The Weekly - 4th November 2025

NOV 4, 2025

Tipping Points

Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

This Week at Re7:

Re7 Featured in Blockworks Coverage of Acre’s Bitcoin Yield Vault

Blockworks spotlighted Re7’s role in curating Acre’s first BTC-in/BTC-out yield strategy, delivering an estimated 14% APY through Ethereum-based DeFi protocols. The article highlights how Re7’s Morpho vaults and risk-curated approach underpin Acre’s vision of bringing transparent, BTC-denominated yield to on-chain investors.

Evgeny Gokhberg Featured on The Block Podcast

Evgeny Gokhberg joined The Block’s latest podcast episode recorded at the Starknet BTCFi Summit in Singapore, now live. The conversation explores how Starknet is positioning itself as the execution hub for BTCFi — highlighting Re7 Capital’s BTC-denominated yield strategy as a key example of institutional DeFi innovation.

Weekly Summary

Crypto valuations are at ‘tipping point levels’

Near-term drivers have been shortages of dollars and therefore flows into crypto assets, aided by Government shutdown

Sector-wide fundamentals continue to diverge to valuations at record levels

Tipping Points

In our last Weekly edition, we wrote that markets were signalling ‘business as usual’ dynamics despite sentiment remaining very fearful.

Global market capitalisation still remains in its broad multi-year fractal and has dropped to $3.4T (-20% from ATHs).

Short-Term Market Drivers

Fast forward two weeks from our last post, and that market dynamic remains the same today with an ongoing hangover from the October 10th liquidation event.

The only difference since then though is the ongoing US Government shutdown - the joint longest on record at 35 days.

One key impact, without any resolution, is the drainage of liquidity from the market as the Treasury pulls cash via securities issuance.

In simple terms, this is creating a dollar shortage which 1) creates stresses in the financial system and 2) negatively impacts risk assets that are most sensitive to changes to liquidity dynamics (i.e. crypto).

