How Tokenized Funds Are Rewiring Global Yield

JAN 4, 2026

Real-world asset (RWA) value on-chain has crossed $35 billion, increasing 2.5× year-on-year.

Co-authored with Dune

How Tokenized Funds Are Rewiring Global Yield

Real-world asset (RWA) value on-chain has crossed $35 billion, increasing 2.5× year-on-year.

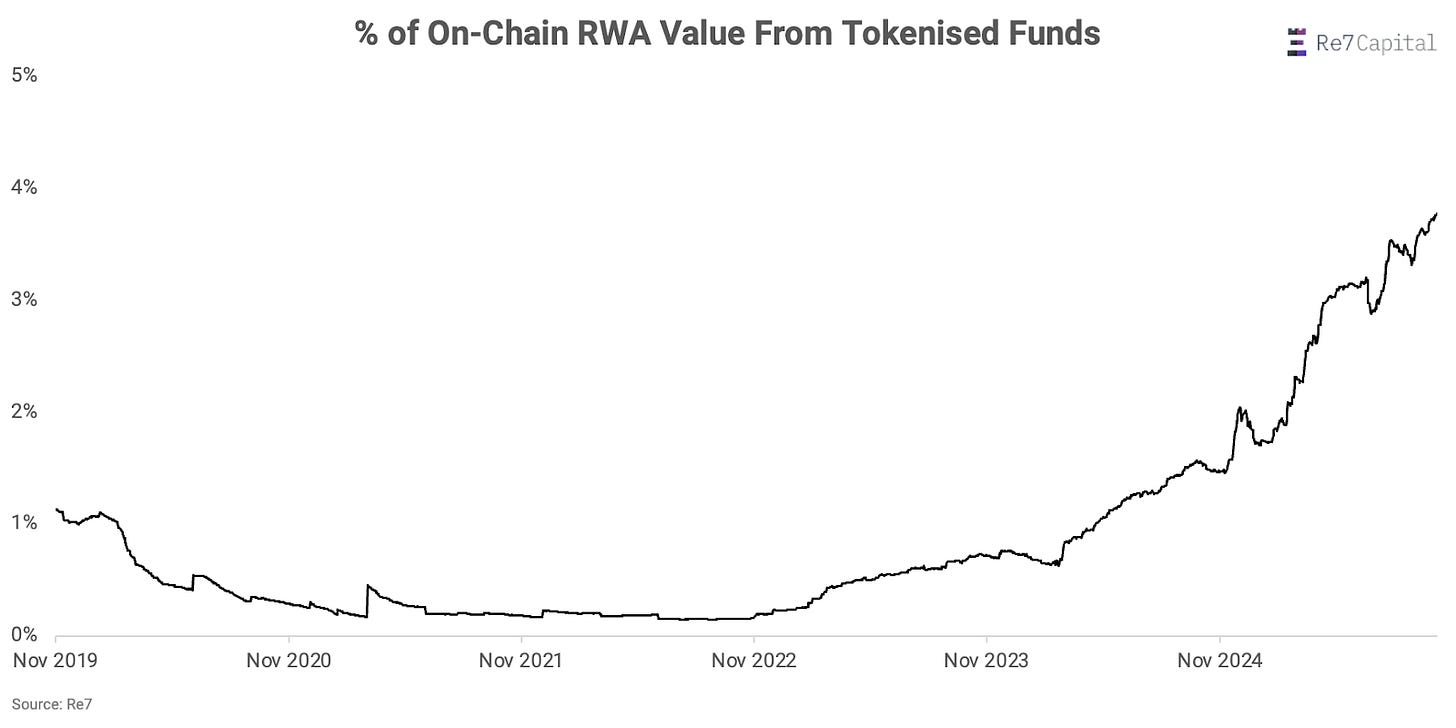

One of the fastest-growing subcategories contributing to this exponential growth over the last 2 years has been tokenised funds (money market funds and alternatives).

Tokenised funds now represent 4× the RWA value they did over that period and account for ~4% of total on-chain RWA value.

AUM has been increasing due to a number of benefits tokenised funds have enabled for on-chain and off-chain market participants:

Liquidity: Unlike traditional funds with lockup periods, tokenized versions enable 24/7 trading, redemptions, or use as collateral in DeFi.

