The Weekly - 21st October 2025

OCT 21, 2025

Exploring DeFi's Fundamental Growth Story

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

Summary

BTC and ETH continued to hold their uptrend despite the major liquidation flush earlier in October, signaling resilience across digital assets. Market sentiment remains near cycle lows, a level that historically preceded strong recoveries. With Bitcoin’s weekly volatility compressed to record lows, conditions resemble past setups that led to outsized gains. Meanwhile, DeFi fundamentals strengthened, with adjusted TVL growth accelerating faster than valuations, highlighting genuine on-chain expansion beneath the surface calm.

On Good Terms, For Now

So far, BTC and ETH continue to respect their ascending trend lines despite the large liquidation flush earlier in October.

As we wrote last week, markets seemed to be signalling ‘it’s business as usual’ and so far that appears to be holding up.

BTC/USD D (left) and ETH/USD (right). Both assets are respecting their uptrend for now.

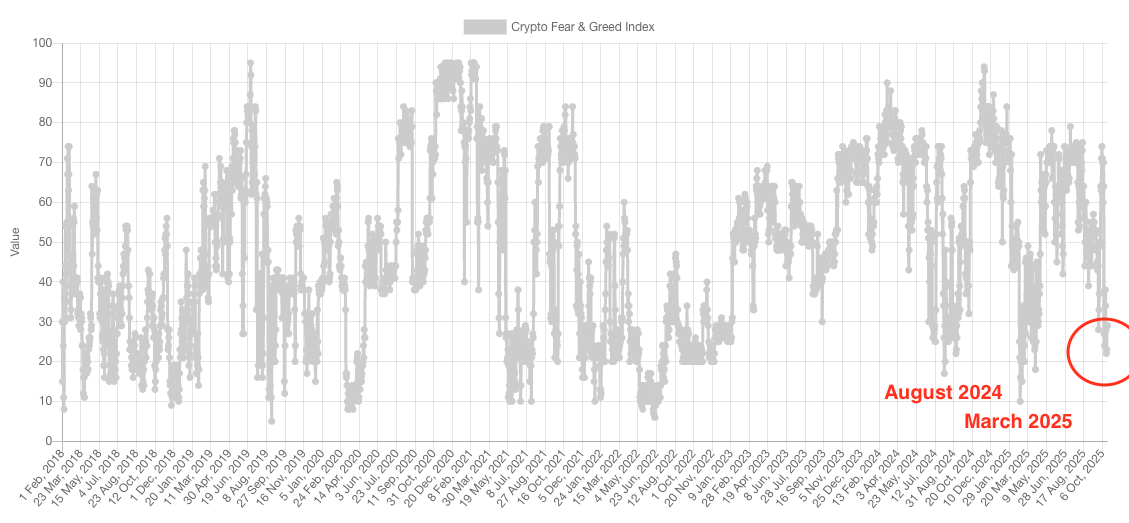

This may be a surprise for many as current investor sentiment remains very fearful.

Current sentiment is at the 3rd lowest we’ve seen this cycle. The other two times (August 2024 and March 2025) preceded +30-40% moves in the market over the following 3 months.