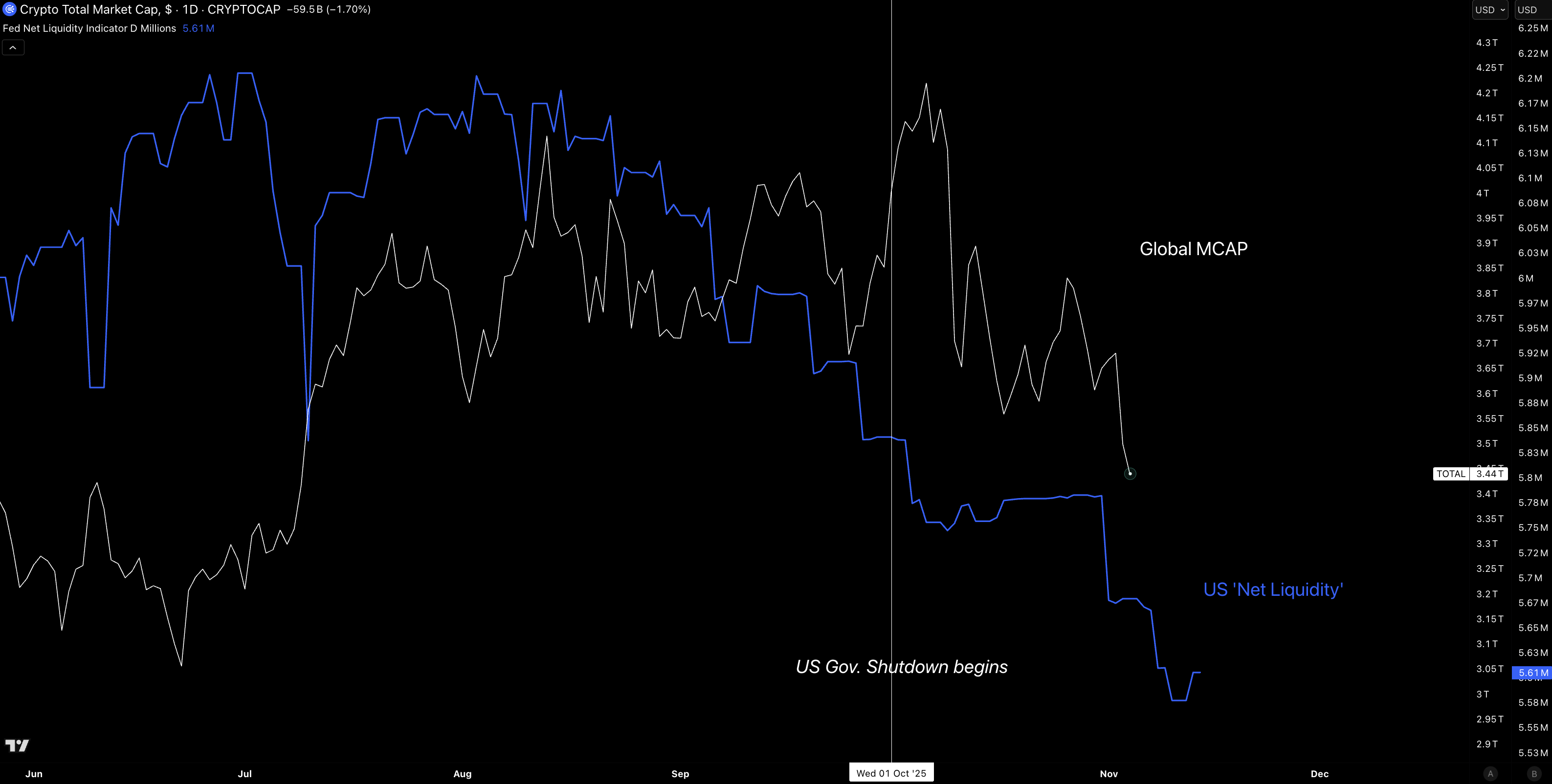

Crypto markets (white) have started to contract from ATHs shortly after the government shutdown began on October 1st.

With no outflows from the Treasury’s ‘checking account’ since then, 'net liquidity’ measures that factor in these key liquidity flows show clear contractions and eventual impact on crypto prices.

Global MCAP (white) vs. US Net Liquidity (blue).

