The Weekly - 11th November 2025

NOV 11, 2025

Right On Cue

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

Weekly Summary

Crypto bounces off key support

Identifying reasons for the crypto market re-bound

Base stablecoin dynamics

Right On Cue

Last week, we covered how the market was at an ‘inflection point’ where valuations were becoming depressed by a combination of government shutdowns, dried-up liquidity flows, and poor investor sentiment.

However, despite this, we believe the broader market structure remains constructive until proven otherwise.

This is because the structural drivers underpinning a forward-looking, long-term bullish outlook remain intact.

Crypto Market Capitalisation

Last week, crypto market capitalisation wicked down to its two-year trend support ($3.2T).

In typical fashion, this also marked a trough in the Fear & Greed Index. Notice the pattern of tests of this support during the current bull cycle.

Global crypto MCAP ($) vs. Crypto Fear & Greed Index.

“Fear and greed are stronger forces than long-term resolve.”

- Warren Buffet

Orange Coin

For BTC, we think prices were supported at the $100K level for five clear reasons:

$100K is a strong psychological level where bids were stacked to capitalise on any drawdowns found.

The 50W moving average has typically provided support for the current bull cycle.

It traded at its ascending trendline over the last two years.

BTC is consolidating in a widening megaphone pattern and was trading at the bottom of the range.

Volume has been strongest at the $95k-$97k range (and therefore, see point 1) where those levels may also see the strongest support from investors.

Visible range volume profile (VRVP) simply calculates the volume profile within the visible range of prices.

Realising Losses

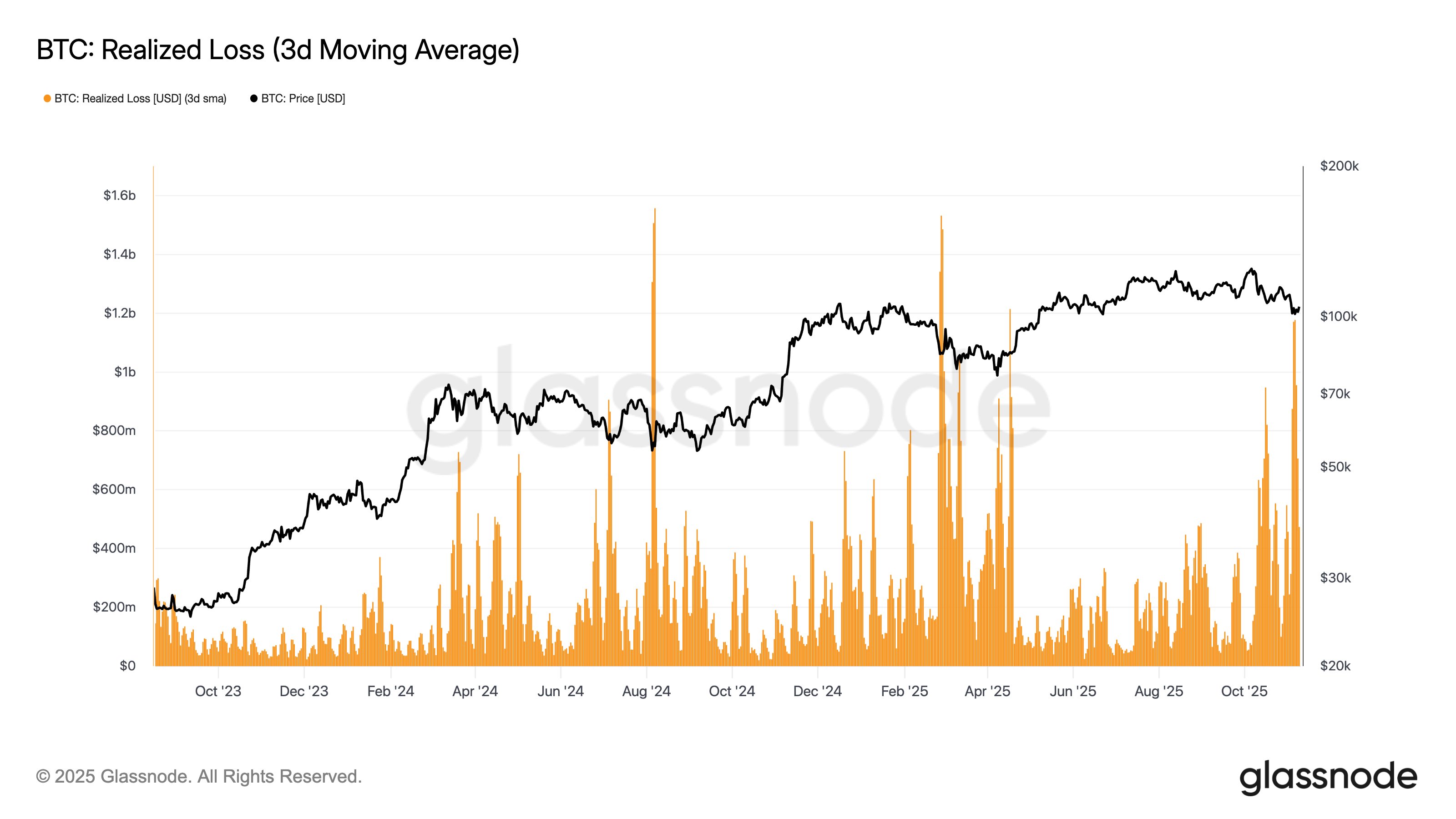

We can see capitulation has also peaked when recent BTC holders have realised significant losses.