Composability: Tokens integrate with DeFi protocols (e.g. Aave’s Horizon RWA market, recently surpassing $500 million) for lending, borrowing, or yield farming, often amplifying returns (e.g. 20–50% APY via looping strategies).

Transparency: Blockchain records ensure auditable ownership and transactions, with NAV updates published on-chain.

Accessibility: Tokenisation lowers barriers to entry (e.g. $10,000 minimum on-chain commitment vs. $2 million for a core fund), though often restricted to accredited investors due to regulations.

Tokenized Treasuries

A major subcategory of tokenized funds is tokenised treasuries.

Tokenized U.S. Treasury bills (T-bills) have quickly become one of the real-world asset (RWA) representations of traditional finance products in the decentralized finance space.

The on-chain T-bill market is now approaching $9 billion in tokenized issuance, driven initially by a very simple motivation: migrating low-risk yield on-chain.

In 2023, DeFi lending yields on stablecoins like USDC and DAI were far below the “risk-free” rates offered by short-term T-bills. TradFi investors and crypto treasuries saw an opportunity to capture superior yields without taking additional credit or duration risk.

This sparked the first wave of tokenized T-bill products.

Fast-forward to 2025: tokenized T-bills have become a key infrastructure layer for on-chain credit, hedging, stablecoin collateral, and risk transfer.

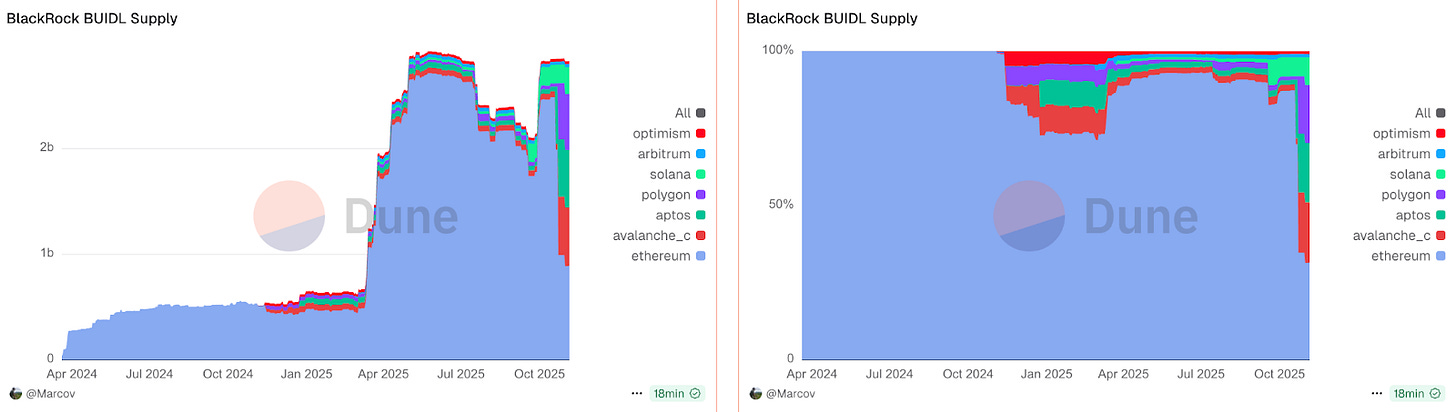

BlackRock’s BUIDL, which tokenized U.S. dollar yield from short-term treasuries, has seen its supply grow to ~$3 billion and is now issued across a wider range of EVM-compatible chains.

Over two-thirds of BUIDL’s on-chain supply now resides on chains other than Ethereum mainnet.

