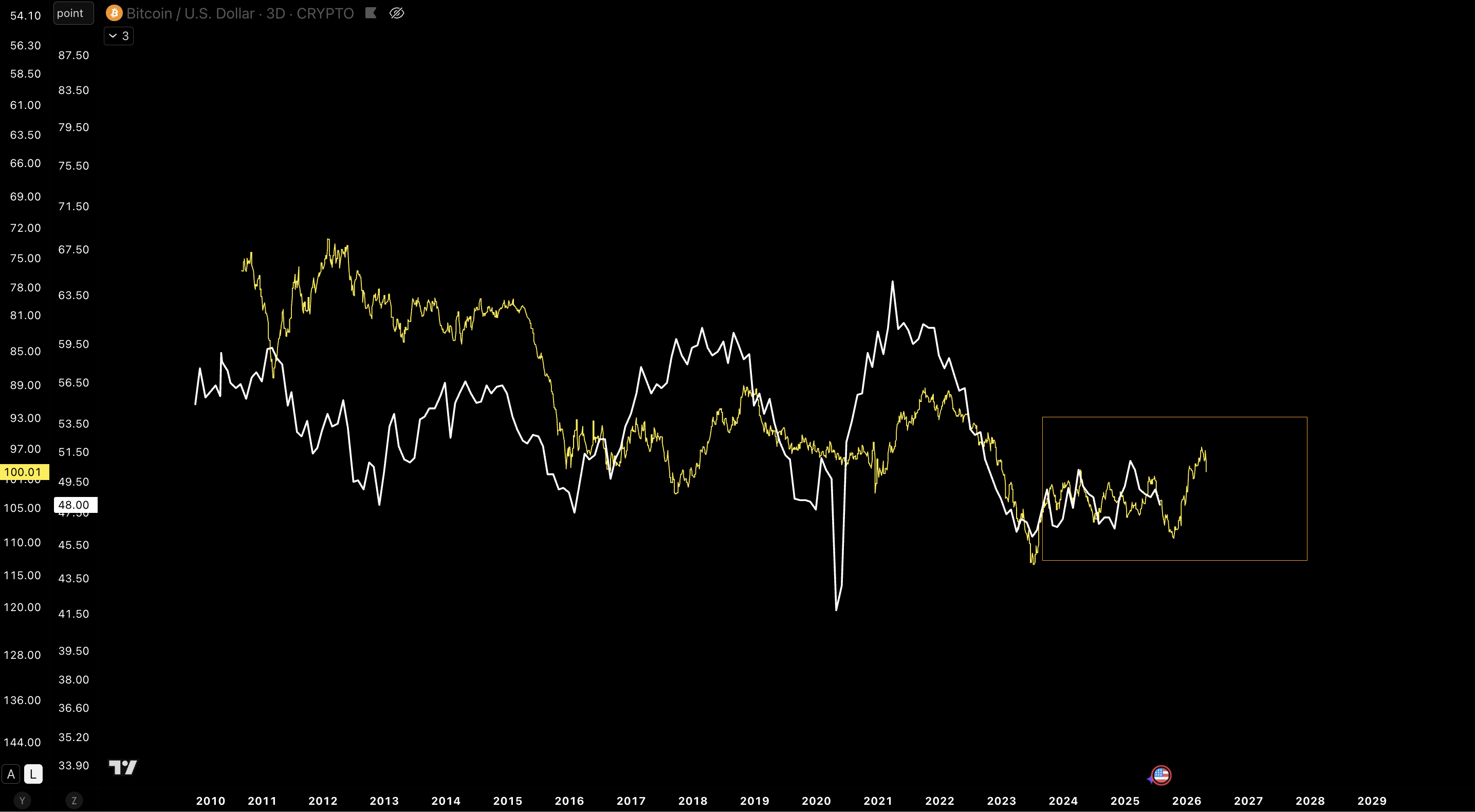

Dollar weakening (yellow, inverted) is also a pull for economic expansion.

As we’ve said before, markets don’t peak without a peak in the business cycle which hasn’t happened yet. This cycle has dragged on following lagged and aggressive monetary responses post COVID.

US ISM vs. Dollar (inverted).