Realized Loss denotes the total loss (USD value) of all moved coins whose price at their last movement was higher than the price at the current movement.

BTC Realised Loss (3D Moving Average).

With resolution of the Government shutdown feeling like it’s closer than ever, investors are repositioning and ramping up their risk appetite once again.

However, markets are not out of the woods yet. We need to have the finalised re-opening of the US government to finalise liquidity resolution.

This is because we need to resume net inflows into the market to sustain bids.

But as long as sentiment stays excessively bearish, it sets the stage for a potential chase rally where upside volatility remains the non-consensus view today.

Structural Trends

Base Punches Above Its Weight on Stablecoins

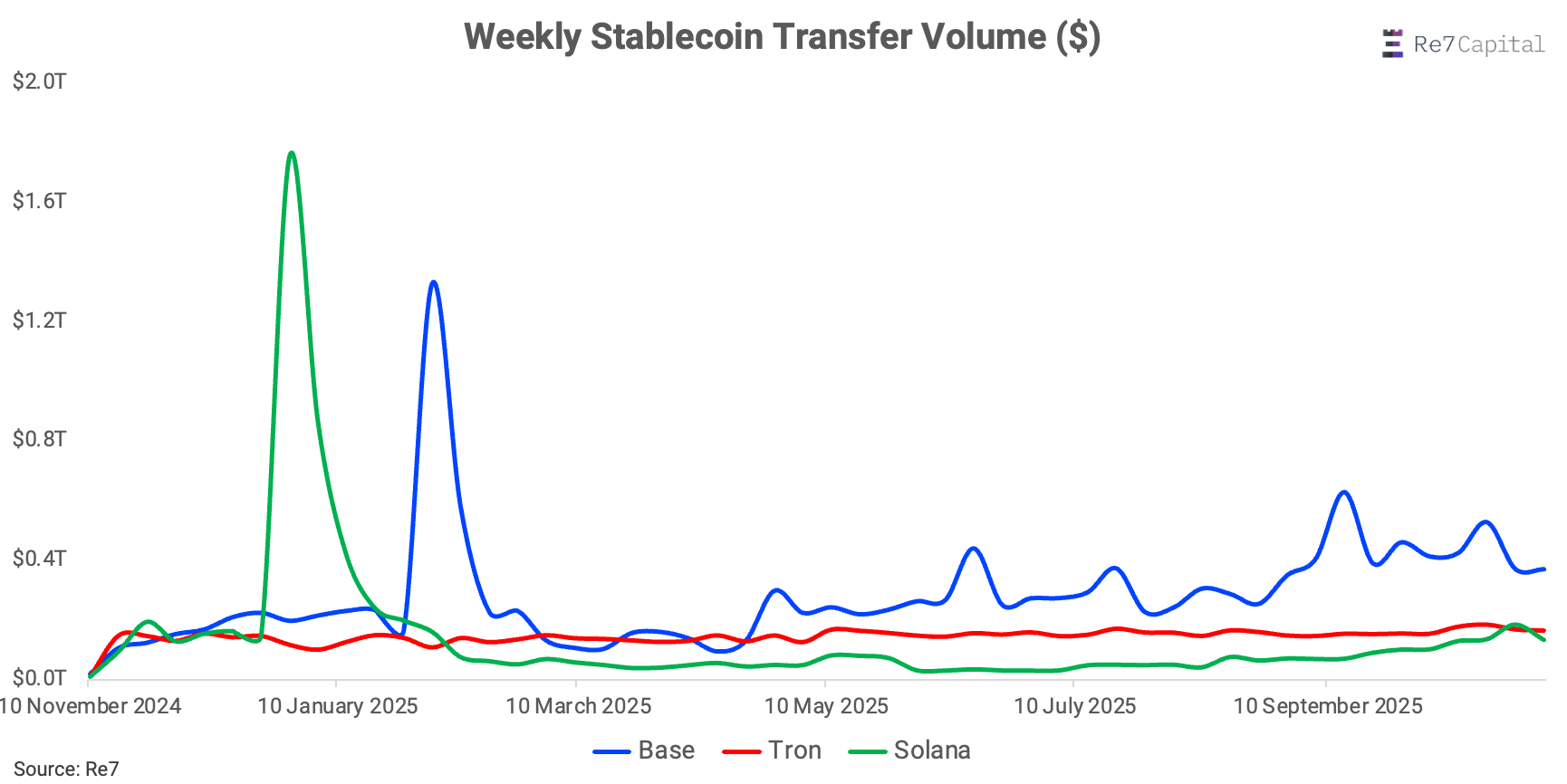

A market dynamic emerging that is not discussed widely is the stablecoin use on Base.