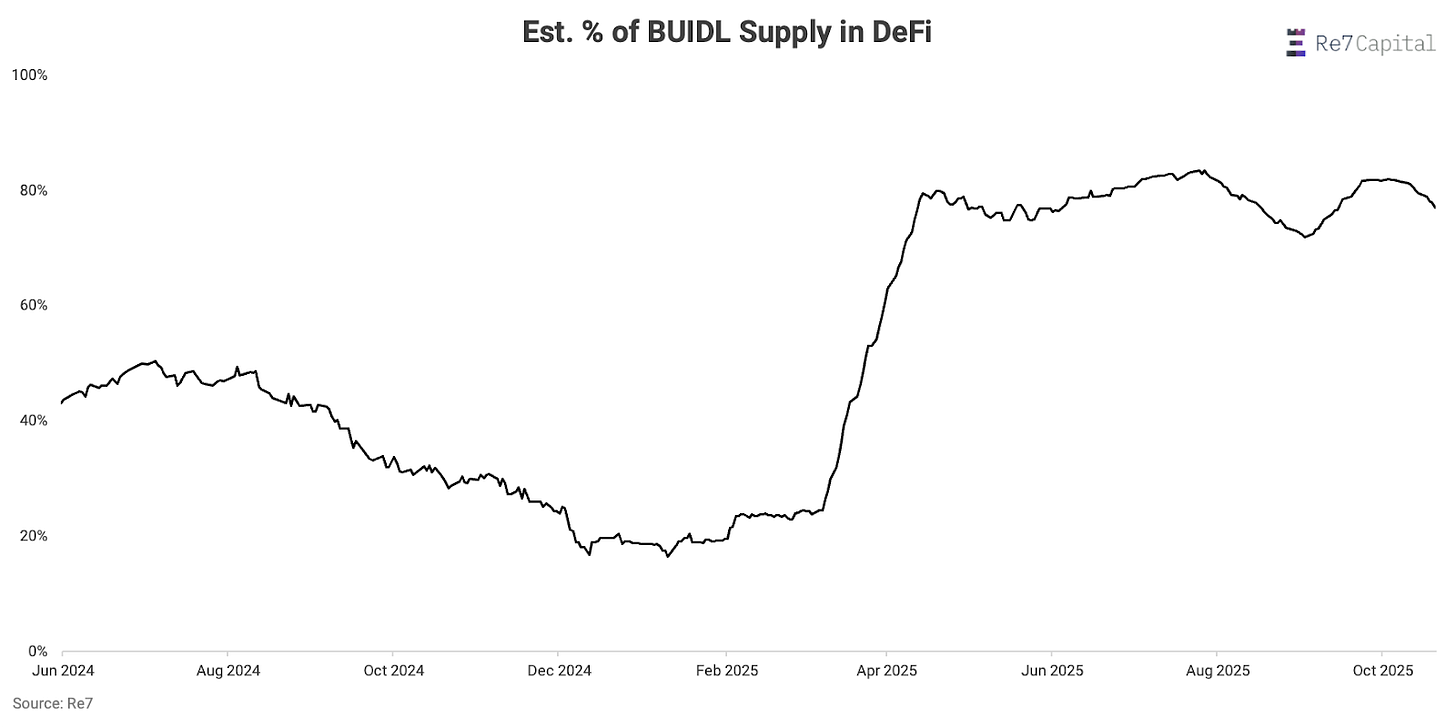

One growth factor has been the BUIDL token being used as collateral within DeFi, where Re7 Labs became the risk curator for the first BUIDL DeFi integration.

BUIDL has also become a key collateral asset for stablecoins like Ethena’s USTb as well as tokenised funds like Ondo’s OUSG.

T-Bills Backing Stablecoins

Tokenized T-bills and money market funds can also act as collateral for other DeFi verticals like stablecoins.