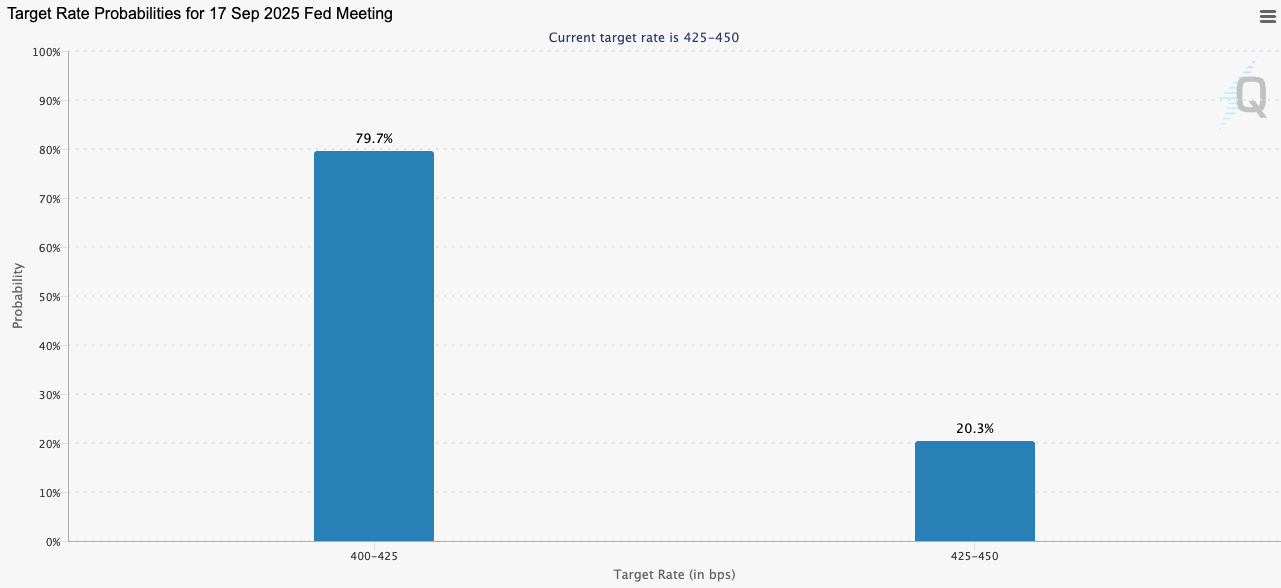

Rate cuts are the path of least resistance which will help underpin the economic growth over the coming quarters.

Markets are now pricing in 80% chance of rate cut at the September FOMC.