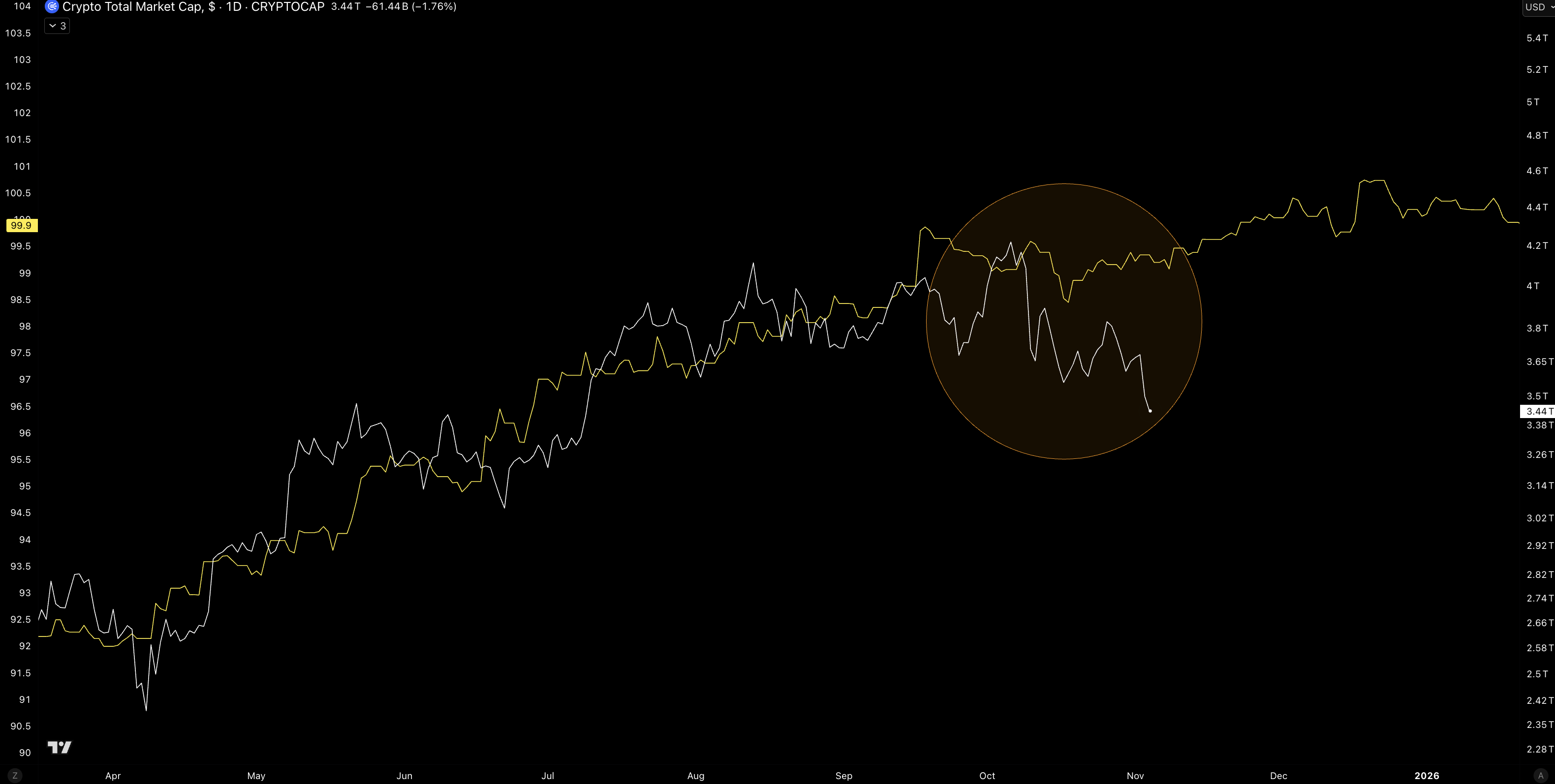

This also helps colour why crypto markets are temporarily diverging from their typical positive relationship with liquidity…

Crypto Market Capitalisation ($; white) vs. M2 Net Liquidity 11 Week Lead (yellow).

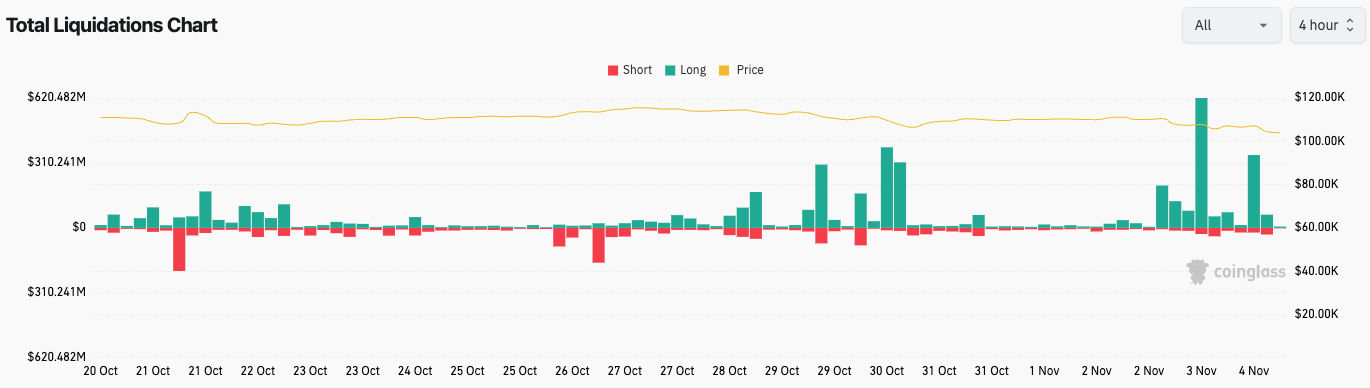

…and also why a Trump-China deal last week wasn’t able to buoy sentiment. In fact, it led to $1B in long liquidations.

Total Market Liquidations (4Hr).

There are signs that this liquidity drain could start locking up the financial system.

Government shutdowns are temporary by nature. Regardless, there is an increasing need for adding liquidity to the market.