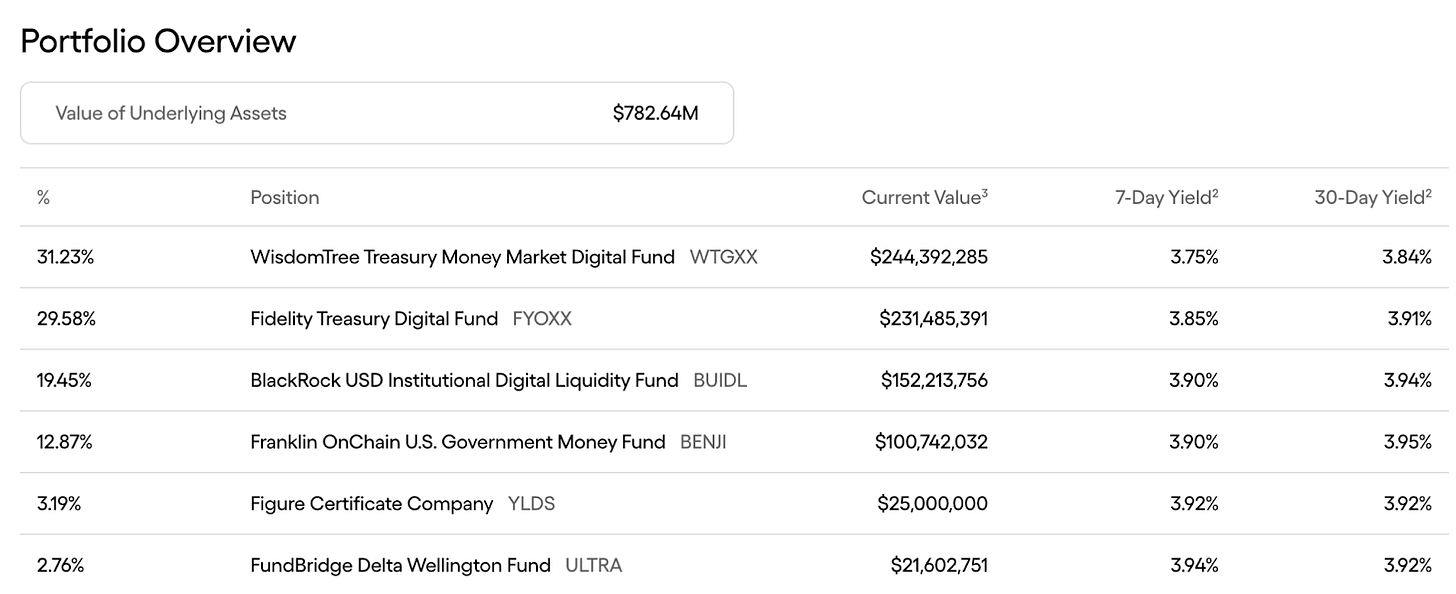

Ondo’s OUSG is collateralised almost entirely by these funds. Of that collateral, BlackRock’s BUIDL accounts for ~20% of OUSG’s total supply.

Taken together, we can see the evolving utility of tokenized T-bill assets like BUIDL within DeFi — approximately 75% of all BUIDL supply is actively deployed.

More stablecoins — and thus, effectively, on-chain currency — are now formally backed by tokenized T-bill funds, creating a sharp irony: Legacy fiat is backed by faith in governments (or indirectly by their ability to issue T-bills), while digital dollars are backed directly by the same T-bills — on-chain, transparent, and verifiable.

In turn, yield-bearing assets like OUSG can themselves be used as collateral. For example, OUSG’s integration with Aave enables holders of volatile assets to borrow yield-bearing, ultra-stable RWA assets without selling the underlying asset itself.

Alternative Tokenized Funds

Beyond T-bills, alternative tokenized funds can provide yield through collateralised loan obligations (CLOs) — strategies for capital preservation and higher yields (sometimes targeting 5%+ floating rates).