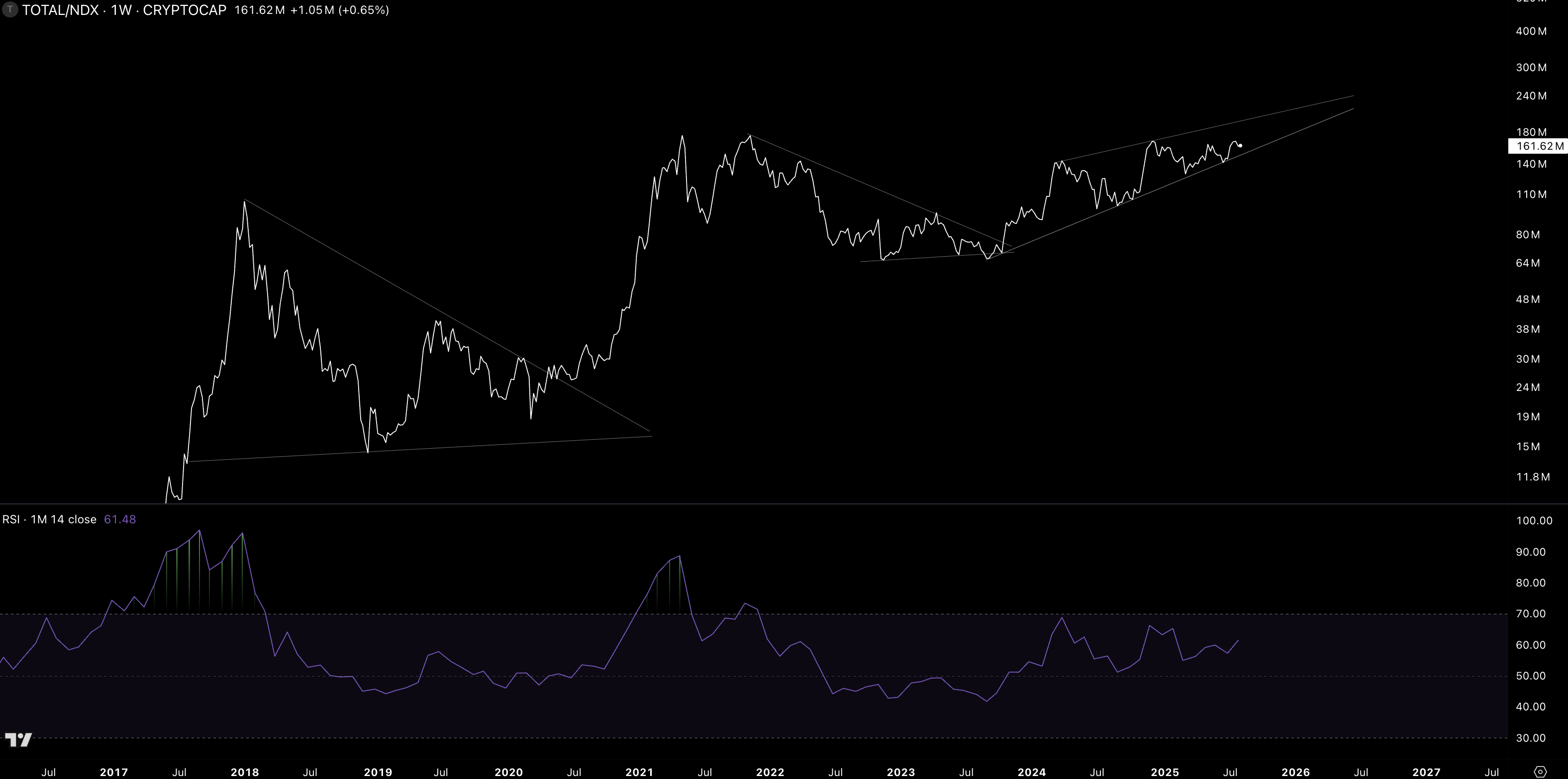

Crypto/NASDAQ has kept its upwards wedge formation to a tee this cycle.

It’s reasonable to expect crypto topping out vs. high growth tech equities when monthly RSIs are in overbought territory (i.e. a blow off-top dynamic) which structurally feels some distance away from today.

Crypto/NASDAQ ratio.