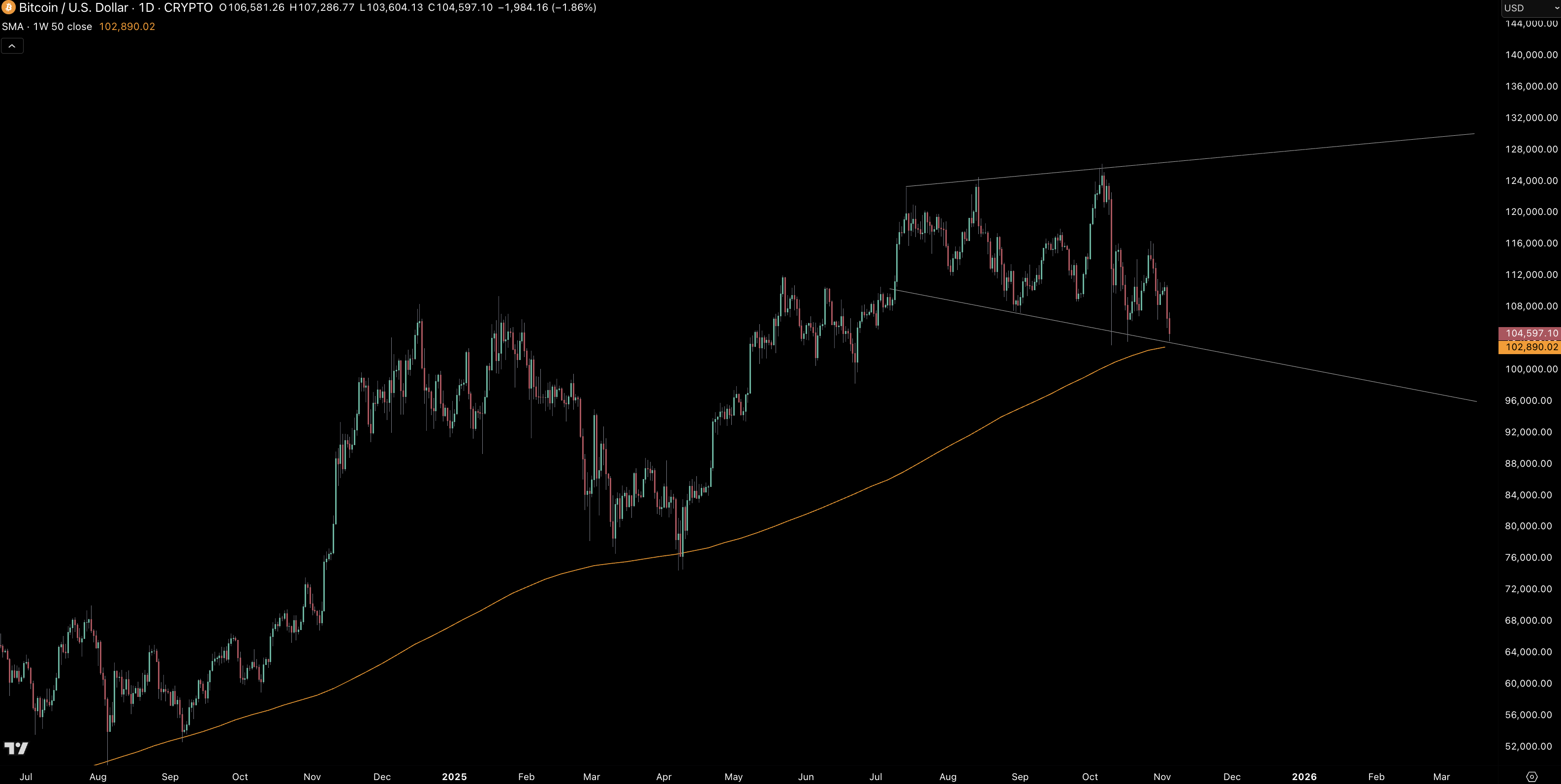

This comes at a time when crypto valuations are compressing to key levels.

Therefore it feels the market is at a tipping point yet again.

BTC is at the bottom of its widening channel, finding key support at its 50W MA (has been reliable support during bullish trends).

BTC/USD (D) and 50W MA.