Low Volatility, High Upside Concoction

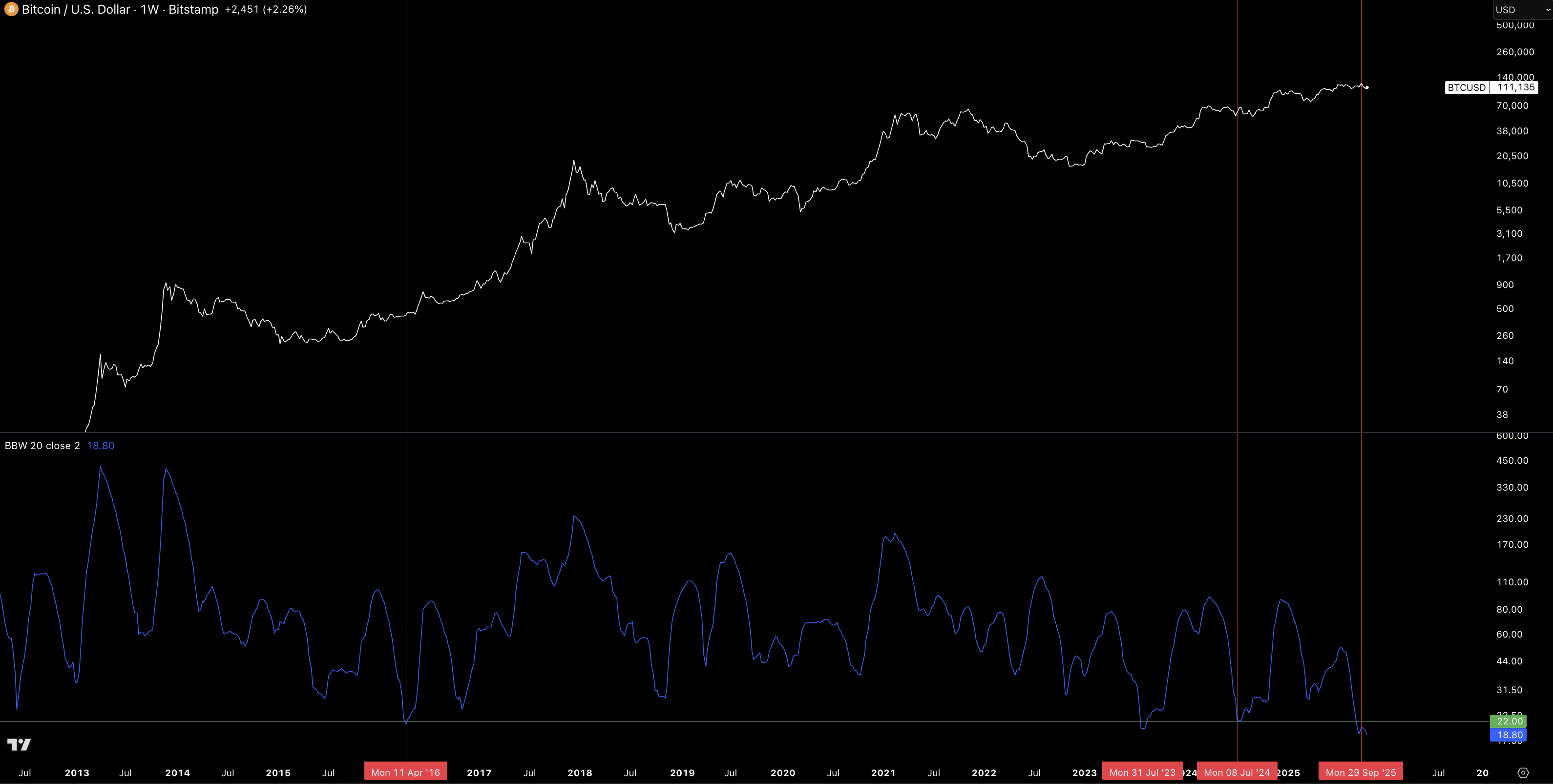

Bollinger bands measure market volatility where low scores indicate a low-volatility environment.

We are now seeing Bitcoin’s Bollinger bands narrow to the most extreme we’ve ever observed on a weekly basis. There have only been 3 prior instances where it has ever fallen <22 on its weekly (2016, 2023, 2024).

Typically, in a bull market, such low volatility periods precede positive performance in BTC for the following 3 months after.

BTC/USD W (above) vs. Bollinger Bands Width (below).