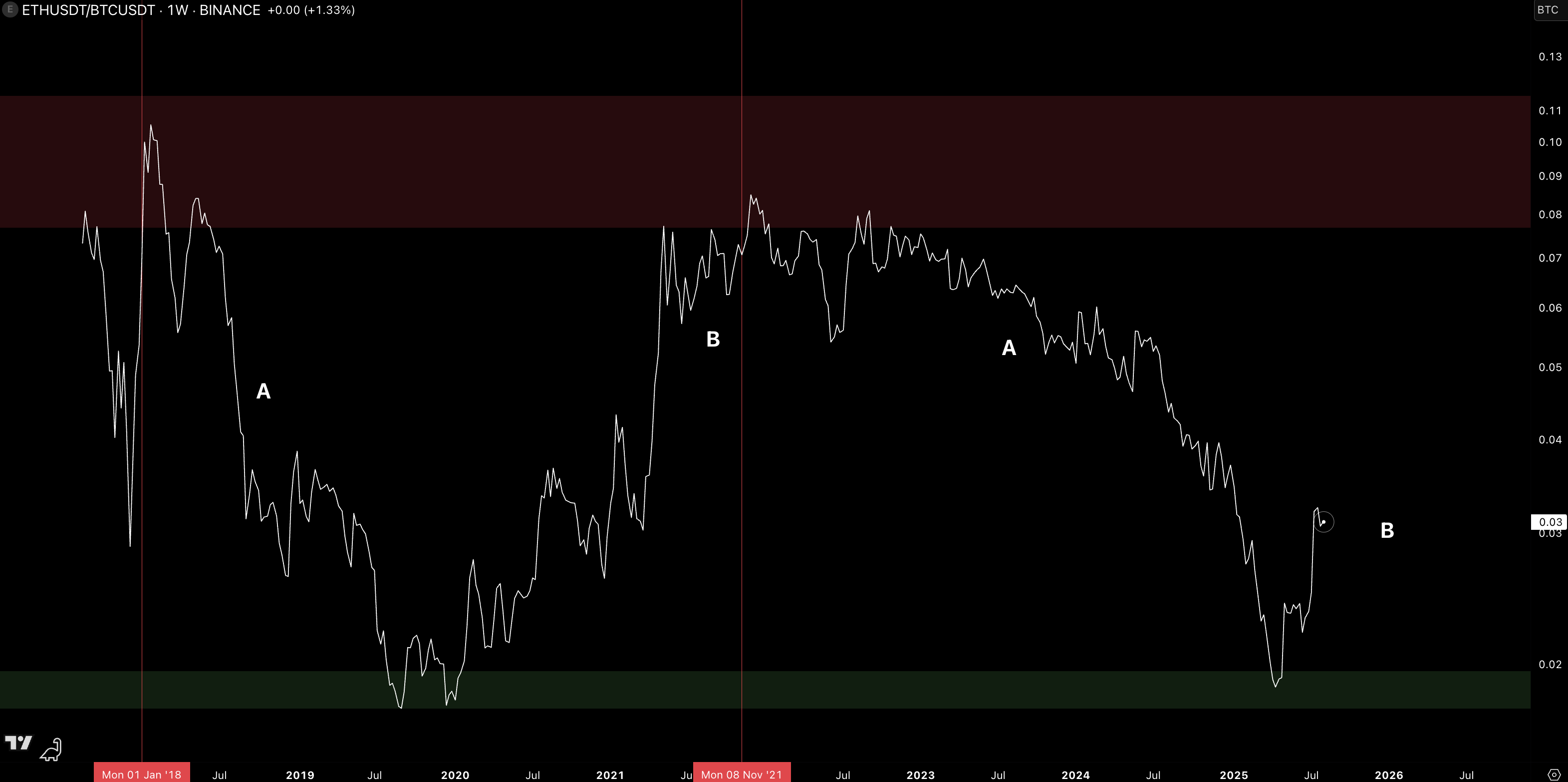

ETH peaks vs. BTC when market peaks also occur after correcting to cyclical lows during the cycle itself.

ETH/BTC.

Altcoin Strength

Alts market cap still maintains its upwards channel…

Altcoin market cap index.