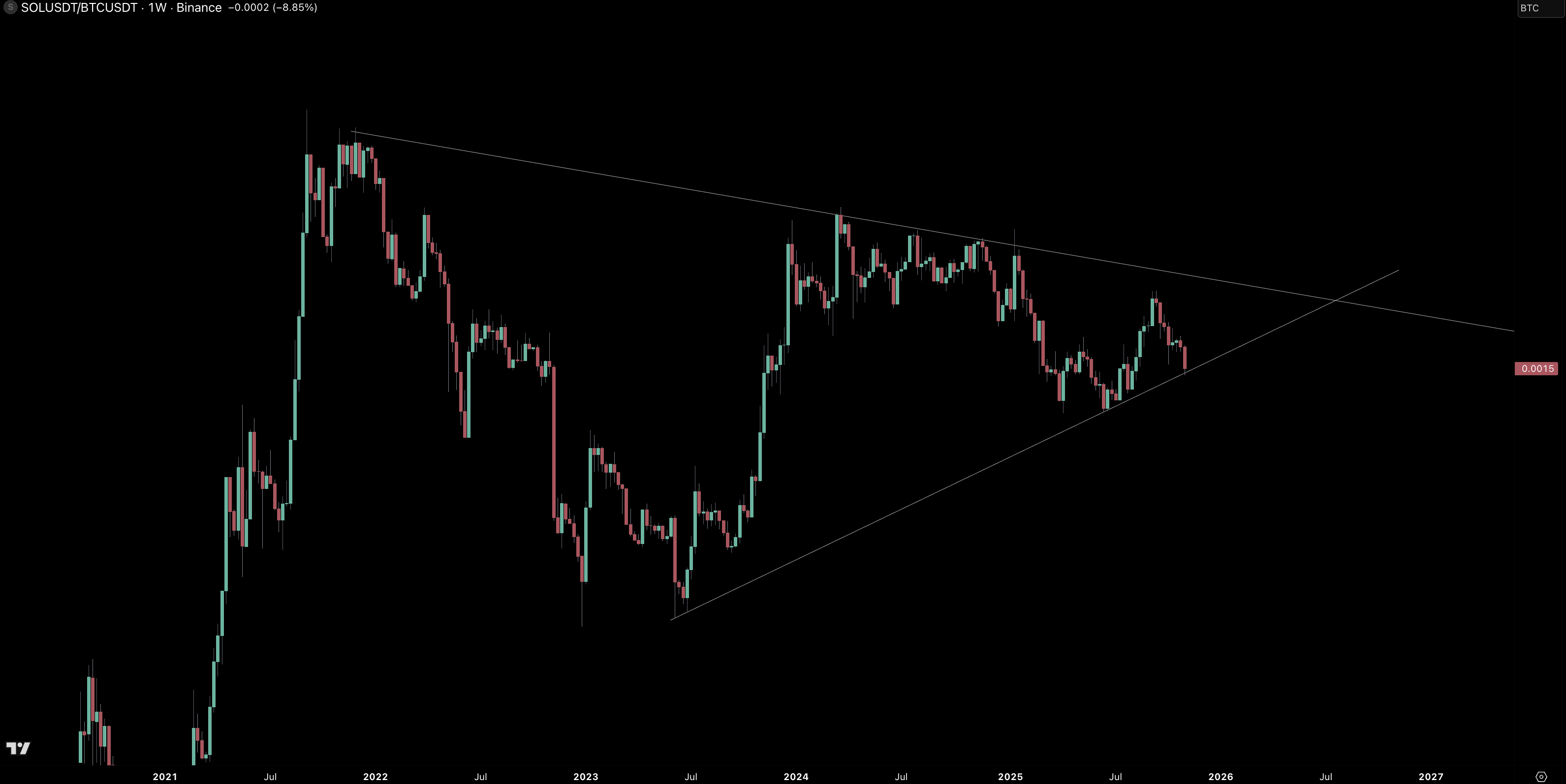

Leading L1s like SOL vs. beta are also trading at tipping point levels too…

SOL/BTC ratio (W).