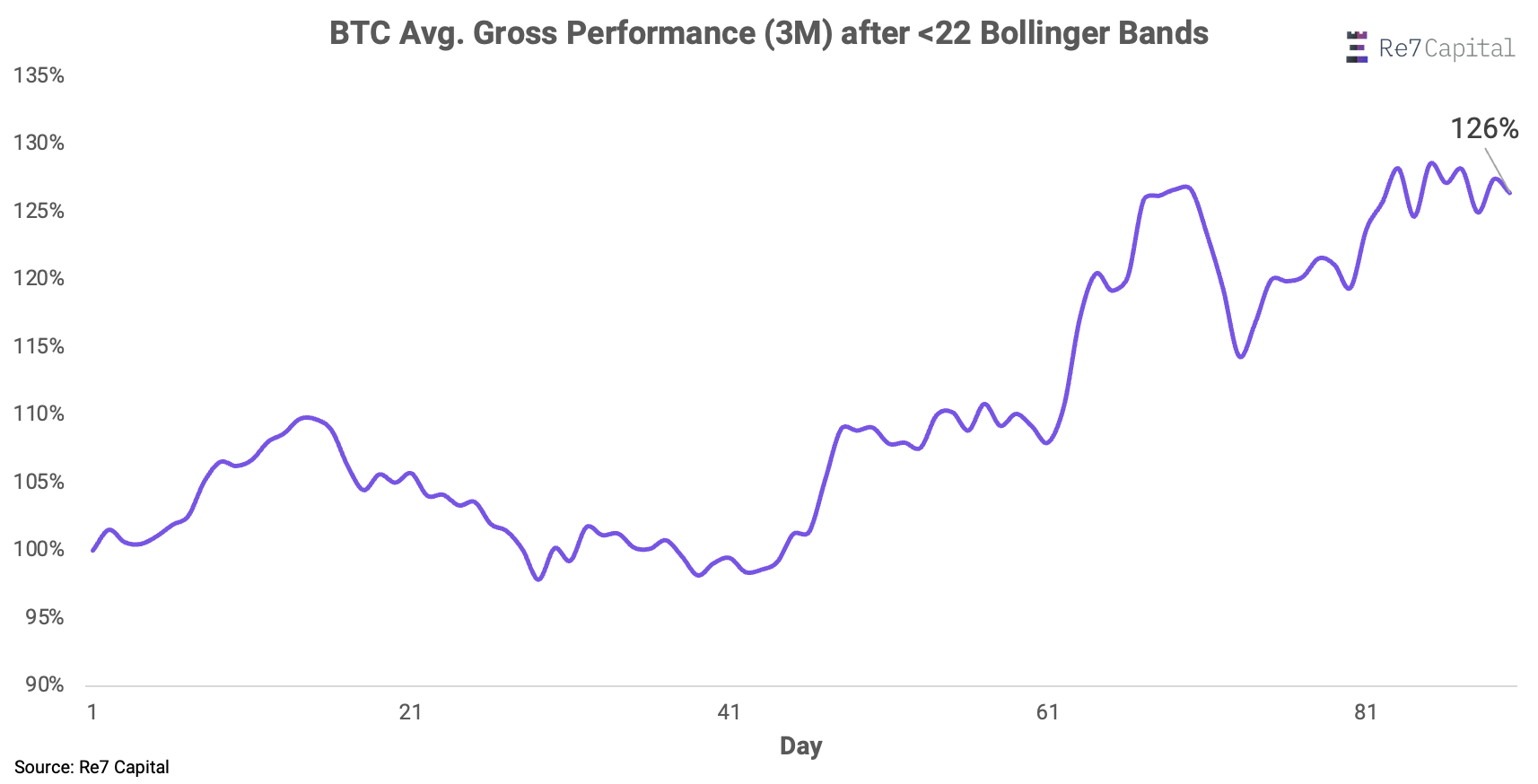

The average gross performance of BTC for the 3 months following a BB print of <22 is +126%, where all three scenarios were positive at the end of this period.

While a small sample size, it’s equally important to understand the underlying volatility dynamics.

Assuming the market top is not in, these extreme scenarios are still useful to gauge the probability of more explosive upside volatility outcomes in the following months of calmness (as the asset consolidates).

Avg. BTC gross performance for following 3 months after printing <22 Bollinger Bands on the weekly.

Gold

We can see structural reasons that could lead to upside volatility expansion as well. Gold, which recently broke above $4,300 per ounce, tends to lead BTC by approximately 17 weeks.

This makes sense when you consider that both assets respond to shared macroeconomic triggers — global liquidity expansion, inflation fears, and de-dollarisation, but at different speeds and with varying investor behaviour.

BTC/USD (orange) vs. Gold ($USD/oz; red) leading by 17 weeks.

Liquidity

The recent 15% market drawdown (close prices) closely aligned with the expected decline based on a regression analysis of historical liquidity contractions and their impact on global crypto market capitalization.

In other words, the impact over recent months scaled proportionally to roughly 40% of the drawdown experienced in Q1 2025.