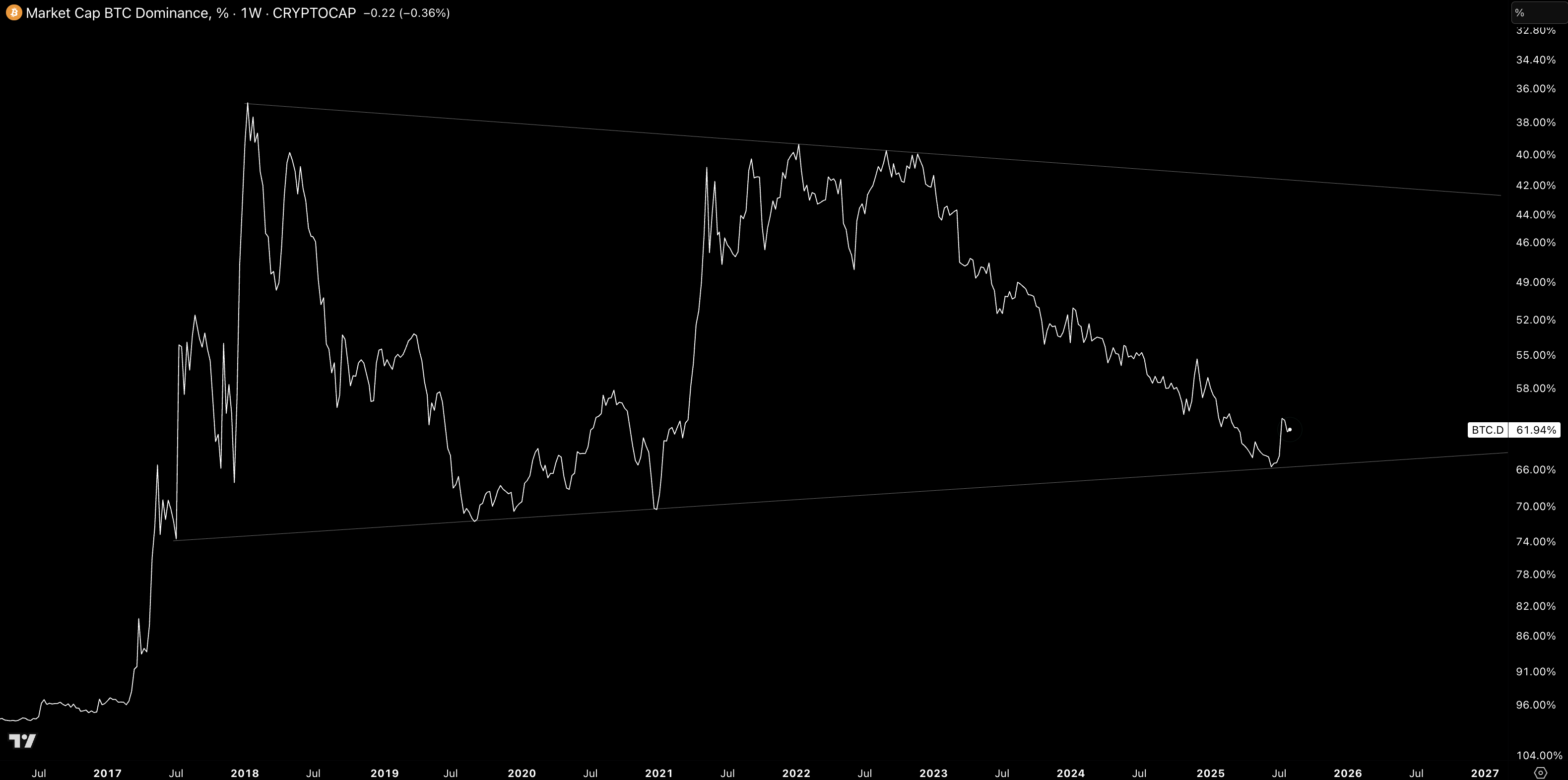

Bitcoin dominance (inverted) is at its 8 year range lows meaning the growth opportunity is skewed towards alts vs. beta on a relative basis.

BTC market dominance (%).