Divergences

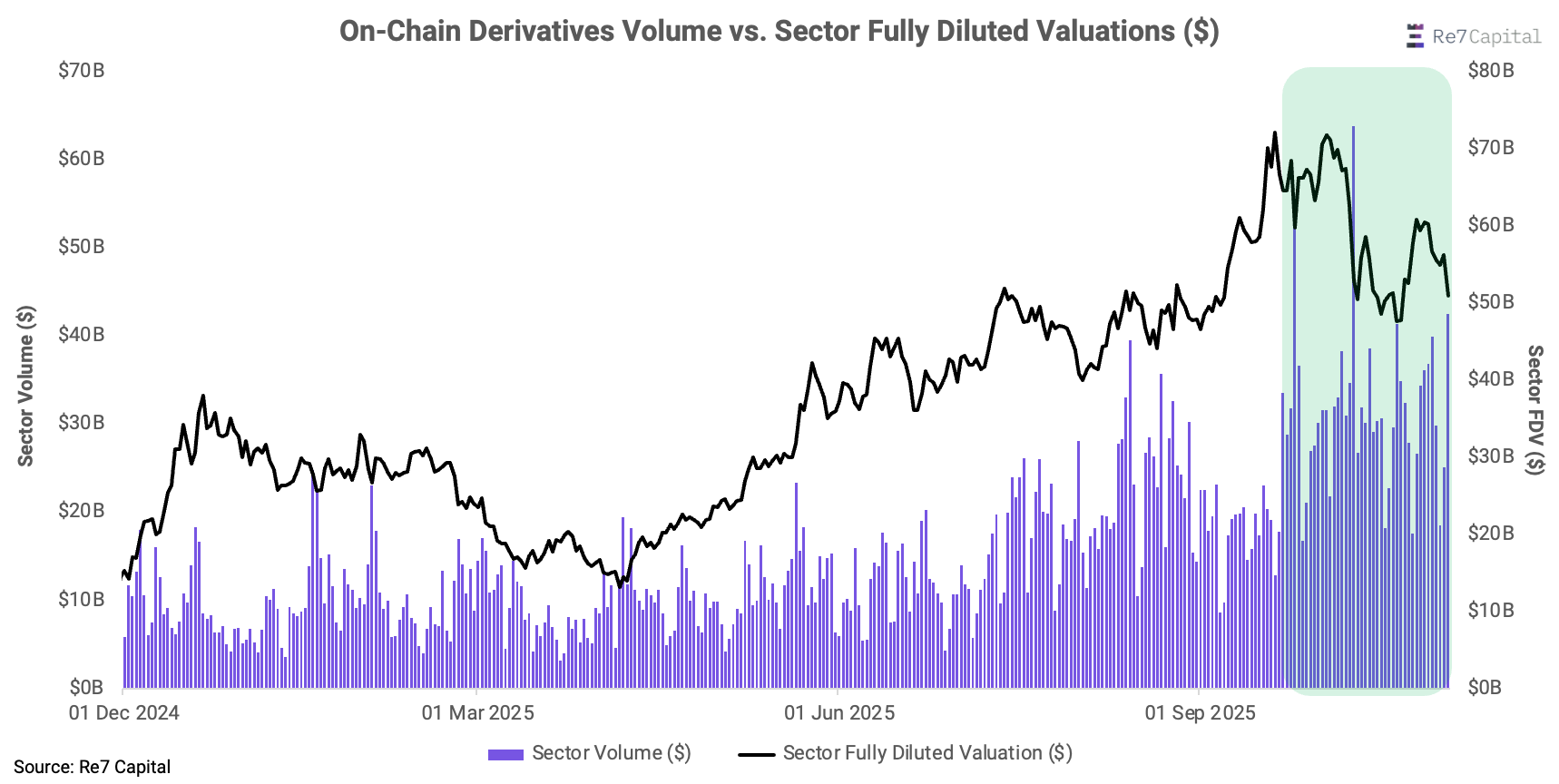

Sector-level fundamentals continue to trend higher while valuations approach these key levels.

For example, global on-chain derivative volumes are diverging the most significantly to valuations with this current market contraction.