Fundamental Growth Story - DeFi

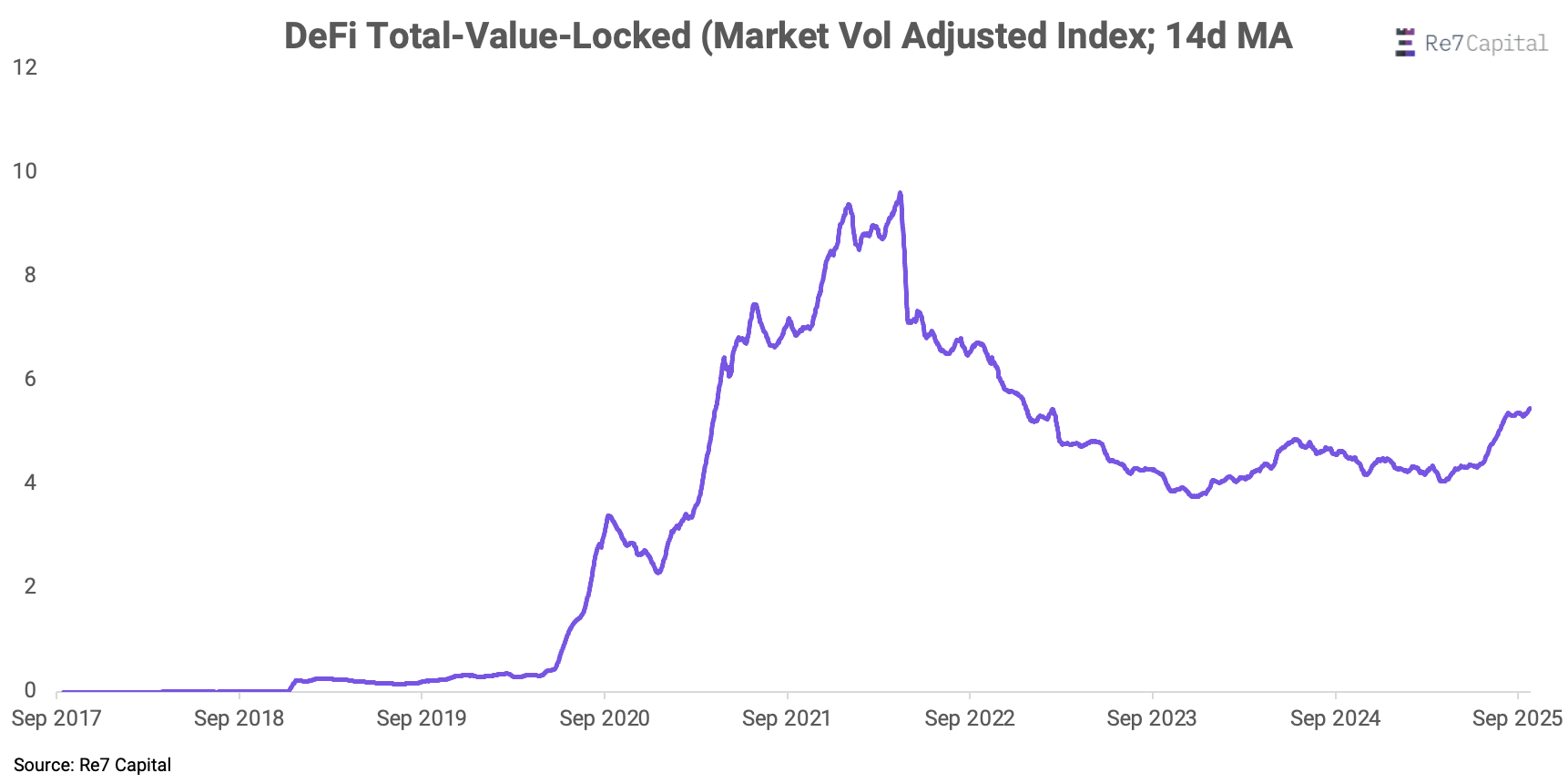

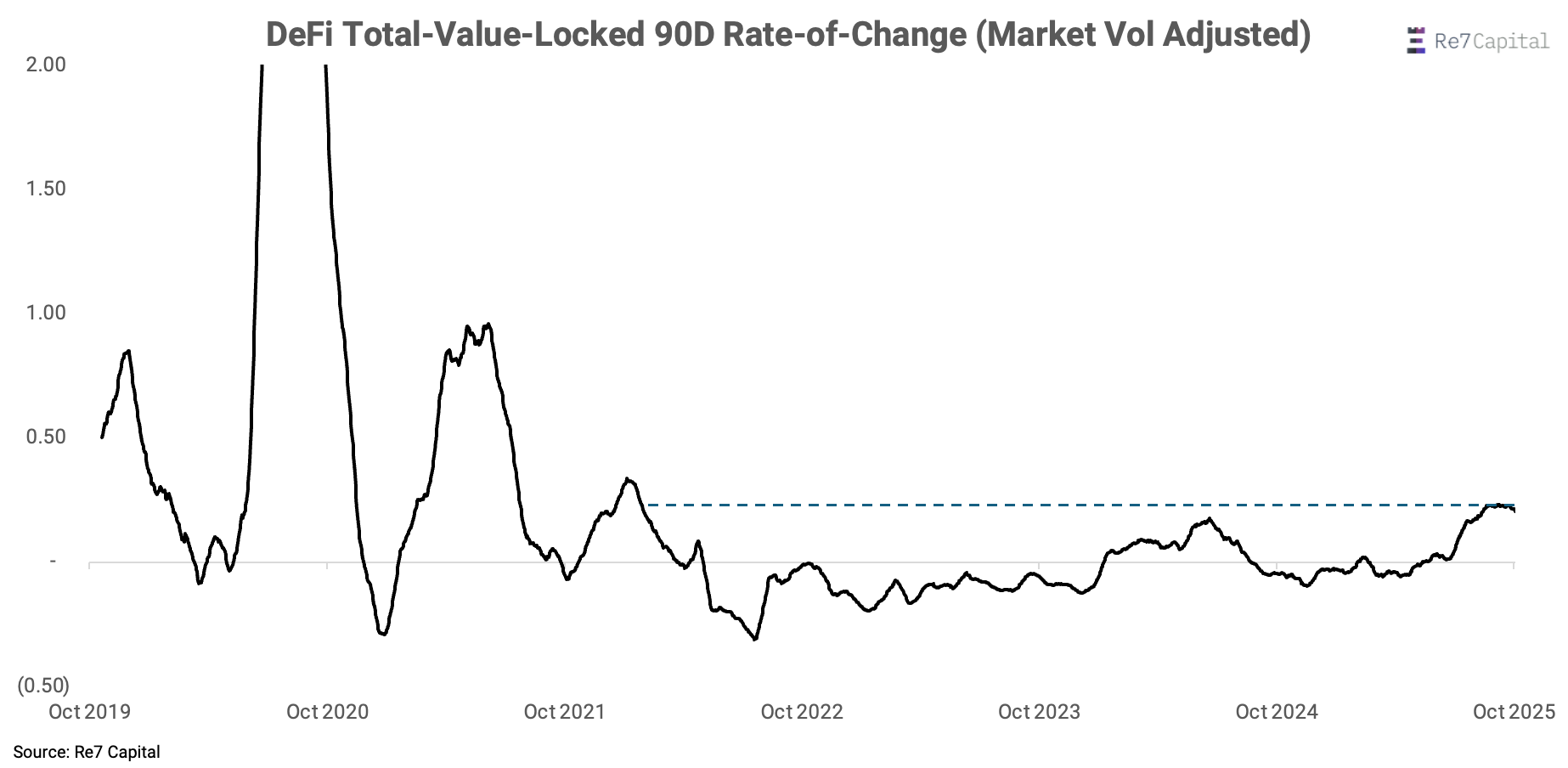

The growth story is also supported at the fundamental level. DeFi total value locked (TVL), adjusted for market volatility, is not only expanding but also accelerating.

This shows that the DeFi sector is expanding at a faster rate than valuation growth, signalling net inflows into sectors such as lending.

The acceleration can be best seen by the 90D rate of change in the index - where DeFi (adjusted for market valuations) is growing at the fastest rate in the current cycle and in 4 years - surpassing the peak in summer 2024.

Updates on Re7 Labs

mRe7YIELD Delivers 44% APY and Expands with Gearbox Integration:mRe7YIELD, the tokenized delta-neutral DeFi strategy designed by Re7 and powered by Midas, has achieved a 44% APY over the past 7 days. With instant minting live across Ethereum, Etherlink, and Starknet, users can now also deposit mRe7YIELD into Gearbox to earn leveraged yields exceeding 139% APR.

Upcoming Migration for mRe7YIELD/USDC.e LPs: The official USDC.e → USDC migration on Starknet will take place on Monday, November 20. All LPs in mRe7YIELD/USDC.e are required to manually migrate their positions to native USDC via StarkGate before the upgrade to ensure uninterrupted yield generation and accurate accounting.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week.

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management, and DeFi ecosystem design. Learn more…

We’re Hiring. We’ve just opened two new roles: Operations Portfolio Risk Manager and Vault Strategist, with more positions available across teams. If you’re excited by institutional DeFi and want to help shape its future, explore our open roles.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.