Base currently sees $400B in stablecoin transfers per week - the 2nd highest after Ethereum at $700B.

This is 2x the stablecoin volume of Tron and nearly 3x of the volume found on Solana.

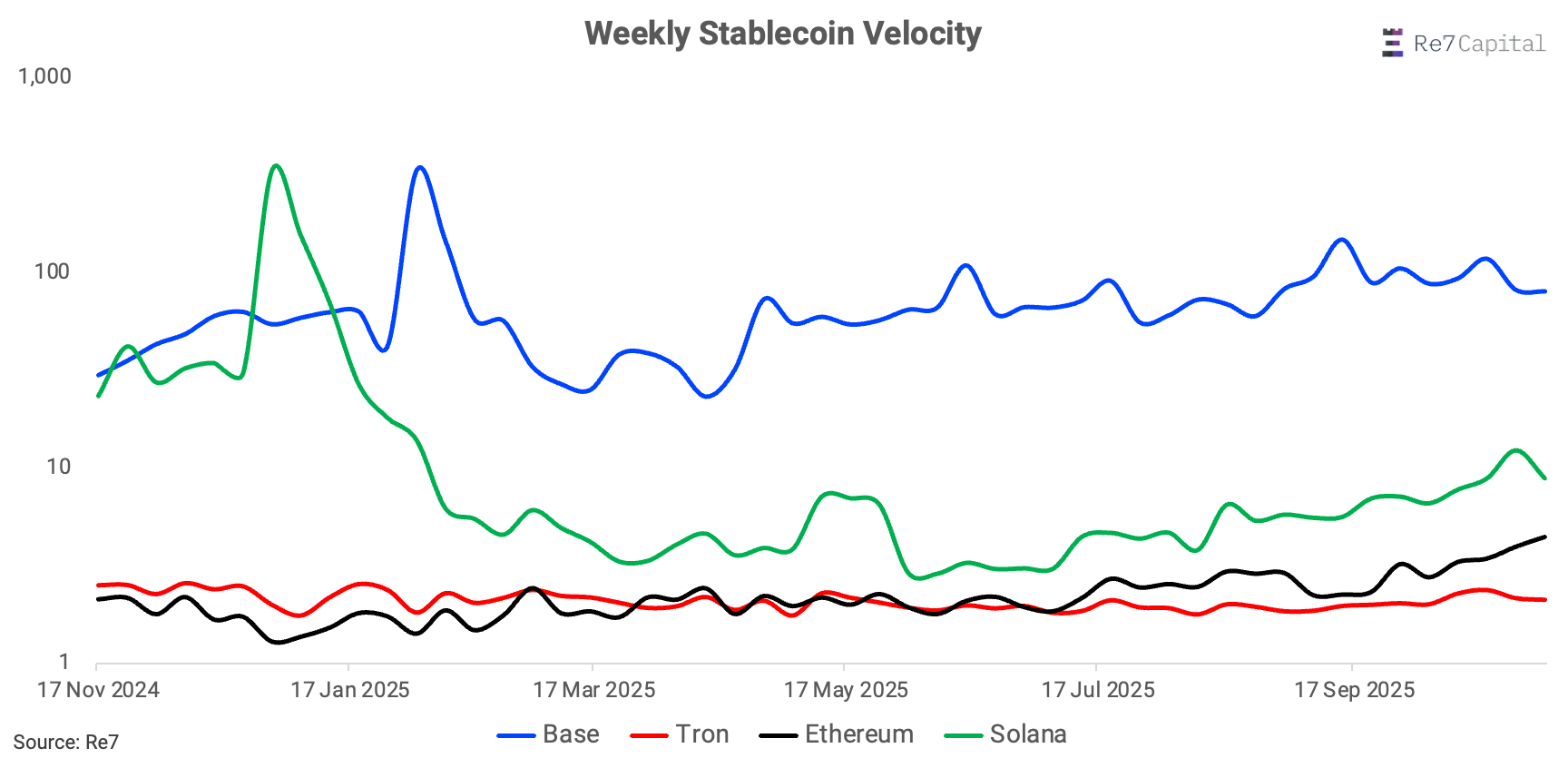

What’s more impressive is how much stablecoin volume Base is generating relative to its stablecoin supply.

High ‘velocity’ (i.e. high volume relative to supply) shows stablecoins are moving more frequently and signals stablecoins are being used more for payments, trading, and DeFi activity compared to other chains.

Weekly Stablecoin Velocity (volume/supply). Note, whales & bots can inflate velocity (MEV, arbitrage).

In other words, it’s a proxy measure for how hard the chain’s “money” is working.

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management, and DeFi ecosystem design. Learn more…

We’re Hiring. We’ve just opened three new roles: DeFi - BD, DeFi Program Manager and DeFi Associate, with more positions available across teams. If you’re excited by institutional DeFi and want to help shape its future, explore our open roles.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.