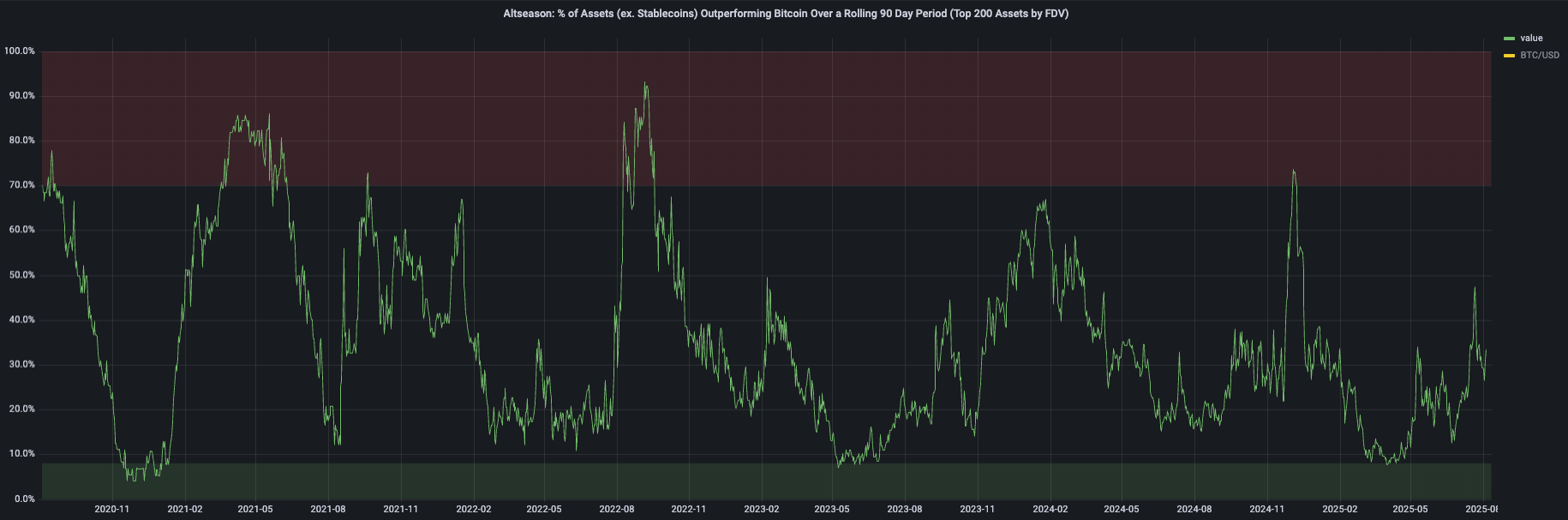

Altcoins tend to see out their relative growth cyclically too, where they extend to overbought levels (red zone) relative to BTC after printing their cyclical lows (green zone).

We are firmly on that path today without being close to the overextended zone.

Altcoin strength index.

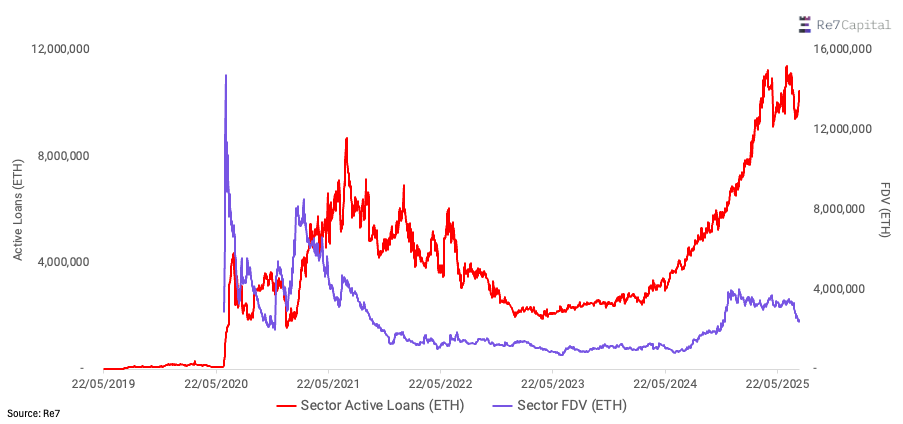

We also continue to see massive divergences between sector-level KPIs.

Take lending, where active loans have outpaced ETH in the most aggressive fashion since inception (red line).

Yet, the sector fully diluted valuation has yet to reflect or catch up to this growth in ETH terms.

Valuation catch ups structurally supports the view of the alt opportunity, providing context that this strength can be underpinned by record high fundamental growth.

In other words, rising adoption and on-chain activity could fuel outperformance in a risk-on market period.

Re7 in Media:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Updates on Re7 Lab Vaults

We are excited to announce that our Gearbox Re7 WETH pool on Lisk is LiveSupply ETH and earn up to 11% APY

We are excited to share that the Turtle tacETH on Mainnet has incredible yield opportunitiesUsers are still earning up to 16% APY with Rewards in TAC and stETH.

Keep an eye out for our Gearbox Re7 USDC pool on Etherlink this should be live very soon with an official announcement.

We are excited to share on AVAX the USDC Re7 Labs Cluster on Euler is earning up to 10% APY.Supplying USDC earns the base lending APY plus additional WAVAX rewards.

Keep an eye out for our new Morpho vaults that will be launching soon on Soneium.Soneium is an Ethereum Layer-2 protocol powered by Optimism's Superchain technology, and developed by Sony Block Solutions Labs

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.