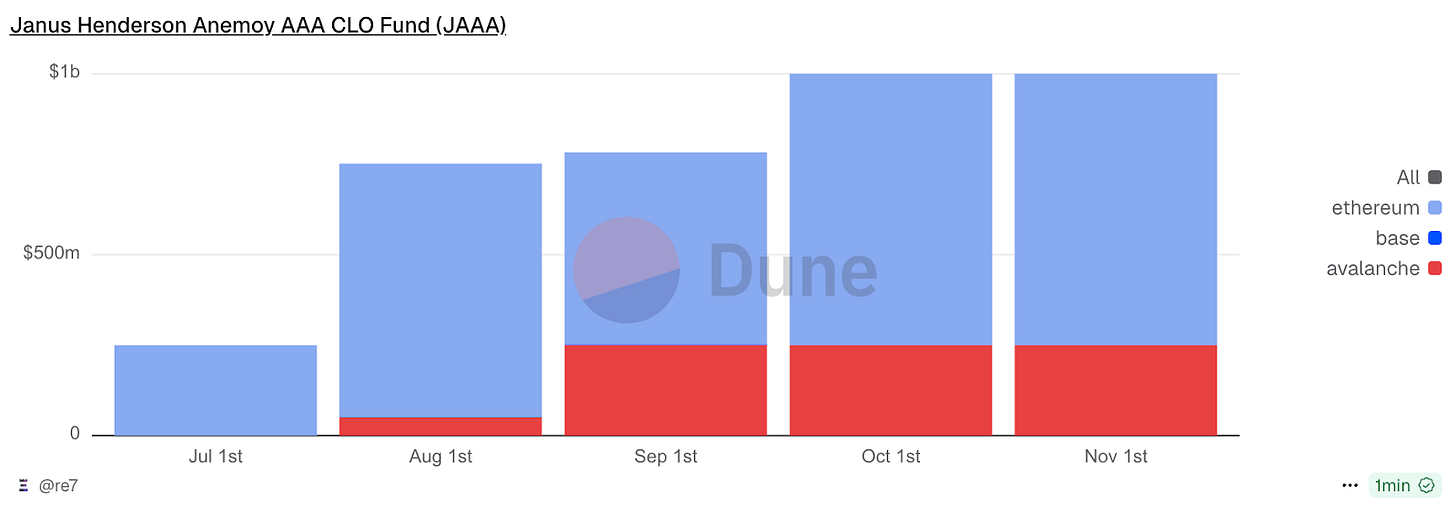

One example is the Janus Henderson Anemoy AAA CLO fund, which targets >5% yield.

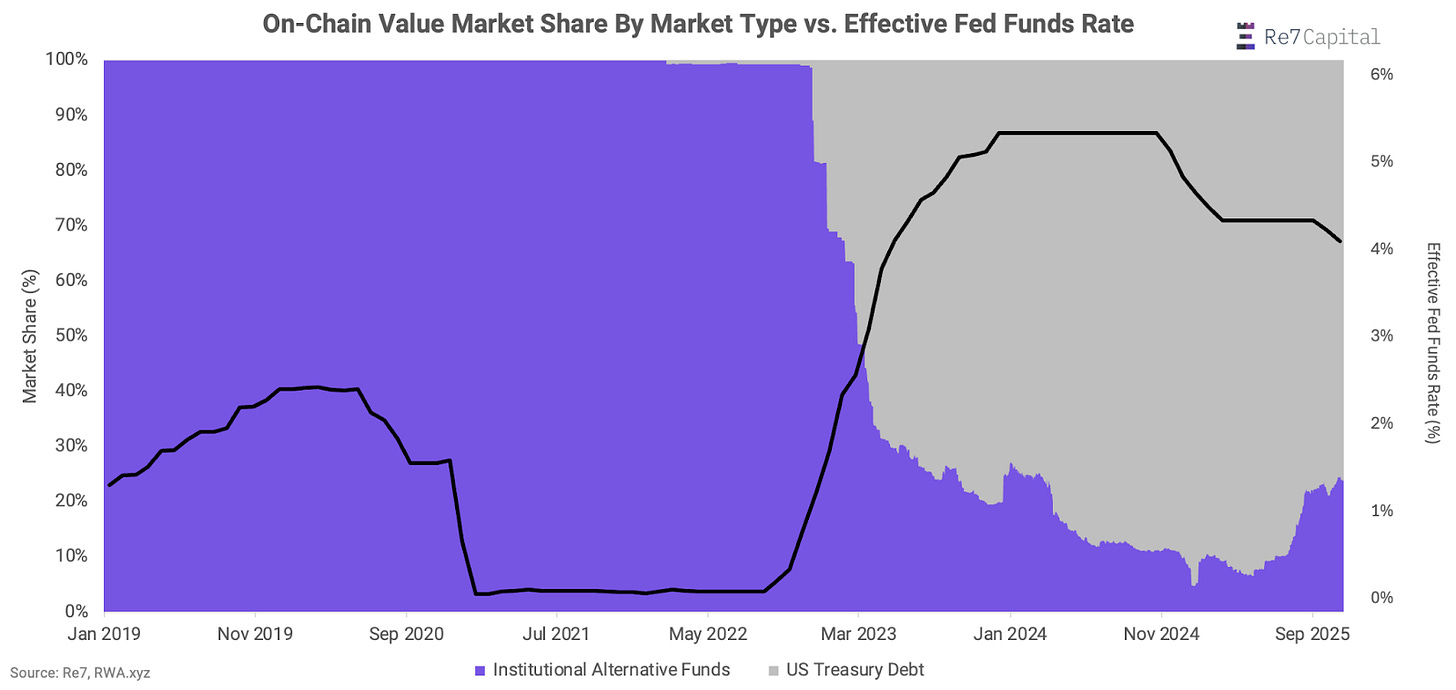

Tokenized U.S. T-bills previously dominated over alternative tokenized funds because the rising Fed funds rate increased the risk-free rate and reduced risk premia.