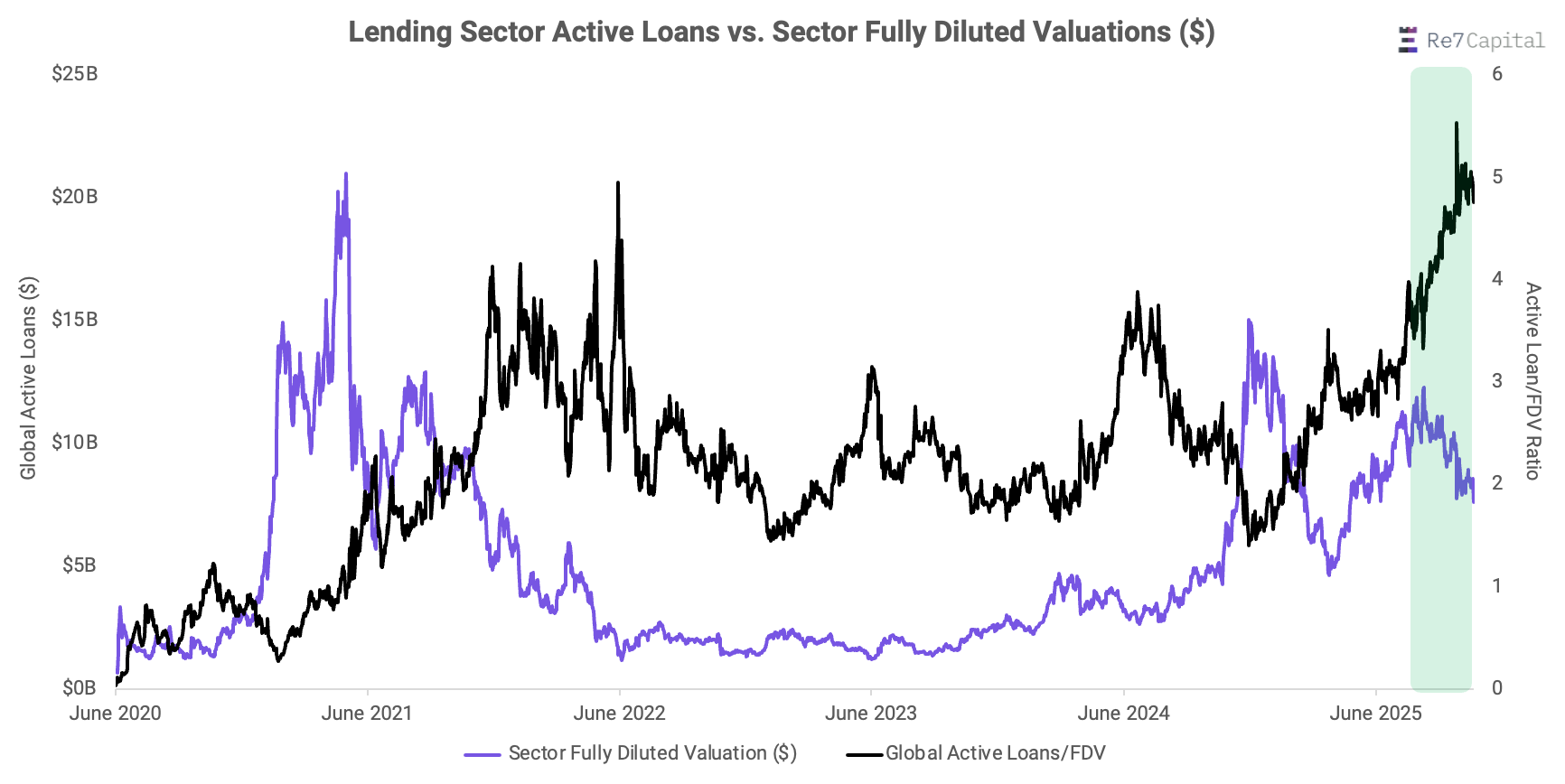

Lending is another example. Visualised differently, the ratio of global active loans to sector valuations has reached new ATHs.

In other words, the lending sector has never been so cheap relative to the total active loans the sector underwrites.

So it’s clear that crypto markets are looking for a liquidity resolution to inform where they go from their current ‘tipping point’ levels.

Valuations are battling through the last lines of defence while sector-level fundamentals signal that mis-pricing is to the upside.

Updates on Re7 Labs

Re7 Labs curates new Gearbox vault with Yield Network on Etherlink: Yield Network offers exclusive +5% APY boost for its USDC Gearbox vault, curated by Re7 Labs, now yielding over 21% APY. It combines Gearbox’s lending infrastructure with Re7’s risk-curated DeFi strategy.

Make sure to join the Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week.

About Re7

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs is its innovation arm, focused on on-chain risk curation, vault management, and DeFi ecosystem design. Learn more…

We’re Hiring. We’ve just opened three new roles: DeFi - BD, DeFi Program Manager and DeFi Associate, with more positions available across teams. If you’re excited by institutional DeFi and want to help shape its future, explore our open roles.

Disclaimers

The content is for informational purposes only. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.