With rates now coming down, we are seeing the opposite dynamic where CLOs can offer higher returns above the risk-free rate. It does so by securitising pools of senior-secured corporate loans.

The largest example is the Janus Henderson Anemoy AAA CLO fund, which now exceeds $1 billion in AUM — effectively tripling on-chain AUM since July 2025.

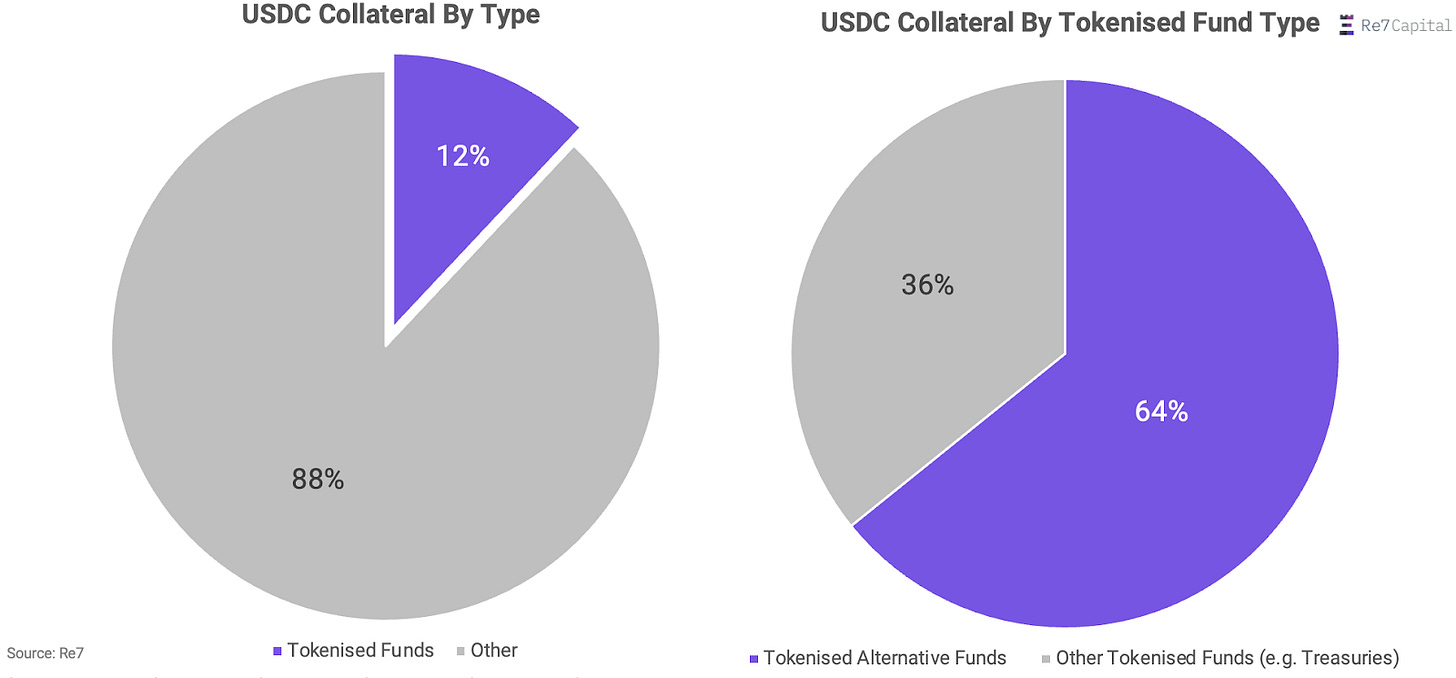

These tokenized alternative funds have been used as core collateral for stablecoins to supplement allocations to T-bills.

For example, 12% of Sky’s USDS is collateralised by tokenised funds.

Of this 12%, 64% is represented by alternative funds (mainly Janus Henderson Anemoy AAA).

Looking Ahead

What began as a theoretical bridge between TradFi stability and DeFi composability is now core infrastructure for on-chain credit, yield, and stablecoin issuance.

Being in a rate cut environment, tokenized alternative funds within CLOs are likely to increase their market share relative to their Treasury counterparts, making them more relevant and prominent on-chain as the credit cycle progresses.

As risk premia expand, these higher-yielding, structured assets will deepen DeFi’s capital efficiency and attract the next wave of institutional flows.